The crypto sector is in a bull market, and frequent proof comes from nameless merchants who publish their five-, six- and seven-figure funding returns as screenshots on Crypto Twitter.

This situation creates a FOMO-like state of affairs the place everybody will get grasping. The temptation to spice up potential earnings by twenty instances or extra is usually irresistible for many novice merchants.

Right this moment, virtually each cryptocurrency trade affords leveraged buying and selling utilizing derivatives. To enter these markets, a dealer has to first deposit collateral (margin), which is often a stablecoin or Bitcoin (BTC). Nonetheless, in contrast to spot (common) buying and selling, the dealer can not withdraw from a futures market place till it has been closed.

These devices have advantages and might enhance a dealer’s outcomes. Nonetheless, those that typically depend on incorrect data when buying and selling futures contracts find yourself with heavy losses moderately than income.

The fundamentals of derivatives

These leveraged futures contracts are artificial, and it’s even attainable to quick or place a guess on the draw back. Leverage is essentially the most interesting facet of futures contracts, however it’s price noting that these devices have lengthy been utilized in inventory markets, commodities, indexes, and international trade (FX).

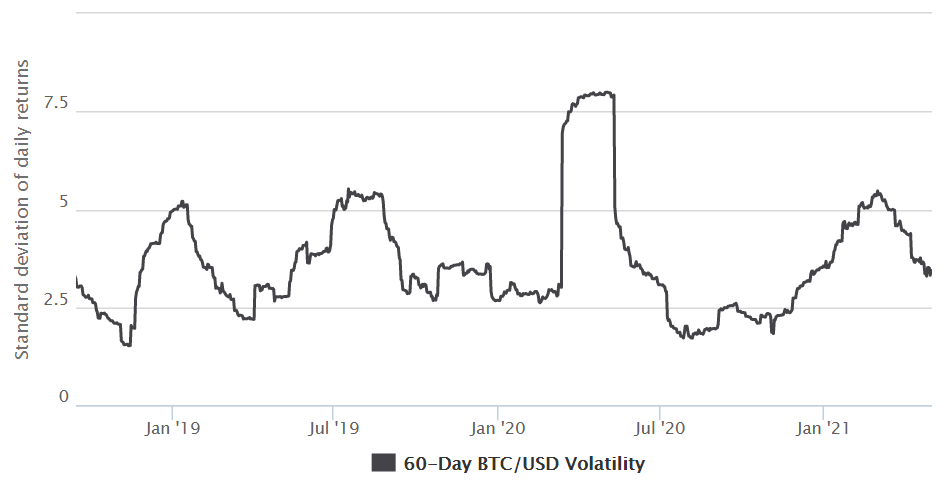

In conventional finance, merchants measure every day worth change by calculating the common closing worth adjustments. This measure is broadly utilized in each asset class, and it is known as volatility. Nonetheless, for numerous causes, this metric is not useful for cryptocurrencies and might hurt leverage merchants.

To be temporary, the upper the volatility, the extra typically an asset worth presents wild oscillations. Opposite to the expectation, shifting up by 7% to 10% day by day represents a low volatility indicator. This occurs as a result of the deviation from the imply is small, whereas random fluctuations between a destructive 3% to a constructive 3% current a a lot wider vary.

