Coming each Saturday, Hodler’s Digest will assist you to observe each single necessary information story that occurred this week. One of the best (and worst) quotes, adoption and regulation highlights, main cash, predictions and rather more — per week on Cointelegraph in a single hyperlink.

Prime Tales This Week

Altcoins rally as bulls pile into large-cap tokens and layer-one tasks

We’re effectively and actually within the throes of “altseason” now, with Bitcoin’s dominance exhibiting no indicators of diminishing.

Ether delivered a surprising surge that took its value above $3,000 for the very first time, breaking new data all through the week. On Saturday, ETH remained in uncharted territory after racing to highs of $3,800.

Amongst these celebrating ETH’s spike shall be Ethereum co-founder Vitalik Buterin, who has formally develop into a crypto billionaire. Pleasure is constant to construct forward of a long-awaited improve that can overhaul the community’s fuel price construction in July.

ETH is in good firm, too. EOS rallied by greater than 100% this week following a current protocol that will increase the venture’s inflation price. Litecoin has hit a one-year excessive towards Bitcoin, with many analysts predicting prolonged upside momentum. And Bitcoin Money jumped 68% amid rumors {that a} looming onerous fork may increase the community’s consumer base.

Even Ethereum Traditional, the onerous fork sparked by disagreements after a devastating 2016 hack, has pumped 130% prior to now week.

After all, there’s one altcoin particularly that continues to steal the present…

Could 8 “day to observe” for Dogecoin amid warning it will probably endure an XRP-style crash

DOGE has appeared unstoppable in current weeks. It hit unprecedented highs of $0.7376 early on Saturday. To place into context how bonkers the joke cryptocurrency’s surge actually is, $1 invested on Jan. 1 would now be price $139 at present costs.

Mania over the monetary homage to Shiba Inus in every single place could also be about to succeed in a climax when DOGE fanatic and mega-billionaire Elon Musk hosts Saturday Night time Reside. It’s inevitable that his look will function infinite sketches about Dogecoin, and that might pump costs even additional.

However not everyone seems to be discovering DOGE’s surge to be a trigger for celebration. Lowstrife, a preferred account on Twitter, believes the tip is nigh, with the crypto dealer recognizing eerie similarities between DOGE’s present charts and XRP within the heady days of 2018.

Again then, XRP had hit all-time highs of $3.20 that stay true to this present day, however then slowly pale to lows of $0.14 — a lack of 95.6%.

Warning of an impending apocalypse for DOGE, Lowstrife wrote: “Every of DOGE’s main rallies this 12 months has been smaller and fewer aggressive. What took 18 hours at first has been ongoing for two days now. I believe that is the ultimate push earlier than it’s throughout for good. Could eighth is the day to observe.”

Even Musk himself has been cooling the hype, reminding followers that crypto investments stay speculative.

Sq.’s Bitcoin income up 1,000% in 12 months

A flurry of earnings outcomes this week powerfully illustrated the influence that Bitcoin’s sensational first quarter has had.

Sq. blew analysts’ expectations by delivering earnings of $0.41 per share between January and March — far past the $0.16 forecast. Income got here in at $5.06 billion, dwarfing predictions of $3.36 billion.

Bitcoin alone drove $3.5 billion in income, an astonishing improve of 1,000% in simply 12 months. Total, the crypto-friendly firm’s gross revenue additionally surged 79% 12 months on 12 months to hit $964 million.

Sq.’s additionally sitting on paper earnings of $250 million after making two high-profile Bitcoin purchases — one in February and one in October.

PayPal has additionally been heralding the “nice outcomes” it has been receiving from its crypto service. The platform’s earnings and income additionally exceeded predictions in Q1.

Coinbase inventory plunges to document low, additional decoupling from crypto

The celebratory environment isn’t common. Coinbase shares tumbled to recent lows on Thursday as Wall Road buyers continued to cycle out of high-flying tech shares.

COIN bottomed at $255.15, the place it was in peril of breaching the $250 reference value set on the eve of its public itemizing in April. All of this comes regardless of the whole market cap of all cryptocurrencies surging past $2.4 trillion.

FBB Capital Companions’ director of analysis, Mike Bailey, informed Bloomberg: “We noticed a mini-bubble in SPACs, IPOs, crypto, clean-tech and hyper-growth in late 2020 and early 2021 and lots of of those asset lessons are nursing unhealthy hangovers.”

(That mentioned, his assertion that crypto is nursing a “unhealthy hangover” is misplaced.)

Coinbase’s woes could also be linked to rising competitors amongst crypto exchanges, which has left retail buyers spoiled for selection. There’s a hazard that this might eat into the revenues it derives from transaction charges, which make up most of its revenue.

Comic Invoice Maher excoriates environmental influence of crypto

Elon Musk’s stint on the field this weekend serves as a strong counterweight to comic Invoice Maher, who didn’t depart crypto fans in stitches throughout a current phase.

