A typical saying within the investing world is “The pattern is your good friend,” a phrase that factors to the concept nearly all of the time, sticking with the prevailing market pattern will produce optimistic outcomes.

A number of the frequent metrics used to determine market tendencies embrace: technical evaluation, which includes finding out value charts to identify alternatives; basic evaluation, which includes taking a look at a challenge’s underlying financial and technological components; and social media metrics, which assist an investor take heed to the heartbeat of what the broader public is targeted on.

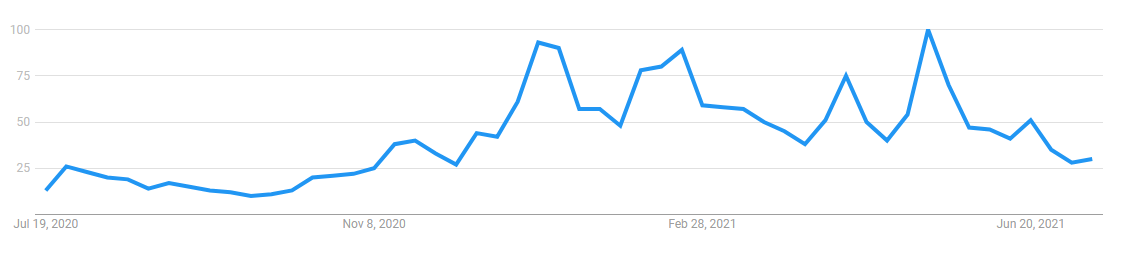

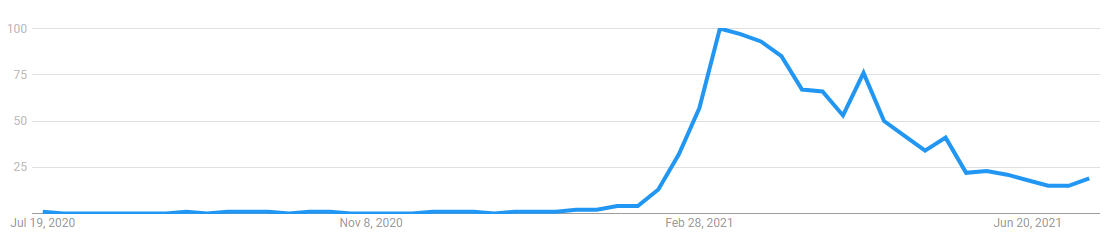

One of many extra widespread metrics that crypto merchants use to determine rising patterns is Google Developments, a product that analyzes the recognition of search queries carried out through Google’s search engine. Utilizing Google Developments, customers can view the info in easy line graphs that additionally present a breakdown by geographical area.

The Google Developments chart for “Bitcoin” exhibits a number of sharp spikes in searches over the previous 12 months, most notably in early January, late February, mid-April and once more in mid-Could.

A have a look at the BTC value chart exhibits that every of the spikes in Google searches coincided with run-ups within the value of Bitcoin (BTC) and signifies that search queries do certainly supply some perception into figuring out tendencies that would influence costs.

The identical strategy will also be utilized to altcoins and decentralized finance (DeFi) tokens. Let’s check out how social evaluation preceded the rise of widespread NFT-related tokens and DeFi blue chips like Polygon’s MATIC.

Curiosity in DeFi got here in two waves

DeFi was the most well liked sector within the cryptocurrency market at the start of 2021, and it appeared like not a day handed with out some newly emerged lending or farming protocol reaching $1 billion in whole worth locked.

