Sustainable investing based mostly on environmental, social and governance (ESG) elements has shortly develop into central to how we make investments. Buyers are demanding extra from their asset managers: They wish to make investments based mostly on their values and they’re demanding extra accountability from firms about addressing altering societal points.

Certainly, the Index Business Affiliation (IIA)’s most present Annual Benchmark Survey discovered that the variety of ESG indexes elevated 40% in response to rising investor demand.

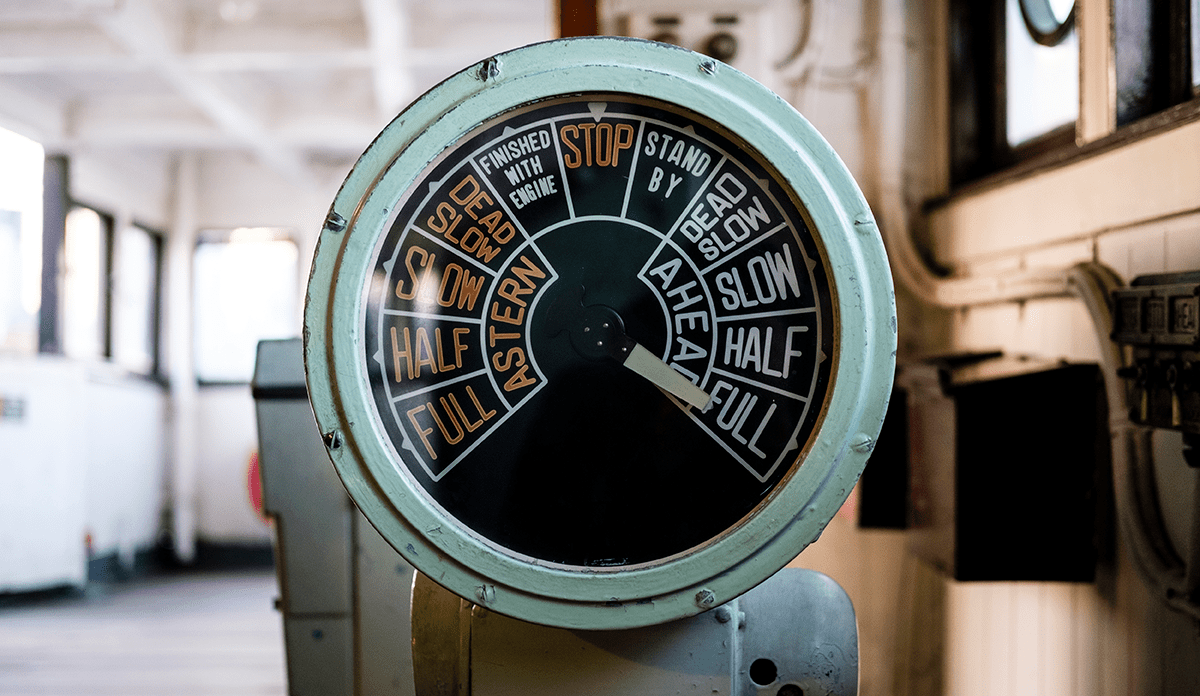

As soon as only a area of interest funding technique and coverage, sustainable investing has taken the helm in navigating international funding developments. The asset managers chargeable for the composition and administration of worldwide ESG portfolios are, by definition, figuring out which firms meet ESG requirements for funding.

However buyers need extra solutions. They wish to know what’s wanted to take ESG investing to the subsequent stage. Who units ESG requirements and the way are they measured for firms which can be evaluated globally? How do asset managers decide which firms meet these requirements and warrant inclusion in funding portfolios? Or, conversely, how do they determine which firms lack the ESG credentials vital for inclusion?

To raised perceive the key challenges and alternatives within the ESG market, the Index Business Affiliation (IIA) got down to assess how asset managers understand ESG investing. We commissioned a survey in early 2021 of 300 asset administration firms in 4 main economies — France, Germany, the UK, and america. Survey questions have been designed to seek out out extra in regards to the elements driving international asset managers’ ESG funding selections, the perceived challenges and limitations on this market, and the way asset managers anticipate the way forward for ESG investing unfolding.

On a fundamental stage, the survey findings confirmed a number of the extra apparent developments in ESG investing. Unquestionably, ESG is a really excessive precedence for international asset managers and can probably stay so within the decade to come back.