On Maher’s program, he in contrast the trade to a digital recreation — and talked about mining in a derisive tone. Maher additionally implied that investing in tokens was a infantile endeavor, and illustrated his level with quotes from Warren Buffett.

He mentioned: “There’s something inherently not credible about creating lots of of billions in digital wealth with nothing ever really being completed and no precise product made or service rendered. […] Sadly, what’s actual is the unfathomable quantity of electrical energy these large supercomputers suck up for his or her mining.”

Maher even quipped that Satoshi Nakamoto, the pseudonym utilized by Bitcoin’s inventor, is the Japanese time period for “Monopoly cash.”

Anthony Pompliano shared the clip together with this caption: “By no means ask a comic for funding recommendation.”

Binance CEO Changpeng Zhao replied, writing: “Very unhappy to observe. Really feel actually hopeless for him. Joke’s going to be on him. Time will present.”

Winners and Losers

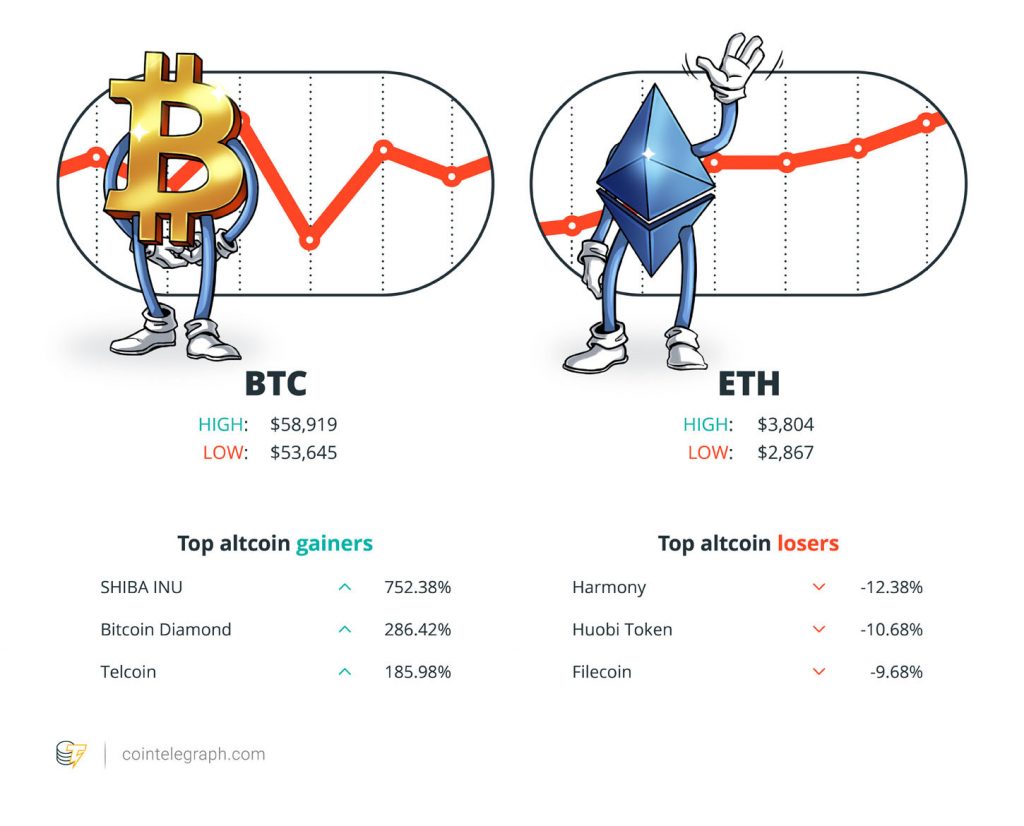

On the finish of the week, Bitcoin is at $58,366.32, Ether at $3,811.20 and XRP at $1.56. The full market cap is at $2,433,633,423,933.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Shiba Inu, Bitcoin Diamond and Telcoin. The highest three altcoin losers of the week are Concord, Huobi Token and Filecoin.

For more information on crypto costs, make certain to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“Seems like Uniswap v3 is extra fuel costly than v2, roughly as anticipated.”

Haseeb Qureshi, Dragonfly Capital managing associate

“With cryptocurrencies already creating unimaginable worldwide wealth, it’s actual property that can maintain that wealth and supply patrons with a legacy.”

Alex Sapir, Sapir Corp chairman

“We noticed a mini-bubble in SPACs, IPOs, crypto, clean-tech and hyper-growth in late 2020 and early 2021 and lots of of those asset lessons are nursing unhealthy hangovers.”

Mike Bailey, FBB Capital Companions director of analysis

“It positively can go a lot increased, I feel we are able to see the value go to $10,000, the place lots of ETH bull value targets start to kick in and folks take earnings.”

