by C Hamilton

Because the previous adage goes, actual property is all about location, location, location. Given this, I needed to supply a regional and state by state view of the scenario, the place declining complete populations, giant declines amongst these employed, and declining beneath 60 yr previous populations are going down parallel to a resurgence in rate of interest pushed residence valuations and constructing.

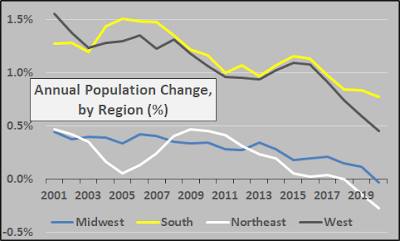

First, annual change in regional complete populations. Progress in all 4 areas is decelerating however outright declines are actually underway within the Northeast and Midwest.

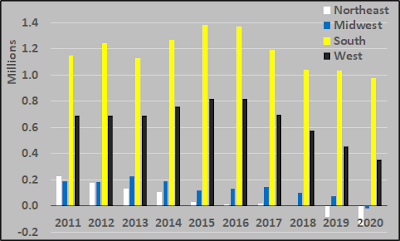

Annual inhabitants change (tens of millions), by area during the last decade. Decelerating development and outright declines.

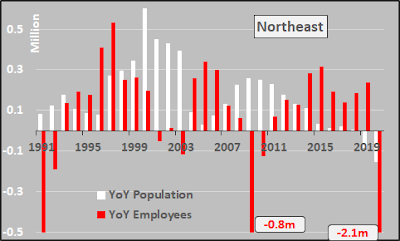

Northeast

Yr over yr change in complete inhabitants, workers. Lengthy decelerating development within the Northeast has turned to an outright declining inhabitants. The expansion of the inhabitants is all the time a governor of the potential development of these employed.

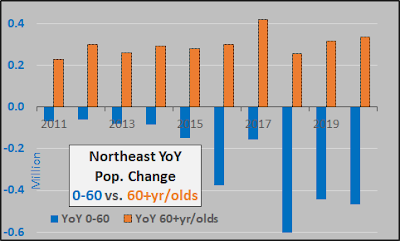

Yr over yr change in beneath versus over 60 yr previous inhabitants. On an annual foundation, the Northeast beneath 60 yr previous inhabitants is now declining by a few half million, or equal to shedding a metropolis in regards to the measurement of Baltimore yearly. This working age depopulation reduces the amount of potential workers, potential residence patrons/renters whereas the amount of aged (potential residence sellers) soars.

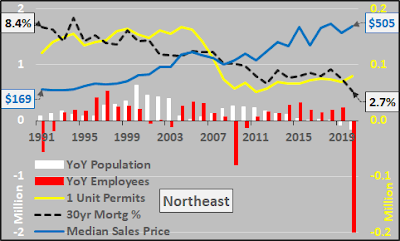

Northeast, placing it collectively.

- declining complete inhabitants

- declining beneath 60 yr previous inhabitants (potential patrons) versus hovering aged inhabitants (potential sellers)

- giant decline amongst employed (potential patrons/renters) and shrinking future amount of potential workers

- report low mortgage charges

- accelerating constructing exercise and rising variety of complete housing items

- rising residence costs

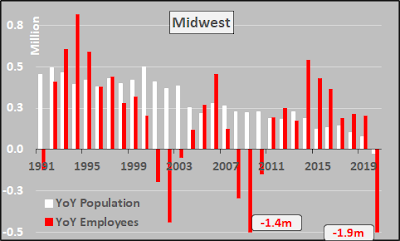

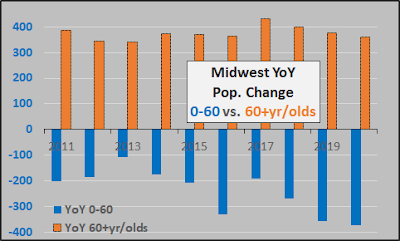

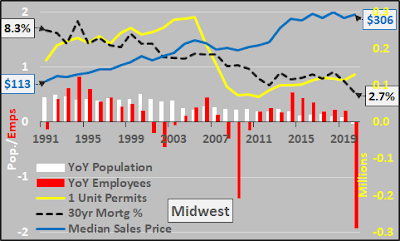

Midwest

Yr over yr change in complete Midwest inhabitants, workers. Many years of decelerating development have turned to what’s more likely to be a long time of inhabitants declines.

