Huobi Asset Administration is trying to be the Grayscale of Asia with the launch of 4 cryptocurrency associated tracker funds. The funds embrace a Bitcoin Fund, an Ethereum fund, a multi-asset basket of digital currencies, and a personal fairness fund for mining companies. The intention is clearly to entice main institutional traders into the area with a product that feels acquainted. The fund and asset administration firm is ready up in Hong Kong, despite the fact that Huobi maintains a number of workplaces inside the mainland. Huobi is China’s most established alternate and ranks second on the worldwide liquidity rankings behind Binance.

DOGEmania continues

Excessive volumes and volatility continued on the world’s hottest memecoin. On April twenty eighth, searches on WeChat for the Chinese language model of ‘Canine-coin’ have been up over 65% from the day past. Shiba, one other dog-themed memecoin, was additionally in style with Chinese language exchanges MXC, Gate, Hotbit, LBank and Hoo. These 5 claimed the highest spots for centralized exchanges by quantity on April twenty ninth. This means that Chinese language traders are much less interested in fundamentals and persevering with to put money into a extra trend-based method.

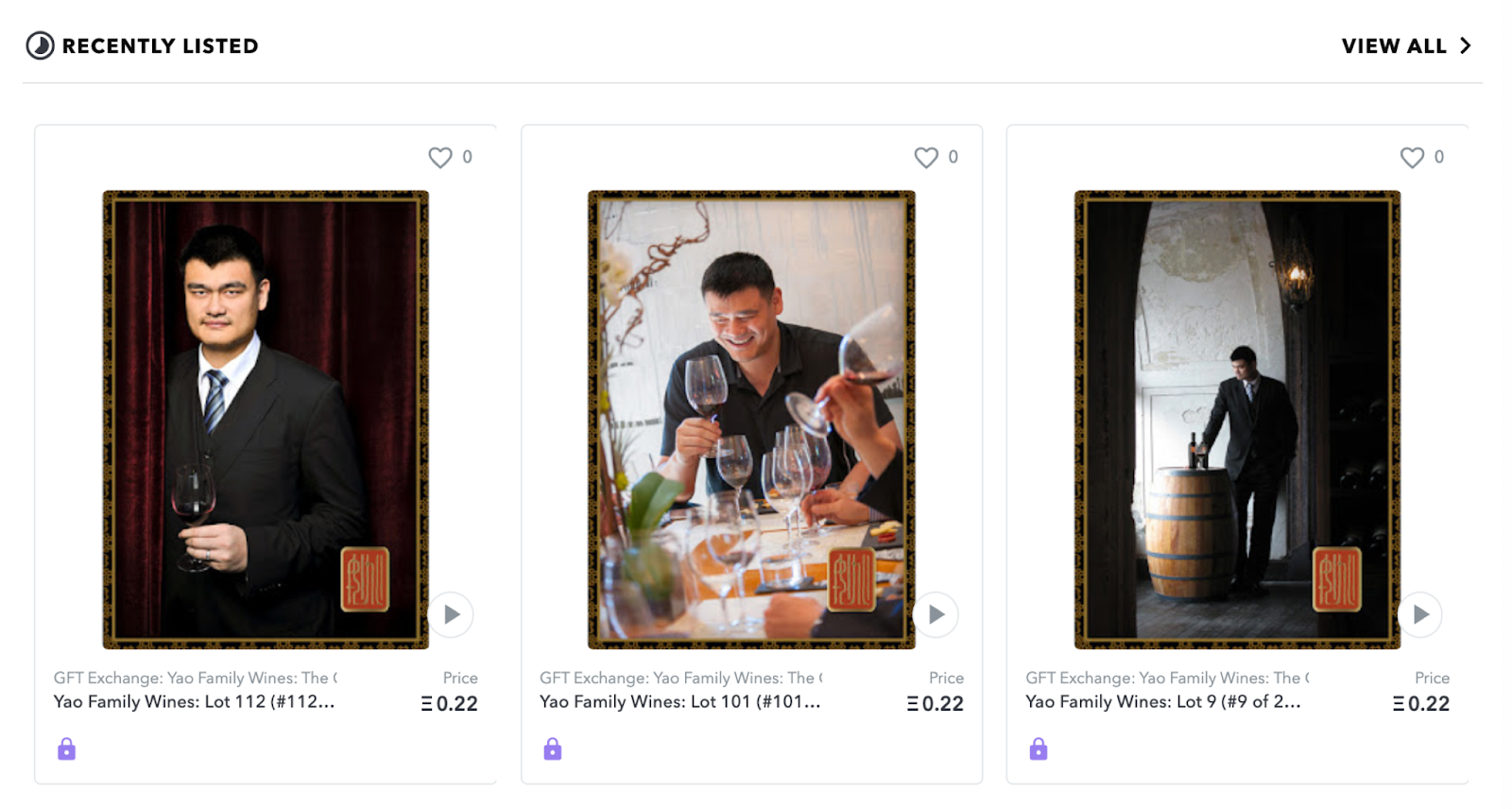

Yao Ming takes a shot at NFTs

The vineyard based by retired Chinese language basketball star Yao Ming launched an unique wine paired with an NFT. Yao Household Wines launched 200 restricted version bottles in a collection named The Chop. This can be a reference to historic stone seals, often known as chops, that have been used on official Chinese language paperwork or items of artwork. The NFTs are actually being traded on OpenSea for between 0.2-0.5 ETH. Yao Ming is presently an government within the Chinese language Basketball Affiliation and is well-known for his humanitarian work off the court docket.

Crypto initiatives wriggle off the hook

After 5 proposed class motion lawsuits towards crypto firms have been dismissed in New York federal courts, various blockchain initiatives, together with Tron, will likely be sleeping a bit of simpler. The 5 dismissed instances have been initially filed by plaintiffs upset about deceptive traders, participating in market manipulation and the sale of digital property that have been allegedly unlicensed securities. Instances towards Binance, Kucoin, and Tron have but to be dismissed however contemplating the similarities, it appears they’ve a great shot at dismissal too. Tron has a blended notion in China, the place Chinese language co-founder Justin Solar has raised quite a lot of eyebrows along with his heavy handed strategy to advertising.

Digital China Summit and the digital yuan

On April 25-26, lots of China’s largest companies and organizations got here collectively to debate the subject of digitalization. E-commerce big JD.com introduced it had been paying a few of their employees salaries with DCEP, China’s central financial institution digital forex. The agency additionally introduced it makes use of the know-how for choose business-to-business funds. JD.com, which is analogous to Amazon, is not any stranger to blockchain and digital currencies. It maintains a blockchain division that’s liable for various initiatives associated to provide chain administration and meals security.

On the summit, Ant Finance revealed that various non-public firms had been supporting the government-led undertaking. Ant Group and Tencent, the businesses that personal the 2 largest non-public fee processors within the nation, are included within the undertaking. Additionally named was smartphone and 5G know-how supplier Huawei. This received’t be a significant shock, as non-public firms will likely be wanting to act in solidarity with the nationwide insurance policies. Nevertheless, it does doubtlessly lay a transparent path to marketplace for the digital yuan if it may be built-in into the nation’s hottest apps and merchandise.

This weekly roundup of reports from Mainland China, Taiwan, and Hong Kong makes an attempt to curate the business’s most essential information, together with influential initiatives, modifications within the regulatory panorama, and enterprise blockchain integrations.

Source link