by Charles Hugh-Smith

Sustaining the phantasm of confidence, permanence and stability serves the pursuits of these benefiting from the bubbles and those that favor the protection of the herd, even because the herd thunders towards the precipice.

The misperception that collapse is an all or nothing phenomenon is frequent: Both the system rights itself with a little bit of money-printing and rah-rah or it collapses into post-industrial damage and gangs are battling over the past stash of canned beans.

Neither state of affairs considers the fragility and resilience of the socio-economic system as an entire. It’s each way more fragile than the believers within the permanence of the waste is development mannequin grasp and extra resilient than the full collapse prognosticators grasp.

The latest comparatively gentle logjams in international provide chains of necessities are mere glimpses of precariously fragile delivery-supply techniques. These could be understood as bottlenecks that solely insiders see, or as unstable nodes via which all of the economic system’s connections run. Put one other method, the economic system’s as a community seems decentralized and strong, however this phantasm vanishes once we take into account how the whole economic system rests on a number of unstable nodes.

One such node is the supply of gasoline and fuels. It’s such an environment friendly and dependable system that 99.9% of us take it as a right: there’ll at all times be loads of gasoline at each station, the tanks of jet gas will at all times be topped off, and so forth.

The 0.1% know that this technique, as soon as disrupted, would knock over dominoes all via the economic system.

Hyper-efficiency and hyper-globalization has diminished the variety of producers of necessities to the purpose that disruptions can’t be overcome with redundant sources. We see this all over the place within the international economic system: a handful of vegetation and firms (generally a single supply of important parts) course of or manufacture important parts in a lot bigger techniques.

That is how you find yourself with 1000’s of newly manufactured automobiles parked in heaps awaiting one essential half that’s briefly provide.

One other key weak spot is the whole system’s reliance on debt, leverage and hypothesis. Few appear to grasp that bodily manufacturing and supply techniques can grind to a halt for monetary causes–for instance, traces of credit score being pulled, a counterparty to some arcane commodity swap goes below, taking the presumably solvent company down with it, and so forth.

The extra debt that’s been piled up, the better the instability of the whole system. Danger at all times seems low till the system destabilizes, after which all of the hedges fail and threat breaks out, flooding via the whole monetary system.

Leverage is nice enjoyable on the best way up, because it magnifies good points. Because the Federal Reserve implicitly ensures that “purchase the dip” will generate large good points, why not ramp up leverage ten-fold to maximise these Fed-guaranteed good points?

Leverage is much less enjoyable on the best way down. When the underlying collateral has shrunk to twenty% of the leveraged bets being made, a 21% decline within the asset wipes out all of the collateral holding up the palace of leveraged debt.

The Fed can print cash however it will probably’t create collateral, nor can it make bancrupt entities solvent. All of the Fed can do is enhance the debt and leverage, which isn’t the answer, it’s the issue.

Hypothesis can be inherently unstable, because the euphoric herd, as soon as startled, turns in panic and stampeded in concern. Markets which appeared liquid–i.e., sellers might depend on somebody shopping for as many thousands and thousands of shares as they desired to promote–change into illiquid, as consumers vanish like mist in Dying Valley. With consumers gone, costs plummet to ranges the herd reckoned “not possible” simply days earlier than.

The Fed’s complete technique within the twenty first century has been to inflate asset bubbles that generate the phantasm of wealth–the so-called wealth impact which is presumed to encourage voracious borrowing and spending.

Sadly for the Fed, many of the good points flowed to the highest 0.1%, and an economic system primarily based on a handful of billionaires shopping for super-yachts and spaceships is a line of dominoes awaiting the inevitable “accident.” So there are two systemic issues with counting on asset bubbles to generate “wealth”: 1) since 90% of the belongings are owned by a skinny slice of the populace, bubbles enhance destabilizing inequality, and a couple of) bubbles are intrinsically unstable. So the U.S. economic system, depending on the Fed for the “juice” of financial stimulus, is now depending on extremely unstable bubbles in belongings, debt and leverage, bubbles which have generated extremes of wealth/earnings inequality which might be destabilizing the social and political orders.

