by David Haggith

The S&P 500 failed a breakthrough on Thursday and tucked its head again beneath its 4200 ceiling once more, the place it has remained rangebound for weeks. Job information on the financial entrance that many analysts toasted as nice couldn’t raise sentiment out of the doldrums on Thursday, nor might it cease Netflix from making its first loss of life cross in additional than two years. Falling beneath its 200-day transferring common is mostly thought to be an indication {that a} inventory is trending down for the long term.

The market’s response to Thursday’s employment information additional reveals the diploma to which inflation issues are tugging downward on market sentiment. Whereas the excellent news about jobs gave a jolt of raise to shares within the opening hours, because it was digested, traders seemed to be determining that excellent news can be dangerous information for inventory costs as a result of a rebounding job market might add further inflationary pressures as firms are being pressed to pay greater wages to draw individuals again to work. Inflationary pressures, in flip, will strain the Fed to show down its large money-pumping engines, which have pressured a serious stream of latest money into shares and bonds at a fee of $120-billion a month for a yr now.

The current employment state of affairs is nice for labor, due to the federal government stimulus checks, as a result of the benefit with which individuals can stay out of the workforce empowers them to press firms to spice up pay in an effort to entice them again in. For the previous decade, labor has misplaced out to income being shared solely with shareholders. Labor has seen little actual acquire in wages whereas shareholders have seen large positive factors as a result of nearly direct stream of Fed cash into shares and bonds as a budget debt has financed inventory buybacks in document quantities for years. Lastly, a few of these income at the moment are being pressured towards labor as many within the labor drive maintain again till jobs pay greater than they’re making on unemployment.

The Fed throws a shock monkey wrench

The largest damper on the Thursday inventory market was a shock transfer by the Fed. Chairman Powell of the Us Individuals’s Financial institution has been saying for months and mentioned once more as just lately as every week or two in the past that the Fed isn’t even starting to start out to consider speaking about decreasing its stimulus packages. Nonetheless, quickly rising inflation and a reverse repo disaster appear to have pressured the Fed quite abruptly from not even excited about beginning to speak about tapering QE to having already determined to take a child step.

That is the very state of affairs I laid out for each the reverse repo disaster and inflationary pressures in my final two articles:

The Fed introduced it’ll begin promoting off a few of the company bonds it has been shopping for. This feels like a reasonably innocent breath within the course of monetary tightening that avoids touching authorities bonds. As I just lately argued, the Fed can’t cease funding the federal government instantly:

The Fed’s completely large reverse repo operations (used this month to extract half a trillion {dollars} in money cash out of the system!), achieved on the similar time the Fed is creating cash within the system, depart us with no query that the Fed is instantly financing the federal government and monetizing its debt at no matter degree the federal government calls for (with nearly no restraint on the federal government’s half for its position).

Because it does scale back the Fed’s steadiness sheet, it comes near the Fed saying it is going to be reversing its QE (bond shopping for) in what quantities to a small ongoing quantity of QT (bond promoting), however it doesn’t fairly go there because it leaves the Fed’ authorities bond shopping for nonetheless absolutely in play. Nonetheless, the Fed wispered, and the market cringed a bit of.

Discover how the Fed remains to be not hinting it’ll cease absorbing authorities bonds, becoming with my earlier argument:

Whereas all astute and sincere individuals knew the Fed was financing the federal government debt for years, the Fed USED TO be capable of considerably fairly argue it was not shopping for treasuries illegally to finance the federal government however that it solely purchased treasuries as a approach of setting financial coverage.

It clearly doesn’t want them for financial coverage now that it’s promoting off bonds and definitely not with rates of interest plunging to the zero sure, and actual charges creeping unfavorable.

That argument vanished fully this month as a result of the Fed’s purchases of treasures at the moment are really driving financial actuality completely out of whack from the Fed’s personal said coverage objectives.

As Wolf Richter wrote,

It’s a loopy state of affairs the Fed backed into as tsunami of liquidity goes haywire, banking system strains underneath $4 trillion in reserves.… With these reverse repos, the Fed is promoting Treasury securities to counterparties and is taking their money, thereby massively draining liquidity from the market – the other impact of QE…. At the same time as liquidity goes haywire, and because the Fed making an attempt to take care of it through reverse repos, the Fed remains to be shopping for about $120 billion monthly in Treasury securities and mortgage-backed securities, thereby including liquidity.… This liquidity-haywire state of affairs seems to be an emergency that must be addressed now.

