Pandemic-related job losses pressured many older Individuals out of the office prior to now 12 months, maybe completely. However the COVID-19 disaster additionally appears to have delayed some retirements.

Distant work eradicated commutes and infrequently allowed extra versatile schedules with fewer interruptions. On the identical time, the pandemic restricted many conventional retirement actions, together with journey and visits with household. Whereas some employed older staff look ahead to retiring when restrictions ease, others say teleworking has made staying on the job extra tenable.

Tax accountant Larry B. Harris of Asheville, North Carolina, discovered loads to love about working from house, together with extra flexibility and fewer time in his automotive.

“I’d by no means labored from house besides in a snowstorm. I discovered that I beloved it,” says Harris, 67. “I feel it is going to preserve me working longer.”

Uneven restoration, uneven retirement influence

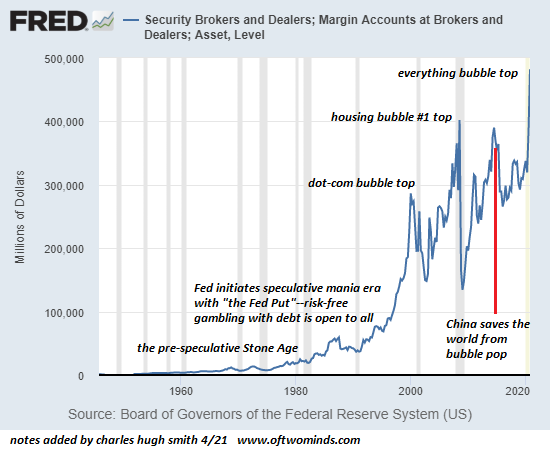

Economists discuss a Ok-shaped restoration, the place a portion of the nation’s industries and inhabitants bounce again shortly from recession whereas others stagnate or proceed to sink. One thing related could also be occurring with child boomer retirements, as better-off staff acquire extra choices whereas these with fewer decisions lose floor.

The tempo of retirements amongst child boomers, these born from 1946 to 1964, accelerated through the pandemic, a Pew Analysis Heart evaluation of month-to-month labor pressure information discovered. The variety of boomers who reported that they have been out of the labor pressure as a result of retirement grew 3.2 million within the third quarter of 2020 in contrast with the earlier 12 months. Earlier than the pandemic, the variety of retired boomers had been rising a median of two million every year since 2011, when the primary boomer turned 65.

Some folks retired to keep away from COVID-19 publicity, whereas others could have been nudged to “seize the day” by the pandemic’s reminder of our mortality. However large job losses could have pressured many into early retirement, economists and monetary planners say.

One among licensed monetary planner Neal Van Zutphen’s purchasers, a lady in her late 50s, misplaced a well-paying job within the hospitality trade. Most individuals who lose a full-time job of their 50s by no means get better financially, in keeping with analysis by nonprofit newsroom ProPublica and the City Institute, a nonprofit analysis group.

“It’s tough to discover a new place of comparable caliber,” says Van Zutphen of Tempe, Arizona. “She hopes to work half time at one thing.”

Pandemic recession hit older staff more durable

Older staff misplaced jobs quicker and returned to work slower final 12 months than midcareer staff, in keeping with a examine by The New Faculty’s Schwartz Heart for Financial Coverage Evaluation that tracked unemployment from April by way of September final 12 months. The examine discovered that for the primary time since 1973, staff 55 and older confronted persistently increased unemployment charges than staff ages 35 to 54.

Sure older staff — ladies, Black folks and people with out school levels — have been much more prone to lose their jobs. And these staff are inclined to have much less saved, so they’re additionally extra uncovered to retirement dangers reminiscent of downward mobility and poverty, the examine mentioned.

On the identical time that the pandemic was pushing hundreds of thousands out of the workforce, lockdown orders gave hundreds of thousands of others a crash course in working from house. About 75% of federal authorities workers, for instance, have been working remotely in September, in keeping with a survey performed by the Authorities Enterprise Council, a analysis group.

So it will not be a coincidence that far fewer federal workers retired in 2020 in contrast with the 2 earlier years, in keeping with an evaluation of month-to-month information from the Workplace of Personnel Administration by Federal Information Community, a media outlet that covers the federal authorities. The evaluation discovered that 92,008 federal workers retired in 2020, the fewest since 2010. The workplace processed 101,580 retirements in 2019 and 107,612 in 2018.

A small delay can have a big effect

Staff don’t at all times get to determine when to retire, however delaying it, when doable, will help shore up funds. Early exits from the workforce can heighten the danger of long-term monetary insecurity. Retirees could not have saved sufficient, and so they may get decrease funds if they begin pensions or Social Safety advantages sooner than deliberate.

Working an additional 12 months or two permits folks to save lots of extra for retirement and make the most of increased “catch-up” limits on 401(ok)s, IRAs and well being financial savings accounts, says licensed monetary planner Nadine Burns of Ann Arbor, Michigan.

Staying on the job additionally will help with one of the crucial vital retirement choices: when to begin taking Social Safety advantages. Making use of earlier than full retirement age, which ranges from 66 to 67, completely reduces the checks that comprise a giant chunk of most individuals’s retirement earnings.

Some folks have little alternative, although, as a result of they don’t have sufficient different earnings to stay on whereas they wait, says John Boroff, director of retirement and earnings options for Constancy Investments.

“When you’re nonetheless working, it’s a neater determination to place off Social Safety,” Boroff says.

This text was written by NerdWallet and was initially printed by the Related Press.

Source link