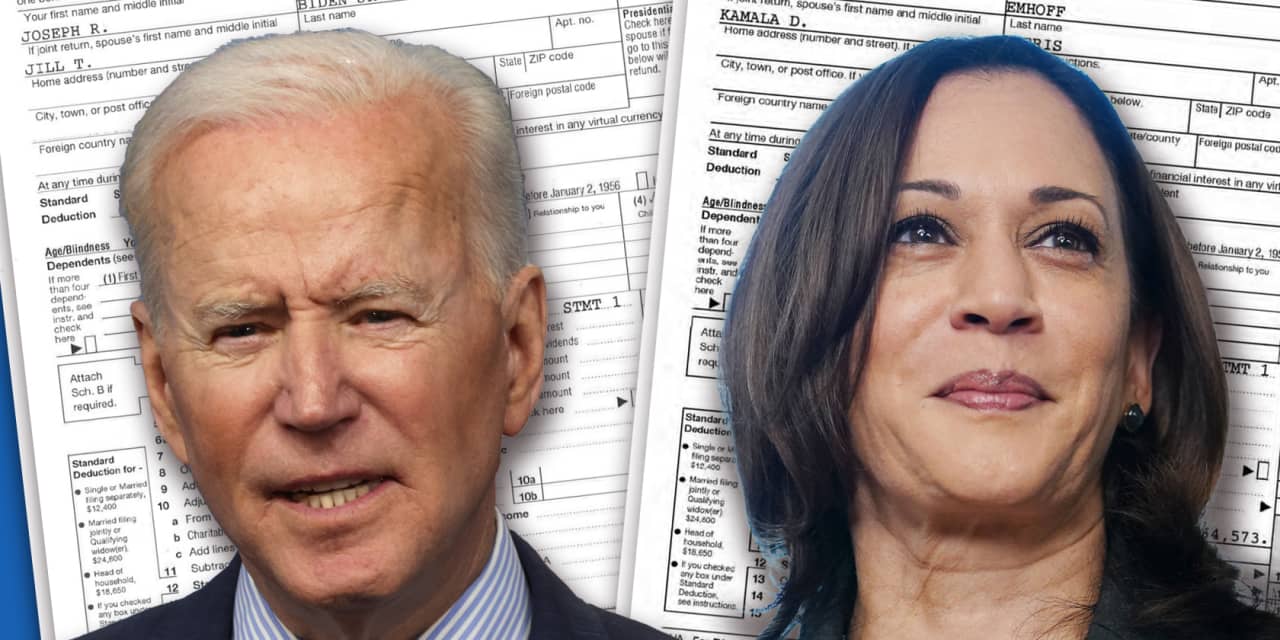

President Joe Biden has been touting his proposed tax hikes on the wealthy by saying they should begin “paying their justifiable share.”

If his proposals develop into legislation, the Commander-in-Chief should put his cash the place his insurance policies are by paying extra on his personal taxes, in accordance with a MarketWatch evaluation.

The president needs to fund his $1.8 trillion American Households Plan by rising taxes for rich households a number of methods, comparable to elevating the highest earnings tax bracket to 39.6% from the present 37% price, a return to the highest price earlier than Trump-era tax cuts.

“

Biden needs to fund his $1.8 trillion American Households Plan by rising taxes for rich households a number of methods, comparable to elevating the highest earnings tax bracket to 39.6% from 37%.

”

That one step would solely value Biden $1,000 to $2,000 further on his federal earnings tax invoice, in accordance with calculations from three accountants who crunched the numbers utilizing the president’s 2020 tax returns and the Treasury Division’s particulars on tax enhance proposals for his or her evaluation.

If the American Households Plan turned legislation, the tax chew can be even more durable on Vice President Kamala Harris and her husband, Second Gentleman Doug Emhoff. The couple would pay roughly $30,000 further in federal earnings taxes if the highest price climbed to 39.6%, the three estimates stated.

The White Home didn’t remark by Monday afternoon on the estimates. The White Home launched Biden and Vice President Kamala Harris’ 2020 tax returns final month.

Their 2020 earnings

These paperwork present the Bidens paid $157,414 in federal taxes final 12 months. The sum features a $142,538 income-tax obligation and different taxes, together with self-employment tax. The Bidens additionally obtained a $4,649 refund.

Harris and her husband’s 2020 returns confirmed they paid $621,893 in federal tax, with $540,095 in earnings taxes along with greater than $82,000 for different federal taxes. The couple owed $34,489 to the IRS.

