Margin buying and selling permits traders to borrow stablecoins or cryptocurrency to leverage their place and enhance the anticipated return. For instance, borrowing Tether (USDT) will enable one to purchase Bitcoin (BTC), thus rising their Bitcoin lengthy place.

Traders may also borrow BTC to margin commerce a brief place, thus betting on value draw back. Because of this some analysts monitor the full lending quantities of Bitcoin and Tether to achieve perception into whether or not traders are leaning bullish or bearish.

Are analysts flipping bearish based mostly solely on Bitfinex’s margin knowledge?

This week, some distinguished analysts cited a surge in Bitcoin quick positions on Bitfinex, peaking at 6,621 BTC on June 7. As Cointelegraph reported, impartial researcher Fomocap discovered a visual correlation between margined quick positions and the Might 19 value crash.

Nonetheless, when analyzing a broader scope of knowledge — together with the margin longs, perpetual contracts funding fee and protecting put choices — there isn’t a proof of distinguished gamers making ready for a shock unfavourable transfer.

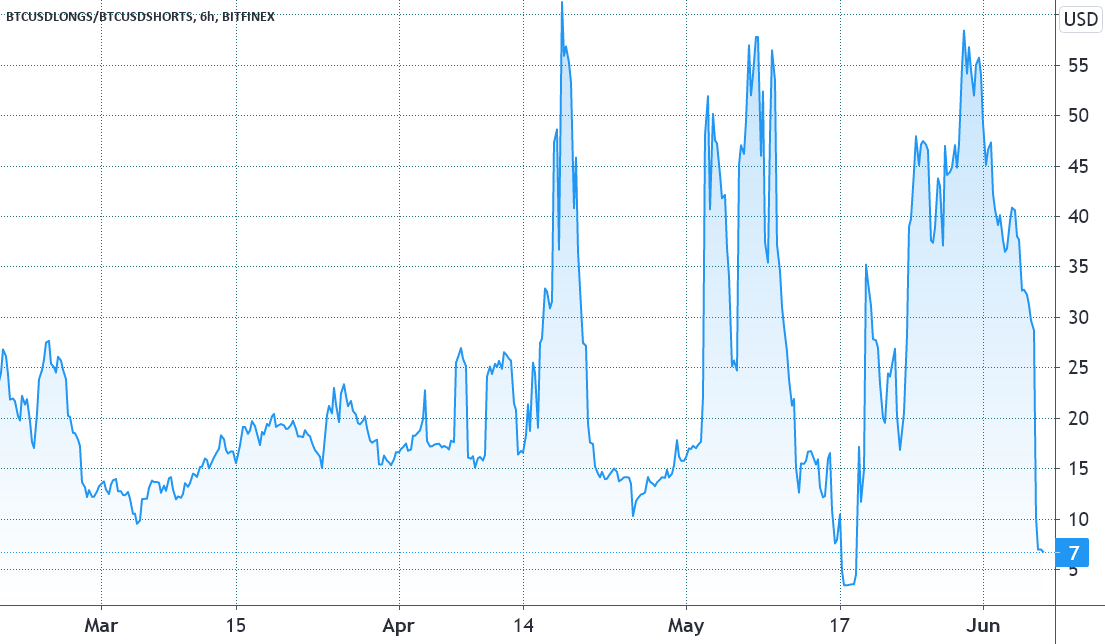

A single occasion of Bitcoin margin shorts spiking forward of the unfavourable value swing shouldn’t be thought-about a number one indicator. Moreover, one must consider Bitcoin margin longs — an opposing, normally bigger drive.

Because the above chart signifies, even on Might 17 the variety of BTC/USD lengthy margin contracts outpaced shorts by 3.6, at 39,000 BTC. In actual fact, the final time this indicator dropped beneath 2.0, favoring longs, was on Nov. 26, 2020. The consequence was not good for the shorts, as Bitcoin rallied 64% over the next 30 days.

