Coming each Saturday, Hodler’s Digest will show you how to monitor each single essential information story that occurred this week. The most effective (and worst) quotes, adoption and regulation highlights, main cash, predictions and way more — every week on Cointelegraph in a single hyperlink.

High Tales This Week

Coinbase will get off to a rocky begin because it lists on the Nasdaq

It was billed as a “watershed” milestone for cryptocurrency — the business’s “Netscape second.” This week, Coinbase made its inventory market debut.

There was no scarcity of pleasure within the run-up to Wednesday’s direct itemizing on the Nasdaq, with Bitcoin rallying to $64,863.10 earlier than the open. COIN’s reference value was set at simply $250, with all 1,700 workers pocketing 100 shares every.

In true crypto kind, it was a unstable debut. Coinbase’s inventory shortly rose to $430 earlier than falling sharply throughout the first couple of minutes of buying and selling, closing its inaugural session at a still-impressive $328. It wrapped up Friday at $342, with a market cap of $67.2 billion.

COIN’s arrival on Wall Avenue is critical due to the way it provides traders oblique publicity to cryptocurrencies. Ark Make investments is very bullish on the inventory, snapping up greater than 1 million shares that will likely be shared throughout three exchange-traded funds.

General, the inventory’s efficiency has been hailed as constructive thus far, particularly in contrast with how IPOs have carried out up to now. Will this embolden different exchanges to observe swimsuit?

Coinbase may see payment compression in long run, CEO expects

As you’d anticipate, the alternate loved a lot fanfare on the massive day and even embedded the title of a New York Instances article referencing Joe Biden’s stimulus bundle into the Bitcoin blockchain. Nonetheless, Coinbase CEO Brian Armstrong was eager to handle a number of the issues raised by analysts.

Some worry that the mooted $100-billion valuation forward of the itemizing was too excessive amid fears crypto exchanges will quickly find yourself in bitter competitors that may drive down charges — and have an effect on general profitability. Given how this accounted for 96% of Coinbase’s income in 2020, it’s type of an enormous deal.

On CNBC, Armstrong sought to deal with this head on. Whereas he stated that payment reductions are doable in the long run, the chief doesn’t consider it’s an imminent menace. Plus, by the point it’s, he predicts “possibly 50% or extra” of revenues will come from various streams similar to debit playing cards and crypto custody.

Dogecoin doubles in a day as YTD good points hit 5,000%, whereas Bitcoin value dips

Bitcoin cooled as soon as COIN began buying and selling. And whereas Ether has comfortably outperformed the world’s largest cryptocurrency this week (securing a brand new all-time excessive of $2,547.56 on Friday), altcoins have been stealing the present.

If Dogecoin is a joke, it’s actually wiped the smile off cynics’ faces. DOGE was buying and selling at simply $0.07 on Monday however started a frenzied 514% climb to highs of $0.43 by Friday. That’s a surge of 8,735% because the begin of the 12 months — and there’s little doubt it’s going to have turned quite a few lovers into in a single day millionaires.

The frenzy noticed DOGE leapfrog Bitcoin Money and Litecoin within the rankings, with a market cap that’s twice as huge as Deutsche Financial institution’s.

Even skilled merchants have been caught abruptly. There’s one factor we all know for sure, although: Daring predictions of a $1 DOGE at some point at the moment are trying much less outlandish.

XRP value soars to new highs after latest authorized victories and relisting rumors

With the market cap of altcoins surpassing $1 trillion, one clear theme has emerged this week: Older cryptocurrencies are having fun with one thing of a renaissance. And it isn’t simply DOGE that’s mooning… XRP is racing increased, too.

XRP hit multi-year highs of $1.96 this week. Though that’s a way off the all-time file of $3.84 set in January 2018, this nonetheless displays year-to-date good points of 790%. The most recent spike brought about a whopping $420 million of liquidations on derivatives exchanges.

Momentum for XRP has been constructing due to a sequence of authorized victories for Ripple in its battle with the Securities and Change Fee, together with rumors that the token could also be relisted on a number of exchanges.

Elsewhere, two forked initiatives that when sought to problem Bitcoin and Ethereum for his or her seats on the prime — Bitcoin Money and Ethereum Traditional — additionally racked up triple-digit good points. Will different retro cryptocurrencies be subsequent?

Jim Cramer cashes out half his “phoney cash” Bitcoin to repay mortgage

Enigmatic CNBC host Jim Cramer risked attracting the ire of crypto lovers this week — for 2 causes.

