It has now been three months since Bitcoin’s value peaked at an all-time excessive simply shy of $65,000. For a lot of the final two months, Bitcoin (BTC) has been buying and selling within the $30,000–$40,000 vary, as a lot as 54% decrease than its peak

The downturn got here at a time when many analysts have been predicting precisely the other — a bull cycle set to run to new report highs inside months — with some even speculating {that a} six-figure BTC value would materialize this yr.

So, what’s happening? Is the present market downturn only a blip on an in any other case upward trajectory, or is the crypto market again within the sort of long-term bearish territory final seen in 2018?

Bullish metrics

Bitcoin’s historic value exercise has a compelling correlation with its halving cycles, with earlier all-time highs being reached inside round 12 to 18 months of a halving. PlanB, the creator of the Inventory-to-Move BTC value mannequin, is among the many most vocal proponents of this. On Twitter, the analyst remains resolute that the Inventory-to-Move Cross Asset Mannequin (S2FX) predicts additional bullish motion, pointing to related momentary downturns earlier than epic rallies in earlier cycles.

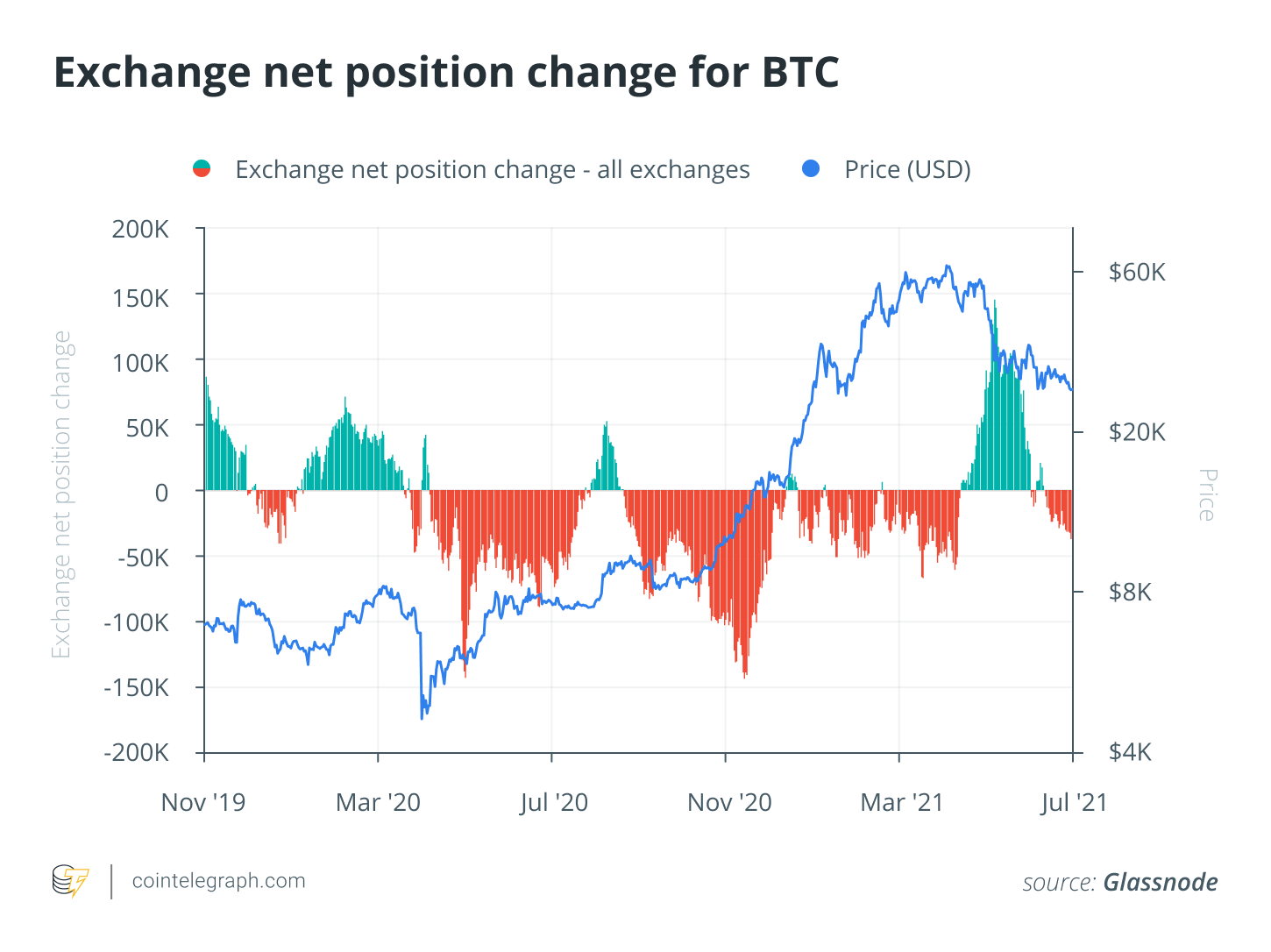

Up to now, the S2FX mannequin has been one of the vital correct value predictors of Bitcoin over time. As well as, on-chain metrics seem to assist the speculation that bearish sentiments could possibly be short-lived. For example, shortly after Bitcoin’s April value peak, merchants immediately began transferring funds onto exchanges, ending an virtually uninterrupted eight-month run of HODLing.

Igneus Terrenus, head of communications at crypto trade Bybit, believes that short-term merchants have been chargeable for the sell-off following BTC’s value highs. He instructed Cointelegraph:

“A sequence of deleveraging occasions shook off many short-term speculators, whose capitulation accounts for almost all of realized losses in current months. Whereas the euphoria at first of the yr has all however dissipated, whales and long-term holders have remained assured by way of the market’s total bearish sentiments.”

