Crypto merchants are drawn to the market by its bombastic progress and profitable alternatives to make a revenue. Nevertheless, not each investor is looking for volatility or utilizing degenerate leverage ranges to gamble at derivatives exchanges.

Actually, stablecoins often comprise half of the overall worth locked (TVL) on most decentralized finance (DeFi) functions that concentrate on yields.

There is a purpose why DeFi boomed regardless of Ethereum community median charges surpassing $10 in Might. Institutional buyers are desperately looking for fastened revenue returns as conventional finance seldomly affords yields above 5%. Nevertheless, it’s potential to earn as much as 4% monthly utilizing Bitcoin (BTC) derivatives on low-risk trades.

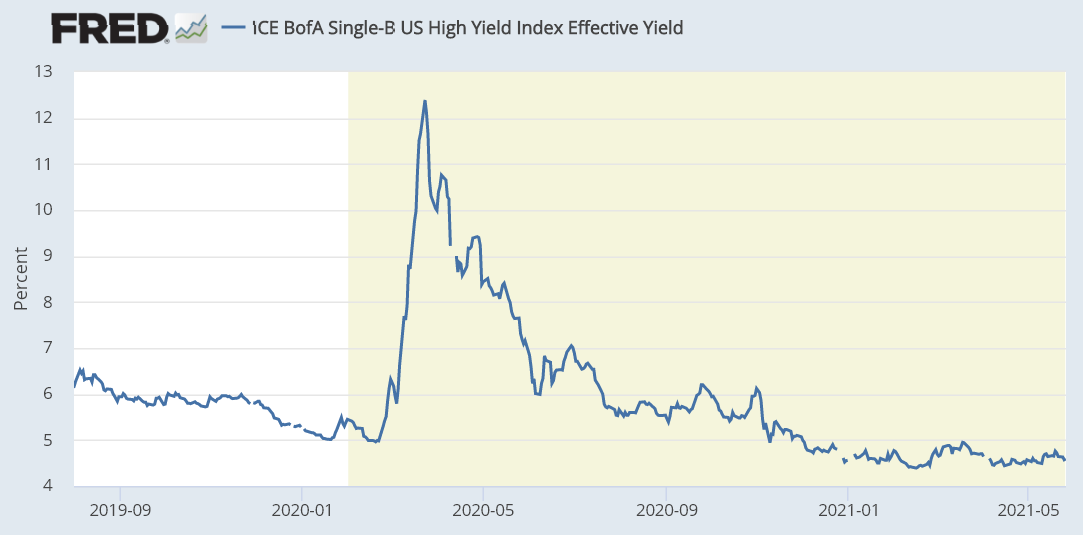

Discover how even non-investment grade bonds, far riskier than Treasury Payments, yield beneath 5%. In the meantime, the official inflation fee in america for the previous 12 months has stood at 4.2%.

Paul Cappelli, a portfolio supervisor at Galaxy Fund Administration, not too long ago instructed Cointelegraph that Bitcoin’s “inelastic provide curve and deflationary issuance schedule” make it a “compelling hedge in opposition to inflation and poor financial insurance policies that might result in money positions changing into devalued over time.”

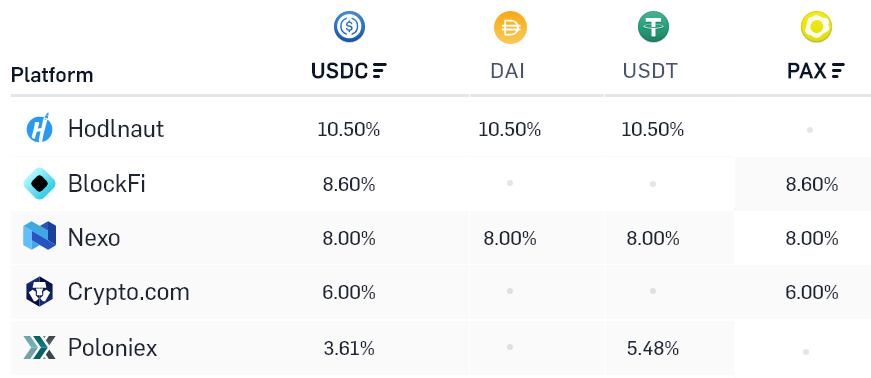

Centralized providers similar to Crypto.com, BlockFi, and Nexo will sometimes yield 5% to 10% per yr for stablecoin deposits. To extend the payout, one wants to hunt increased dangers, which doesn’t essentially imply a much less recognized alternate or middleman.