Wolf Road

Nicely, possibly this seemingly rushed choice to start out promoting off its company bonds is the Fed’s is the Fed’s approach of testing the waters for that form of emergency motion with out touching what it’s doing in authorities bonds. The Fed usually begins hinting at modifications like this months prematurely. It doesn’t simply drop them out of the blue. So, the announcement does have an pressing look to it. The Fed claims it has nothing to do with financial coverage, and maybe it doesn’t for it actually can be insufficient to the duty; but, even the New York Instances notes,

It was vital for the Fed to sign that this was not a financial coverage motion. The Fed’s policy-setting Open Market Committee can also be shopping for large quantities of government-backed bonds, however these purchases are totally different, meant to foster stronger financial circumstances by holding markets chugging and holding down borrowing prices. Markets are on edge as officers tiptoe towards excited about when and the way to gradual that program.

NYT

Why was it so vital for the Fed to clarify this announcement had nothing to do with financial coverage? As a result of, no matter how small the sum of money is within the grand scheme of issues, it unsettled markets on Thursday. The Fed even needed to guarantee traders that the sale will probably be “gradual and orderly.” The Fed’s warning is proof of simply how a lot it realizes the inventory market sits on a hair set off in the case of even a touch of tightening.

The central financial institution will purpose to reduce the potential impact on markets by factoring in day by day liquidity and buying and selling circumstances for exchange-traded funds and company bonds, it mentioned in a press release.

Reuters

Here’s what I believe is the takeaway on this: Patrick Leary, a senior dealer at Incapital bought it proper when he famous that the Fed’s motion, minor because it was, helped pave the way in which for the dialogue about tapering out of its financial coverage “lodging,” as they prefer to name it.

“That is one little step and a great way to check the waters when it comes to what the market response goes to be,” mentioned Leary.

Monetary Instances

The market shuddered sufficient to point out its sensitivity on this space, rigorously scripted because the message was to assuage all concern.

Elliott waves off inflation dangers as Fed flinches

Whereas the market shudders each time the Fed even brings up the truth that it’s not but speaking about tightening, one specific Elliott wave theorist has been criticizing my declare that inflation may have the ability this yr to kill the bull market.

Whereas increasingly more opinion items are being offered within the written and tv media about how inflation is about to kill our inventory market, I’ll let you know that I’m fairly unconcerned in regards to the widespread refrains from the peanut gallery. In my humble opinion, it is a bull market which probably has a lot additional to run within the coming yr or two. And, I base my perspective on my goal, mathematically derived Elliott Wave evaluation

Searching for Alpha

But, Thursday’s announcement by the Fed and corresponding market response illustrates the primary certainly one of two probably pathways by which I mentioned inflation will kill the market: 1) It can both drive the Fed to tighten a lot sooner than it has mentioned it might, or 2) it’ll tear the worth out of the greenback and push up bond yields to compensate for inflation, which can change the equity-risk premium on shares. (The quantity by which shares have to outperform the yields on authorities bonds in an effort to compensate for the upper danger of shares.)

Inflation will get constructed into bond yields by the bond market, and shares change into much less enticing as yields reprice upward to compensate for hovering inflation.

It seems to be like Fed flinched and jolted right into a contact of QT, sending Thursday’s shiver via the inventory market. So, the inflation story of mine that my self-appointed nemesis is criticizing has fledged and is beginning to fly.

This similar Elliott Wave theorist has lastly admitted he was lifeless improper on the S&P 500 (represented by the SPX) bounding off 4200 into a brand new rally:

My final public article on my short-term expectation within the SPX was clearly incorrect, and was our first “miss” in fairly a while. However, as I mentioned, it’s merely unattainable for me to be proper 100% of the time.

In truth, the S&P held solidly beneath his prediction that 4200 can be the brand new ground off which the market would rally. As an alternative, 4200 turned the S&P’s ceiling for a month and a half!

That doesn’t cease him from claiming his method offers beneficial

distinction to all the opposite articles you probably learn which proceed to warn you in regards to the widespread “perception” that inflation is the boogie man that’s about to kill our inventory market:

After which he quotes certainly one of my very own feedback about how he missed his prediction that claimed the S&P would bounce proper off of 4200 into a brand new rally because of inflation issues:

“[The S&P] retains pounding its head in opposition to that barrier however not likely busting via, as a result of inflation issues hold grabbing its butt like a junkyard canine pulling somebody down off the fence he’s making an attempt to scale.”

Although he believes my inflation argument is a boogieman, my declare about inflation holding the market down held true in opposition to his for a month and half throughout which the S&P bought no raise. Despite that fail on his half, the writer remains to be placing out in opposition to my prediction that inflation will gnaw away on the market till it lastly kills it along with his new declare for a rally:

I’m nonetheless searching for the market to rally as much as the 4350-4440SPX area…. And, the way by which we rally over the approaching month will inform me the place the best goal resides inside that subsequent goal area.

