Making selections with out a plan hardly ever produces high quality outcomes. The identical is true for making actual property funding selections. It is advisable be analytical all through the funding course of, beginning by educating your self on actual property investing and varied choices obtainable, then deciding what sort of funding fits your targets greatest.

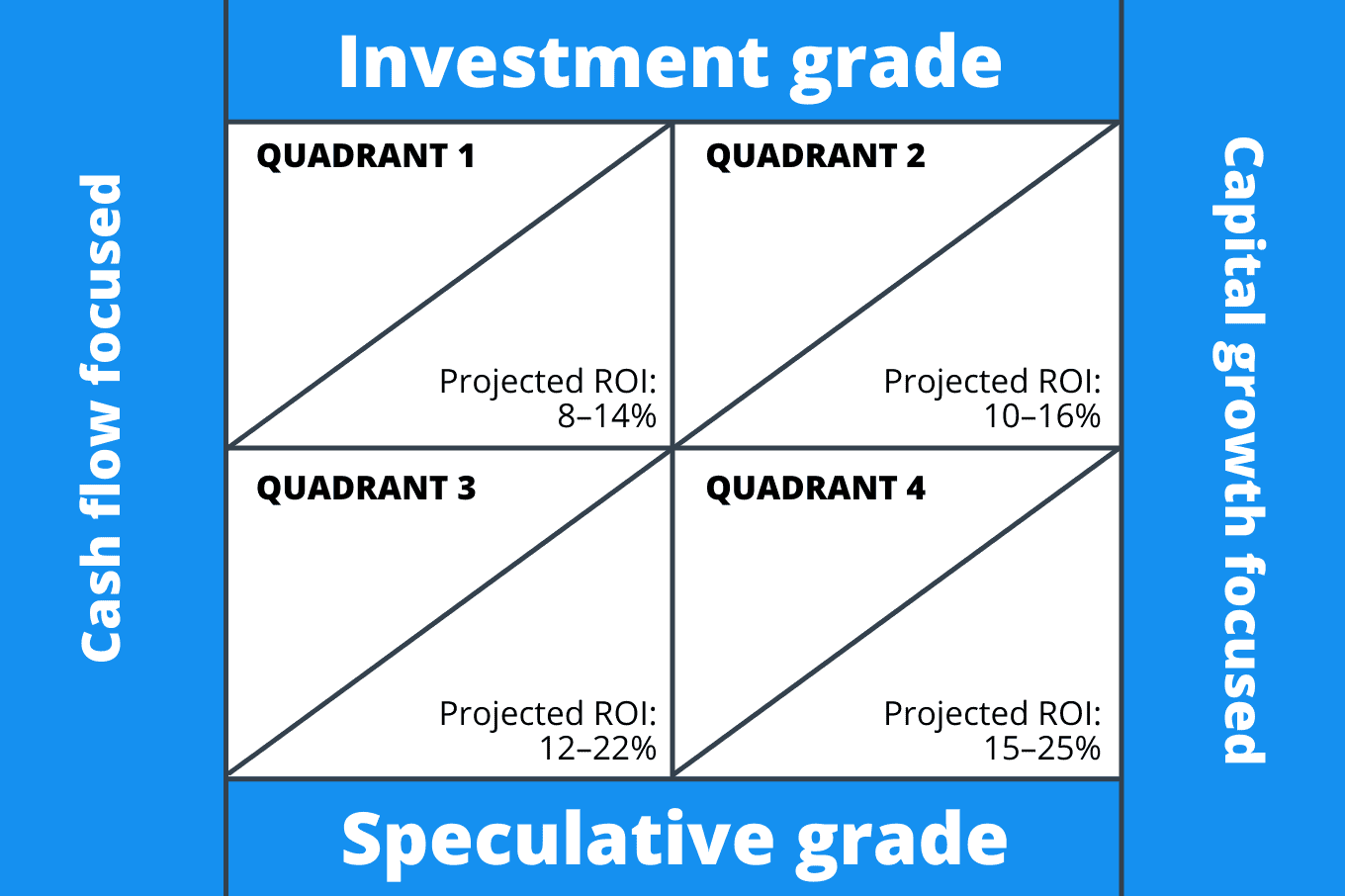

What are the 4 investor quadrants?

With the intention to make clever selections about actual property investing, you must perceive the varieties of funding selections which can be on the market and match them together with your long-term plans. My companion, Mike Zlotnik, has developed the Investor Quadrant methodology, which we share with our investor group.

