Your potential alpha isn’t simply the place the map differs from the territory. It’s the place the map differs from the territory and the place different buyers are misusing that map.

Persevering with within the wake of the earlier memo, let’s look at the steadiness sheet.

Counting the Complete Steadiness Sheet

Fairness and debt buyers are the most typical sources of capital, however they aren’t the one ones.

Warren Buffett launched many

buyers to the idea of insurance coverage float — money collected prematurely from

clients that’s akin to a 0% mortgage. In a means, insurers are estimating the

acquisition price and default fee of those 0% quasi-loans.

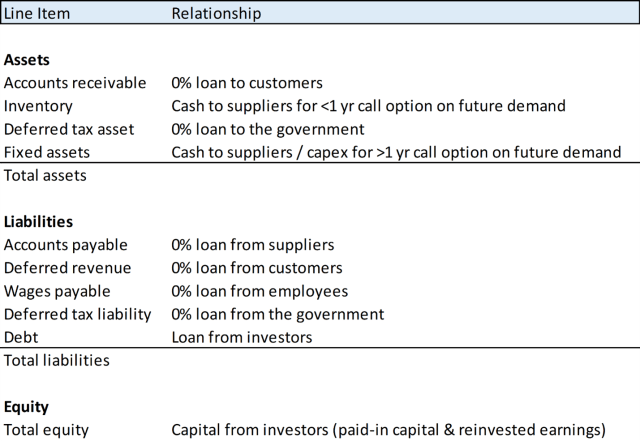

You’ll be able to prolong Buffett’s considering to categorize every steadiness sheet line merchandise by the connection it represents: clients, suppliers, workers, buyers, and the federal government.

Categorizing the Steadiness Sheet by Relationships

For those who characterize these float sources as 0% loans, you must analyze them with a debt investor’s mindset. These quasi-loans may be helpful or dangerous relying on their credit score, maturity, and liquidity profiles. For instance, provider financing by way of accounts payable has been an affordable capital supply for Costco however a supply of ache for some issue finance companies.

Stock and glued property don’t match this quasi-loan mildew. They extra carefully resemble actual name choices. An organization buys stock with the expectation that this actual possibility will find yourself within the cash — {that a} future buyer will purchase the products. Suppliers sometimes haven’t any obligation to return the money if the stock doesn’t promote, so it’s not a quasi-loan. Mounted property work in a lot the identical means. It’s a enjoyable mental train to mannequin writeoffs, depreciation, and amortization as decay on these actual choices, however thus far I haven’t discovered this to be a cloth supply of alpha.

Rethinking the price of capital could also be

extra helpful.

WACC Ought to Embody All Liabilities

Value of capital is a tenuous idea.

Charlie Munger amusingly calls it a “completely wonderful

psychological malfunction.”

Completely different folks have totally different capital sources and alternative prices. Why will we assume that each investor ought to use the identical low cost fee? Furthermore, an organization’s price of capital is path dependent on the firm stage and the macro stage. Why will we challenge one static low cost fee as a substitute of simulating many potential paths for price of capital?

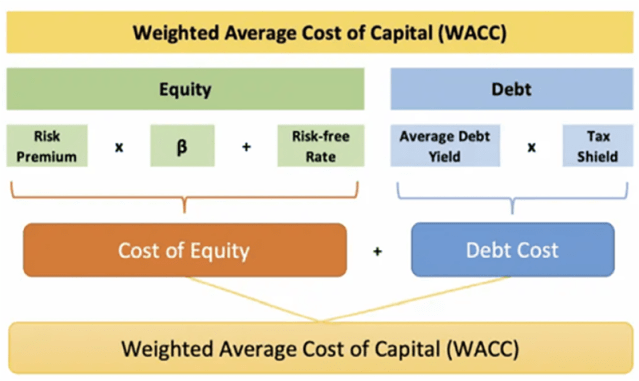

But when we insist on utilizing this system, we must always no less than depend the entire capital sources that corporations faucet. To begin, right here is the present definition of the weighted common price of capital (WACC):

Weighted Common Value of Capital (Present Definition)

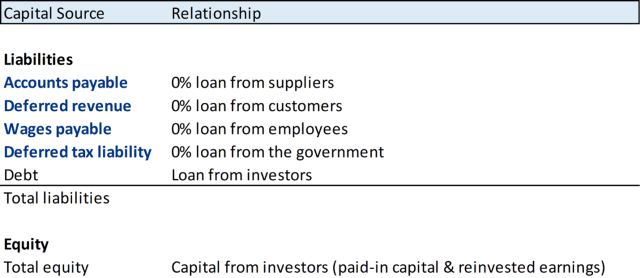

The standard WACC is restricted to capital supplied by buyers. It actually needs to be expanded to incorporate non-investor capital sources, as highlighted in blue under.