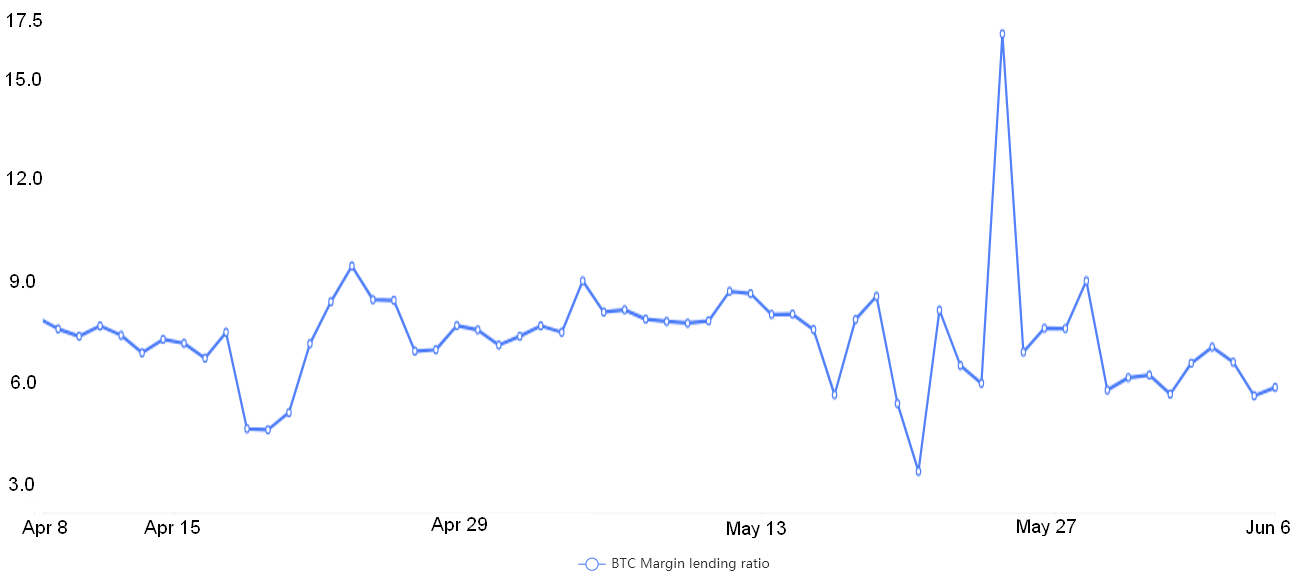

At any time when merchants borrow Tether and stablecoins, they’re possible lengthy on cryptocurrencies. Then again, BTC borrowing is especially used for brief positions.

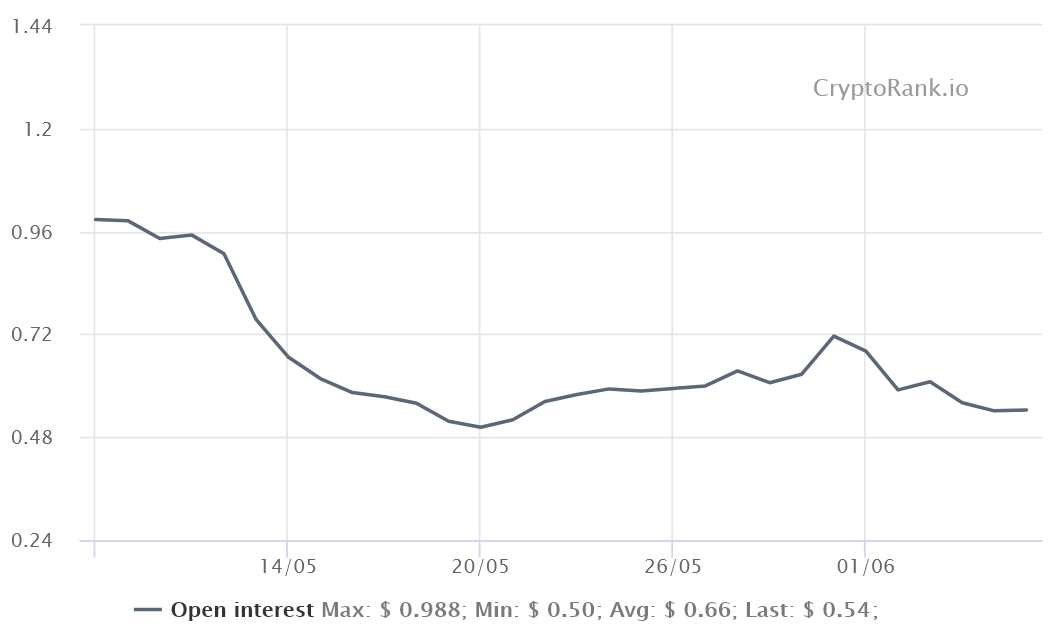

Theoretically, at any time when the USDT/BTC lending ratio goes up, the market is angled in a bullish method. The ratio at OKEx bottomed at 3.5 on Might 20, favoring longs, nevertheless it shortly returned to the 5.5 stage. Subsequently, there isn’t a proof of a big motion favoring shorts on margin markets.