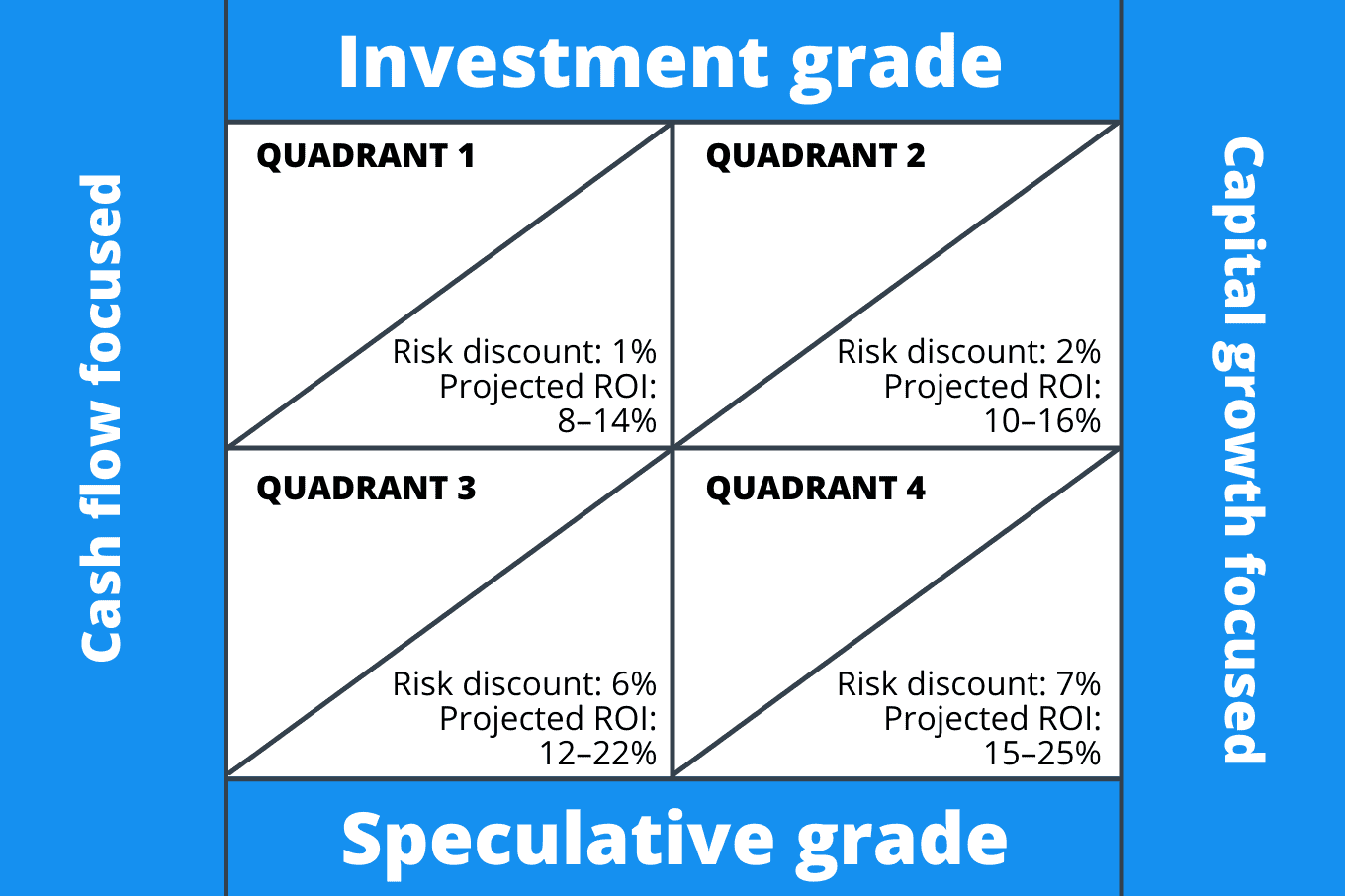

The quadrants go from left to proper in numerical order, with quadrants one and two on the highest and quadrants three and 4 on the underside.

The left aspect of the quadrants focuses totally on money move and never as a lot on progress, whereas the proper aspect is targeted predominantly on capital progress and fewer so on revenue.

The higher row of the quadrants is the funding grade and therefore tends to incorporate moderate- to low-risk varieties of investments, whereas the underside row of quadrants consists of speculative-grade and applies to higher-risk investments.

