If there was a soundtrack to the annual outcomes for Hipgnosis subsequent week, Hey Massive Spender can be good. In a deal-making flurry geared toward capitalising on a surge in music listening in the course of the pandemic, the music rights proprietor has over the previous 12 months spent $1bn (£710m) on evergreen hit songs, shopping for the rights to 84 music catalogues by artists starting from Neil Younger to Shakira.

Its whole catalogue, which additionally consists of songs by Beyoncé, Blondie, Barry Manilow and extra, is price $2.2bn following that spree.

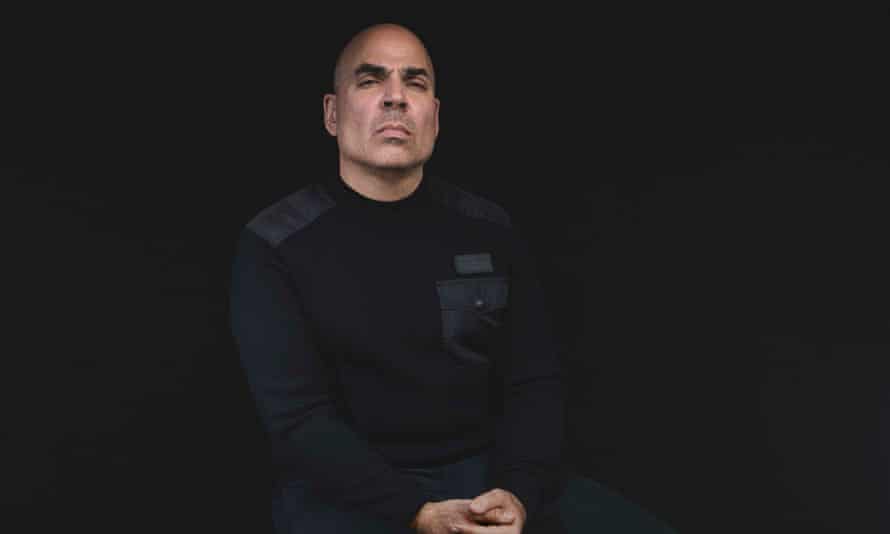

The London-listed firm, which earns royalties each time one of many 65,000 songs to which it owns the rights is streamed, is predicted to report on Tuesday that revenues rose by two-thirds to $138m and income climbed by half to $107m within the 12 months to the top of March. Merck Mercuriadis, founder and chief government of Hipgnosis, stated final month that whereas he by no means “wished for a pandemic” the end result was an “acceleration of consumption of traditional songs via streaming”.

Since floating on the London Inventory Alternate in 2018, Hipgnosis has spent $2bn on rights to catalogues, and now values its total portfolio of 138 catalogues at $2.2bn, a rise of 13.6%, or $265m, since flotation.

The streaming growth has saved a music business that had been struggling within the tooth of piracy and the inexorable decline of CD gross sales. Final 12 months, international music gross sales grew for a sixth consecutive 12 months to $21.6bn, fuelled by an 18.5% rise in subscriptions to streaming companies, which now account for 62% of complete international gross sales. Whole international music revenues are up greater than 50% from their nadir in 2014, due to the 443 million customers of subscription streaming companies similar to Spotify, Apple Music and Amazon Music.

However Hipgnosis’s mannequin is proving that not all music is created equal, and that the oldies could be the most effective. Now 60% of the songs Hipgnosis owns the rights to are greater than 10 years previous – an enormous rise from the 32.5% seen on the finish of March final 12 months. Two years in the past that proportion was simply 10%.

Mercuriadis is just not the one one cashing in. Warner Music, the world’s third-largest music firm, dwelling to artists together with Ed Sheeran, moved to drift final June and has seen its share worth enhance 15% up to now 12 months to provide it a market worth of $18bn. Proprietor Len Blavatnik paid simply $3.3bn for the corporate in 2011. And Vivendi – proprietor of the world’s largest music firm, Common Music, dwelling to artists and rights from Woman Gaga to the Beatles – is about to drift in Amsterdam in September with a valuation in extra of €35bn.

Nevertheless, the growth instances could also be coming to an finish as streaming income development slows, notably in mature western markets, and bidding wars for premium artist catalogues overheats. In an interview with the Guardian final 12 months, Mercuriadis estimated that he had two, perhaps three years at greatest, to safe commercially viable offers for catalogues earlier than the music business encounters the Netflix-fuelled drawback TV faces: hyperinflation for crown-jewel content material. Within the meantime, although, Hipgnosis will preserve spending.

Source link