(Bloomberg) — China’s capability to take care of stability in its monetary markets is being examined by the Federal Reserve’s sudden hawkish shift.

Beijing has repeatedly voiced concern that liquidity-fueled bubbles abroad would burst when financial circumstances lastly began to tighten. Bullish hypothesis domestically already prompted intervention by Chinese language authorities, significantly in commodities. As such, a transfer by the Fed that begins to go off such a danger can be welcomed by the Communist Occasion, if its a centesimal anniversary wasn’t days away.

The ensuing volatility in world markets threatens to spill into China and overshadow Occasion pageantry on July 1. President Xi Jinping — who is anticipated to hunt a 3rd time period in a management shuffle subsequent yr — is scheduled to ship a speech and hand out medals at a ceremony on the day. Preparations have included military-aircraft rehearsals for an aerial present in Beijing and bus a great deal of guests shipped to “purple websites” to study Occasion historical past.

Up to now, Beijing’s means to maintain its markets regular seems to be working.

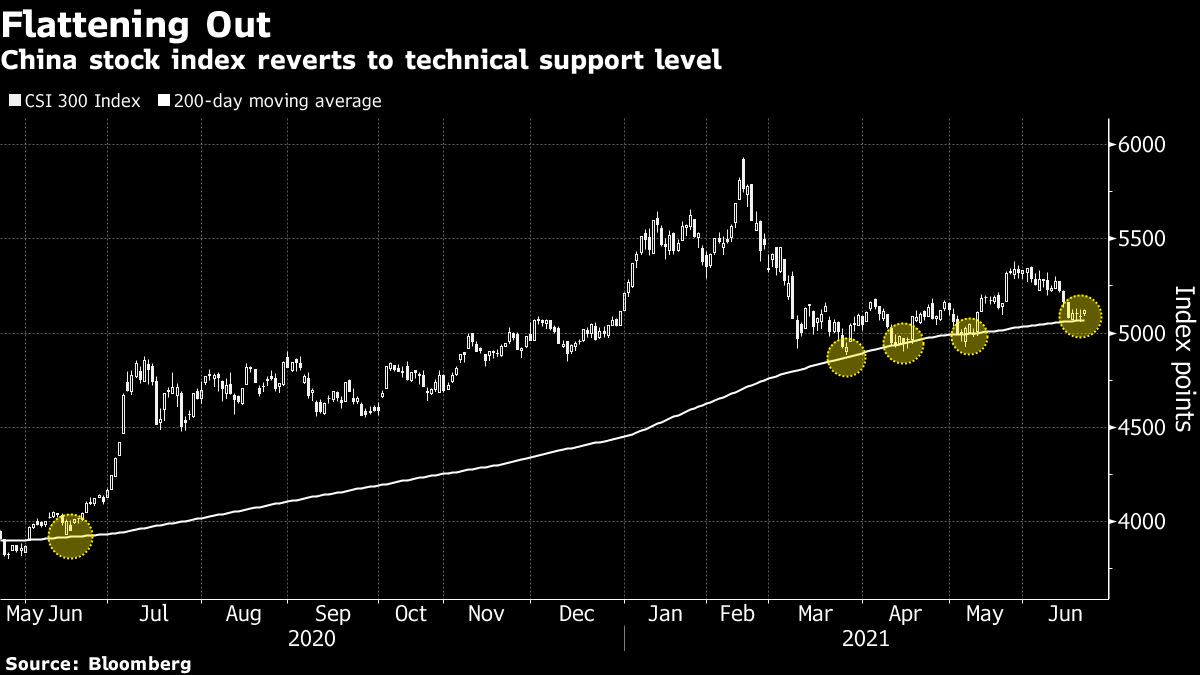

The CSI 300 Index of shares barely budged this week even because the Fed’s pivot whipsawed benchmarks in Tokyo, London and New York. Extra broadly, volatility in China’s $12 trillion inventory market stays low — with the gauge buying and selling close to its 200-day transferring common — after officers helped suppress frenzied buying and selling earlier this yr.

“We don’t count on Chinese language markets to be significantly risky into the CCP anniversary,” stated Gary Dugan, chief government officer at asset supervisor World CIO Workplace in Singapore.

Whereas the yuan has turned wilder — and weaker — Beijing had already been attempting to restrain appreciation after the forex rose to a three-year excessive towards the greenback. Up to now month, authorities pressured lenders to carry extra foreign currency in reserve and expanded a quota for funds to take a position abroad to a document $147 billion. The Chinese language forex now has depreciated about 1.7% in June however is anchored close to its 100-day transferring common.

Merchants have introduced ahead their expectations of U.S. tapering after seven Fed officers final week projected an interest-rate hike as quickly as 2022, up from 4. On Tuesday, Fed Chair Jerome Powell stated the central financial institution can be affected person in ready to carry borrowing prices.

The second half of the yr might even see extra dangers to market stability, in accordance with Citigroup Inc. economists. They predict the financial influence of China’s credit-tightening measures will develop into extra seen, whereas a restoration in world manufacturing might stress the nation’s exports.

“The general macro backdrop is prone to flip much less pleasant for danger belongings put up the CCP’s centennial celebration in July,” wrote Citi economists together with Xiangrong Yu in a notice final week. “We predict coverage tightening may develop into extra pronounced.”

(Updates with Wednesday market strikes all through, provides newest Powell feedback in eighth paragraph. Clarifies language of QDII quota in seventh paragraph.)

Extra tales like this can be found on bloomberg.com

Subscribe now to remain forward with essentially the most trusted enterprise information supply.

©2021 Bloomberg L.P.

Source link