When evaluating any undertaking, step one is to find out whether or not it’s income- or growth-focused, adopted by figuring out the funding danger degree. This course of lets you place every funding into one of many 4 classes, which in flip helps you determine whether or not that is the kind of funding that fits your explicit monetary wants.

Let’s overview every of the 4 quadrants in larger element to interrupt down the method for classifying every sort of funding.

Extra on danger from BiggerPockets

Quadrant 1

- Contains institutional-quality offers

- Investments fall into low- to moderate-risk classes

- Offers provide money move from day one

- Examples embody performing notes, first-lien mortgage notes, or tremendous conservative leverage fairness offers

Quadrant 2

- Contains institutional-quality offers

- Investments fall into low- to moderate-risk classes

- Offers provide restricted to no money move initially

- Examples embody non-performing notes or average leverage value-add offers

Quadrant 3

- Contains speculative-quality offers

- Investments fall into higher-risk class with the next diploma of uncertainty

- Investments initially undertaking greater money move and focus on producing revenue

- Examples embody second-lien performing notes, excessive leverage value-add offers, or mezzanine debt fund

Quadrant 4

- Contains speculative-quality offers

- Investments fall into higher-risk class with the next diploma of uncertainty

- Investments initially undertaking restricted money move and focus on multiplying worth down the street

- Examples of such offers embody growth, main re-development, land hypothesis, and heavy value-add initiatives with low or nonexistent preliminary money move

Improve your investing at present

Profitable investing requires correct, easy-to-understand details about your properties and the markets you spend money on. BiggerPockets Professional offers you the knowledge it’s good to discover your subsequent nice deal and maximize your present investments.

alter for danger

Take into account that all initiatives have dangers, and it’s good to perceive the right way to calculate returns which can be adjusted for possible dangers. With the intention to obtain that, it’s good to subtract the danger low cost/loss reserve from the projected return.

The high-level steerage for danger adjustment or loss reserve ranges round 1-3% (common is 2%) for investment-grade initiatives and 5-20% (common is 6-8%) for speculative-grade initiatives. As you may think about, the speculative-grade deal dangers are a lot greater, and thus additionally provide greater projected returns.

It’s not unusual for these pointers to fluctuate considerably relying on components together with market fluctuations, sponsors, project-specific dangers comparable to inadequate capital danger or greater development value, and lots of others. The values under are used particularly for illustration functions to clarify the methodology and the dangers concerned.

The desk above illustrates examples of potential danger reductions for every of the 4 quadrants and the risk-adjusted returns primarily based on such reductions. As you may see from this instance, the danger reductions related to the speculative-grade initiatives could also be so much greater and the returns might find yourself being decrease than the returns for the investment-grade initiatives. Due to this fact, so much will depend on your funding portfolio, your short- and long-term targets, and your funding danger tolerance to doubtlessly generate a lot greater returns.

There aren’t any set-in-stone values, and the intent right here is to provide you normal steerage to know the varied investments, related dangers, and sensible expectations of the potential returns and losses.

use the quadrants to assist make investments

Your query now’s most certainly, “Which one is greatest for me?�? Solely you recognize what’s greatest for you. However these might help you identify your portfolio-building technique.

In case your fundamental goal is capital preservation, then you’re most certainly a conservative investor on the lookout for investments with decrease volatility. You’ll probably profit from a well-diversified fund that invests in quite a lot of initiatives.

Take into account that diversification might apply to geographic places, funding methods, or actual property asset courses. So, every fund might incorporate one or two or all three of those diversification methods. The extra diversification methods are applied inside every fund, the upper the precise hedge towards volatility such fund gives.

Some examples of single-strategy funds embody funds targeted on multi-family or cell residence parks. In the case of particular person asset syndication offers, the danger can be greater than in a fund as a result of diversification causes that we simply mentioned. If something goes mistaken with this single undertaking, then you’re prone to not obtain any dividends or doubtlessly lose some or the entire principal funds you had invested. In a fund, the danger of all and even most initiatives failing is pretty low, and therefore the volatility is so much decrease than that of a single-asset funding.

Let me use a selected instance. Let’s say that two people, Ella and Frank, have $200,000 to speculate. Ella determined to speculate all of it in a fund that diversifies throughout all three funding methods, whereas Frank invested in 4 totally different single-asset syndications. Guess which investments have decrease dangers and the next hedge towards the funding’s volatility? You guessed accurately—Ella’s.

We steadily use these funding quadrants to show our buyers the right way to make better-informed funding selections, and hopefully they shed some gentle on the funding methodology for you as properly.

Source link