Nonetheless, over the current weeks, buying and selling platforms have as soon as once more seen funds flowing out. Glassnode’s Realized HODL Ratio, which tracks the willingness of buyers to let go of their holdings, additionally seems to replicate related patterns seen in earlier cycles.

Richard Nie, chief analysis analyst at Bingbon, believes that the trade flows are telling. Chatting with Cointelegraph, he concurred that the metrics point out a bullish shift. “We ought to concentrate to the variety of whale holders and the quantity of BTC held by exchanges,” he stated, including that as “extra BTC is withdrawn from exchanges and moved into personal addresses, this can be a robust bullish sign.”

Mati Greenspan, founder and CEO of Quantum Economics, instructed Cointelegraph: “Proper now crypto volumes throughout exchanges are the bottom they’ve been all yr. As soon as buying and selling picks up once more, that might be an excellent indication the lull is full.”

Broader bullish indicators

Challenge funding is one other vital indicator of market sentiment, and 2021 has been an excellent yr for crypto startups. As reported by Cointelegraph, the crypto trade noticed extra funding within the first quarter of 2021 than in all of 2020 put collectively, pulling in $2.6 billion.

The downturn since April doesn’t seem to have spoiled the appetites of enterprise capitalists in any respect. In late Could, stablecoin issuer Circle raised $440 million, and solely days later, Mike Novogratz’s Cryptology Asset Group introduced it was launching a crypto funding fund value $100 million.

By mid-June, Bloomberg had reported that the entire enterprise capital funding in crypto for the yr was already as much as over $17 billion. Even discounting the $10 billion that Block.one directed into its new trade enterprise, it’s enough to display that the crypto market’s second-quarter efficiency hasn’t but affected the expansion in enterprise capital funding.

There are additionally macro market components to think about. Amid ongoing uncertainty surrounding the state of the worldwide financial system, some, together with Robert Kiyosaki — writer of Wealthy Dad Poor Dad — have predicted a inventory market crash. In Kiyosaki’s case, he’s additionally been encouraging his followers to replenish on gold and Bitcoin. There are indicators that Bitcoin could also be turning into extra correlated to shares, however may a mass inventory sell-off imply buyers finally flip to BTC as a safe-haven asset?

An extra consideration is Bitcoin’s upcoming Taproot improve because of activate in November. It marks the primary improve to the Bitcoin community for the reason that Segregated Witness (SegWit) fork, which came about in August 2017. After all, that was adopted by an epic run as much as a brand new all-time excessive of $20,000 in December 2017. It’s arduous to know if historical past may repeat itself on this regard or if there’s even any direct correlation between the upgrades and the markets, but it surely’s value allowing for.

Bears within the type of regulators

It’s past doubt that the most important bearish forces shaping the markets over the previous few months have been regulatory. Most notably, the Chinese language authorities’s mining clampdown has created widespread uncertainty. Many giant mining operations have been pressured offline — in some circumstances completely and in others briefly as they relocated from China to new websites. This migration little doubt got here at a big expense, and within the meantime, Bitcoin’s mining problem has undergone its greatest drop in historical past, solely confirming the affect that the clampdown has had on the community.

Nonetheless, lawmakers from different nations have additionally just lately began to take a better have a look at crypto. India, which solely relaxed its stance towards cryptocurrencies in 2020, may as soon as once more be contemplating a ban, though the state of affairs continues to evolve.

The UK Monetary Conduct Authority additionally just lately launched a marketing campaign towards Binance, ordering it to cease endeavor regulated exercise within the nation. Now, crypto companies are withdrawing licensing purposes within the U.Ok., whereas customers are discovering themselves locked out of the trade by their banks.

Usually, Binance has been below regulatory stress from all around the world, for quite a lot of causes. Within the meantime, it’s nonetheless not clear if regulators are going after Binance particularly or if the trade is just seen as a consultant of the remainder of the crypto trade.

Associated: Binance within the crosshairs: Are regulators listening to crypto?

Institutional analysts have additionally been making ominous predictions about Bitcoin’s value, with JPMorgan issuing a warning that the near-term setup for BTC continues to look unstable. Whereas these developments aren’t more likely to be as seismic because the Chinese language mining ban, they haven’t helped market confidence.

Daniele Bernardi, CEO of fintech administration firm Diaman Group, believes that there are causes to be cautious, telling Cointelegraph:

“If we analyze the Bitcoin value based mostly on the S2F mannequin, Bitcoin costs have the potential to triple within the brief time period. Nonetheless, at Diaman, we’ve additionally developed a mannequin based mostly on the speed of adoption. Following this mannequin, a $64k ATH is truthful.”

A stronger bull case?

Because it has beforehand been urged that a lot of the indicators level to this bull market solely being at a midway level, is there sufficient proof to reverse that course? All issues thought-about — and unsurprisingly — it’s too quickly to say definitively. On one aspect, there’s regulatory tumult and a considerable decrease in buying and selling quantity, suggesting an total lack of curiosity and engagement. On the opposite, there are some telling on-chain metrics and indicators of investor sentiment that seem to stack up in favor of a seamless bull market.

Associated: GBTC unlock edges nearer as affect on Bitcoin value stays unclear

Nonetheless, in apply, the regulatory points proceed to spook the market, proving that value fashions and VC funding aren’t essentially capable of assuage considerations. If there are additional main clampdowns, then it could be that the bull market can not recuperate in any case.

The truth that costs have held above $30,000 up to now, regardless of maybe the most important take a look at to mining safety in historical past, is a testomony to the bullish forces at play. If the present regulatory state of affairs begins to calm, then there’s each likelihood that the bullish a part of the market cycle may nonetheless play out to its predicted conclusion.

Source link