$2 billion price of Bitcoin (BTC) choices will expire on Friday, Aug. 27. Some analysts argue {that a} sturdy name (purchase) choice shopping for exercise on Aug. 22 was possible the catalyst for the latest $50,000 worth check.

Digital asset buying and selling agency QCP Capital talked about in its market replace that an entity has been “constantly pushing (choice) costs greater in the previous couple of weeks.” The exercise, which befell through the morning buying and selling session in Asia, aggressively purchased bullish choices in chunks of 100 BTC contracts every.

The report additionally mentions the exhaustion of regulatory considerations within the close to time period, as crypto-related selections from the Senate Banking Committee and regulators are unlikely to bear fruits in 2021.

Bears may be analyzing completely different information

Nonetheless, the newest “The Week On Chain” report from blockchain analytics supplier Glassnode included some regarding information from Bitcoin on-chain exercise. Such evaluation discovered that the quantity of entity-adjusted transactions has not responded to the continuing bullish motion.

Furthermore, Decentrader, a crypto market-intelligence supplier, highlighted inadequate buying and selling quantity throughout this latest transfer to push BTC’s worth above $52,000.

Friday shall be an vital check of the $50,000 stage, as 4,372 BTC choice contracts await the $218 million resolution.

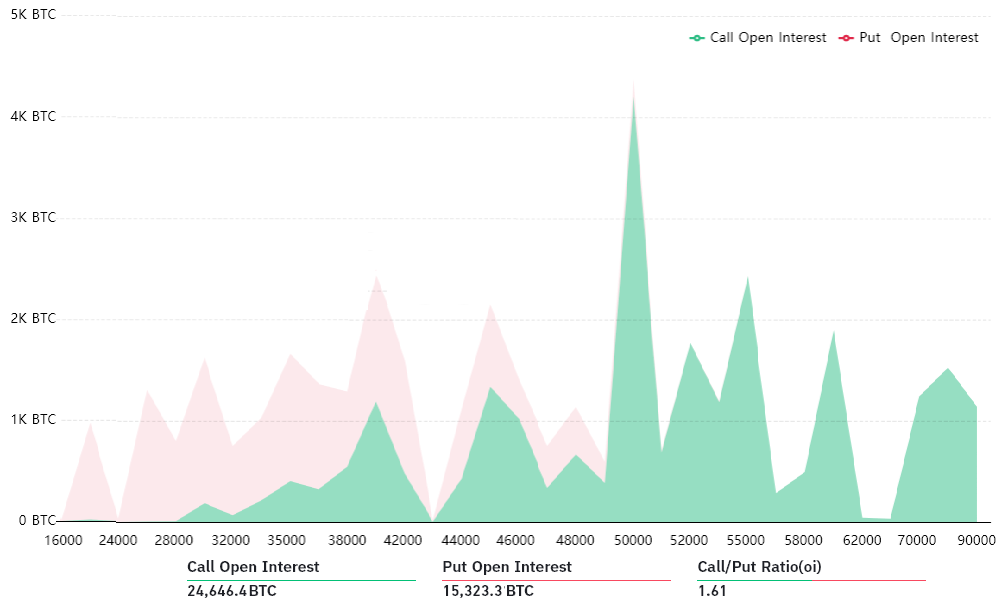

The preliminary call-to-put evaluation reveals the huge dominance of the neutral-to-bullish name devices, with 60% bigger open curiosity. Nonetheless, bulls may need been too optimistic, as 68% of their bets have been positioned at $50,000 or greater.

Associated: Bitcoin rejects $51K after Michael Saylor reveals new BTC buy — What’s subsequent?

91% of the put choices will in all probability be nugatory at expiry

Then again, 91% of the protecting put choices have been positioned at $46,000 or under. These neutral-to-bearish devices will change into nugatory if Bitcoin trades above that worth on Friday. The choices expiry occurs at 8:00 am UTC, so some extra volatility is anticipated forward of the occasion.

Beneath are the 4 most probably situations, contemplating the present worth ranges. The imbalance favoring both facet represents the potential revenue from the expiry contemplating calls (purchase) choices are extra incessantly utilized in bullish methods, whereas protecting places are utilized in neutral-to-bearish trades.

- Beneath $45,000: 4,040 calls vs. 2,500 places. The web result’s a $69 million benefit for the neutral-to-bullish devices.

- Above $46,000: 6,500 calls vs. 1,300 places. The web result’s $239 million favoring the neutral-to-bullish devices.

- Above $48,000: 7,400 calls vs. 420 places. The web result’s a $335 million benefit for neutral-to-bullish devices.

- Above $50,000: 12,000 calls vs. 35 places. The web result’s a $600 million benefit for neutral-to-bullish devices.

The above information reveals what number of contracts shall be obtainable on Friday, relying on the expiry worth. There is no approach to measure the web consequence for each market participant as some traders might be buying and selling extra advanced methods, together with market-neutral ones utilizing each calls and protecting places.

These two competing forces will present their energy as bears will attempt to reduce the harm. Both approach, bulls have full management of Friday’s expiry, and there appear to be sufficient incentives for them to defend the $48,000 stage and even attempt a extra important acquire by pushing the worth above $50,000.

In the meantime, bears ought to consider the September expiry, though holding in thoughts that El Salvador is anticipated to introduce Bitcoin as authorized tender subsequent month. As well as, the nation is constructing the infrastructure to help a state-issued Bitcoin pockets known as Chivo.

The views and opinions expressed listed here are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer entails threat. It is best to conduct your individual analysis when making a call.

Source link