(Bloomberg) — Central banks could also be regaining their urge for food for getting gold after staying on the sidelines for the previous 12 months.

Central banks from Serbia to Thailand have been including to gold holdings and Ghana just lately introduced plans for purchases, because the specter of accelerating inflation looms and a restoration in world commerce gives the firepower to make purchases. A rebound in shopping for — which had dropped to the bottom in a decade — would bolster the prospects for gold costs as another sources of demand falter.

“Long run, gold is probably the most vital guardian and guarantor of safety towards inflationary and different types of monetary dangers,” stated the Nationwide Financial institution of Serbia. Serbian President Aleksandar Vucic just lately introduced the central financial institution intends to spice up holdings of the valuable metallic to 50 tons from 36.3 tons.

Bullion has come beneath stress this 12 months as larger bond yields made the non-interest bearing haven appear much less enticing to buyers. After recovering in April and Might, gold fell by probably the most in additional than 4 years final month because the Federal Reserve turned extra hawkish and the greenback strengthened.

The restoration in world commerce is bolstering the present accounts of rising market nations, giving their central banks the choice of shopping for extra gold. Greater crude costs are additionally boosting bullion purchases by oil exporters, together with Kazakhstan and Uzbekistan, in line with James Metal, chief treasured metals analyst at HSBC Holdings Plc. That’s more likely to proceed, he stated.

“If a central financial institution is diversifying, gold is a fabulous means of shifting out of the greenback with out deciding on one other foreign money,” he stated.

The dear metallic was little modified Monday at $1,787.24 an oz by 9:10 a.m. Shanghai time.

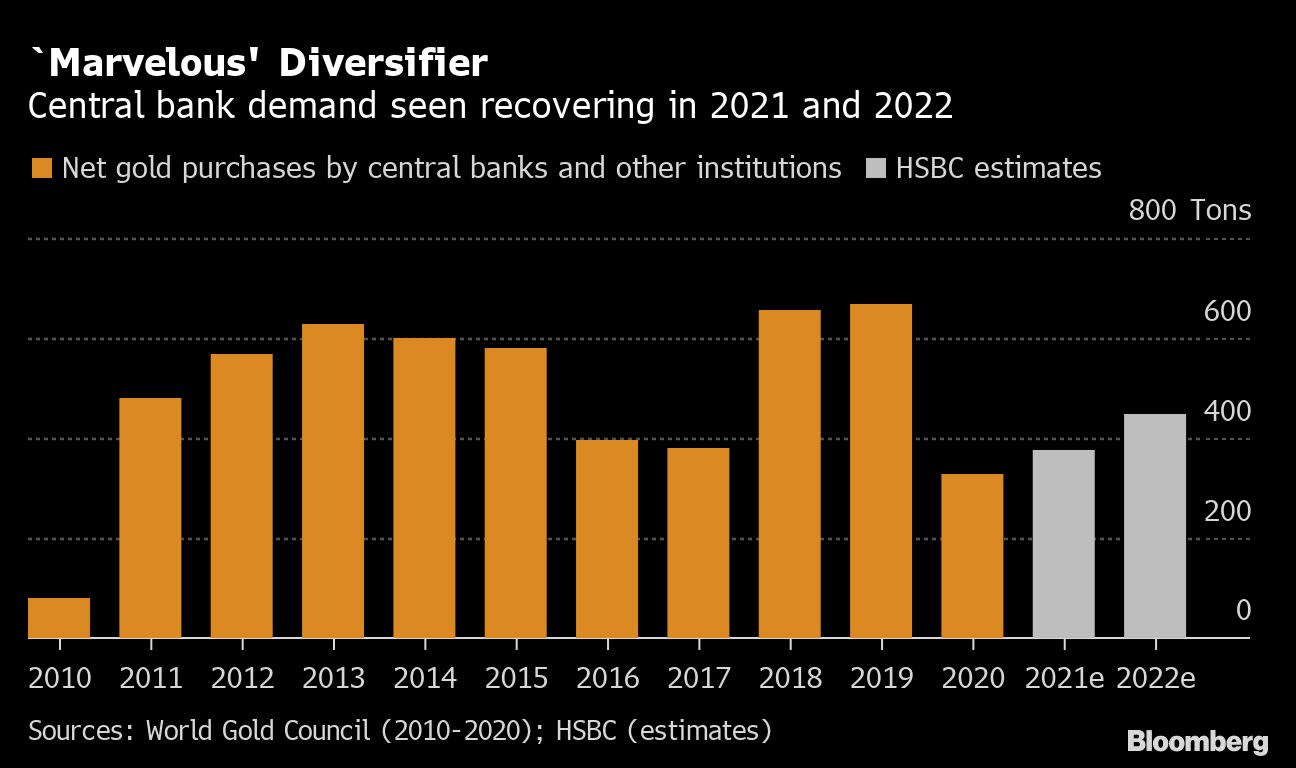

In a bullish situation, as the worldwide economic system rebounds, central financial institution shopping for might attain about 1,000 tons, Aakash Doshi and different Citigroup Inc. analysts wrote in a report. The financial institution’s forecast is for purchases to climb to 500 tons in 2021 and 540 tons subsequent 12 months. That’s beneath the dual peaks above 600 tons in 2018 and 2019, however a major advance on the 326.3 tons bought final 12 months, in line with World Gold Council knowledge.

Learn extra: BOE Gold Instructions Excessive Premium, Alerts Central Financial institution Shopping for

About one in 5 central banks intend to extend their gold reserves over the following 12 months, in line with a survey by the WGC revealed final month.

Central banks are one element of bodily shopping for that’s serving to to counter hefty investor outflows from exchange-traded funds, stated Commonplace Chartered Plc’s treasured metals analyst Suki Cooper.

“Geopolitical tensions, the necessity for diversification and heightened uncertainty have continued to buoy curiosity in gold reserves,” stated Cooper.

Extra tales like this can be found on bloomberg.com

Subscribe now to remain forward with probably the most trusted enterprise information supply.

©2021 Bloomberg L.P.

Source link