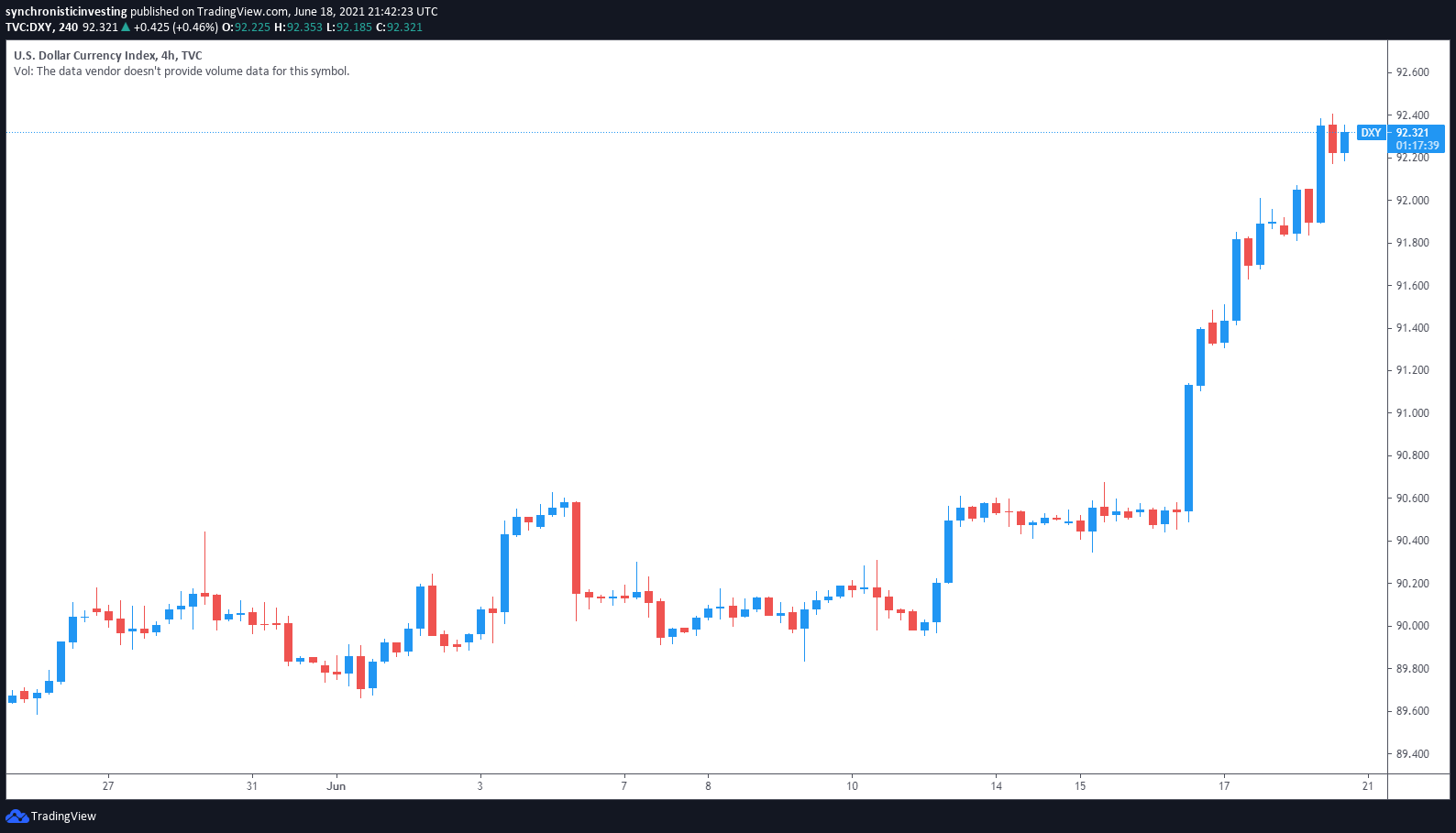

Bitcoin (BTC) and the broader monetary markets confronted a brand new wave of promoting on June 18 following feedback from James Bullard, the president of the USA Federal Reserve Financial institution of St. Louis, indicating that he expects the primary rate of interest enhance to occur in late 2022.

Bullard’s feedback have been much more hawkish than Wednesday’s feedback from Fed Chair Jerome Powell, who indicated that the speed hikes would are available in 2023. Powell’s feedback triggered a sell-off throughout monetary markets because the U.S. greenback gained power.

Knowledge from Cointelegraph Markets Professional and TradingView exhibits that because the greenback was strengthening, Bitcoin bulls have been overwhelmed by sellers, triggering a decline to a every day low at $35,129.

The uniform sell-off throughout quite a lot of property together with shares, gold and cryptocurrencies has additional eaten away on the narrative that Bitcoin is an uncorrelated asset, as knowledge exhibits that BTC’s correlation with each gold and shares has continued to extend all through 2021.

Conventional markets shut the week down

Friday’s shut in conventional markets marked one of many worst weeks for the Dow since October after the index noticed 5 straight classes of losses for a complete decline of three% this week.

The S&P 500 and NASDAQ have been additionally exhausting hit on Friday, closing the day down 1.31% and 0.92% respectively, whereas the 10-year treasury word fell by 4.04% in response to the strengthening greenback.

