Ether (ETH) has outperformed Bitcoin (BTC) by 32% since Might, and though there was a gradual circulation of bullish stories from JPMorgan Chase and Goldman Sachs, derivatives metrics present parts of bearishness in each belongings.

Bitcoin is buying and selling 41% beneath its $64,900 all-time excessive, and that transfer has pushed the “Crypto Worry and Greed Index” to its lowest degree since March 2020. Whereas retail merchants worry the dip, world funding agency Guggenheim Investments has filed with the USA Securities and Trade Fee for a brand new fund which will search publicity to Bitcoin.

Billionaire investor Stanley Druckenmiller reiterated his bullish stance on Bitcoin when he mentioned:

“I believe BTC has gained the shop of worth recreation as a result of it is a model, it has been round for 13–14 years and it has a finite provide”.

Ethereum community momentum has been excellent

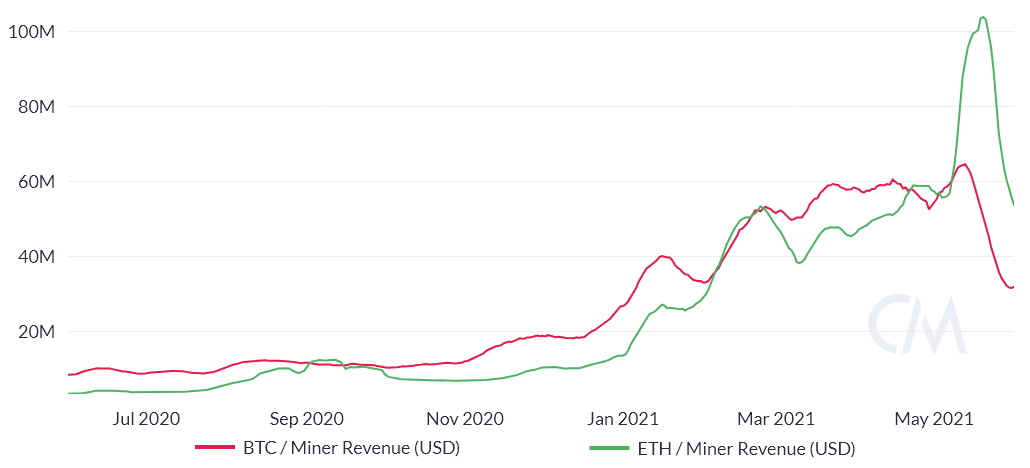

Ethereum overtook Bitcoin when it comes to miner income and community worth transacted proper as a report from Goldman Sachs revealed that the worldwide funding financial institution believes Ether has a “excessive likelihood of overtaking Bitcoin as a dominant retailer of worth.” The report famous the expansion of the decentralized finance (DeFi) sector and the nonfungible token (NFT) ecosystems being constructed on Ethereum.

Discover how Ethereum miners’ income considerably outpaced income for Bitcoin miners in Might, reaching a $76 million each day common. This determine leapfrogged Bitcoin’s $45 million in miners’ income, together with the 6.25 BTC subsidy per block, plus transaction charges.

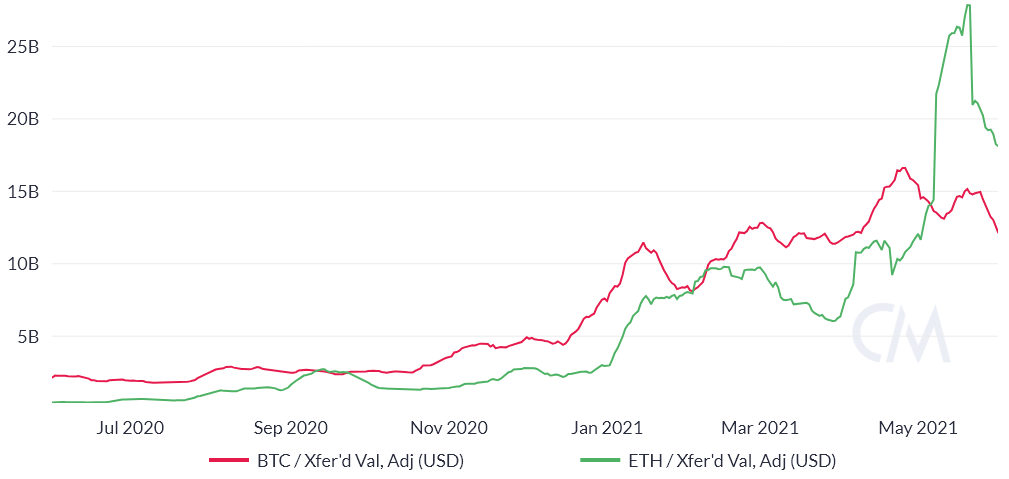

An analogous state of affairs occurred with the quantity transacted and transferred on every community. For the primary time, Ethereum introduced a major benefit, based on this metric.

The chart above exhibits the Ethereum community settling $25 billion per day on common, which is 85% larger than Bitcoin. Stablecoins definitely performed an necessary position, however so did the $50 billion internet worth locked in decentralized finance purposes.