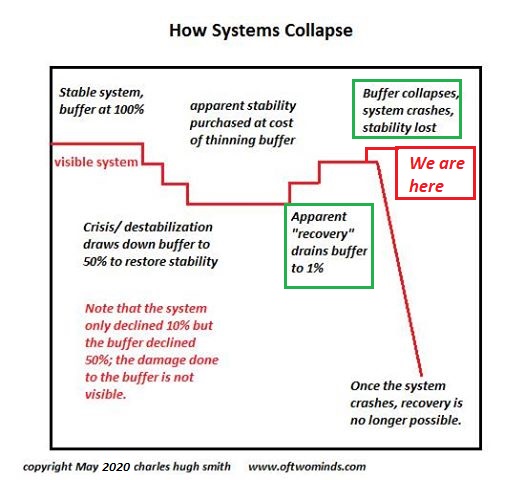

Because the three charts beneath illustrate, the fragility and instability are effectively hidden till it’s too late: bubbles, debt, leverage, budgets and revenues can solely click on increased as a result of the system breaks down if there may be any sustained decline (the rising wedge mannequin of breakdown). As soon as the subsystems fail, there’s no placing the eggshell again collectively.

The second chart depicts how buffers skinny beneath the floor, masking the systemic fragility. The lack of redundancy, the decay of upkeep, the lack of skilled staff–all of those are hidden from public view till the system breaks down.

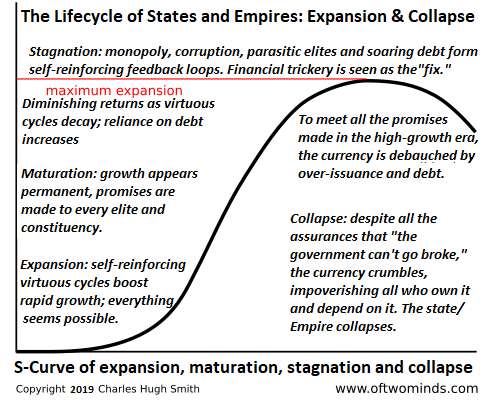

The third chart tracks the S-curve of enlargement, confidence, complacency, delusion and collapse adopted by human techniques, from nations to empires to companies: because the buffers skinny and the rising wedge reaches an apex of vulnerability, the management evinces a delusional confidence within the permanence and stability of more and more fragile, unstable techniques.

Sustaining the phantasm of confidence, permanence and stability serves the pursuits of these benefiting from the bubbles and those that favor the protection of the herd, even because the herd thunders towards the precipice.

That is how breakdowns in apparently steady subsystems triggers the autumn of dominoes all through the bigger system, resulting in a collapse that was extensively seen as “not possible.” Such is the facility of complacency and delusion.

In the event you discovered worth on this content material, please be part of me in looking for options by turning into a $1/month patron of my work by way of patreon.com.

My new ebook is offered! A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% reductions (Kindle $7, print $17, audiobook now out there $17.46)

Learn excerpts of the ebook totally free (PDF).

The Story Behind the E-book and the Introduction.

Latest Movies/Podcasts:

AoE Salon #44: We are saying “Satyagraha”, they are saying “sedition” with writer Max Borders (1:03 hrs)

My COVID-19 Pandemic Posts

My latest books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Learn the primary part totally free (PDF).

Will You Be Richer or Poorer?: Revenue, Energy, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Learn the primary part totally free (PDF).

Pathfinding our Future: Stopping the Ultimate Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Learn the primary part totally free (PDF).

The Adventures of the Consulting Thinker: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); learn the primary chapters totally free (PDF)

Cash and Work Unchained $6.95 (Kindle), $15 (print) Learn the primary part totally free (PDF).

Turn out to be a $1/month patron of my work by way of patreon.com.

Source link