Not solely did he check with Bitcoin as “phoney cash,” one thing that causes the pink mist to descend for a lot of maximalists, however he additionally revealed he has bought 50% of his BTC portfolio to repay a mortgage.

Cramer confirmed he had purchased numerous Bitcoin at $12,000 — which means it had risen fivefold by the point he offloaded half of it. The anchor subsequently admitted: “I do know individuals are going to be offended with me.”

Some Twitter customers likened the one-time crypto critic’s transfer to the notorious pizza buy for 10,000 BTC. However others have praised Cramer’s transfer and argued that it’s essential to take earnings off the desk, writing: “Promoting solely 50% after a 5x acquire doesn’t sound toooo foolish.”

Winners and Losers

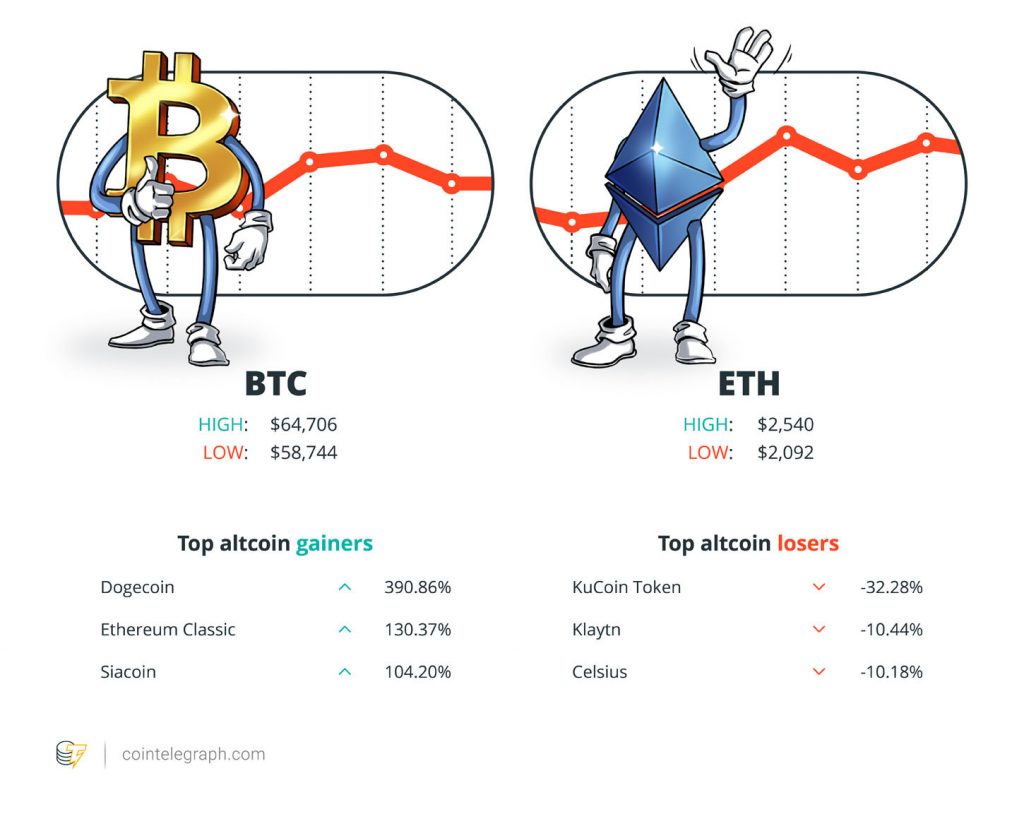

On the finish of the week, Bitcoin is at $62,272.53, Ether at $2,466.78 and XRP at $1.69. The entire market cap is at $2,274,625,979,472.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Dogecoin, Ethereum Traditional and Siacoin. The highest three altcoin losers of the week are KuCoin Token, Klaytn and Celsius.

For more information on crypto costs, be sure to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“It is a actually essential day for the entire crypto world. That is saying ‘that is an asset class, and it’s an asset class that’s right here to remain.’”

Mike Novogratz, Galaxy Digital founder and CEO

“We haven’t seen any margin compression but, and I really wouldn’t anticipate to see it within the quick and the midterm. Long run, sure I do suppose there may very well be payment compression similar to in each different asset class on the market.”