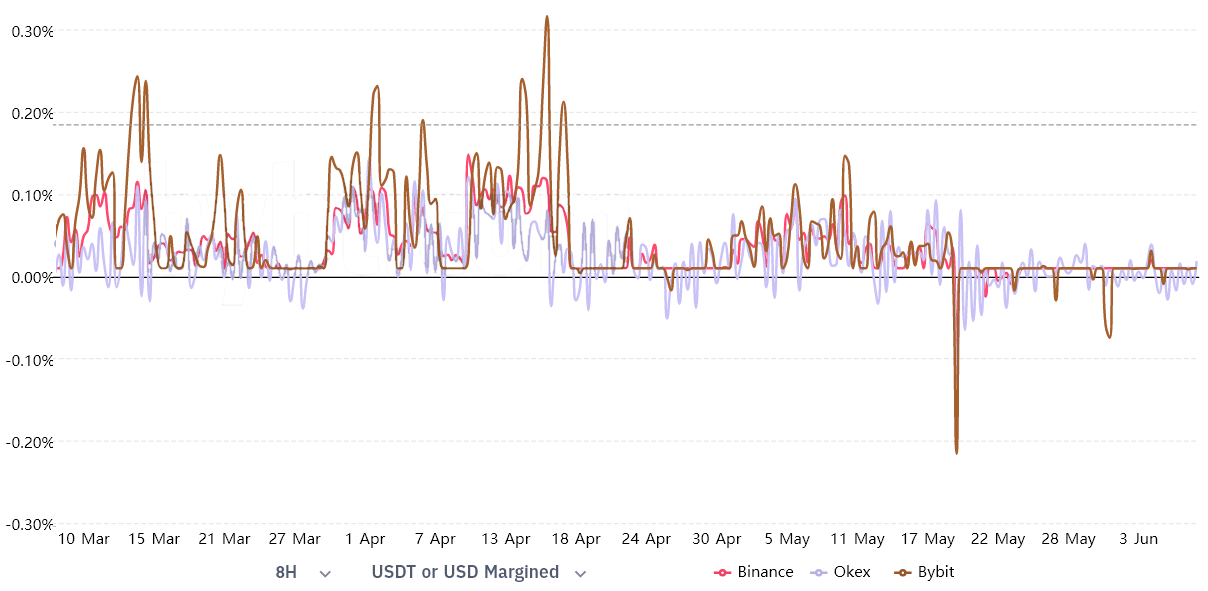

The perpetual futures funding fee remains to be flat

Perpetual futures costs commerce very near common spot exchanges, making the lives of retail merchants rather a lot simpler as a result of they now not have to calculate the futures premium.

This magic can solely be achieved by the funding fee charged from longs (patrons) when demanding extra leverage. Nonetheless, when the scenario is reversed and shorts (sellers) are over-leveraged, the funding fee goes unfavourable, and so they change into those paying the price.

As displayed above, the funding fee has been principally flat since Might 19. Had there been an enormous surge for shorting demand, the indicator would have mirrored the transfer.

The choices put-to-call ratio stays bullish

The decision (purchase) possibility gives its purchaser with upside value safety, and the put (promote) does the alternative. This implies merchants aiming for neutral-to-bearish methods will usually depend on put choices. Then again, name choices are extra generally used for bullish positions.

Take discover of how the neutral-to-bullish name choices outnumber the protecting places by practically 90%. Had skilled merchants and whales been anticipating a market crash, this ratio would have been positively impacted.

Traders shouldn’t make buying and selling selections based mostly on a single indicator, because the remaining markets and exchanges could not corroborate it. For now, there’s completely no indication that heavy gamers are betting on Bitcoin quick positions.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes threat. You need to conduct your individual analysis when making a call.

Source link