Since 2013 the Grayscale Bitcoin Belief Fund (GBTC) has provided its buyers publicity to Bitcoin (BTC) by means of a publicly quoted personal instrument. Nevertheless, the belief’s convertibility and liquidity vastly differ from an Alternate Traded Fund (ETF).

Trusts are structured as firms, a minimum of in regulatory type, and are ‘closed-end funds’ which might initially solely be bought to accredited buyers. This implies the variety of obtainable shares is proscribed, and retail merchants can solely entry them through secondary markets. Moreover, a GBTC share can’t be redeemed for the underlying BTC place.

Traditionally, GBTC used to commerce above the equal BTC held by the fund, which was brought on by the retail crowd’s extra demand. The frequent follow for institutional shoppers was to purchase shares instantly from Grayscale at par and promote at a revenue after the six-month lock-up interval.

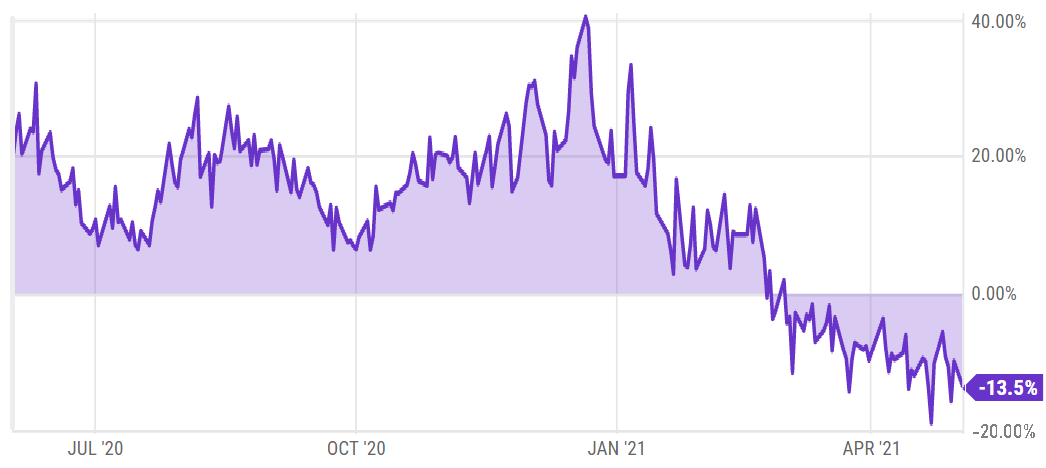

Throughout most of 2020, GBTC shares traded at a premium to its Web Asset Worth (NAV), which various from 5% to 40%. Nevertheless, this example drastically modified in March 2021. The approval of two Bitcoin ETFs in Canada closely contributed to extinguishing the GBTC premium.

ETF funds are much less dangerous and cheaper in comparison with trusts. Furthermore, there isn’t any lock-up interval, and retail buyers can attain direct entry to purchase shares at par. Subsequently, the emergence of a greater Bitcoin funding automobile seized a lot of attract that GBTC as soon as possessed.

Can DCG save GBTC?

In late February, the GBTC premium entered adversarial terrain, and holders started desperately flipping their positions to keep away from getting caught in an costly and non-redeemable instrument. The scenario deteriorated as much as an 18% low cost regardless of BTC worth reaching an all-time excessive in mid-March.

On March 10, Digital Forex Group (DCG), Grayscale Investments’ mum or dad firm, introduced a plan to buy as much as $250 million of the excellent GBTC shares. Though the conglomerate didn’t specify the rationale behind the transfer, the extreme low cost actually would have pressured their fame.

Because the scenario deteriorated, DCG introduced a roadmap for turning its belief funds right into a U.S. ETF, though no particular ensures or deadlines have been knowledgeable.

On Might 3, the agency introduced that it had bought $193.5 million value of GBTC shares by April. Furthermore, DCG elevated its GBTC shares repurchase potential to $750 million.

Contemplating the $36.3 billion in belongings below administration for the GBTC belief, there’s motive to imagine that purchasing $500 million value of shares won’t be sufficient to ease the worth low cost.

Due to this, some necessary questions come up. For instance, can DCG lose cash by making such a commerce? Who’s desperately promoting, and is a conversion to an ETF being analyzed?

Trying ahead

Because the controller of the fund administrator, DCG should purchase the belief fund’s shares at market costs and withdraw the equal Bitcoin for redemption. Subsequently, shopping for GBTC at a reduction and promoting the BTC at market costs will constantly produce a revenue and there is no threat by doing this.

Other than a couple of funds that repeatedly report their holdings, there is no approach to know who has been promoting GBTC beneath internet asset worth. The one buyers with 5% or extra holdings are BlockFi and Three Arrows Capital, however none have reported decreasing their place.

Subsequently, it may very well be probably a number of retail sellers exiting the product at any value, however it’s inconceivable to know proper now.

Whereas shopping for GBTC at a ten% or bigger low cost may appear a cut price at first, buyers should keep in mind that as of now, there is no means of getting out of these shares other than promoting it on the market.

The views and opinions expressed listed below are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes threat. You need to conduct your personal analysis when making a call.

Source link