by Charles Hugh-Smith

That the period of stability has ended and a brand new period of more and more chaotic volatility has begun shouldn’t be on anybody’s radar as a risk.

The usual debate about the way forward for the financial system is: which can we get, excessive inflation or a deflationary collapse of defaults and asset bubbles popping?

The talk goes spherical and spherical in widening circles of complexity as analysts delve into each nuance of the talk.

A current dialog with my buddy A.T. raised a 3rd risk few appear to think about: more and more chaotic volatility would be the new regular, as wild swings between inflation and deflation will enhance in amplitude and ferocity because the system destabilizes.

More and more chaotic volatility is a traditional signal of a system that has misplaced equilibrium and is making an attempt to regain its dynamic stability by going into overdrive.

The amplitude and violence of those fluctuations enhance as every try to revive stability fails.

This lack of stability shouldn’t be what folks count on. The expertise of the previous 60 years has been that any hiccup in monetary stability–a recession or market crash–is short-term, because the system responds with financial and financial stimulus which shortly restores the system’s stability.

That the period of stability has ended and a brand new period of more and more chaotic volatility has begun shouldn’t be on anybody’s radar as a risk.

Human physiology affords a helpful analogy: blood glucose homeostasis, which is the system of insulin manufacturing and sensitivity that maintains the dynamic stability of glucose in our bloodstream to be used as vitality.

Insulin is produced as wanted after a meal to manage the extent of glucose throughout the ideally suited bandwidth of homeostasis, i.e. the vary of dynamic stability that optimizes insulin manufacturing and glucose ranges. (3.5 to five.5 mmol/L or 70 to 130 mg/dL)

In metabolic issues, the physique’s sensitivity to insulin declines, and in response the physique will increase the manufacturing of insulin to compensate for the decline in sensitivity.

Because the illness progresses, sensitivity drops additional, forcing the manufacturing of insulin into overdrive. Ultimately this overdrive degrades the physique’s capability to supply insulin and the regulatory system managing glucose ranges crashes.

Within the financial analogy, the system is responding to the decline of surpluses and efficiencies by pumping ever bigger sums of recent cash into the system as quantitative easing (monetary stimulus) and financial stimulus (extra federal spending funded by borrowing).

Decrease rates of interest are meant to stimulate extra personal borrowing, one other type of stimulus.

The preliminary huge dose of monetary insulin has created huge asset bubbles and a frenzied rush to restock inventories depleted in the course of the pandemic.

The traditional media is echoing the Federal Reserve and different authorities who declare the ensuing spike of inflation is short-term and can quickly fade. Different analysts concern the scarcities usually are not transitory, as they replicate depletion of real-world assets that can’t be overcome by injecting extra insulin (cash) into the system.

