Promoting is a tempting place to start out for finance administrators on the hunt for value financial savings. However at the same time as makers of a few of the world’s hottest family merchandise are squeezed by essentially the most intense inflationary pressures in a decade, they’re considering twice about taking the axe to advertising and marketing budgets.

Purveyors of shopper items spent massive on adverts throughout the pandemic, when elevated issues about hygiene boosted demand for cleansing merchandise and lockdown restrictions spurred gross sales of food and drinks for residence consumption.

Procter & Gamble was notably aggressive in seizing the second, spending $8.2bn on promoting within the 12 months to June — $900m greater than the earlier yr. Within the drinks sector, Diageo’s advertising and marketing expenditure rose 17 per cent to £2.16bn over the identical interval.

For the advert enterprise, such corporations had been a much-needed supply of labor as commissions dried up from different company purchasers. Companies developed campaigns for the sector that sought to seize the temper of the second, similar to Dove’s Braveness is Stunning video, which featured the faces of frontline healthcare staff.

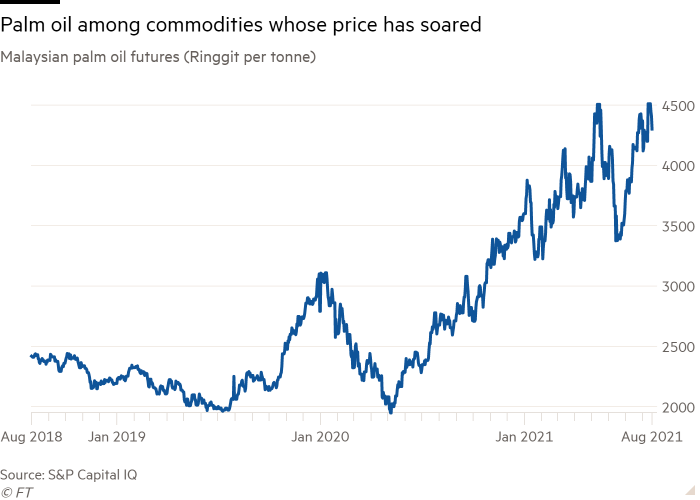

What number of promoting {dollars} to deploy — and the place — within the months forward is extra of a dilemma, nevertheless. Whereas lockdown guidelines gave gross sales a lift for family packaged items teams similar to P&G, the outlook is much less shiny: the price of transportation and uncooked supplies similar to palm oil is spiralling concurrently shopper demand for some merchandise is faltering. In the meantime, the reopening from lockdown is encouraging corporations in different sectors to extend advert expenditure, pushing up costs.

Mark Learn, chief government of WPP, the world’s largest promoting group, mentioned that alongside expertise and prescribed drugs, shopper packaged items (CPG) had been among the many most resilient industries throughout the pandemic. Now that different purchasers had been rising promoting expenditure once more, there was “some stress on margins and advertising and marketing prices” within the sector.

“We’re seeing a blended image throughout our CPG purchasers, however in the principle I feel they realise the necessity to spend money on advertising and marketing — these corporations which have gained share wish to retain it,” he mentioned.

Some CPG corporations can extra simply shrug off the fee pressures than others as a result of the easing of lockdown restrictions ought to enhance their gross sales. Drinks corporations, as an illustration, are positioning manufacturers for the reopening of pubs, golf equipment and eating places.

Dolf van den Brink, chief government of Heineken, which introduced plans earlier this yr to chop 8,000 jobs to rein in prices, mentioned: “We actually really feel strongly about the necessity to improve our advertising and marketing and promoting bills.

“Despite the fact that it’s a bit painful [financially] within the brief time period, it’s the suitable factor to do long run.”

However for different corporations, the reversion of shopper behaviour to pre-pandemic norms is inflicting gross sales to gradual — complicating the calculation on advertising and marketing expenditure. UK group Reckitt Benckiser, maker of End dishwasher tablets and Lysol disinfectant, is amongst a number of to report that elevated shopper demand for soaps and disinfectants has lately begun to average.

Chief government Laxman Narasimhan mentioned the group doesn’t “actually have particular targets which we disclose” for promoting however that “advertising and marketing spend stays excessive”.

Within the US, analysts at Barclays anticipate advertising and marketing spend to dip within the months forward at bleach maker Clorox, which spent $790m on advertising and marketing in its monetary yr to the top of June and is forecast to spend $700m within the yr forward, and Kimberly-Clark, the corporate behind Andrex bathroom roll and Kleenex tissue, the place it’s estimated to fall from $956m in 2020 to $879m this yr.

Presenting outcomes that confirmed a second successive quarterly decline in natural gross sales, Mike Hsu, Kimberly-Clark’s chief government, instructed analysts the corporate had “chosen to tug again a bit of bit” on promoting spending in some areas. He highlighted bathroom paper in North America, for which demand had eased as customers spend extra day out of the home.

