Argo Blockchain, a publicly traded blockchain know-how firm centered on cryptocurrency mining, is taking a look at a possible secondary itemizing on the Nasdaq trade.

On Tuesday, the corporate announced that it’s now exploring the potential of a secondary itemizing on the Nasdaq as a part of its operational and strategic replace for June 2021.

Argo Blockchain mentioned that the agency has not but reached a call on the timing of the secondary itemizing, noting that “there isn’t a assure that the itemizing will probably be finalized.” “Any proposed itemizing is topic to market and different situations, and there will be no assurance as as to whether or when the proposed itemizing could also be accomplished,” the corporate acknowledged.

As a part of the newest replace, Argo Blockchain disclosed that the corporate mined a complete of 167 Bitcoin (BTC) with a mining income of 4.4 million British kilos ($6 million) and a mining revenue price of 78%. Based on the announcement, Argo Blockchain’s whole mining income stands at 883 BTC year-to-date, and the corporate initiatives to carry 1,286 BTC or an equal quantity by the tip of the month.

Argo Blockchain CEO Peter Wall mentioned that the crypto trade confronted “huge adjustments” in June, referring to a major discount within the whole world hash price and mining problem amid a crackdown on crypto mining in China. “Argo has capitalised on these adjustments, persevering with to ship sturdy income at a powerful margin,” the agency famous.

Associated: China crypto ban a ‘large alternative for Canada,’ mining group head says

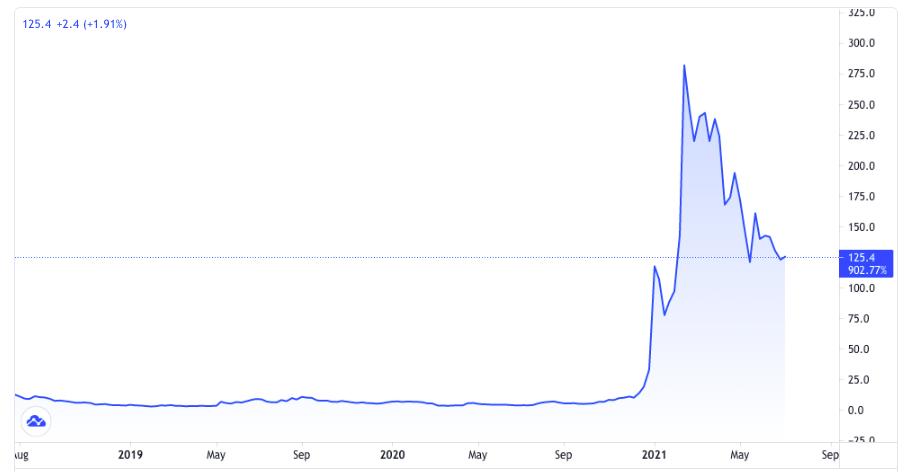

As beforehand reported, Argo Blockchain turned the primary crypto mining firm to record on the London Inventory Change in 2018, inserting over 159 million strange shares at 16 British kilos ($22). The inventory has considerably surged since itemizing, reaching an all-time excessive above 280 kilos ($387) this February, in accordance with information from TradingView.

On the time of writing, the ARB inventory is buying and selling at 125 kilos ($173), down round 2% over the previous 24 hours.

Source link