Yr over yr change in Midwest beneath 60 versus over 60 yr previous inhabitants. Midwest beneath 60 yr previous inhabitants is declining by about 350 thousand yearly, or equal to shedding a metropolis the dimensions of Cleveland yearly whereas the 60+ yr previous inhabitants grows by about the identical.

Midwest placing it collectively…

- declining complete inhabitants

- declining beneath 60 yr previous inhabitants (potential patrons) versus hovering aged inhabitants (potential sellers)

- giant decline amongst employed (potential patrons/renters) and shrinking future amount of potential workers

- report low mortgage charges

- accelerating constructing exercise and rising complete variety of housing items

- elevated however secure residence costs over final decade

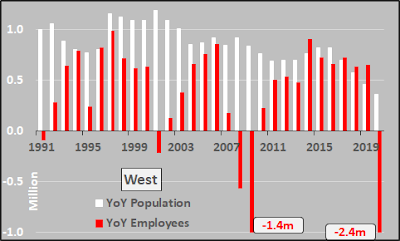

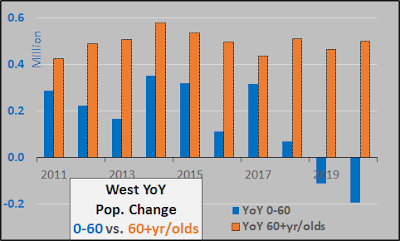

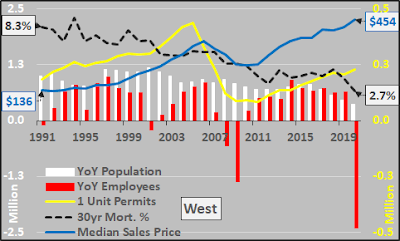

West

Yr over yr change in complete inhabitants, workers. Accelerating deceleration of development…and potential development.

Yr over yr change in beneath 60 versus over 60 yr previous populations. Underneath 60 yr previous inhabitants now falling by about 200 thousand, or equal to shedding a metropolis the dimensions of Tempe yearly. Once more, this accelerating deceleration can be an accelerating deceleration of potential future development…or probability for outright declines amongst workers, shoppers, homebuyers versus hovering portions of aged.

Pulling it collectively

- decelerating complete inhabitants development

- declining beneath 60 yr previous inhabitants (potential patrons) versus hovering aged inhabitants (potential sellers)

- giant decline amongst employed (potential patrons/renters) and decline potential for future employment development

- report low mortgage charges

- considerably accelerating constructing exercise and rising complete variety of houses

- hovering residence costs

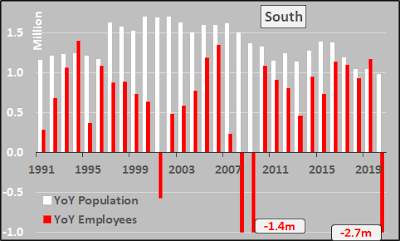

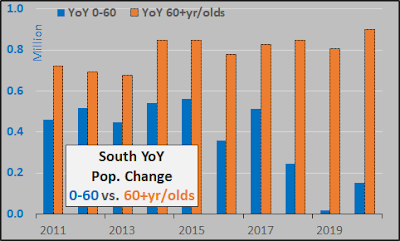

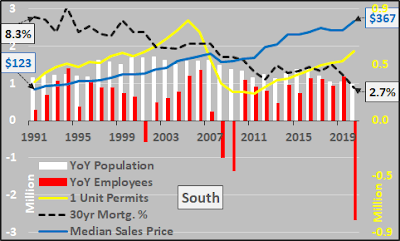

South

Yr over yr change in complete inhabitants, workers. The first supply of US inhabitants development though clearly decelerating.

