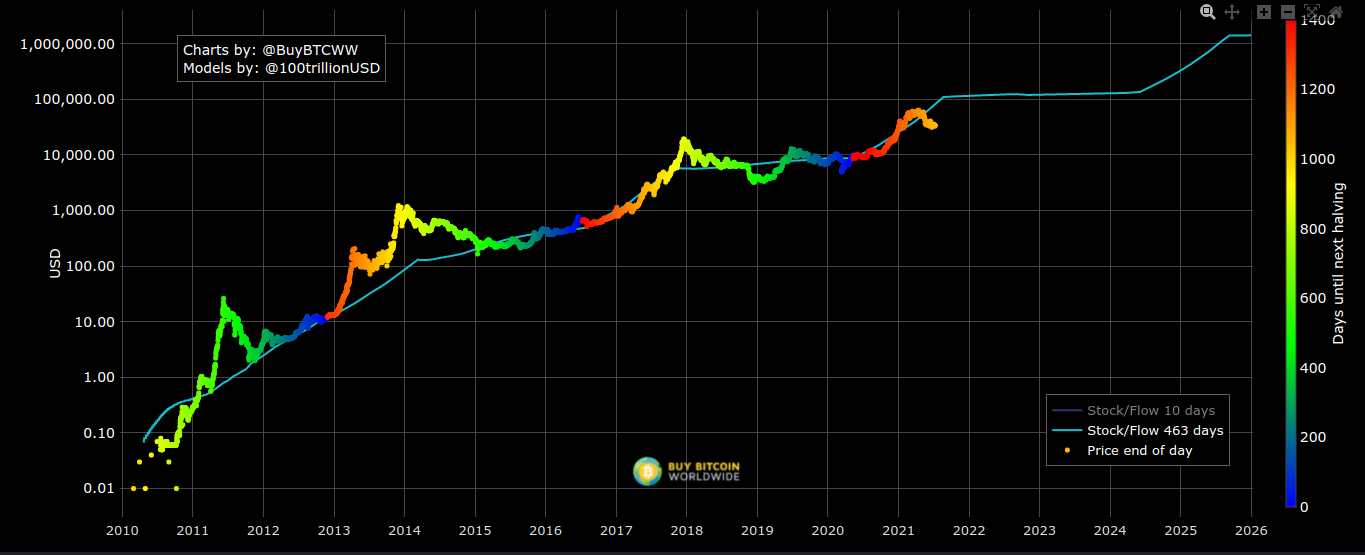

Bitcoin (BTC) has by no means been as far under its goal worth as it’s now, the stock-to-flow mannequin exhibits this week.

In a tweet on July 10, Lex Moskovski, chief funding officer at Moskovski Capital, confirmed stock-to-flow flagging a historic second in Bitcoin’s twelve-year lifetime.

“Nice shopping for alternative”

With BTC/USD displaying few indicators of a real bullish restoration, the pair has been drifting ever farther from the worth that the stock-to-flow worth mannequin calculates it ought to have.

Inventory-to-flow is arguably the preferred of the Bitcoin forecasters, and has traditionally tracked BTC worth motion with stunning accuracy, taking each anomaly under consideration to stay legitimate.

As Cointelegraph reported, nonetheless, present habits is giving stock-to-flow a run for its cash, and as of now, its goal worth comparatively has by no means been so removed from actuality.

“Unfavorable Inventory-To-Stream deflection is the best it is ever been in the entire Bitcoin historical past,” Moskovski commented.

“It is a nice shopping for alternative, when you’re a believer on this mannequin.”

According to the Stock-to-Flow Multiple, BTC/USD must be buying and selling at $82,703 on Saturday. On the time of writing, the precise spot worth was $33,850 — 59% decrease.

The mannequin’s creator, PlanB, has caught by a critically bullish view on Bitcoin for 2021, his newest worth prediction calling for $135,000 by December as a “worst-case situation.”

The analyst is presently off the grid and never commenting on occasions, promising to return in August, which has a minimal worth goal of round $47,000.

Inventory-to-flow faces critical bear calls

PlanB has by no means dominated out stock-to-flow turning into invalidated at any level, and this might develop into a actuality if essentially the most bearish eventualities develop into actuality.

Associated: PlanB feeling ‘uneasy’ as 41% of his followers tip $100K BTC received’t occur this 12 months

Amongst them is a $10,000 warning from Scott Minerd, the Guggenheim govt who this week claimed there was not “any cause” to purchase Bitcoin beneath present situations.

Different knowledge factors to an prolonged restoration interval for Bitcoin fundamentals, whereas December might deliver promoting strain as soon as extra, in step with historic precedent.

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails danger, you need to conduct your personal analysis when making a call.

Source link