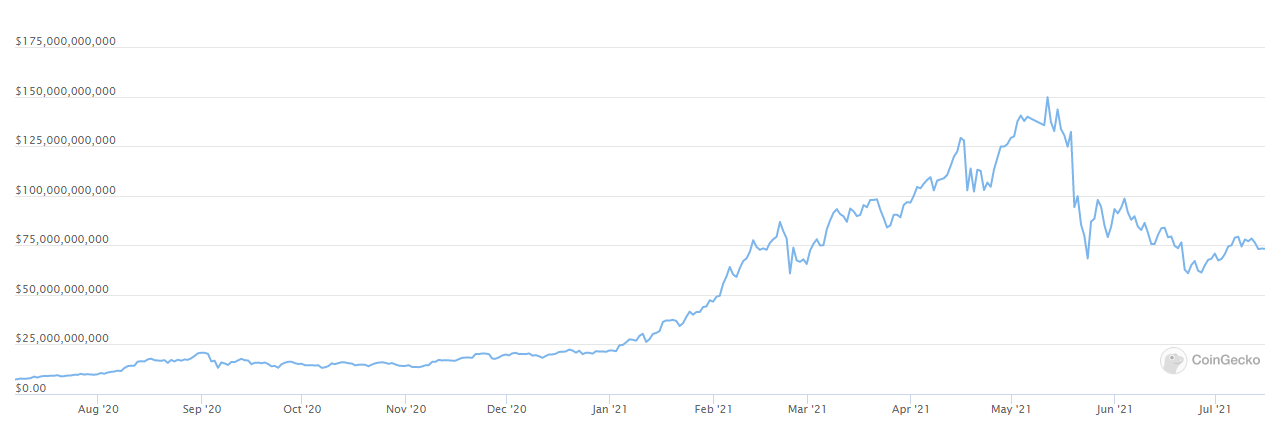

Knowledge from CoinGecko exhibits that the overall market capitalization of the highest 100 DeFi tokens started to quickly improve in mid-January, and ultimately, the determine peaked in mid-Could after your entire cryptocurrency market proceeded to dump.

Looking “DeFi” in Google Developments produces the next chart, which really exhibits a spike within the variety of queries across the identical time because the market cap of DeFi tokens started to extend.

This determine continued to extend even after the variety of queries declined throughout the month of March.

Spikes seen within the variety of searches in April and once more in Might also occurred across the identical time as spikes within the DeFi market cap.

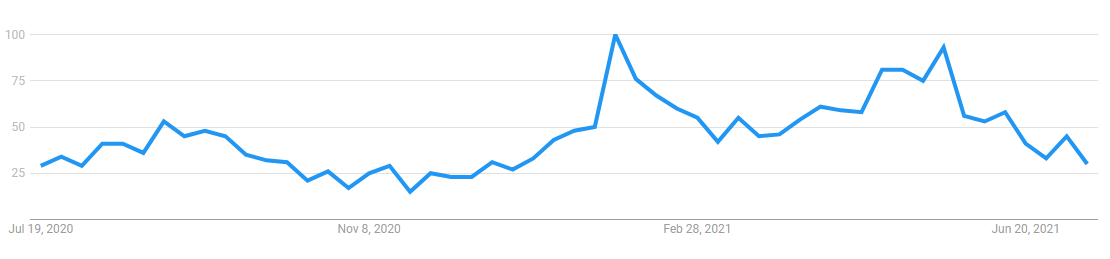

Searches for “NFT” went parabolic on the finish of February

The rise of nonfungible tokens, or NFTs, in February and March caught the world’s consideration as big-name celebrities like NFL veteran Rob Gronkowski and Twitter CEO Jack Dorsey acquired in on the motion and established public sale homes like Sotheby’s helped facilitate NFT auctions, together with the latest sale of CryptoPunk #7523, which was bought for a document $11.8 million.

