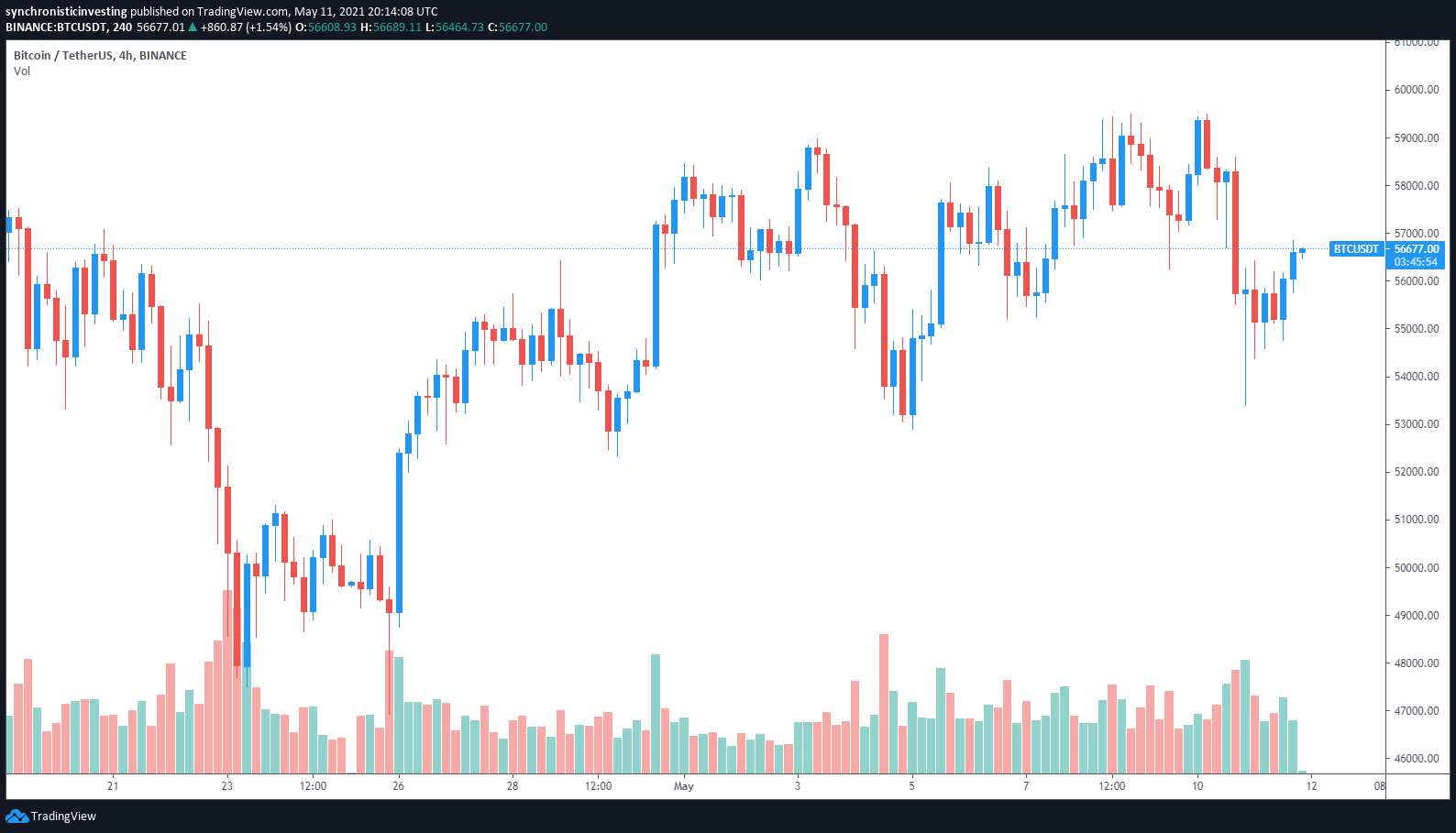

The markets have been combined on Might 11 as Bitcoin (BTC) recovered from Monday’s drop to $53,000 by bouncing to $56,862 however the digital asset continues to be discovering resistance on the $57,000 stage.