As for the trigger behind the latest hawkish stance from the Fed, Bullard pointed to a better than anticipated stage of inflation because the financial system reopens following the Covid-19 lockdowns.

Bullard mentioned:

“We’re anticipating a very good yr, a very good reopening. However this can be a larger yr than we have been anticipating, extra inflation than we have been anticipating. I feel it’s pure that we’ve tilted just a little bit extra hawkish right here to include inflationary pressures.”

Bullard recommended that sooner or later, inflation is “working at 3% this yr and a pair of.5% in 2022 earlier than drifting again right down to the Fed’s 2% goal.”

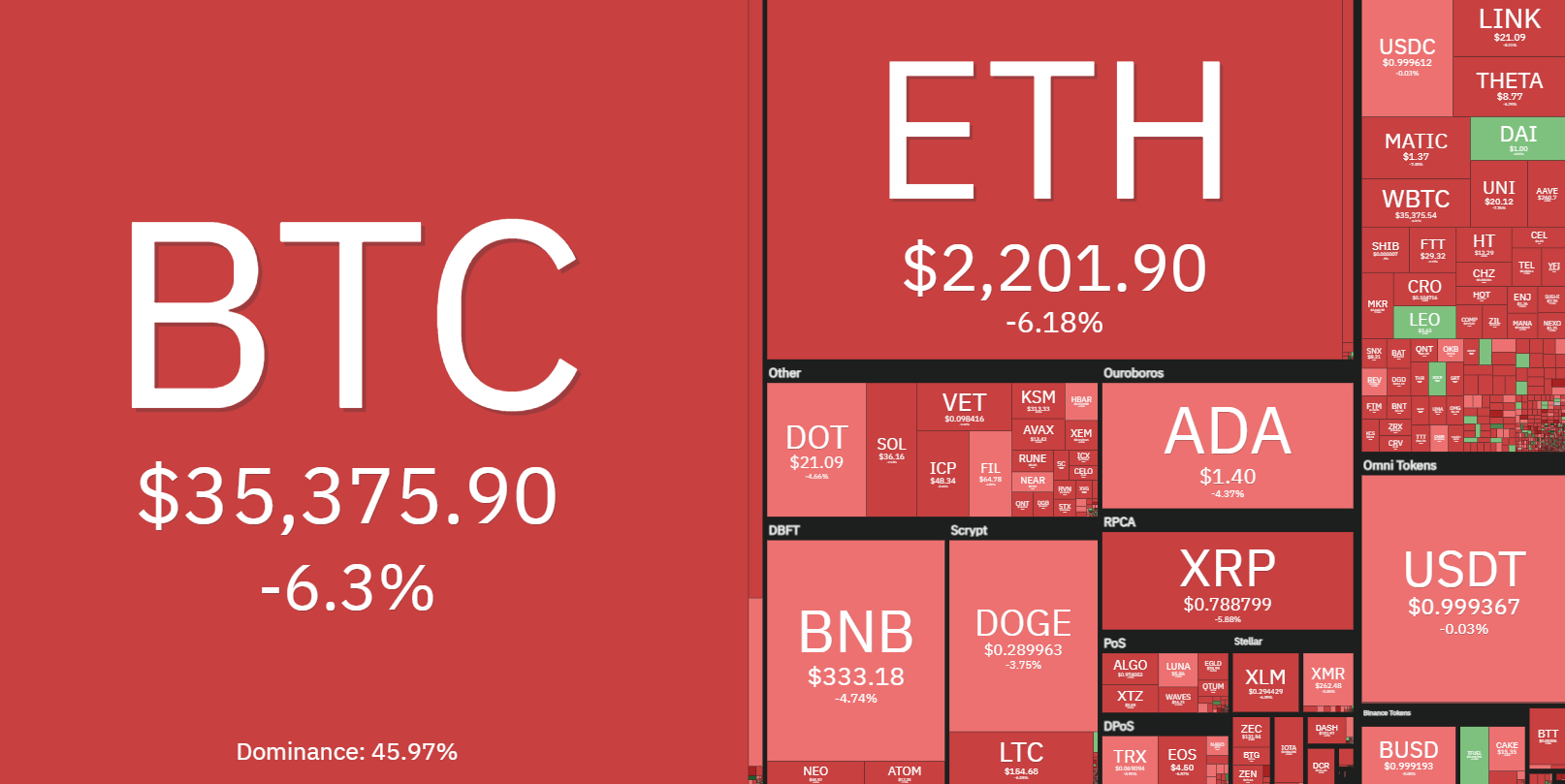

Altcoins worth crumble

Altcoins noticed their costs decline alongside Bitcoin on Friday as merchants as soon as once more fled to the security of stablecoins as market volatility picked up.

Ether (ETH) noticed its worth slide greater than 13% to achieve a low at $2,137 and Amp (AMP) fell 33% from its all-time excessive of $0.1211 that was established on June 16.

Associated: Bulls hesitate to purchase the dip after Bitcoin worth falls near $35K

Of the highest 200 cash, the 2 finest performances of the day have been ZKSwap (ZKS) with a 14% achieve Gnosis (GNO) which rallied by 7.4%.

The general cryptocurrency market cap now stands at $1.486 trillion and Bitcoin’s dominance charge is 44.8%.

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, it is best to conduct your personal analysis when making a call.

Source link