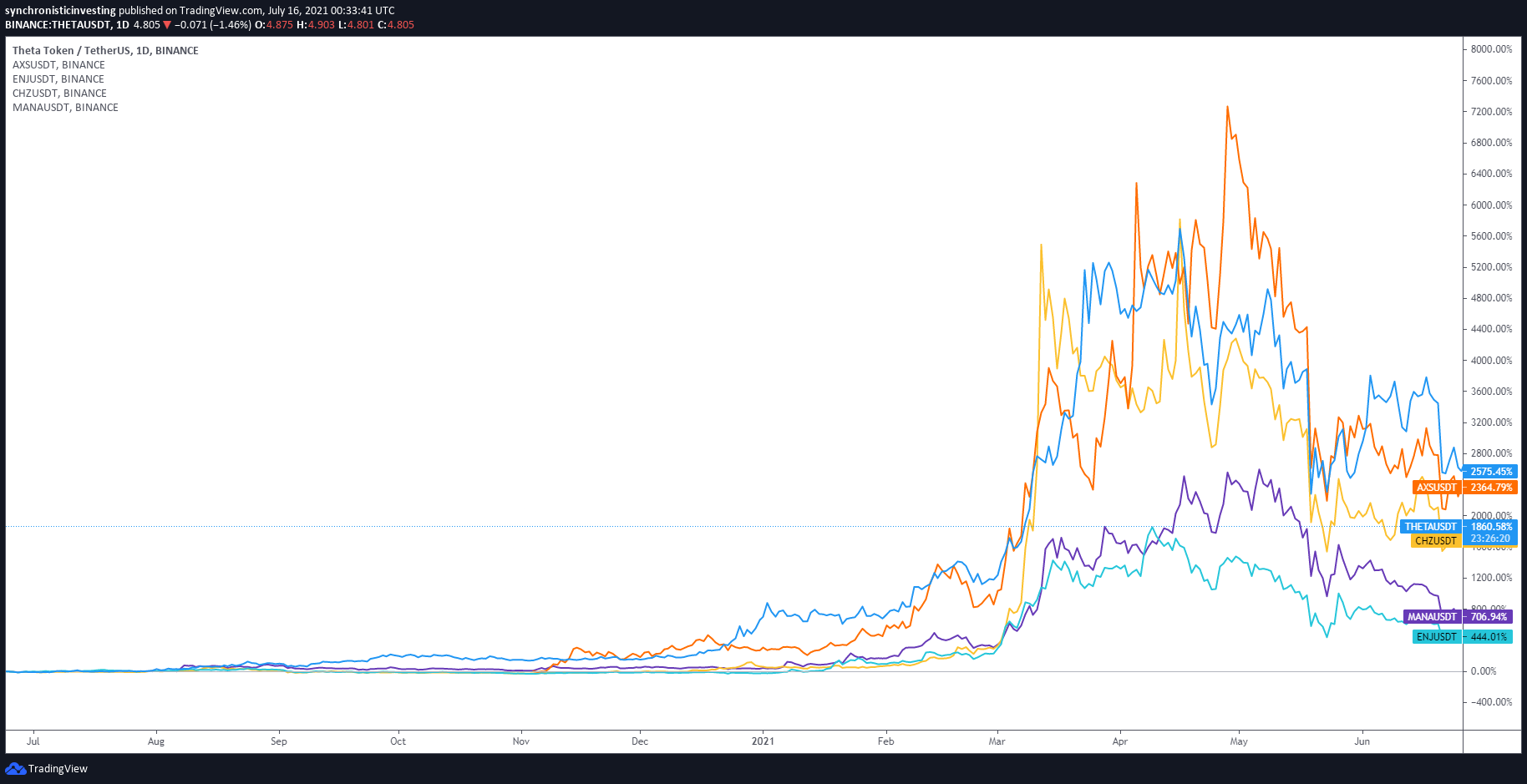

A number of the greatest month-to-month positive factors from NFT initiatives embrace a 443% achieve within the value of THETA between March 1 and 21, and a 530% achieve within the value of Axie Infinity Shards (AXS) from Feb. 23 to March 15. Chiliz (CHZ) noticed a 3,690% surge in value between Feb. 13 and March 13.

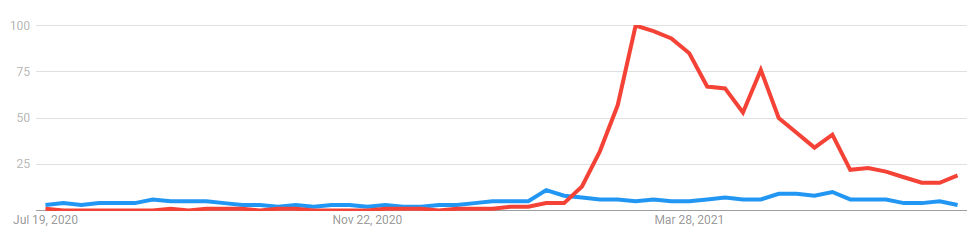

The rise in costs coincided with a surge in NFT-related searches registered by Google Developments.

Whereas it was broadly reported that NFTs stole DeFi’s thunder, proof of the rotation may be seen when the DeFi and NFT search curiosity charts are mixed. As proven under, there’s a sudden and big rise in NFT queries as searches for DeFi fall.

The magnitude of NFT search queries was additionally considerably increased than that of DeFi, hinting that nonfungible tokens could also be an optimum path to encouraging the widespread adoption of cryptocurrencies.

Trying on the late February to early March timeframe on the worth charts, a dip within the value of DeFi tokens is seen at roughly the identical time as the costs of NFT tokens begin to rise, indicating some stage of rotation out of DeFi and into NFTs.

Each charts present spikes in search curiosity that line up with value will increase in associated DeFi and NFT tokens, and so they additionally handle to seize the diminishing curiosity seen as costs fell in June and July.