The futures premium is barely bearish

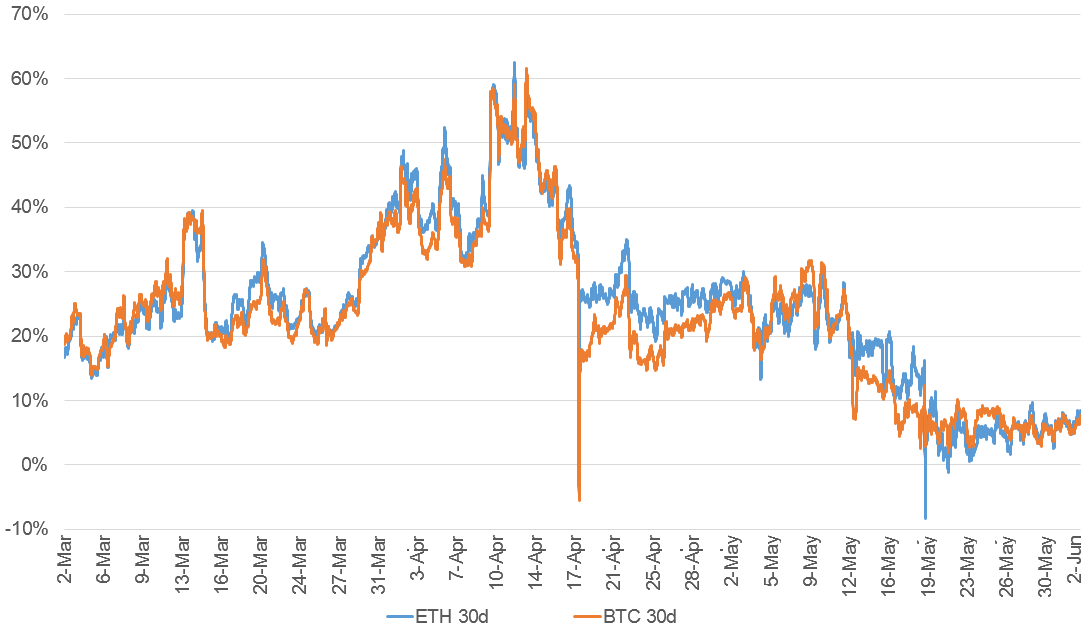

When measuring the futures contract premium, each Bitcoin and Ether show comparable ranges of bearishness. The idea charge measures the distinction between longer-term futures contracts and the present spot market ranges.

The one-month futures contract often trades with 10%–20% premium versus common spot exchanges to justify locking the funds as an alternative of instantly cashing out.

As depicted above, the futures premium has been beneath 10% for the reason that Might 19 crash for each Bitcoin and Ether. This means a slight bearishness, though removed from a unfavourable indicator, referred to as backwardation.

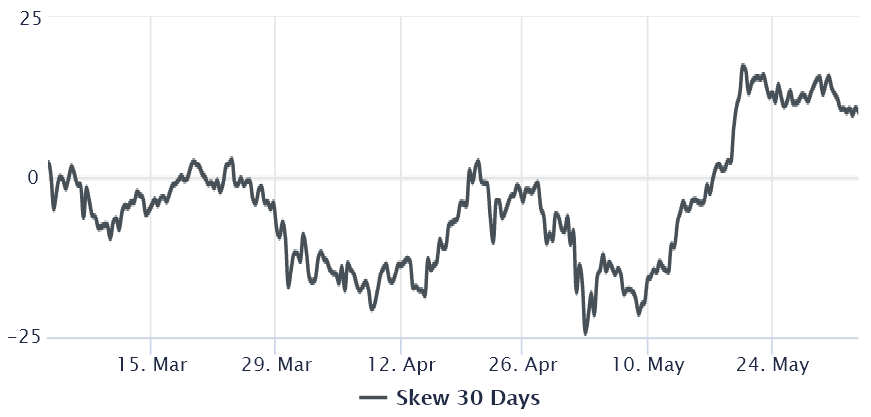

Ether’s 25% delta skew indicators “worry”

To evaluate Ether merchants’ optimism, one ought to take a look at the 25% delta skew. The metric will flip optimistic when the neutral-to-bearish put choices premium is larger than similar-risk name choices. This case is often thought of a “worry” situation. Alternatively, a unfavourable skew interprets to a better value of upside safety and factors towards bullishness.

Much like the futures premium, Ether choices’ 25% delta skew has been ranging above 10% since Might 19. This means that market makers and whales are unwilling to supply draw back safety, indicating “worry.”

Albeit distant from a extremely hostile state of affairs, each Ether derivatives indicators level to a whole lack of bullishness, regardless of the altcoin’s 270% achieve year-to-date.

Within the face of this disappointing information, some analysts will discover the “glass half full,” because it leaves room for a optimistic shock. Ethereum Enchancment Proposal 1559, or EIP-1559, which is anticipated for July, will create a base community price that may fluctuate based mostly on community demand. The replace additionally proposes to burn transaction charges, thereby introducing deflation to the Ethereum ecosystem. OKEx analyst Rick Delaney said that it “could improve the asset’s attraction among the many planet’s wealthiest traders.”

The views and opinions expressed listed here are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes threat. It is best to conduct your individual analysis when making a choice.

Source link