Whereas I wouldn’t be too stunned if the market does rally that a lot, it doesn’t defeat the inflation argument in any respect. I don’t count on the bull received’t combat the bear, however I do doubt his higher goal for this summer time:

I believe we are going to see one other pullback, which we could wish to now contemplate as a “June Swoon.” How lengthy that swoon will final is one thing of which I’m not but sure, however I extremely doubt it’ll final till November. Somewhat, the upper likelihood means that after that bout of weak spot from the 4350+ area, we are going to probably proceed to rally into the autumn time frame and assault the 4600SPX area I’m nonetheless anticipating to be struck in 2021.

That I doubt. I’ll notice his now uncertain-sounding June beliefs have revised his view to look much more like mine than his authentic assertion of a decisive rally off of 4200. Whereas week’s Friday shut could even make it appear like his hope for hitting 4350 in June earlier than the swoon is already proving proper, I see it a lot totally different from a longer-term perspective.

Funky Friday

The market stalled in a single day after Thursday’s flop again beneath 4200 with futures happening barely extra as traders waited with bated breath for the federal government’s Friday jobs report from which they’d divine the dangers of inflation. Many had been anticipating an excelling jobs report, they usually wrote that such a report would improve strain on the Fed to taper its QE even sooner. In that case, the market was anticipated to fall additional because it did upon Thursday’s sturdy employment report by ADP.

I didn’t be part of that bandwagon, although I do consider inflation is the market’s linch pin at this level. What they bought on Friday, nevertheless, was one of the best lackluster jobs report the market might hope for — one in that Goldilocks zone of contentment that claims the economic system isn’t cratering however that additionally it is not almost sturdy sufficient to trigger the Fed to start out rolling trimming again on its all-out quantitative easing.

The report hit the market’s candy spot, and so the S&P climbed again up above 4200 and will climb additional till it will get the subsequent massive dangerous inflationary information.

That’s precisely why I believe this jobs report will will in the end show dangerous for the Fed by holding inflationary pressures within the Fed’s blind spot. You see, the Fed and most economists are searching for full employment to be the signal of tolerating inflationary pressures, however in actuality inflation is being pushed scorching proper now, as I’ve mentioned can be the case for the previous yr, by severe shortages throughout a time of considerable money — money the Fed is creating and shortages the Fed is fostering.

I say that as a result of low unemployment really means the US will stay sub-par in manufacturing for longer. That may end in persevering with shortages and possibly deeper shortages, however the Fed solely sees stalling employment numbers proper now as justification for pouring on the money gasoline for longer. That gasoline, nevertheless is precisely the chemistry wanted to maintain heating the inflationary inferno, not simply because, as many assume, extra money equals extra inflation, however as a result of extra money through authorities assist allows the labor drive to remain unemployed longer, which suppresses manufacturing and will increase wage strain to entice employees again into the job market! It’s self-defeating.

The inventory market believes together with the Fed low employment will hold inflation down by decreasing spending energy, however it received’t as long as the Fed and feds hold supplying goodly quantities of money stimulus to the unemployed! It really means inflation will burn hotter as shortages undercut the economic system much more. What we’ve is STAGFLATION — inflation within the context of a completely stagnant (i.e., unproductive) economic system.

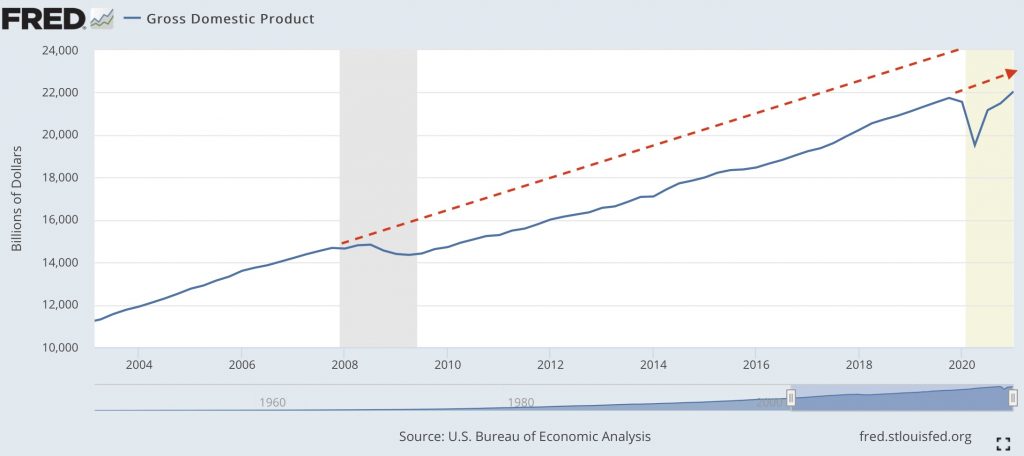

Right here you possibly can see stagflation at work:

What you see is that, even with the Fed pouring on new cash as gasoline at a fee of 120-billion a month, which is 50% higher than QE3, enterprise exercise is now really falling. Vastly diminished returns on that funding.