Ether (ETH) additionally labored its approach again above $4,100 however in keeping with Cointelegraph analyst Marcel Pechman, the bullish sentiment for Ether seen in current weeks has begun to fade as merchants query whether or not new all-time highs will likely be sustainable within the quick time period.

Knowledge from Cointelegraph Markets and TradingView exhibits that Bitcoin bulls defended a late-night sell-off on Might 10 that briefly dropped the worth of BTC beneath $54,000 earlier than dip consumers wolfed up promote orders and lifted the worth again above $56,000.

blue-chipWhile the blue chip cryptocurrencies have been caught in a sideways market, canine-themed meme cash together with Shiba Inu (SHIB) and Dogelon Mars (ELON) have adopted Dogecoin’s (DOGE) lead and seen their costs explode for triple-digit features.

Ethereum bulls take a quick breather

Bitcoin’s range-bound buying and selling between $50,000 and $60,000 in current weeks can partially be attributed to the rising value of Ether, which has caught the eye of institutional traders searching for publicity to extra than simply BTC. The rising demand for Ether can clearly be seen within the value motion of the ETH/BTC pair.

In accordance with David Lifchitz, managing associate and chief funding officer at ExoAlpha, Ether’s current all-time excessive was partially attributable to a “continued rotation away from Bitcoin” which helped push the worth of Ether “as excessive as $4,214 earlier than instantly puking right down to $3,658 (-13% in an hour).”

The downturn within the crypto market coincided with a selloff within the U.S. fairness markets that hit the tech-heavy NASDAQ index particularly laborious. Lifchitz famous that Bitcoin and the opposite cryptocurrencies have been ultimately capable of “bounce again half of the loss from the excessive.”

Whereas the sell-off “could possibly be defined by some correlation trades resulting in a fast profit-taking in cryptos”, Lifchitz additionally pointed to the potential for a extra organized selloff the place some merchants took benefit of frothy market situations.

Lifchitz mentioned:

“It may even have been an organized selloff as Ethereum was at its ATH after a torrid journey (i.e. ETH was susceptible to a fast drop) with the intention to spook the weak arms and shake them off, triggering a cascading promoting impact, earlier than shopping for again ETH on a budget as proven by the even greater quantity to purchase proper after the selloff.”

Lifchitz highlighted that simply:

“Twenty-four hours later, Bitcoin is again in the course of its twilight zone ($50,000 to $60,000) and Ether is slowly grinding greater above $4K. So all in all, it was simply an unusual day in crypto land.”

Additional perception into the market strikes over the previous week was provided by Ben Lilly, co-founder and analyst at Jarvis Labs, who highlighted a rise in on-chain revenue taking over the past week that had “numerous capital turning over all through altcoins.”

Lilly mentioned:

“As capital made its approach from coin to coin, income have been being realized as Bitcoin traded sideways. What we noticed on Might 10 was the top of this section.”

Altcoins lead the market greater

The general altcoin market shook off the bearish strikes seen within the larger-cap cryptocurrencies. EOS led the day with a 50% bounce which took the worth to $13.92 after Block.one introduced that it had secured $10 billion in funding to launch an EOS-based cryptocurrency alternate named Bullish International.

Yearn.finance (YFI) managed to interrupt out of the buying and selling vary it had been caught in to placed on a 58% rally to a brand new document excessive above $80,000, whereas the worth of Revain (REV) exploded 130% to achieve a multi-year excessive at $0.049.

The general cryptocurrency market cap now stands at $2.474 trillion and Bitcoin’s dominance charge is 42.8%.

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, you need to conduct your personal analysis when making a choice.

Source link