Nikhil Shamapant, retail investor

“We’ve dedicated to having no HQ, and it’s necessary to indicate our decentralized workforce that nobody location is [more] necessary than the opposite.”

Coinbase

“Every of DOGE’s main rallies this 12 months has been smaller and fewer aggressive. What took 18 hours at first has been ongoing for two days now. I believe that is the ultimate push earlier than it’s throughout for good. Could eighth is the day to observe.”

Lowstrife

“DeFi might result in a paradigm shift within the monetary trade and probably contribute towards a extra sturdy, open, and clear monetary infrastructure.”

Federal Reserve of St. Louis

“Volatility is in every single place […] It isn’t distinctive to crypto.”

Changpeng Zhao, Binance CEO

“After all I hate the Bitcoin success, and I don’t welcome a foreign money that’s so helpful to kidnappers and extortionists and so forth.”

Charlie Munger, billionaire investor

“There’s something inherently not credible about creating lots of of billions in digital wealth with nothing ever really being completed and no precise product made or service rendered.”

Invoice Maher, comic

Prediction of the Week

They see ETH rollin’: Why did Ether value attain $3,500, and what’s subsequent?

Ether’s booming value has prompted feverish discuss a long-fabled “flippening” the place ETH overtakes BTC because the world’s largest cryptocurrency.

Though that’s fanciful proper now, there are a selection of bullish predictions in the case of the place Ether’s value is headed subsequent.

Considered one of them comes from Nikhil Shamapant, a retail investor who not too long ago printed a analysis report the place he argued ETH could possibly be price $150,000 by 2023.

He informed Cointelegraph: “It positively can go a lot increased. I feel we are able to see the value go to $10,000, the place lots of ETH bull value targets start to kick in and folks take earnings. I feel we’ll head as much as that $10,000-to-$25,000 vary, hit lots of provide and will see some massive drawdowns and consolidation at that time.”

FUD of the Week

The charges sting, however Uniswap v3 sees extra quantity on launch day than v2’s first month

Information means that Uniswap v3 had a profitable first 24 hours — processing greater than twice the amount that v2 did in its first month.

However not everybody’s been enamored with the newest iteration of the world’s hottest decentralized change, with some customers complaining in regards to the prices related to utilizing it.

One individual wrote on Twitter: “Much more costly to make errors now. Tried emigrate my UNI/ETH liquidity to V3, failed and paid 108.09 usd price of fuel.”

Dragonfly Capital’s managing associate, Haseeb Qureshi, additionally wasn’t impressed. On Twitter, he wrote: “Seems like Uniswap v3 is extra fuel costly than v2, roughly as anticipated. […] Particularly, it’s about 28% dearer for single-hop transactions it seems to be like. For bigger transactions that cross a number of ticks/buckets, the fuel prices needs to be barely bigger.”

New York invoice proposes ban on crypto mining for 3 years over carbon considerations

A Democrat senator in New York, Kevin S. Parker, is proposing a three-year ban on crypto mining.

Information facilities would solely be allowed to function in the event that they cross an environmental influence evaluate, amid considerations that BTC mining may trigger the state to overlook formidable targets designed to sort out local weather change.

New York Senate Invoice 6486 mentioned: “A single cryptocurrency transaction makes use of the identical quantity of vitality that a mean American family makes use of in a single month, with an estimated stage of worldwide vitality utilization equal to that of the nation of Sweden.”

The invoice is but to obtain widespread backing from different senators. Nevertheless, the Democrats do management the decrease home and senate.

Employer paid employee in crypto, then demanded it again when value rose

A United States-based enterprise growth specialist has claimed that an organization that paid them for contract work utilizing cryptocurrency now needs them to return the tokens following a major rally within the asset’s value.

The unnamed worker, recognized solely as “Crypto Confused,” wrote to MarketWatch and mentioned: “I’m not actually positive what to do. I’ve labored with this individual for a few years, and he tends to attempt to change the phrases of fee after agreeing on a sure means of working.”

Columnist Quentin Fottrell replied: “If the worth of the cryptocurrency had fallen by 100% since August 2020, would he wish to pay you in {dollars}? If it all of the sudden dipped by that quantity at this time, would he observe up together with his staff?”

Greatest Cointelegraph Options

DOGE as web cash? TikTokers and sports activities followers see a use case for Dogecoin

As consultants pinpoint varied teams as Dogecoin’s vanguard, the coin’s potential base appears to be a large coalition.

From nay to yay: JPMorgan’s path to crypto may shake up finance

After bashing Bitcoin again in 2017, JPMorgan CEO Jamie Dimon appears to have softened his stance on crypto, and so has the agency itself.

As Bitcoin’s fee choices develop, BTC’s true future position up for debate

Declaring BTC a retailer of worth — gold 2.0 — however not a medium of change, defies logic. It should first have a use case.

Source link