Nevertheless, one can obtain a 2% weekly yield utilizing Bitcoin derivatives. For these devices, liquidity at the moment sits at centralized exchanges. Subsequently the dealer must think about counterparty threat when analyzing such trades.

Promoting a lined name can turn into a semi-fixed revenue commerce

The customer of a name possibility can purchase Bitcoin for a set value on a set future date. For this privilege, one pays upfront for the decision possibility vendor. Whereas the client sometimes makes use of this instrument as insurance coverage, sellers are often aiming for semi-fixed revenue trades.

Every contract has a set expiry date and strike value, so potential positive factors and losses may be calculated beforehand. This lined name technique consists of holding Bitcoin and promoting name choices, ideally 15% to twenty% above the present market value.

It might be unfair to name it a set revenue commerce as this technique goals to extend the dealer’s Bitcoin steadiness, nevertheless it would not shield from detrimental value swings for these measuring returns in USD phrases.

For a holder, this technique doesn’t add threat because the Bitcoin place will stay unchanged even when the worth drops.

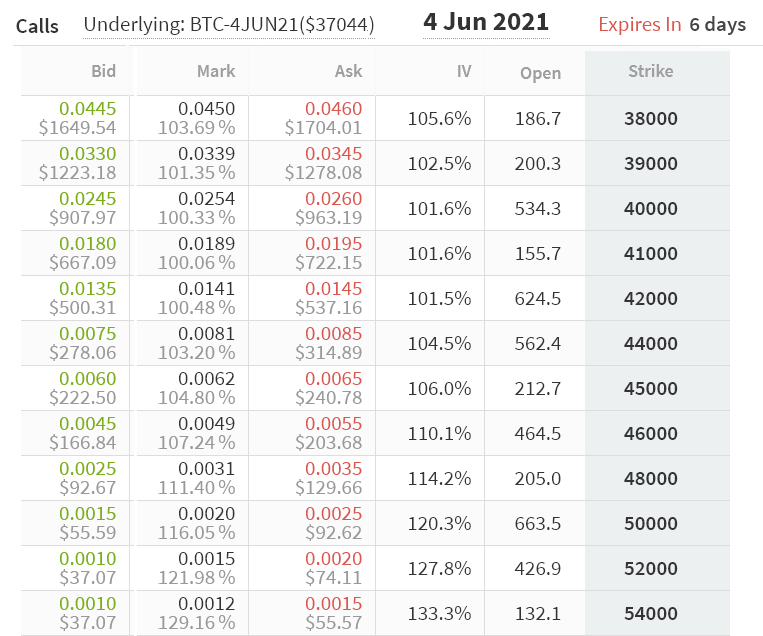

Contemplating that Bitcoin was buying and selling $37,000 when the above knowledge was gathered, a dealer might promote the $44,000 name possibility for June 4, maturing in six days. Depositing a 0.10 BTC margin needs to be sufficient to promote 0.30 BTC name possibility contracts, thereby receiving 0.00243 BTC upfront.

Two outcomes: increased Bitcoin amount or bigger USD place

There are basically two outcomes, relying on whether or not Bitcoin trades above or beneath $44,000 at 8:00 am UTC on June 4. The $44,000 name possibility will turn into nugatory for any stage beneath this determine, so the choice vendor retains the 0.00243 BTC advance cost along with the 0.10 BTC margin deposit.

Nevertheless, if the expiry value is increased than $44,000, then the dealer’s margin might be used to cowl the worth distinction. At $46,000, the web loss is 0.011 Bitcoin, subsequently lowering the margin to 0.089 ($4.094). In the meantime, on the time of the deposit, the 0.10 Bitcoin margin was price $3,700.

Certainly the lined name possibility vendor would have made extra money by holding the 0.10 Bitcoin from the start, as the worth elevated from $37,000 to $46,000. Nonetheless, by receiving the 0.00243 BTC superior cost, one will enhance the Bitcoin holdings even when the worth strikes beneath $37,000.

That 2.4% revenue in Bitcoin phrases will occur for any expiry beneath $44,000, which is eighteen.9% increased than the $37,000 when Deribit possibility costs had been analyzed.

The views and opinions expressed listed here are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer entails threat. You need to conduct your personal analysis when making a call.

Source link