Good morning, and welcome to our rolling protection of the world financial system, the monetary markets, the eurozone and enterprise.

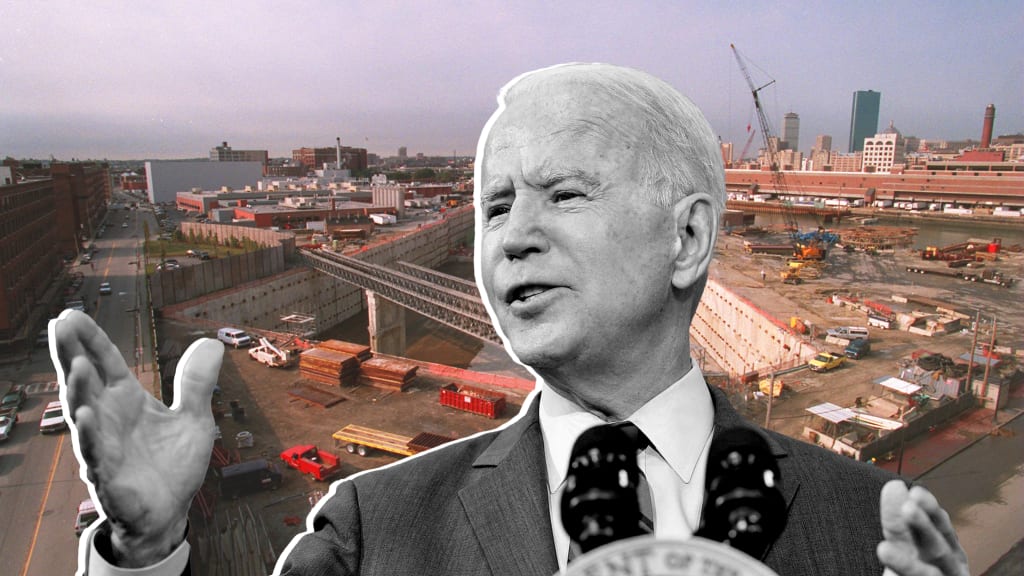

Joe Biden’s announcement of a bipartisan settlement on a $953bn infrastructure plan – billed as the biggest funding in public transit in American historical past – has boosted inventory markets within the US and Asia. On Wall Road, the S&P 500 and the Nasdaq closed at new file highs of 4,266 and 14,369 respectively.

In Asia, Japan’s Nikkei rose 0.66% whereas Hong Kong’s Hold Seng climbed 1.4% and the Australian inventory market added 0.5%.

President Biden

(@POTUS)We’ve struck a deal. A bunch of senators – 5 Democrats and 5 Republicans – has come collectively and cast an infrastructure settlement that may create hundreds of thousands of American jobs.

Michael Hewson, chief market analyst at CMC Markets UK, says:

Final evening’s beneficial properties [on Wall Street] have been helped by the bipartisan settlement of a $579bn infrastructure invoice, a lot lower than the Democrats would have favored, however nonetheless a reasonably respectable addition to the entire different stimulus packages seen prior to now six months. The brand new spending would come with cash for roads, bridges, rail and public transit, all areas which have been sorely uncared for through the years. Whereas the settlement is welcome it nonetheless faces a excessive bar in passing into regulation given the Democrats slender majorities on Capitol Hill.

As a consequence of final evening’s robust US end, markets right here in Europe look set to open larger, with journey shares more likely to be in focus after the federal government added Malta, Madeira and the Balearics to the inexperienced listing, in addition to indicating that it will take a look at dropping quarantine guidelines for totally vaccinated UK residents returning house from amber listing nations later in the summertime.

UK ministers have eased journey restrictions for a variety of vacationer hotspots, including Malta to the “inexperienced listing” of nations requiring no quarantine for returning travellers, in addition to a handful of Caribbean nations.

UK automotive manufacturing continues to extend, however the restoration is held again by world provide shortages, for instance of semiconductors, warned the Society of Motor Producers and Merchants. Some 54,962 automobiles left the manufacturing unit gates in Might, up 934% on Covid-wrought Might 2020 when manufacturing dwindled to five,314, however nonetheless down 52.6% on Might 2019.

Up to now this yr UK factories have turned out 429,826 vehicles, up 105,063 on 2020, however total output stays down by 22.9% on the identical five-month interval in 2019.

In Germany, shopper confidence has improved greater than anticipated, following a powerful enterprise optimism studying yesterday.

The GfK institute stated its shopper sentiment index, primarily based on a survey of two,000 Germans, rose to -0.3 factors, the very best degree since August and up from -6.9 the earlier month.

Shoppers have been much more optimistic about their very own private revenue state of affairs in addition to the general financial prospects. Consumers’ expectations for the financial system hit a 10-year excessive, reaching 58.4 factors. Nonetheless, Germans’ willingness to make purchases rose solely barely.

The Agenda

- 9am BST: Italy enterprise and shopper confidence for June

- 11am BST: France Unemployment profit claims for Might

- 12pm BST: Financial institution of England Quarterly Bulletin

- 1.30pm BST: PCE worth index

- 3pm BST: Michigan Shopper Sentiment closing for June

Source link