Throughout an interview with Bloomberg TV on Might 3, Binance CEO Changpeng Zhao recommended that Bitcoin (BTC) “might be much less unstable” than the inventory costs of Apple (AAPL) and Tesla (TSLA).

Zhao argued that crypto’s volatility was not not like the inventory market, including: that “volatility is in all places” and that “it’s not distinctive to crypto.”

Nevertheless, these concerned in cryptocurrency buying and selling most likely know that cryptocurrency costs fluctuate much more than listed trillion-dollar firms. This begs one to query whether or not or not Zhao is detecting a pattern that some could have missed?

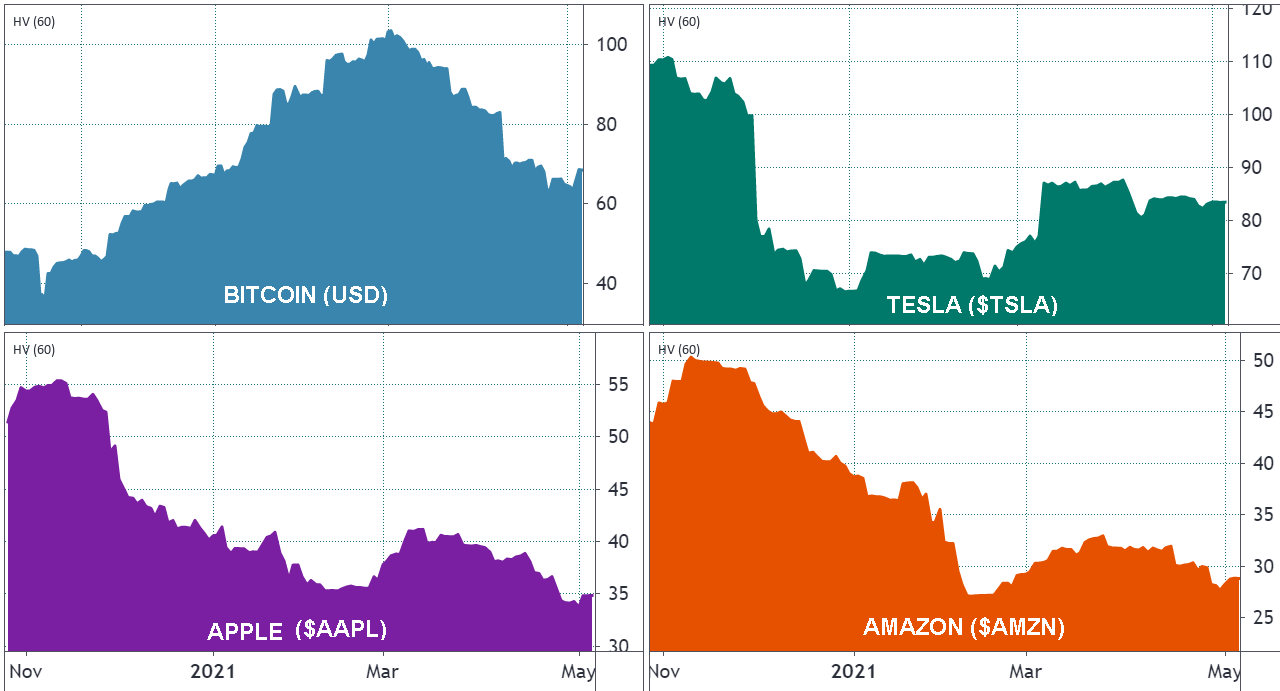

The primary apparent studying from the chart above is that each Bitcoin and Tesla share totally different volatility ranges when in comparison with trillion-dollar shares like Apple and Amazon.

Furthermore, shares appear to have skilled a 60-day volatility peak in November 2020, whereas Bitcoin was comparatively calm.

Tesla is an exception fairly than the norm

One other factor to contemplate is that Tesla’s market capitalization is $633 billion, and it has but to publish a quarterly internet earnings above $500 million. In the meantime, each single top-20 international firm is extremely worthwhile. These embody Microsoft (MSFT), Google (GOOG), Fb (FB), Saudi Aramco (ARAMCO.AB), Alibaba (BABA), and TSM Semiconductor (TSM).

