If one phrase might be used to explain how the vast majority of individuals within the cryptocurrency ecosystem really feel concerning the near-term outlook for Bitcoin (BTC) it could be ‘undecided’, as combined indicators from all method of indicators have many merchants ready for a big transfer in both course earlier than planning their subsequent entry level.

A brand new report from Delphi Digital took a macro take a look at Bitcoin’s present value motion and located that a wide range of elements, together with low change volumes and the strengthening U.S. greenback have weighed closely on the highest cryptocurrency.

Bitcoin’s latest dip to $31,000 provides to the aura of concern that at the moment envelops the crypto market and analysts at the moment are warning that failure to shut above $31,000 might see BTC drop to the $29,000 to $24,000 zone.

Listed below are three areas of focus that Delphi Digital highlights as being probably the most impactful on the short-term value motion for Bitcoin

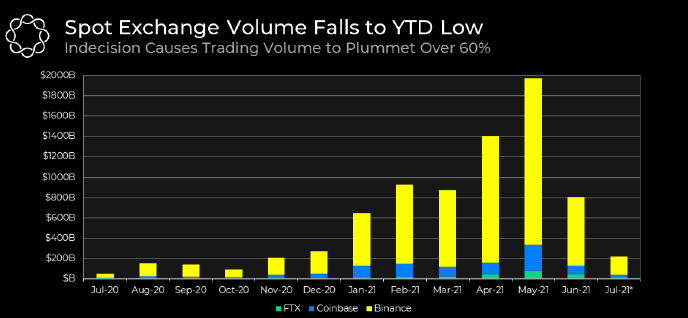

Spot volumes and open curiosity collapse

In line with Delphi Digital, declines in buying and selling exercise are one of many greatest elements affecting the market. It is because after the Might 19 sell-off there was an exodus of spot and derivatives merchants from exchanges.

As seen within the chart above, after seeing a considerable enhance in the course of the first half of 2021, change volumes have fallen by greater than 60% as costs collapsed and merchants swore off utilizing leverage.

The precipitous drop in BTC value additionally helped to tamper down retail merchants’ use of excessive leverage in derivatives markets and proof of this comes from BTC futures open curiosity dropping again to ranges seen since early 2021.

Delphi Digital stated:

“This purge has prompted vital injury to the bullish market construction, with futures foundation close to 0% and depressed funding charges for perpetual contracts.”

On a extra constructive observe, the mega liquidation occasion seen again in Might helped filter out overleveraged merchants, that means “stronger-handed individuals are those primarily contributing to present open curiosity ranges.”

Greenback energy results in BTC weak spot

One other issue weighing on the worth of Bitcoin has been the latest energy of the U.S. greenback, which has been on an uptrend since bottoming at 89.53 on Might 25.

As seen within the chart above, a big inverse head and shoulders sample has fashioned on the DXY chart with the neckline now being examined for the third time.

Ought to the greenback make one other leg increased, the present financial restoration might be threatened as monetary circumstances would tighten and this would possibly weigh closely on lots of the hottest trades of 2021.

Delphi Digital stated:

“Commodities, gold, rising market equities, Bitcoin are all weak to a strengthening dollar, although the pace of its transfer additionally stays a essential issue.”

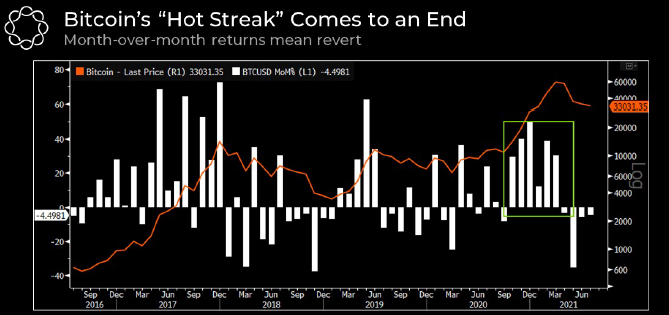

Bitcoin value falls to a long run assist

Whereas the 51% drop in BTC value has many analysts afraid that one other multi-year bear market might be beginning, it’s necessary to account for a number of the bigger macro tendencies that led to the present circumstances.

The above chart exhibits that Bitcoin had six consecutive months of value good points earlier than a downturn and the asset was due for a pullback from a historic perspective.

Even with BTC down 51% from its all-time excessive, on a year-over-year foundation, its value remains to be 250% increased than its $9,100 valuation on July 16, 2020.

The long-term uptrend for Bitcoin stays intact with its value at the moment testing the 12-month transferring common, an necessary degree of assist that can decide the place the worth heads from right here.

Bitcoin buying and selling quantity on spot and by-product exchanges is down and the prospects of a strengthening greenback weigh closely on world monetary markets. This has resulted in indecisiveness being the first emotion that guidelines the crypto market in the intervening time and this sentiment is more likely to persist till a significant value motion or motivating occasion prompts engagement from sidelined merchants.

The views and opinions expressed listed below are solely these of the creator and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, you must conduct your personal analysis when making a choice.

Source link