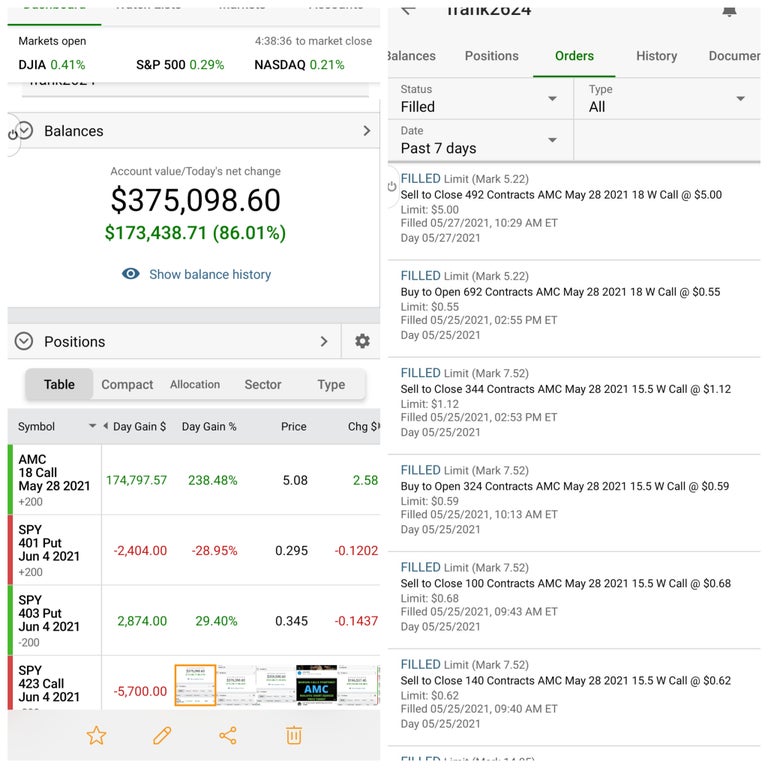

In the meantime, different analysts are trying on the skyrocketing leverage within the system, the place million-dollar speculative bets are leveraged into billion-dollar bets that cascade into crashes and defaults when the bets go unhealthy.

Leverage is troublesome to evaluate as a lot of it’s within the shadow / off-balance-sheet banking system, the place unique monetary devices are buried deep in footnotes and even consultants have hassle unraveling the advanced bets embedded in CDOs and numerous multi-party swaps.

So we now have all the required ingredient for each inflation and asset-debt deflation, and that is the backdrop for the binary debate of inflation or deflation.

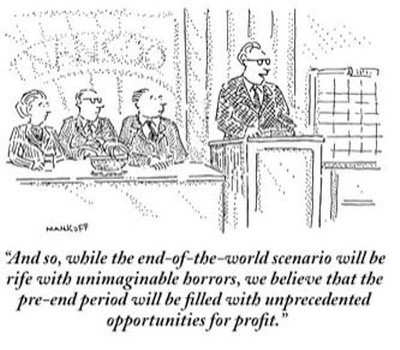

However maybe the long run shouldn’t be one or the opposite, however a quickly destabilizing system that can change into more and more vulnerable to semi-chaotic swings of ever better amplitude as regulatory businesses (central banks and Treasuries) try and flood the system with sufficient insulin to restabilize debt / leverage / asset costs which can be more and more desensitized to traditional stimulus.

As every new flood of stimulus pushes debt, leverage and property larger, it additional desensitizes the system, setting the stage for yet one more collapse of speculative leverage, which then prompts an excellent bigger flood of financial insulin, which then triggers an much more dramatic crash when then causes an excellent massive dose of financial insulin, and so forth till the system crashes.

Ultimately the financial insulin has not one of the desired results, and the mechanisms for producing extra insulin (cash) break down as properly.

In different phrases, each crucial mechanisms break down: the financial system not responds to new injections of stimulus and the issuance of cash not features as desired.

Because the monetary system loses stability, injecting extra financial insulin solely pushes the system additional into chaotic volatility.

For 3 generations, the Warren Buffett funding technique labored splendidly: simply purchase Coca-Cola and so on. and by no means promote. We see this identical mindset within the by no means promote crypto, diamond fingers of the present speculative mania.

If the monetary system loses stability, this buy-and-hold technique will fail. The winners in more and more chaotic volatility might be those that not see any worth within the inflation-deflation debate and not count on one or the opposite–or a return to stability. It gained’t be that straightforward or that simple.

This essay was first revealed as a weekly Musings Report despatched completely to subscribers and patrons on the $5/month ($54/yr) and better degree. Thanks, patrons and subscribers, for supporting my work.

For those who discovered worth on this content material, please be a part of me in searching for options by turning into a $1/month patron of my work by way of patreon.com.

My new ebook is offered! A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% reductions (Kindle $7, print $17, audiobook now accessible $17.46)

Learn excerpts of the ebook without cost (PDF).

The Story Behind the Ebook and the Introduction.

Current Podcasts:

Charles Hugh Smith on the Period of Accelerating Expropriations (38 min) (FRA Roundtable Perception)

Covid Has Triggered The Subsequent Nice Monetary Disaster (34:46)

My COVID-19 Pandemic Posts

154 views

Source link