On June 7, america authorities job pressure seized greater than $2 million in Bitcoin (BTC) to pay a ransom following an assault on the Colonial Pipeline system. A warrant filed with the U.S. District Courtroom for the Northern District of California reveals that authorities recovered 63.7 BTC.

As information of the restoration unfold by way of mainstream media, some retailers instructed that the U.S. authorities in some way hacked the Bitcoin tackle with a view to extract the funds. For instance, College of Michigan professor and New York Occasions contributor Justin Wolfers tweeted:

Information that the federal government has found out how you can snatch bitcoin from the web wallets of cyber criminals certainly reduces the use circumstances for Bitcoin even additional.

— Justin Wolfers (@JustinWolfers) June 8, 2021

This triggered a dialogue on whether or not an entity might break by way of SHA-256 encryption, and if that’s the case, why waste this means on unlocking a Bitcoin pockets that solely incorporates $2 million?

The identical kind of cryptography is utilized by the Nationwide Safety Company, banks, international businesses, cloud storage techniques, and most digital gadgets like smartphones and communication apps.

If governments needed to create short-term havoc within the cryptocurrency market, they would want to make massive gross sales to negatively impression the worth. Nonetheless, there would in all probability be at the least 3 telling indicators that may trace that this kind of state of affairs was unfolding.

Open curiosity at CME BTC futures would spike

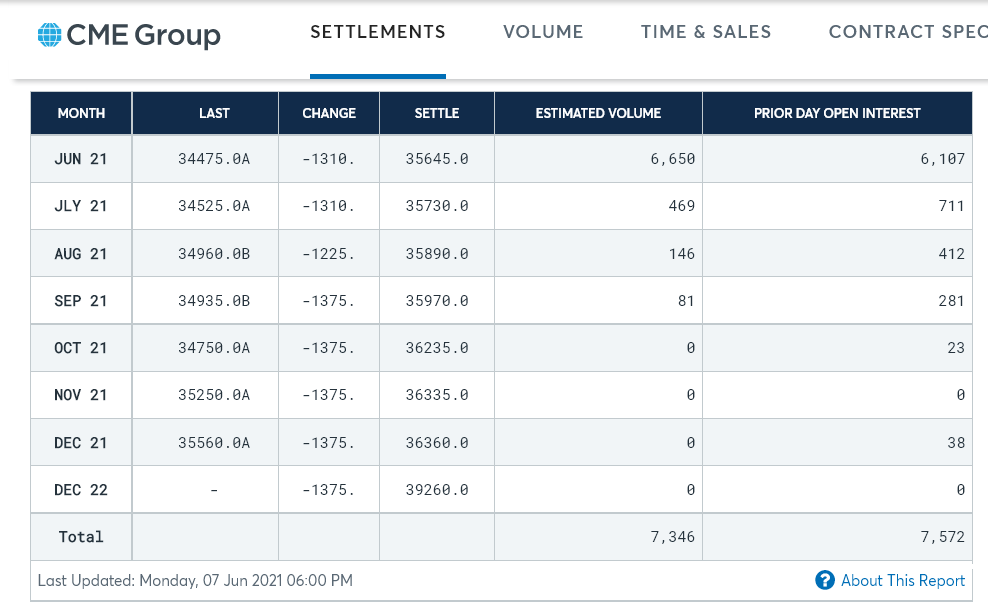

The almost definitely car for presidency entities to brief (promote) is by buying and selling CME Bitcoin futures. Along with the worth strain, analysts would want to substantiate a big enhance in open curiosity, which is the variety of contracts in play. Sadly, CME doesn’t present real-time information for this indicator.

As proven above, every CME Bitcoin futures contract represents 5 BTC, so the 7,572 open curiosity totals 37,860 BTC. These contracts are financially settled, that means that the winner is paid in {dollars}.

Whereas the present $1.25 billion open curiosity doesn’t appear important sufficient to create shockwaves, the determine did attain $3.3 billion in February as Bitcoin traded at $58,000. Due to this fact, a considerable and speedy enhance within the open curiosity is a possible indicator of government-related exercise.