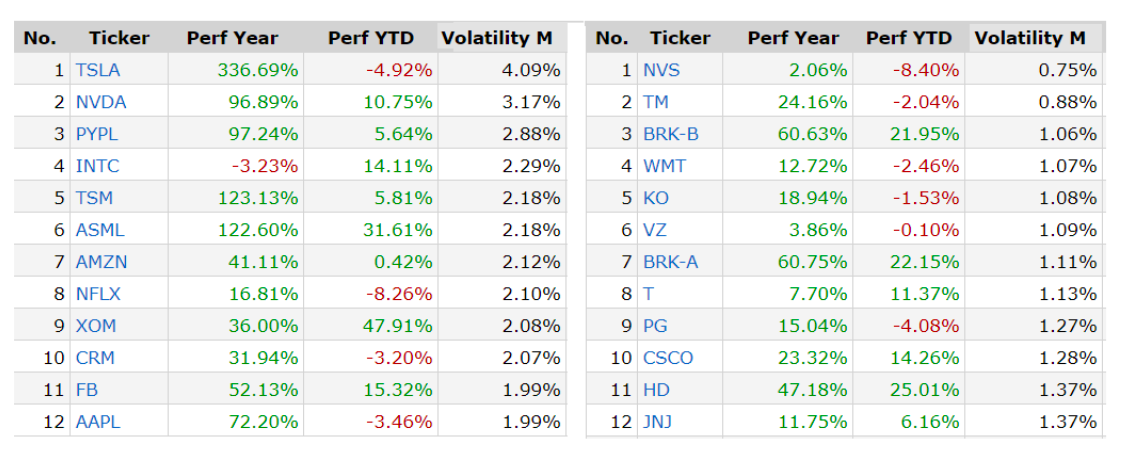

The record above reveals the top-12 and bottom-12 most unstable shares to indicate how Tesla’s (TSLA) value swings are far off the typical of different $200 billion market cap firms. The volatility seen in cryptocurrencies has been the norm, given that there’s a lack of earnings, a really early adoption-stage cycle, and a scarcity of a longtime valuation mannequin.

One does not have to be an professional in statistics to establish that the S&P 500 index efficiency has been just about steady over the previous 12 months, aside from a few weeks again in September and October 2020.

Zhao stands out as the founding father of the main crypto change, however he does not personally commerce. Quite the opposite, he truly recommends holding (HODL) as an alternative of buying and selling in each occasion doable.

Lol, I don’t do leverage or loans. I don’t even commerce. I simply hodl #bnb.

— CZ Binance (@cz_binance) January 12, 2021

Should you really feel wired throughout each dip, you most likely shouldn’t commerce a lot, or not less than change your buying and selling technique. Possibly simply #HODL?

Not the very best recommendation for our enterprise (buying and selling charges), however most likely good recommendation for a lot of new “merchants”.

Not monetary recommendation.

— CZ Binance (@cz_binance) April 22, 2021

Volatility doesn’t measure returns

Solely analyzing volatility presents one other huge downside. The indicator leaves out an important metric for traders, the return. Whether or not an asset is kind of unstable does not matter if, on common, one asset persistently posts greater positive aspects than others.

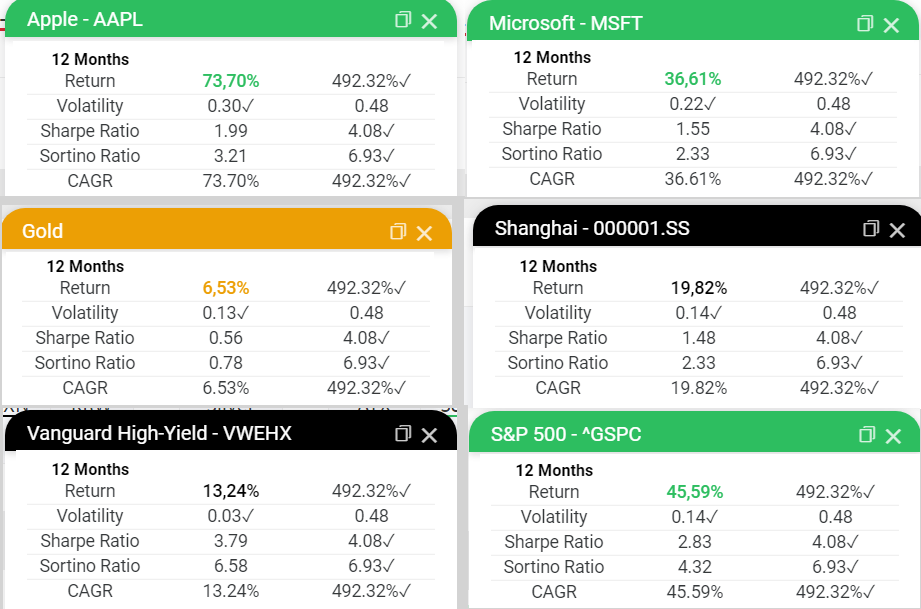

MicroStrategy has listed nearly each foreign money, inventory index, and S&P 500 index part, and curious analysts can examine returns and the sharpe ratio side-by-side with Bitcoin’s.

As defined within the footnotes:

“The Sharpe ratio is a measure of risk-adjusted (actually volatility-adjusted) returns. It’s a method to measure how a lot return an funding generated for the chance (volatility) endured over a while horizon.”

As the info clearly states, Bitcoin is the winner on risk-return metrics towards each main asset and index over the previous 12 months. An analogous final result additionally takes place when utilizing a 5-year timeframe.

Due to this fact, Zhao could have merely incorrectly said that Bitcoin’s volatility is just like the inventory of trillion-dollar firms. Nevertheless, when adjusting the metric based mostly on returns, it’s the incontestable winner.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails danger. It is best to conduct your individual analysis when making a call.

Source link