Yr over yr change in beneath 60 versus over 60 yr olds. The decelerating development of beneath 60 yr olds means a major deceleration of potential employment development, even within the South.

Pulling it collectively

- decelerating complete inhabitants development

- decelerating beneath 60 yr previous inhabitants (potential patrons) versus hovering aged inhabitants (potential sellers)

- giant decline amongst employed (potential patrons/renters) and decelerating potential for future employment development

- report low mortgage charges

- considerably accelerating constructing exercise and rising complete variety of houses

- hovering residence costs

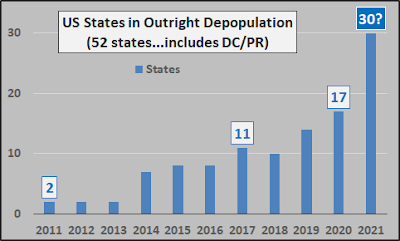

State by State Foundation

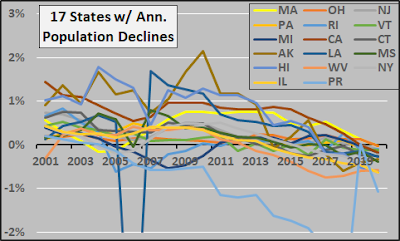

The variety of states experiencing outright depopulation is hovering….and the present 17 states depopulating as of 2020 are more likely to be joined by one other 13 states transitioning into depopulation by yr finish 2021.

States experiencing depopulation in 2020.

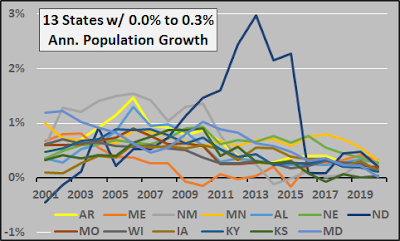

States with minimal inhabitants development…possible transferring to outright depopulation in 2021.

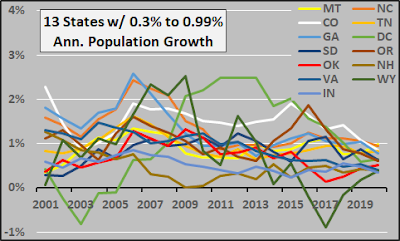

States nonetheless rising however with decelerating development.

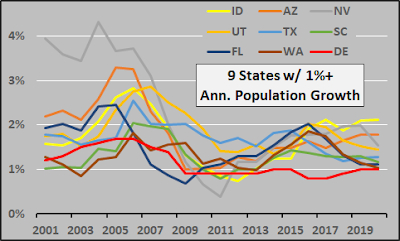

States with inhabitants development in extra of 1%. Solely Idaho and Arizona seeing accelerating development at current.

Nonetheless, by my fast calculations as of 2020, there are 38 states with declining beneath 60 yr previous populations…and solely 12 states that proceed to have growing working age populations, potential patrons, and rising natural demand. However the variety of state nonetheless persisting with working age inhabitants development might be falling to single digits within the subsequent couple of years.

Breaking these dynamics down, on a state by state foundation.

California

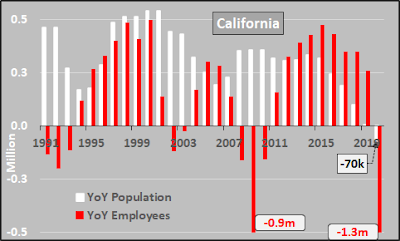

Yr over yr change in complete California inhabitants and workers. Decelerating inhabitants development has turned to depopulation.

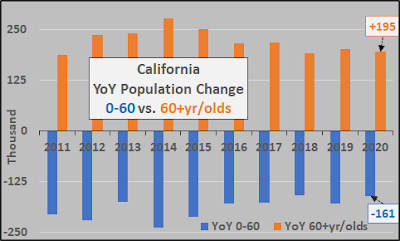

Yr over yr change in California beneath and over 60 yr previous inhabitants. The full inhabitants declines seen in 2020 shouldn’t have been a shock because the inverting demographic pyramid has lengthy been underway in California. Clearly, the overall inhabitants decline might be persistent and the potential for employment development might be restricted by the declining working age inhabitants.