Value of Capital Ought to Embody All Liabilities

Two corporations may have the identical

conventional WACC — solely debt and fairness from buyers — however one may have a

cheaper true price of capital when these 0% quasi-loans are included.

Non-investor capital sources have

fascinating nuances of their very own.

Worker and authorities financing are deferred bills, in order that they aren’t true capital inflows. They’re, nevertheless, fairly helpful for giant firms with regular cash-flow streams to protect. Berkshire Hathaway’s ballooning deferred tax legal responsibility is a chief instance right here.

Buyer and provider financing are sources of latest capital. In these eventualities, clients pay forward of time, and suppliers ship stock to an organization earlier than requiring cost. Examples of buyer financing embody Kickstarter tasks, Tesla’s $14 billion Mannequin 3 pre-sale, and annual contracts in SaaS. Some examples of provider financing are Walmart’s extension of their cost phrases from internet 20 to internet 90 and small retailers guaranteeing stock availability to Groupon’s market.

This broadened WACC may be an alpha alternative when an organization has an underappreciated capital supply and, extra importantly, when that supply can meaningfully change an organization’s total price of capital.

The Market Worth of Fairness

When Luca Pacioli codified

double-entry accounting in 1494, publicly traded

shares didn’t exist.

That’s most likely why early accounting requirements weren’t constructed to replace the steadiness sheet primarily based on honest market worth. Why take note of quotes within the inventory market when there was no inventory market to concentrate to?

To today, GAAP accounting solely tracks fairness guide worth at historic price — contributed capital plus retained earnings after taxes and dividends. If the inventory market costs that fairness larger or decrease than guide worth, this new valuation just isn’t included into the corporate’s accounting.

The issue is that corporations proceed to transact in their very own fairness after going public. In actual fact, making it simpler to transact in their very own fairness is the whole level of going public. A public firm ought to have much less issue promoting fairness to exterior buyers, granting fairness compensation to workers, and shopping for again fairness from the market. How can buyers monitor these transactions in the event that they aren’t absolutely reported?

The way in which to repair that is so as to add a GAAP

line merchandise for the market worth of fairness.

Including a Line Merchandise for Fairness Market Worth

To sidestep the controversy between historic price and honest worth measures, we may add new mark-to-market line gadgets to the steadiness sheet. We may additionally report mark-to-market modifications individually from working revenue. This method would keep away from jitters within the revenue assertion and reply Buffett’s associated criticism of ASC 321.

Traders are already doing this

not directly. Well-liked metrics like enterprise worth and the Q ratio successfully mark

fairness to inventory market worth. Straight monitoring the honest market worth of fairness

would clarify which corporations are savvy sellers in their very own fairness and

that are masking their underperformance with dilution.

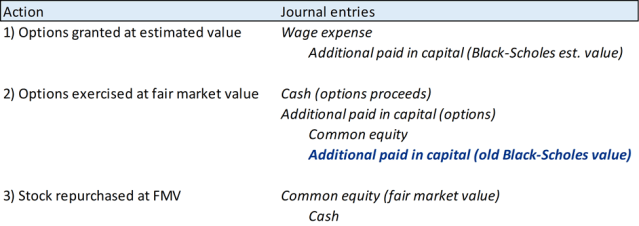

Counting Shared-Based mostly Comp the Proper Approach

This new line merchandise for fairness market worth would additionally allow us to correctly measure share-based compensation (SBC). Because it stands as we speak, we don’t mark SBC to market.

How Share-Based mostly Compensation Is At the moment Practiced

When SBC is first granted, an appraiser comes up with a low fairness valuation that offers the worker a good tax remedy. We simply have to true up the wage expense for the present fairness worth when the worker workout routines their choices.

The dearth of readability round marking fairness to market and SBC creates important potential for alpha. It’s already difficult to display screen for capital allocation — return on shares issued, return on shares repurchased, and acquisition deal buildings. However crucial capital allocation metric is much more opaque — return on workers employed. Proper now, it may be tough for buyers to see who’s incomes the best return on the groups they’ve constructed.