Associated: Hanging a chord: DeFi’s domino impact on NFTs and Internet 3.0 adoption

Twitter mentions may also trace at rising adoption

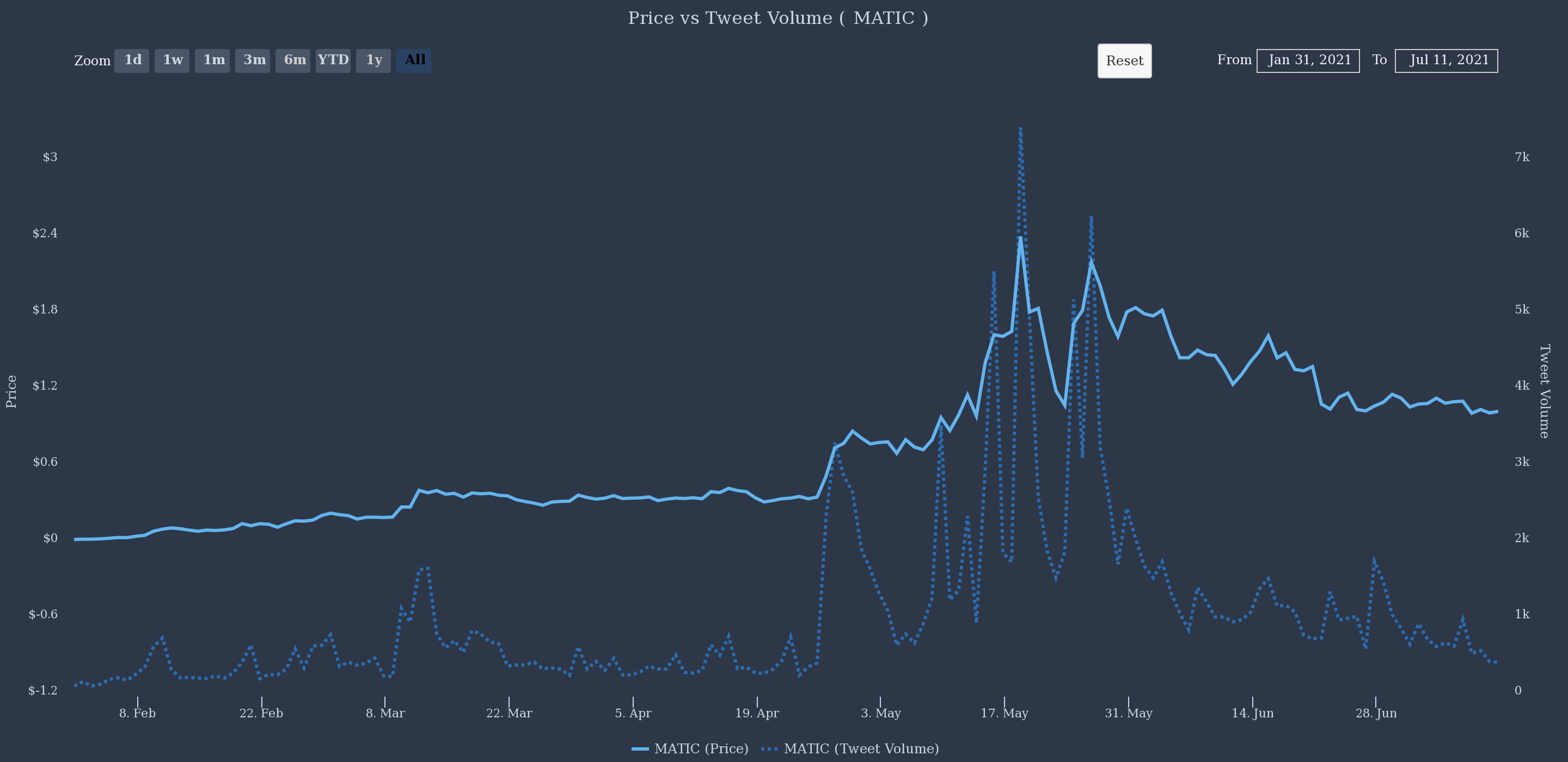

Twitter can also be a great supply to acquire perception into what cash retail buyers could be all for, and analyzing the variety of Twitter mentions can assist hone in on which initiatives have the potential to see future value actions.

In 2021, Polygon emerged as one of the crucial promising layer-two options for the Ethereum community, and social media mentions elevated considerably as the worth of its native MATIC token surged 700% from $0.33 on April 26 to its all-time excessive of $2.68 on Could 18.

As seen within the chart above, information from TheTIE exhibits that many of the giant jumps within the value of MATIC coincided with spikes in tweet quantity the place the key phrase “MATIC” was talked about.

Google Developments additionally exhibits a rise in searches for “Polygon” throughout this time interval, with the preliminary spike in curiosity coming throughout the week of April 25 to Could 1.

Whereas many analysts and pattern watchers want to make the most of technical and basic analyses to maintain a pulse on creating tendencies, it’s essential to do not forget that no cryptocurrency challenge has any worth with out the individuals concerned within the community.

Which means helpful insights can at all times be present in analyzing data and bulletins that catch individuals’s consideration and provoke public engagement.

Need extra details about buying and selling and investing in crypto markets?

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, it is best to conduct your personal analysis when making a choice.

Source link