Perpetual contracts, often known as inverse swaps, have an embedded charge often charged each eight hours. This price ensures there are not any alternate threat imbalances.

Despite the fact that consumers’ and sellers’ open curiosity is matched always, leverage can fluctuate, and when consumers (longs) are demanding extra leverage, the funding charge turns constructive. Thus, they’re those paying the charges to the sellers (shorts).

Nonetheless, the other state of affairs happens when shorts require further leverage, and this causes the funding charge to show damaging.

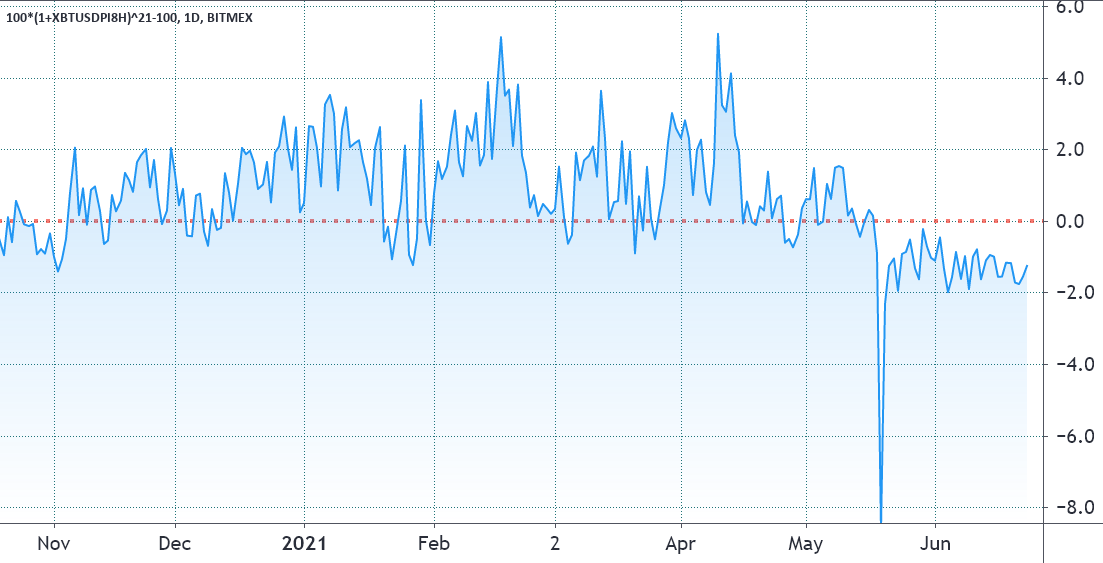

The Bitcoin (BTC) futures funding charge has been damaging since Could 18 (37 days), and this example signifies consumers’ lack of urge for food for leverage longs.

Traditionally, this indicator shifts between 0% and a pair of% per week, though it’d maintain larger ranges for months throughout bull runs. Then again, a damaging funding charge enduring greater than a few days was once unusual.

Nonetheless, 2020 offered a special image as Bitcoin confronted an excessive worth correction in mid-March, taking 60 days to retake the $9,300 assist. One other nosedive passed off in early September as the value stalled from $12,000, and it might solely get better after 50 days later.

Take discover of how the weekly funding charge for March to November 2020 was largely damaging, indicating that sellers (shorts) had been demanding extra leverage. The present state of affairs resembled these intervals in 2020, and a few traders correlate a damaging funding charge with shopping for alternatives.

Associated: Knowledge exhibits derivatives had little to do with Bitcoin’s drop to $29K

Ki-Younger Ju, the CEO of on-chain analytics useful resource CryptoQuant, has proven how traditionally, a low funding charge “might be a purchase sign.”

On this spot-driven & up-only market, a low funding charge might be a purchase sign.

It appears not a good suggestion to attend for a correction when establishments shopping for $BTC.

Chart https://t.co/yzjLW3MUFD pic.twitter.com/IwolH6kz0c

— Ki Younger Ju 주기영 (@ki_young_ju) January 3, 2021

Nonetheless, this evaluation framed virtually solely an enormous bull run the place Bitcoin worth soared from $11,000 to $34,300. Moreover, at what level ought to one open a place if a damaging funding charge can final for 60 days?

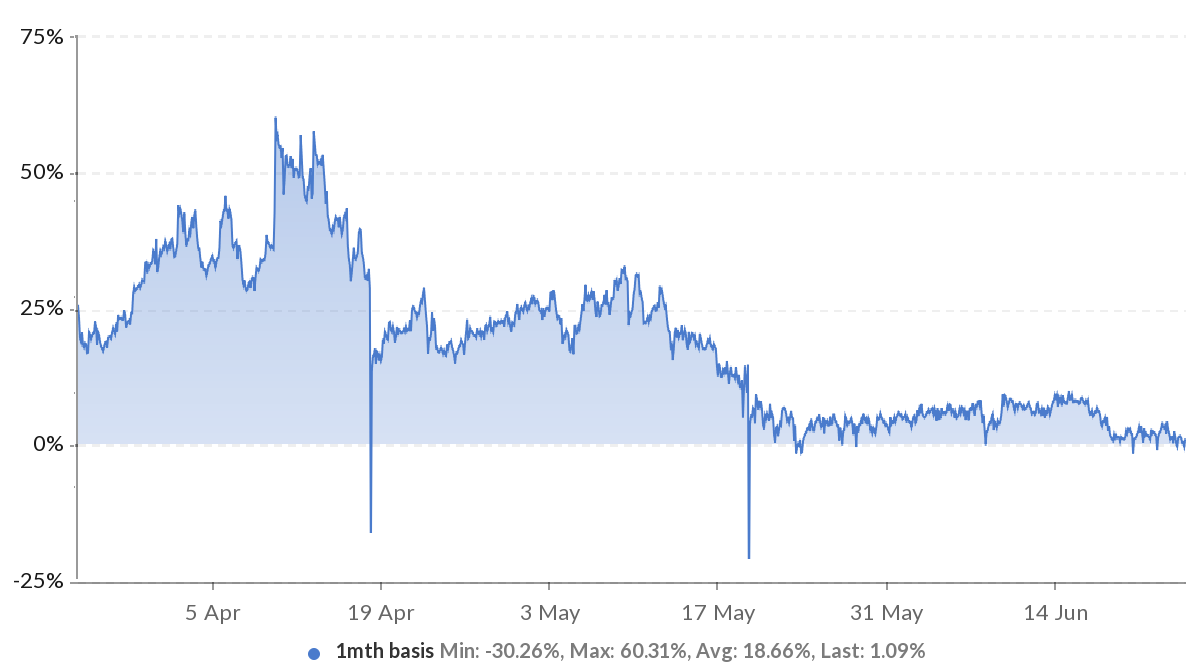

Cointelegraph beforehand confirmed how combining the funding charge indicator with the futures foundation charge gives a greater evaluation of how skilled merchants are positioned. The annualized foundation is measured by the value hole between fixed-month futures and common spot markets.

As depicted above, calling the underside on the premise indicator proper now might be untimely as a result of it has been bouncing close to 0% since June 18.

Proper now, it’s not possible to estimate the timing or set off that can trigger consumers to realize confidence and at last convey the futures market premium again to 10%.

For merchants making an attempt to ‘catch the falling knife,’ a greater technique might be including 25% of the lengthy place now and scale bids each $2,000 under the $30,000 resistance.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails threat. You need to conduct your individual analysis when making a choice.

Source link