Markets with very low volatility are excellent for leverage

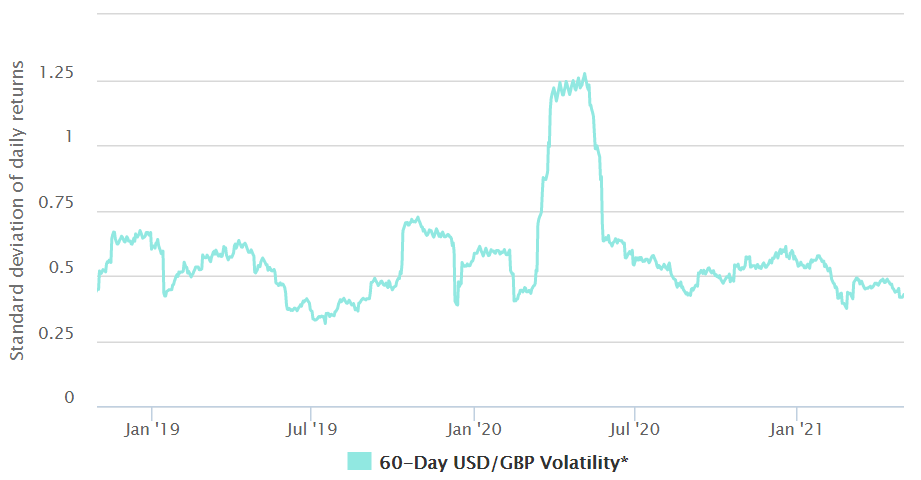

Understanding the final vary of how an asset oscillates is extraordinarily essential when opening leverage positions. Take the British Pound Sterling (GBP), for instance, and one will discover that its volatility is often beneath 1% as shock aggressive every day worth adjustments are uncommon.

FX markets are comparatively secure markets when put next with shares and commodities. Subsequently, some regulated brokers provide even 200x leverage, that means a 0.5% transfer towards the place would trigger a compelled liquidation.

For a cryptocurrency dealer, the Swiss Franc’s (CHF) every day change versus the U.S. greenback would seemingly be seen as a stablecoin.

Nonetheless, the three.4% every day Bitcoin volatility hides a extra harmful worth fluctuation. Whereas measuring every day closing costs for conventional markets is sensible, cryptocurrencies commerce continuous. This distinction probably creates a lot wider actions inside the similar day, though the every day closing typically masquerades it.

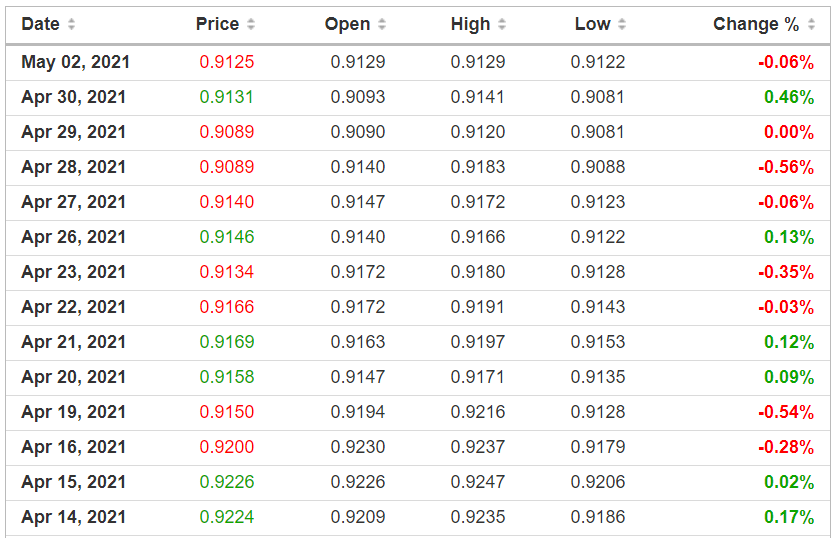

The typical change between the Bitcoin intraday excessive and low of the previous 180 days is 6.5%. As proven above, these ‘intraday strikes’ surpassed 10% on 25 events. That means, in actuality, BTC worth oscillations are a lot bigger than anticipated for a 3.2% every day volatility asset.

20x leverage appears loopy contemplating Bitcoin’s every day strikes

To place issues into perspective, a 5% transfer within the improper route is sufficient to liquidate any 20x leveraged Bitcoin place. This information is obvious proof that merchants ought to actually contemplate danger and volatility when leverage-trading cryptocurrencies.

Quick income are good, however what’s extra essential is with the ability to survive the same old every day worth swings to carry on to these unrealized good points.

Though there’s not a magical quantity to set one of the best leverage for each dealer, one should account for the impact of volatility when calculating liquidation dangers. These aiming to maintain positions open for greater than a few days, aiming for 15x or decrease leverage, appear to be ‘affordable.’

The views and opinions expressed listed here are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. You must conduct your personal analysis when making a call.

Source link