Ether (ETH) and Bitcoin (BTC) pulled again on July 28 as traders awaited contemporary steerage from the Federal Reserve.

ETH value slipped by 0.57% to $2,857, whereas the BTC/USD costs have been up 0.68%, altering fingers at $39,739 at round 10:30 EST. Nonetheless, each the pairs reached their present ranges following a draw back correction from their respective intraday highs of $2,391 and $40,925, respectively.

Merchants raised their publicity within the cryptocurrency market after Tesla’s Elon Musk, Ark Make investments’s Cathie Wooden, and Twitter’s Jack Dorsey spoke in favor of Bitcoin in the course of the B-Phrase Convention final week. Extra tailwinds got here amid speculations about Amazon’s plans to simply accept BTC as funds, a rumor that the retail large denied later.

Ether, whose 30-day correlation with Bitcoin stands at 89% optimistic, moved in tandem with Bitcoin. Their synchronized value traits continued into the New York buying and selling session Wednesday, simply as markets waited for the Federal Reserve to disclose its tapering plans.

Discuss speaking about tapering

The U.S. central financial institution officers will conclude their two-day coverage assembly on Wednesday, with an announcement scheduled to come back out at 14:00 EST. Buyers’ focus might be on indicators from chairman Jerome Powell about how and when the Fed would begin unwinding its asset buy program, and any potential shift of their view on inflation.

Intimately, the U.S. client value index has boomed to hit 5.4% on a year-over-year foundation. Consequently, as a lot as 54% of Individuals suppose that the US financial system is in poor form, per a ballot performed by the Related Press-NORC Middle for Public Affairs Analysis.

However the Fed has rubbished the upper client costs by calling them “transitory” in nature. Consequently, Powell stated in his congressional testimony earlier this month that the central financial institution would proceed its $120 billion a month bond-purchasing program, elevating worries that it might trigger additional inflationary spikes, particularly within the housing sector.

Brian O’Reilly, head of market technique for Mediolanum Worldwide Funds, famous that there are not any indicators of inflation cooling down within the classes forward so the Fed would possibly simply begin trying into the rising client costs, if not placing a pause on their bond-buying program. He added:

“There might be no change, however they’re on the stage the place they’re beginning to speak about speaking about tapering.”

What occurs to Bitcoin, Ethereum subsequent?

The Ethereum and Bitcoin markets’ greatest vulnerability is that their valuations might not be sustained with out increasing liquidity from the Fed.

Associated: Bitcoin bull outlines 7 steps to extra fiscal stimulus and better BTC costs

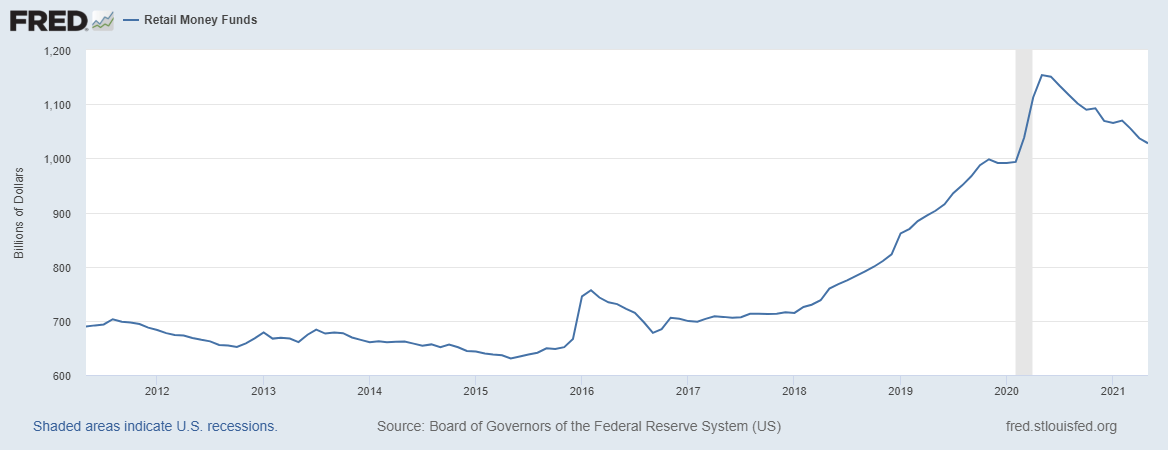

In the meantime, the sturdy underpinning is that there’s substantial capital sitting on the sidelines to enter the market, with a DataTrek Analysis report noting that retail traders on Robinhood alone maintain $400 billion to enter markets on the subsequent huge dip. FRED’s Retail Cash Fund additionally notes that retail traders maintain over $1 trillion versus $643 billion in 2015.

“We dwell in an unprecedented time of fiscal and financial stimulus,” famous Anthony Pompliano, a outstanding crypto advocate and the companion at Pomp Investments, in one among his current notes to shoppers. He added that traders would accomplish that a lot better whereas placing cash in monetary devices than holding money or negative-yielding belongings. He stated:

“If our authorities and financial organizations proceed to outlaw bear markets and ban market corrections via their intervention actions, then the market will solely be allowed to go greater and better over time.”

Given 20% of the American public know BTC properly sufficient to carry it, and at present development charges, shitting on #Bitcoin might be political suicide within the subsequent few years.

— Willy Woo (@woonomic) July 28, 2021

Tim Frost, CEO of DeFi wealth administration platform Yield App, weighed issues over analysts’ renewed upside outlook for Ether and Bitcoin.

He advised Cointelegraph that the markets may resume their downtrend following “a quick rally,” whereby Bitcoin falls to as little as $20,000, taking Ethereum decrease alongside, including that:

“An altcoin revival is a really great distance off. The crypto worry and greed index can also be nonetheless very a lot skewed in the direction of worry - certainly for the longest interval it has ever been skewed in that course. This is not the start of a brand new bull run as a lot because the bear being caught off guard taking a nap.”

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, you need to conduct your personal analysis when making a choice.

Source link