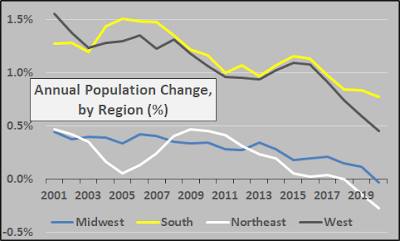

The economic system as measured in gross home product, which I identified an article or two again, isn’t rising again to the extent it might have been at with out the COVIDcrisis; but, inhabitants retains rising. Buyers and economists and market analysts are all specializing in how briskly GDP has risen upward from the outlet it fell into throughout the COVID closures, however manufacturing (the very factor GDP measures) nonetheless stays nicely beneath the place it was headed pre-crisis. It takes a gentle GDP rise simply to maintain up with inhabitants development. Right here’s a graph I shared earlier that reveals the place we’re in comparison with the place we had been heading previous to the most recent disaster in addition to the earlier disaster.

We’ve taken two main steps down with out recovering to our former pattern, which implies there may be much less for everybody, so costs are rising.

On this newly growing stagflation atmosphere, the Fed will hold dumping on gasoline although it has proven indicators that it’s getting nervous about that within the chatter by Fed leaders and in its transfer this week to start out promoting off its company bonds (whereas it continues to purchase up large quantities of presidency bonds).

As Bloomberg’s Chris Antsey notes, the Fed’s management “is more likely to see this report as a modest enchancment however not close to the “substantial additional progress” on employment required to taper its bond-buying program. Whereas inflation is now topping the central financial institution’s 2% objective, jobs stay not likely near the objective.”

Zero Hedge

That jobs obsession is the Fed’s Achilles heal. A powerful jobs report on Friday would have strengthened the hand of these on the Fed who at the moment are brazenly worrying that it could be time to start out speaking about tapering QE prior to later, however the weak report will result in overconfidence of their capacity to maintain pouring on the money gasoline.

A powerful payroll report Friday would give extra ammunition for folk calling for earlier QE tapering. In a way, coverage normalization has already began after the Fed introduced plans to wind down its emergency corporate-credit facility. From that perspective, the height of liquidity is close to.

Zero Hedge

The longer the Fed waits to take away its “lodging” to the market, the extra it should pull a tough cease when it turns into clear inflation has the higher hand.

The Fed has faked itself out

In the present day’s jobs report makes it probably the Fed finds all of the excuse it wants to remain within the dollar-dimishing sport longer, believing inflation will hold its head down as a result of the decrease jobs will hold wages from rising.

The Fed has its eye on the improper gauges. In actual truth, the smaller-than-expected improve in payrolls is probably going as a result of those that are supported by Fed largesse are holding out for greater wages earlier than they make the leap again into the economic system. Firms, because of this, face extra strain to boost wages.

This received’t be the primary time the Fed was blind to the entice it has put itself in. All of us bear in mind the Repocalypse the place the Fed realized the exhausting approach it may by no means rewind its QE with out collapsing the QE-dependent restoration it spent years engineering. Now inflation is urgent in shortly because of an excessive amount of QE within the face of extreme shortages whereas persevering with Fed help for the unemployed will solely make hold manufacturing down with ample incentive to not work.

As you possibly can see beneath, the labor-force participation fee by no means got here near recovering; and, with at present’s numbers, it’s falling again off once more:

Whereas solely half of the pre-COVID work drive that turned unemployed has returned to work, the variety of individuals searching for work has fallen off. These are individuals who both reported they weren’t searching for work or had been unavailable to take a job if supplied. Maybe some merely need their outdated job again, however it’s gone:

7.9 million individuals reported that they’d been unable to work as a result of their employer closed or misplaced enterprise as a result of pandemic.

Zero Hedge

So, no matter what occurs to the inventory market in June, inflation will quickly acquire the higher hand with the Fed’s full help as a result of the Fed can’t see it coming. The Fed will hold throwing cash to the lots through the federal authorities till it’s too late, and that day could come prior to you assume. Inflation WILL kill this market — both by forcing the Fed to tighten prior to the market has been led to count on or by ravaging every part — until some asteroid of a black swan like COVID swoops down and takes it out first.

(Extra on how inflation has constructed simply since my final article will probably be out shortly in my subsequent article.)

233 views

Source link