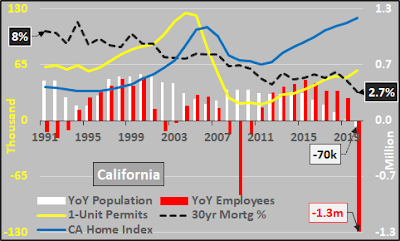

Hovering California residence costs and rising constructing exercise (because of Federal Reserve pushed constant decline in mortgage charges) in opposition to the backdrop of secular depopulation. Specialists clarify that the rising housing worth are as a result of a housing scarcity somewhat than a speculative frenzy…however the information suggests in any other case.

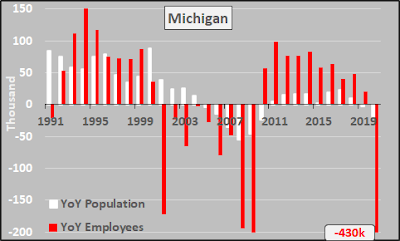

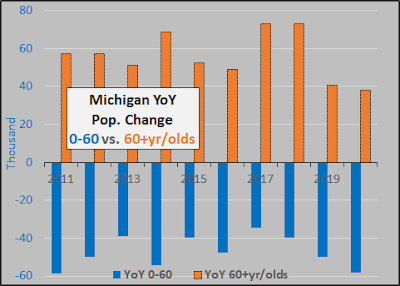

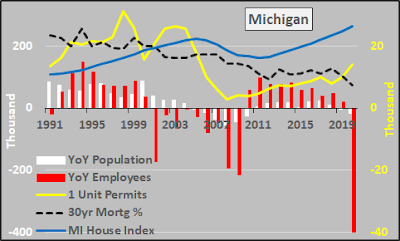

Michigan

Yr over yr change in complete inhabitants, workers.

Yr over yr change in beneath 60 versus over 60 yr olds.

Michigan rising residence costs and rising constructing exercise versus declining complete inhabitants, working age inhabitants, and workers.

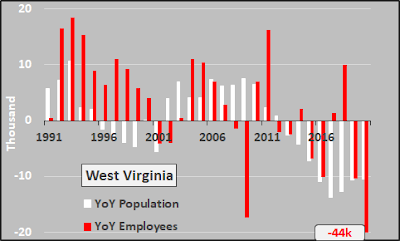

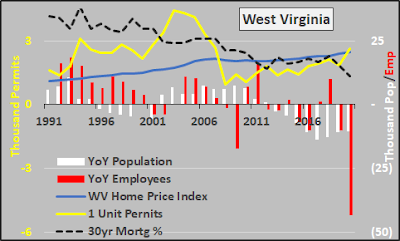

West Virginia

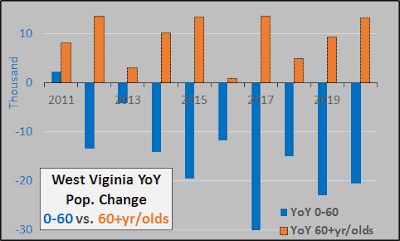

Yr over yr change in complete inhabitants, workers.

Yr over yr change in beneath 60 versus over 60 yr previous inhabitants.

West Virginia is experiencing rising constructing exercise and constantly rising residence values on falling numbers of workers, falling complete populations, and falling working age populations. The time period FUBAR appears acceptable right here.