“There’s as a lot a math part to our promoting programme as there’s a inventive part,” Hsu added. “We’re fairly disciplined.”

Even so, the forecast advert expenditure at each Kimberly-Clark and Clorox is predicted to stay above pre-pandemic ranges. Hsu mentioned the group was sustaining funding in manufacturers in a number of areas and product traces.

Clorox, which spent greater than common on promoting final yr, mentioned it deliberate to take a position about 10 per cent of its gross sales this fiscal yr, in keeping with earlier intervals. The corporate added it had “an ongoing dedication to take a position strongly behind our manufacturers”.

Corporations forecast to extend advert spend regardless of the pressures on prices embody Coca-Cola, PepsiCo and Colgate-Palmolive. Barclays expects P&G’s advert finances will rise one other $250m within the yr forward.

Colgate-Palmolive, which final month issued extra conservative full-year revenue forecasts, citing a “tough value setting”, mentioned that whereas it was accelerating cost-cutting in different areas, promoting was “nonetheless anticipated to be up on each the greenback and a per cent of gross sales foundation”.

Tv nonetheless holds enchantment for the sector, which has lengthy been drawn to the medium’s broad attain, however Google, Fb and different digital platforms have develop into more and more necessary.

Giant manufacturers usually spent at the very least 40 per cent of their advertising and marketing budgets on digital channels, mentioned Brian Wieser, international president of enterprise intelligence at media purchaser GroupM.

Within the UK adults spent a 3rd of their waking hours on common final yr watching TV and on-line video, in accordance with a latest research by Ofcom.

Executives are reluctant to aggressively rein in expenditure partially as a result of the risks of tightened budgets had been uncovered by difficulties at Kraft Heinz, analysts mentioned.

The remainder of the trade, within the US at the very least, had come beneath stress from Wall Road to undertake its stringent strategy to prices — earlier than the meals group, backed by Brazilian-American funding agency 3G, took a $15bn writedown three years in the past on gloomier prospects for a few of its best-known merchandise.

“The funding group has woken as much as it,” mentioned Bruno Monteyne, analyst at Bernstein. There was now “an enormous quantity of focus” on whether or not the businesses had been “gaining share, whether or not they’re nonetheless rising”.

“You solely have to have a look at Kraft Heinz and what occurred when it comes to share worth efficiency. Nobody is holding that up any extra as a paragon of advantage.”

Kraft Heinz, which is now run by a former advertising and marketing government, Miguel Patricio, mentioned it had “remodeled considerably in a brief period of time, changing into extra consumer-obsessed than ever, by reinvesting in our manufacturers and our expertise”.

The corporate — whose merchandise embody Heinz ketchup, Kraft Mac and Cheese, HP Sauce and Philadelphia cream cheese — mentioned it deliberate to spend $100m extra on advertising and marketing this yr than it did in 2019, and was set for added will increase within the years forward.

Competitors each from disruptive start-ups, which have gained traction via digital advertising and marketing, and supermarkets’ cheaper personal labels provides managers another excuse to keep away from taking too harsh an strategy to advert spend.

The significance of branding to packaged items is such that promoting is to a big diploma the lifeblood of the trade.

CPG corporations “consider promoting as a central relatively than discretionary spend, which is how some retailers may consider it”, in accordance with Phil Smith, a former advertising and marketing director at Kraft within the Nineties and now director-general of the UK advertisers’ commerce affiliation, Isba.

Monteyne mentioned executives had been extra ready to curb funding in innovation than they had been in advertising and marketing, or push for efficiencies in different methods, similar to lowering the variety of variations of comparable merchandise.

Smith mentioned the outlook for spending within the sector would finally depend upon the extent to which the businesses might go value will increase on to customers. “There may be clearly massive inflationary stress and in some unspecified time in the future promoting will flex downwards in the event that they’re not in a position to get their worth will increase via,” he mentioned.

Promoting was much more necessary in an inflationary setting, particularly given the aggressive menace from cheaper alternate options, mentioned GroupM’s Wieser. “For those who’re going to go on prices, are you actually going to influence customers to pay extra in case your model is much less current? It is advisable be sure that the patron’s not shifting all the way down to retailer manufacturers.”

Even when finance administrators are keen to safeguard total advertising and marketing budgets, advert executives mentioned purchasers had been being as demanding as ever in pushing for returns. P&G mentioned it was saving on company prices, eliminating waste and lowering “extra advert frequency”.

Ivan Menezes, chief government of Diageo, mentioned: “You want two issues to work actually successfully. One is nice inventive aptitude in understanding customers, creating merchandise and digital engagement. The opposite is knowing the return you get on each greenback you spend.”

Companies are being referred to as on to provide extra concrete proof that their campaigns produce outcomes, not least since advances in expertise have made their effectiveness simpler to measure.

“The extent of scrutiny is perpetually rising, and fairly rightly,” one inventive government within the sector mentioned. “This isn’t artwork. It’s promoting.”

Source link