(Bloomberg) — Gold edged larger after capping the largest drop in 5 months because the Federal Reserve sped up its anticipated tempo of coverage tightening amid optimism concerning the labor market and heightened issues over inflation.

Fed Chair Jerome Powell advised a press convention Wednesday that officers would start a dialogue about scaling again bond purchases used to assist monetary markets and the financial system throughout the pandemic. In addition they launched forecasts that present they anticipate two interest-rate will increase by the top of 2023 — ahead of many thought — they usually upgraded estimates for inflation for the subsequent three years.

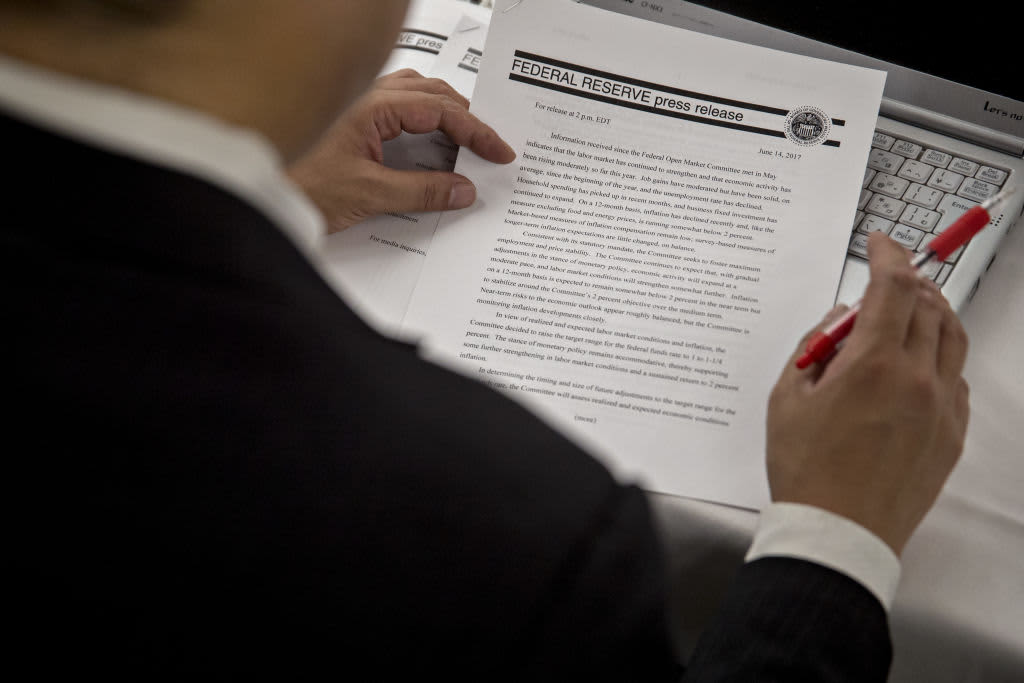

Bullion’s steadying close to a six-week low as buyers weigh the result of the Fed’s two-day gathering, which noticed the central financial institution maintain the goal vary for its benchmark coverage fee unchanged at zero to 0.25%, the place it’s been since March 2020, and preserve the $120 billion tempo of its month-to-month bond purchases. Powell stated the interest-rate forecasts “must be taken with a giant grain of salt,” and cautioned that discussions about elevating charges can be “extremely untimely.”

“Gold undoubtedly took successful on the extra hawkish feedback coming from Powell, but it surely seems just like the market could have overreacted a bit, with merchants shopping for the dip at the moment,” stated John Feeney, enterprise improvement supervisor at Sydney-based bullion seller Guardian Gold Australia. Gold is in for a “bumpy trip” as merchants are undecided over “whether or not or not larger inflation is bullish or bearish for treasured metals costs, as now we have issues round Fed tightening.”

Spot gold rose 0.6% to $1,822.96 at 11:29 a.m. in Singapore, after tumbling to $1,803.87 on Wednesday, the bottom intraday degree since Could 6. Silver and platinum superior, whereas palladium declined. The Bloomberg Greenback Spot Index was regular after rising 0.9% on Wednesday.

“The Fed’s hawkish pivot is a serious buzzkill for gold bulls that might see some momentum promoting over the quick time period,” stated Edward Moya, a senior market analyst at Oanda Corp. “Regardless of the latest weak spot for gold over the previous week, gold’s medium-and-longer time period outlook stays bullish. The road within the sand that must be defended for bullish bullion buyers is the $1,800 degree.”

Extra tales like this can be found on bloomberg.com

Subscribe now to remain forward with probably the most trusted enterprise information supply.

©2021 Bloomberg L.P.

Source link