The futures premium ought to flip detrimental

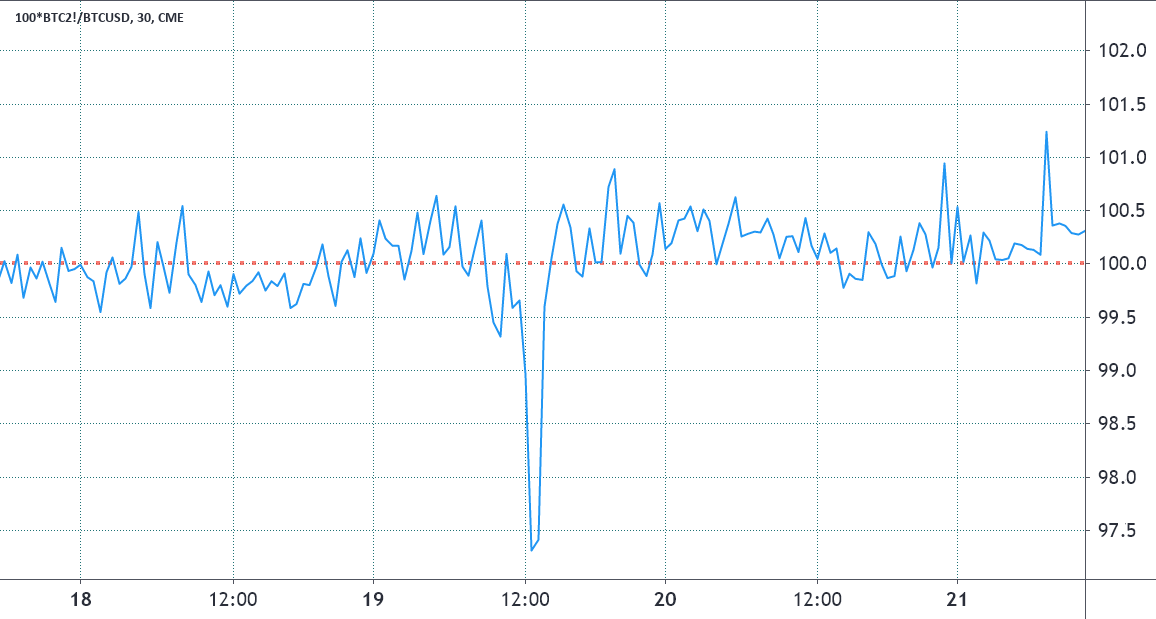

A big futures contract vendor will trigger a momentary distortion within the futures premium. Not like perpetual contracts, these fixed-calendar futures do not need a funding fee, so their worth will vastly differ from common spot exchanges.

By measuring the worth hole between futures and the common spot market, a dealer can gauge the extent of bullishness available in the market. Every time there’s an aggressive exercise from shorts (sellers), the two-month futures contract will commerce at a 1% or greater low cost.

Discover how the July CME futures often commerce between a 0.5% low cost and a 1.5% premium versus common spot exchanges. Nonetheless, throughout the Could 19 crash, aggressive futures contracts promoting triggered the worth to commerce 2.5% under Coinbase.

This motion can both happen throughout liquidation orders or when massive gamers determine to brief the market utilizing derivatives.

Trade infrastructure would come below assault

Although most cryptocurrency exchanges have established their servers in distant areas, governments might attempt to seize bodily servers or net domains.

Traders who’ve been following the crypto sector since 2017 will keep in mind that Alex Vinnik, the founding father of BTC-e, was arrested and the web site hijacked by the U.S. authorities in July 2017.

In November 2020, Cointelegraph printed a wonderful article that defined how, in accordance with a framework from the U.S. Division of Justice, it might be sufficient for a crypto transaction to “contact monetary, information storage, or different pc techniques inside america” to impress enforcement motion.

Any coordinated effort by governments to suppress cryptocurrencies will possible contain an enormous “anti-money laundering” effort in opposition to exchanges, particularly these providing derivatives merchandise to retail traders.

Thus, except these 3 indicators are in place, there may be little motive to consider {that a} huge government-led marketing campaign to disrupt the business is underway.

The views and opinions expressed listed here are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails danger. You need to conduct your individual analysis when making a choice.

Source link