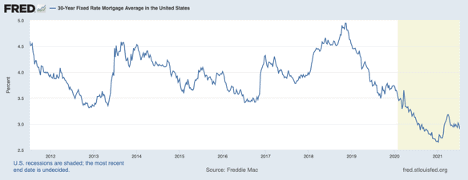

Though rates of interest stay close to historic lows, it’s necessary to not lose sight of how these low rates of interest affect housing costs—particularly as inflation threatens sooner-than-expected charge hikes.

For the final a number of months, the Client Value Index (CPI), one of many principal measurements of curiosity, has been above the Fed’s goal charge of two% year-over-year inflation (most lately round 5%). Whereas some indicators point out this inflation is short-term, it’s one thing to watch. Rising inflation has broad implications for each property costs and actual property traders.

When inflation rises, the federal government normally needs to cease it. The federal government’s major instrument to battle inflation is raised rates of interest, which works by lowering the availability of cash within the financial system. And whereas this tactic tends to work at managing inflation, rising rates of interest can sluggish or even perhaps reserve beneficial properties in property costs.

How rates of interest affect affordability

Before everything, rates of interest affect the affordability of mortgages.

When rates of interest are low, it’s inexpensive for individuals to borrow cash. Rates of interest are basically a measurement of how a lot a borrower pays a lender to borrow cash. The decrease the rate of interest, the much less the borrower pays the lender over the course of the mortgage. That is typically good! Nobody needs to pay a lender or financial institution a cent greater than they need to (sorry, lenders).

However the financial savings debtors get pleasure from as a result of low rates of interest may also drive up property values as a result of low rates of interest enhance housing affordability. When debtors pay the financial institution much less, they will afford costlier houses.

Let’s take a look at an instance.

Julia has a funds of $120,000 for a down cost and desires to maintain the funds for principal and curiosity (P&I) on her mortgage round $1,900 per thirty days.

Just a few years in the past, when rates of interest averaged round 5%, Julia would have maxed out at a property that price round $425,000. For that value, Julia would put down $85,000 (assuming a 20% down cost), and the P&I on her $340,000 mortgage ($425,000 – $85,000) would come out to $1,825.

However now, mortgages are hovering round 3%, which implies Julia can afford a $550,000 home. A down cost would price her $110,000, and regardless that her mortgage would now be for $440,000 ($550,000 – $110,000) her funds could be $1,855.

Cost on $440,000 mortgage at 3% = $1,855

Cost on $340,000 mortgage at 5% = $1,825

Simply because rates of interest dropped from 5% to three%, Julia can now afford a property that’s $125,000 costlier than the property she may afford just a few years in the past! That’s an enormous distinction in value vary.

Take an investing deep dive

Need extra in-depth analyses like this from Dave? Profitable investing requires correct, easy-to-understand details about your properties and the markets you spend money on. BiggerPockets Professional offers you the knowledge you must discover your subsequent nice deal and maximize your present investments.

Does affordability have an effect on the housing market?

Rising affordability doesn’t essentially drive housing all by itself. Nonetheless, whenever you mix elevated affordability with the traditionally low housing stock we’re presently seeing, it’s an ideal state of affairs for costs to climb.

Folks need homes, and there aren’t loads to purchase. Relatively than pocketing the financial savings from low rates of interest, many debtors who intend to purchase select to make use of the cash they’re saving on curiosity to bid up the value of the home. Therefore all of the bidding wars.

Returning to our earlier instance, if Julia have been a house that price $450,000, we all know from our calculations above that she will be able to afford a home as much as $550,000—so she will be able to drive the price of that home all the best way up from $450,000 to $550,000 and nonetheless keep inside her funds.

Take into consideration that for a second. Rates of interest dropping from 5% to three% means a single particular person can drive up the value of a home by $100,000 (22%!) with out altering her funds.

In fact, this is only one excessive instance. However in mixture, this elevated affordability can—and infrequently does—drive up costs throughout the whole housing market.

In distinction, if rates of interest climb and affordability falls, it has the potential to decelerate and even reverse beneficial properties in property costs. It doesn’t at all times occur that approach, however mortgage affordability can considerably affect property properties.

How rates of interest have an effect on threat evaluation

Along with affordability, there’s a extra mathematical approach that rates of interest affect housing costs that’s significantly related to actual property traders.

Most traders select to worth actual property by the revenue the property generates, because it allows traders to measure their return on funding. Sometimes, a metric often known as cap charge is used for this train.

Cap charge is simple to calculate. You merely divide the online working revenue (NOI) of a property by the property’s market worth. For instance, when you had an NOI of $50,000 and a property price $1,000,000, the cap charge is 5%.

Whenever you’re attempting to determine the worth of a property, you should use the inverse of this system. Merely divide the NOI by the typical cap charge in your space.

For instance, when you toured a property with $30,000 in NOI and the cap charge for comparable properties is 7%, you’d seemingly wish to pay round $429,000 ($30,000/.07).

Usually, sellers like a low cap charge and consumers like the other—they wish to purchase at a better cap charge.

The cap charge in your space is fluid, although. Nobody sits down and units what the cap charge might be for multifamily properties in Atlanta. As an alternative, it’s a product of the free market.

Need extra? Learn Professional-only articles from Dave

Professional

Typically a bullish investor could also be keen to purchase at a comparatively low 3-4% cap charge. Different occasions, traders might demand a ten% cap charge or larger for his or her funding. All of it relies on the chance/reward profile of a selected funding and the macroeconomic local weather.

Proper now, cap charges are usually low. With low rates of interest, traders have decrease bills as a result of they’re paying much less to their lenders. With decrease bills comes decrease threat. This (mixed with varied different financial components we received’t get into right here) can embolden traders to purchase at a decrease cap charge.

However, when rates of interest begin to rise, cap charges normally comply with. As an investor, when rates of interest rise, it means your bills go up. With rising bills comes rising threat. And with extra threat, traders should demand higher prospects of return within the type of larger cap charges.

However right here’s the catch: larger cap charges decrease property worth. This ought to be evident from the formulation we reviewed above.

Do not forget that property with $30,000 in NOI we have been contemplating? At a 7% cap charge, the property was estimated to be price $429,000 ($30,000/.07). However, at an 8% cap charge, that very same property is price about $375,000 ($30,000/.08). When traders demand larger cap charges (usually as a result of rising rates of interest), they cut back property values.

This isn’t essentially good or unhealthy. House owners and sellers may see a decline and even reversal of value appreciation, which isn’t enjoyable. However alternatively, many consumers will seemingly welcome decrease property values even when financing is costlier. Both approach, it’s an necessary dynamic to watch over the approaching months.

Whereas fluctuations in rates of interest do have the potential to have an effect on property costs, it’s nonetheless unclear what’s going to occur in right this moment’s market.

When charges change regularly, it doesn’t at all times correspond with a giant shift in market dynamics.

Rates of interest rose from 2016-2019, for instance, and property costs rose steadily throughout that point. So, if rates of interest do begin to rise, it’s not essentially going to trigger declining costs or any type of crash.

My finest guess is that charges will begin to rise within the coming months, however it should occur regularly. This could result in cooling of the housing market again right down to regular development charges (assume 4-8% year-over-year development as an alternative of twenty-two%), however we received’t see a reversal in property costs, not less than within the subsequent yr or so.

To me, it could take a speedy rise in rates of interest with a corresponding drop in demand or an enormous glut of stock for costs to reverse, and personally, I don’t see that occuring quickly.

Source link