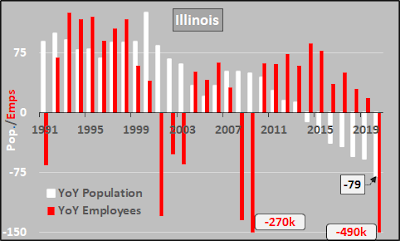

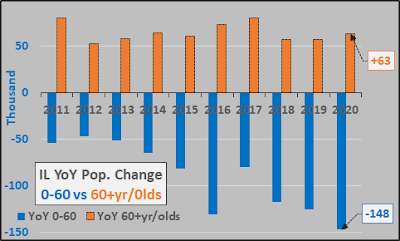

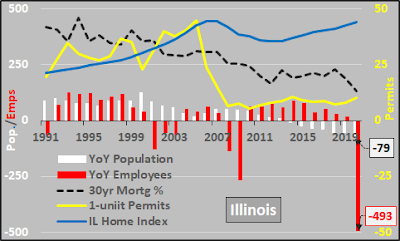

Illinois

Yr over yr change in complete inhabitants and workers.

Yr over yr change in beneath 60 vs. over 60 yr previous inhabitants.

Illinois is a poster baby for the Fed’s impression on housing valuations in opposition to all natural fundamentals. Somewhat than the price of shelter reflecting it’s honest market worth…it displays what the Fed and banks want it to be…in any other case the Fed and banks holding these mortgages are sitting on nugatory paper that possible must be marked to zero.

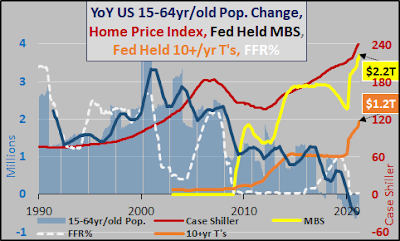

What’s the Federal Reserve’s function in pushing housing costs larger? The Fed units the federal funds charge (in a single day foundation of lending) which is the idea for the remainder of the rate of interest curve. The Fed’s ZIRP (zero rate of interest coverage) coupled with the Fed’s buying of US Treasury’s and mortgage backed securities has backstopped the housing market. What personal entity would purchase 30 yr mortgages in locations which can be presently experiencing depopulation and can see giant scale depopulation over the lifespan of that mortgage??? Regardless of nearly all of America that’s both seeing outright depopulation or depopulation amongst beneath 60 yr previous populations…demand for housing is hovering…similar to the Fed’s holdings of MBS and lengthy Treasury bonds.

The hovering housing demand is actual however for all of the mistaken causes. It’s not actually an insufficient provide of housing however an oversupply of liquidity with a scarcity of potential belongings from which to earn a “secure” return. Previous to 2008, retirees and people approaching retirement would tilt their portfolios towards bonds to reduce the volatility of “riskier” shares. However with the Fed’s decade+ of ZIRP (artificially collapsing bond / CD charges), the hovering inhabitants of quickly to be retired / these in retirement turned their gaze towards RE. Demand for five%, 6%, 7% “secure” returns supplied by being a landlord changed bonds. Foreigners, speculators, flippers all adopted the rising pattern.

The Federal Reserve pushed actual property wealth impact has owners believing they’re sitting on actual wealth as their residence worth soars and mortgage charges plummet. The Fed, similar to Bernie Madoff, is working a Ponzi whereby owners imagine themselves to be wealthy (suppose HELOC or reverse mortgage or MEW). The one distinction between Madoff and the Fed is that the Fed can print all of the {dollars} it needs (inflation be damned)…if/when want be, the Fed (or some tasked entity) is more likely to start shopping for up extra housing with cash from its printing press (even when it’s solely to demolish it). This may possible start in rural states/areas throughout America the place the depopulation is most extreme.

However the worst impacted by this Fed Ponzi are younger adults. They’ve little to no belongings (rising with the Fed’s flood of liquidity). They’re drowning in hovering rents, predatory lending for training, prices of daycare, insurance coverage, co-pays, and normal inflation. They’re getting extra training, taking up extra debt, and having much less to indicate for it. This has resulted in a dramatic rise within the age of first marriages, collapsing fertility charges and births.

Primarily, the farther the Fed (and CB’s worldwide) go together with its asset inflation scheme (the idea of the home and international inflation spike alongside an international shutdown/restart of manufacturing), the decrease the longer term inhabitants sinks…and the extra impactful and highly effective the Fed turns into.

199 views

Source link