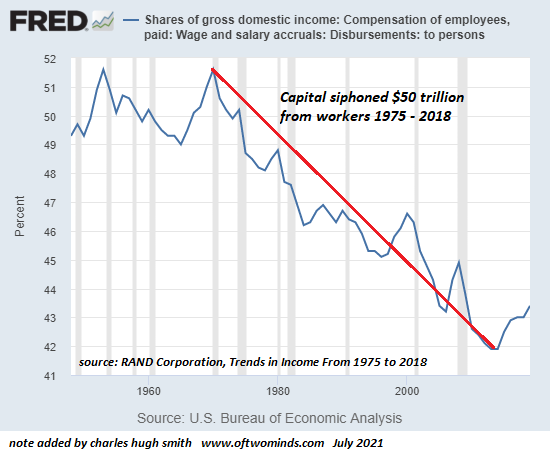

Of the 300 asset managers surveyed, 85% say ESG is a main concern for his or her firms. They anticipate the extent of portfolio funding in ESG to rise significantly within the coming years, with the proportion of ESG property growing from 26.7% in 12 months to 43.6% in 5 years. And this speedy progress isn’t taking place in a vacuum. It’s being fueled by rising international demand for extra ESG-friendly investments.

Precedence of ESG inside Your Firm’s General Funding Providing or Technique

Whereas there are variations throughout nations, our outcomes affirm ESG is a “huge deal” and really a lot on the minds of worldwide asset managers as they formulate funding technique and allocate assets. That is good data to know, however not precisely groundbreaking.

As soon as we moved previous the “Captain Apparent” portion of our survey and began digging deeper into the pondering of those asset managers, we got here to grasp extra about the true challenges — in addition to alternatives — for ESG investing.

The primary problem that rang by loud and clear has to do with information. Excessive-quality information on ESG company efficiency is important, but ESG measurement remains to be an evolving and imperfect science. Our survey confirmed that beneath the rising pleasure and adoption round ESG approaches, there are nonetheless main gaps within the amount and high quality of the ESG data accessible to buyers.

To What Extent Are the Following Facets a Problem to ESG Implementation for Fund and Asset Administration?

Sixty-three % of the asset managers surveyed by IIA recognized a scarcity of quantitative information as a serious (24%) or reasonable (39%) problem to ESG implementation. And 64% cited a scarcity of transparency or inadequate company disclosure round a agency’s ESG actions as one other hindrance.

And this challenge goes past information. Our survey underscored the truth that there isn’t a widespread international consensus on how ESG efficiency must be outlined and measured.

This isn’t because of a scarcity of precise ESG metrics. A dizzying array of market information suppliers and business boards every have their very own method to measuring ESG. This creates a hodgepodge with little consistency throughout markets and metrics. Typically, totally different suppliers have polar reverse takes on a single inventory, and business watchers and the information media haven’t hesitated to focus on these conflicting experiences.

Affect of Regulation

Mandating constant tips and frameworks for the quickly rising ESG funding world is a one other, associated problem. Whereas our survey signifies that international asset managers largely belief regulators to push requirements on this area, additionally they see little consistency throughout markets and regulatory regimes. Fifty-six % of survey respondents say they’re discovering it troublesome to maintain up with ESG laws, 65% say regulators must pay extra consideration to the asset administration business’s views on ESG points, and 78% agree that we are going to see extra ESG regulation of the asset administration business over the subsequent few years.

So, the place will we go from right here? I want I had a crystal ball to inform you what the ESG funding image will seem like in 10 years, and even in 5 years. What makes this space so fascinating is how it’s nonetheless so shortly evolving and software program updates to ESG’s metaphoric international positioning system (GPS) can be vital.

Even the very idea of ESG is evolving. Traditionally, the “E” (environmental) and “G” (governance) elements of ESG have been pretty properly addressed, however the “S,” or social, issue stays very a lot a piece in progress. Society is present process speedy modifications and these modifications aren’t seen with the identical lens in all nations and areas. Versatile requirements that may incorporate these variations can be key to the way forward for ESG progress.

Market indexes have completed a great job in recent times to remain on high of ESG business developments and design index measurement instruments to assist buyers consider ESG markets and issuers and to raised implement their ESG funding methods. Higher company information will allow higher ESG benchmarks, which can permit asset managers to raised put money into ESG mandates from buyers.

Our survey of asset managers helps this level however, importantly, underscores that we nonetheless want a extra correct GPS.

That is the fourth installment of a collection from the Index Business Affiliation (IIA).

For those who favored this put up, don’t neglect to subscribe to the Enterprising Investor.

All posts are the opinion of the creator. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially replicate the views of CFA Institute or the creator’s employer.

Picture credit score: ©Getty Pictures/Tsuji

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can report credit simply utilizing their on-line PL tracker.

Source link