The American Households Plan would additionally tax capital positive aspects at 39.6% for households making greater than $1 million. However that measure wouldn’t have an effect on Biden and Harris personally, a minimum of if their 2020 returns are any indication.

For starters, the Bidens’ earnings falls beneath the $1 million greenback mark, with their 2020 adjusted gross earnings coming at $607,336. Moreover, they didn’t promote, or “notice” any long-term capital positive aspects in the course of the 2020 tax 12 months.

Harris and Emhoff’s adjusted gross earnings is $1.695 million, however they reported a $218 capital loss. If losses exceed positive aspects, the quantity, as much as $3,000, can be utilized to decrease earnings, in accordance with IRS guidelines.

Working the numbers

When MarketWatch requested the accountants to run the numbers on how rather more Biden and Harris would pay below the plan they’re urgent for as public officers, the outcomes various barely attributable to completely different calculation strategies.

Andrew Schmidt, affiliate professor of accounting at North Carolina State College’s Poole Faculty of Administration, stated the Bidens would pay an additional $1,931 whereas Harris and Emhoff would pay $31,382 extra.

He centered on the earnings tax obligation (Line 16) and used the 2020 tax brackets. Schmidt swapped out the present high price and utilized the proposed 39.6% price on taxable earnings over $509,300 for married {couples} submitting collectively.

“

The three estimates hover close to the identical neighborhood, giving a tangible instance of the potential prices for some wealthy households below the Biden administration’s income-tax plan.

”

Equally, Ed Zollars, of Thomas, Zollars & Lynch in Phoenix, Ariz. decided the Bidens would additionally pay an additional $1,931, whereas Harris and Emhoff would pay $31,507 extra.

Zollars additionally began on Line 16, however he used the 2021 tax tables, which account for inflation and can be used to find out tax payments subsequent 12 months. Zollars then inserted the 39.6% price for taxable earnings over $509,300.

Robert Seltzer of Seltzer Enterprise Administration in Los Angeles, Calif. stated the Bidens can be paying an additional $1,091 in earnings taxes, whereas Harris and Emhoff would pay $29,127.

Seltzer began with the quantity of taxable earnings on Line 15, and subtracted $509,300. He multiplied the end result by 2.6%, which is price enhance from 37% to 39.6%.

Nonetheless, the three estimates hover close to the identical neighborhood, giving a tangible instance of the potential prices for some wealthy households below the Biden plan.

Even that $30,000 further for Harris and her husband solely makes up 3% of their after-tax earnings, Schmidt and Zollars stated. For the Bidens, the additional tax solely accounts for 0.3% to 0.5% of their after-tax earnings, Seltzer and Zollars added.

Influence on rich People

A family making between $500,000 and $1 million may see a mean $3,700 enhance of their federal income-tax invoice or $219,880 for these incomes $1 million-plus, in accordance with recently-released estimates from the Tax Coverage Heart.

Seltzer has purchasers within the Harris-Emhoff earnings vary and, primarily based on his conversations with them, he stated they “don’t make a giant fuss” over income-tax hikes. Their concern is the tax therapy for capital positive aspects, he stated.

But it surely all is dependent upon the political leanings of his purchasers. Democrats might swallow increased charges simpler than Republicans. As for the previous, Seltzer stated, “They take a look at the choice of getting Trump over paying an additional 2.6%, and so they’ll gladly pay it.”

“

Political leanings play a task: 65% of Democratic-leaning ballot contributors stated they paid the correct amount versus 46% of Republican-leaning ballot contributors.

”

The president and vp is likely to be simply in a position to abdomen a tax hike, however analysis means that Republican-leaning People who voted for Donald Trump within the final election might not take their very own increased tax invoice as nicely.

Greater than half of People (55%) stated their tax invoice is honest, a Gallup ballot discovered final month: 65% of Democratic-leaning ballot contributors stated they paid the correct amount versus 46% of Republican-leaning ballot contributors.

Greater than two-thirds (69%) of individuals again the concept of extra taxes for rich households and firms, in accordance with a current ballot commissioned by People for Tax Equity, an advocacy group in search of extra taxes on the wealthy.

What’s extra, 43% of individuals stated it was “extraordinarily vital” for rich households and company to “pay their justifiable share,” the ballot stated. The ultra-high web value People are extra vulnerable to pay much less, or no earnings tax in any respect.

ProPublica obtained years of tax returns from among the tremendous elite — together with Tesla

TSLA,

co-founder Elon Musk and Amazon

AMZN,

founder Jeff Bezos — and stated there have been a handful of years the place they didn’t owe earnings taxes.

Source link