Decentralized finance (DeFi) began 2021 by taking the cryptocurrency sector by storm and serving to to kick the bull market cycle into excessive gear as merchants capitalized on methods to simply commerce cryptocurrencies and earn excessive yields on their hodl stacks.

Finally, excessive charges on the Ethereum (ETH) community and some sharp market sell-offs helped contribute to a pullback in token costs and DeFi transactions starting in late February, however that development seems to have reversed over the previous week as exercise on decentralized exchanges is as soon as once more on the rise.

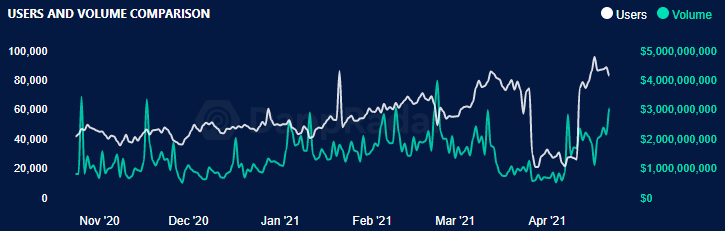

As seen within the chart above, decentralized alternate (DEX) quantity spiked in late February, adopted by a downtrend by way of the primary week of April which noticed the whole quantity traded on all DEXs fall as little as $603 million on April 4.

The uptick in customers in mid-March was partially as a result of explosion in reputation of nonfungible tokens (NFTs), and the tip of that frenzy is marked by a precipitous drop-off in customers seen between March 26 and March 27.

Bitcoin dips ignite DEX exercise

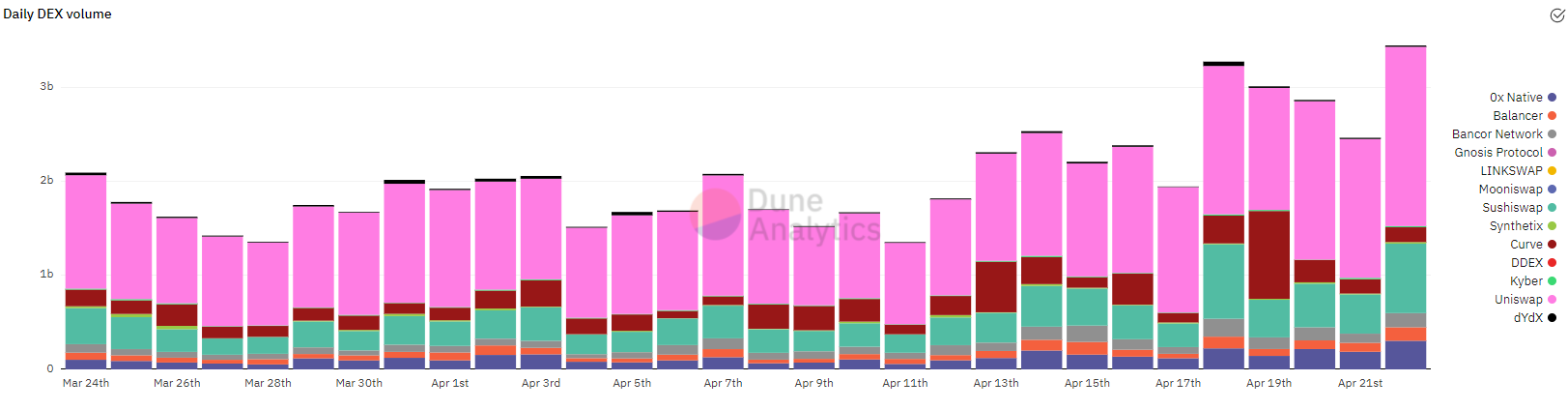

One attainable clarification for the spike in exercise on DEXs in current weeks might be discovered evaluating the amount charts with the worth chart for Bitcoin (BTC), which signifies a attainable correlation between a dip within the worth of BTC and elevated buying and selling exercise.

As the worth of Bitcoin noticed declined from April 6 by way of April 8, DEX quantity started to extend and reached a peak on April 7, simply as BTC worth was bottoming out and getting ready to climb larger.

After Bitcoin worth reached a peak at $64,840 on April 14, it fell right into a downtrend that continued by way of April 24 because the asset stays pinned under $50,000.

DEX quantity noticed a considerable enhance starting April 18, the identical day that Bitcoin skilled a 16% pullback in worth from $60,900 to $50,500, and it has remained elevated since, indicating that merchants could also be rotating out of Bitcoin and into altcoins as the highest cryptocurrency works its means by way of what merchants hope will likely be a quick corrective part.

As seen on the chart above, the every day DEX quantity reached its highest degree in weeks on April 22 as Bitcoin and the broader cryptocurrency market underwent a major downturn that noticed the whole market capitalization fall by greater than $324 million.

With Bitcoin now preventing to regain the $50,000 help degree and a majority of the altcoin market now at fire-sale costs following the downturn from current highs, decentralized alternate exercise could trace at an approaching altcoin season that has traditionally as Bitcoin searches for path following a pullback from a brand new all-time excessive.

The views and opinions expressed listed below are solely these of the creator and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, it is best to conduct your personal analysis when making a call.

Source link