The alpha alternative is to search out

entrepreneurs who’re world-class capital allocators and underappreciated for

it. Consider the greats: Henry Singleton issuing

extremely valued Teledyne fairness for M&A after which shopping for again shares on the

low cost within the Seventies and Eighties. John Malone paying 6x

EBITDA (post-cost synergies) in money and debt to consolidate small cable

operators into TCI. Mark Leonard including area of interest

vertical software program merchandise to the Constellation Software program portfolio.

Discovering simply one among these capital allocators early on would have made an investor’s profession. In a decade, we could look again on the most charismatic staff builders in the identical gentle.

The Potential for Community-Based mostly Accounting

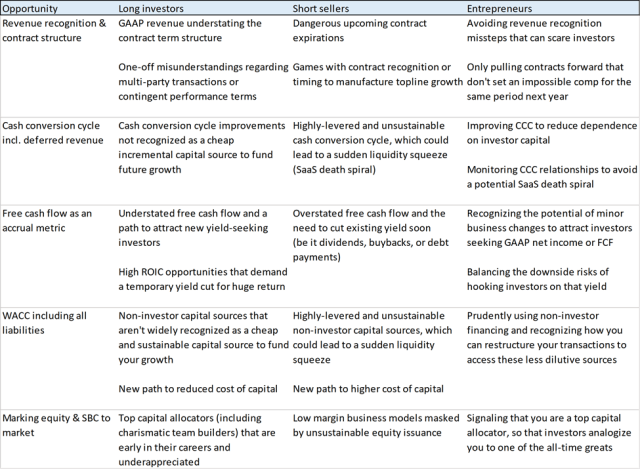

The methods on this collection are a sampling of how one can generate alpha from GAAP as it’s interpreted as we speak. How you utilize them depends upon your technique, whether or not you’re an extended investor, a brief vendor, or an entrepreneur.

Alpha-Producing Accounting Alternatives

How lengthy these alpha alternatives final will depend upon how GAAP and basic funding methods evolve over time. Double-entry accounting was developed with pen and paper. Computer systems may rework the muse upon which GAAP and funding evaluation are constructed.

Put in plain English, companies run

on relationships. Double-entry accounting helps us monitor these relationships,

however GAAP presently has every firm report as if it’s a separate entity. We

need a straightforward strategy to see all of these relationships without delay.

You would possibly name this network-based

accounting.

Contracts are the authorized marker of relationships between enterprise entities. They’re the “connective tissue in fashionable economics” within the phrases of Nobel laureate Oliver Hart. With an up to date framework, we may graph networks of contracts between corporations. This method wasn’t possible in a pre-computing period, and it’s hardly sensible as we speak with our present knowledge requirements. Renovating GAAP for the computing period would make these relationship fashions viable.

I feel the way forward for accounting lies in agent-based modeling. We may deal with corporations as particular person brokers to simulate how they’re interacting now and the way they may work together sooner or later. You’d be capable of see every firm’s community of relationships with its clients, workers, suppliers, buyers, opponents, the federal government, and the general public at giant. A few of these relationships are barely talked about in our present mannequin of GAAP.

Dozens of due diligence questions

can be simpler to reply with network-based accounting.

Does an organization have long-term or short-term buyer relationships? Have the corporate’s suppliers began to supply interest-free financing? Might its buyers be out of the blue compelled to promote out? And the scary one: Is there some contagious danger that might threaten the corporate’s community of key relationships?

The capital markets could possibly be a lot, way more environment friendly if this framework could possibly be correctly abstracted into software program. However for now, that’s only a enjoyable dialog to have after work.

At this time, I’m extra within the alpha that we are able to generate with the markets as they’re presently structured. And I feel that GAAP and the way in which that buyers react to GAAP stories will create important alternatives for a very long time to come back.

Because of Tom King, Nadav Manham, Ben

Reinhardt, Kevin Shin, and Slater Stich for his or her assist with these memos.

You’ll be able to learn extra from Luke Constable in Lembas Capital’s Library.

For those who appreciated this put up, don’t neglect to subscribe to the Enterprising Investor.

All posts are the opinion of the creator. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially replicate the views of CFA Institute or the creator’s employer.

Picture credit score: Grandjean, Martin / Wikimedia

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can file credit simply utilizing their on-line PL tracker.

Source link