Brian Armstrong, Coinbase CEO

“PayPal actually desires to make use of cryptocurrency as a funding supply for on a regular basis transactions. The endgame, although, is a extra noble imaginative and prescient of this inclusive economic system, and issues will likely be carried out a lot otherwise than at the moment.”

Dan Schulman, PayPal CEO

“Bitcoin is trying sturdy at RSI 92. Nonetheless not above RSI 95 like 2017, 2013 and 2011 bull markets.”

PlanB

“You gotta purchase Coinbase when that deal comes. Despite the fact that it’s a $100 billion deal, this has grow to be frequent data that there are numerous corporations which can be going to change. MicroStrategy has all the time been the chief, so others would wish to observe.”

Jim Cramer, CNBC host

“Coinbase is the watershed second by way of legitimizing some valuations you see in crypto.”

Ben Lilly, Jarvis Labs co-founder

“Coinbase IPO Could Enhance #Bitcoin to $70,000, Like #Tesla to $60,000 — The bottom 30-day volatility since October signifies Bitcoin is ripe to exit its cage and bull-market continuation is favored for the following $10,000 transfer.”

Mike McGlone, Bloomberg Intelligence

“Fact be advised I severely suppose we’ve entered the ultimate leg of this $btc bull market. To be clear, ultimate leg may very well be 2-3 weeks or much more. Value may attain 200k or much more who is aware of. Simply don’t make irrational life selections based mostly on unrealized PnL.”

Mohit Sorout, Bitazu Capital founding accomplice

“An ETF can be an even bigger deal, clearly, than Coinbase getting listed.”

Eric Crown, entrepreneur

Prediction of the Week

Ethereum may go to $10,000 in 2021 and outperform Bitcoin, says veteran dealer

Again to Ether now, which has been within the ascendancy this week following an irreversible arduous fork that goals to ship some reforms to transaction charges. On-chain information suggests that ETH’s value may double between now and the top of Could — however some analysts are going even additional.

In an unique interview with Cointelegraph, Scott Melker stated gaining publicity to ETH was “like investing within the web within the early Nineteen Nineties.”

Despite the fact that his value goal for $10,000 by the top of this 12 months could seem outlandish, he added: “I don’t see why that’s loopy. It’s mainly slightly below a 5x from right here. […] Bitcoin did nearly thrice that final 12 months.”

FUD of the Week

r/Wallstreetbets lastly permits crypto threads… then bans them once more

This week, there gave the impression to be a significant breakthrough when r/Wallstreetbets introduced that it might enable Bitcoin, Ether and Dogecoin to be mentioned in a every day thread on Reddit.

The brand new coverage lasted a day, and the explanation why the ban has been reimposed has raised eyebrows.

Bloomberg had claimed that r/Wallstreetbets was “bowing” to digital property by opening up the dialogue past shares, one thing that actually pissed off one moderator.

A brand new submit learn: “Because of the article that was written [by] Bloomberg who someway felt that ‘WallStreetBets Bows to Crypto.’ Crypto dialogue is banned indefinitely. I’ve learn numerous dumb articles written about wsb. This one takes the cake. P.S. Like all the time. Please be respectful.”

Regardless of the plea for respect, many Reddit customers weren’t happy with the dramatic reversal.

Turkey to ban cryptocurrency funds

A brand new ban in Turkey will prohibit crypto holders from utilizing their digital property for funds along with stopping funds suppliers from offering fiat onramps for crypto exchanges.

The ban will come into impact on April 30, rendering any crypto funds options and partnerships unlawful.

In keeping with Turkey’s central financial institution, “any direct or oblique utilization of crypto property in fee companies and digital cash issuance” will likely be forbidden.

Banks are excluded from the regulation, which implies customers can nonetheless deposit Turkish lira on crypto exchanges utilizing wire transfers from their financial institution accounts.

ECB endangers itself by ready round on digital euro, says ConsenSys exec

The European Central Financial institution will put itself in jeopardy if it waits round to launch a digital euro for too lengthy, in keeping with a ConsenSys government.

With a central financial institution digital foreign money set to be years away, Monica Singer stated such initiatives are an opportunity for central banks to restore their errors and repair a damaged monetary system.

She warned that if world banks miss this chance, alternate options from non-public tech giants like Fb may make fiat currencies out of date.

Singer added: “If the central financial institution in Europe is gonna wait till 2028, by then there received’t be a central financial institution. As a result of who’s gonna use the euro in its present kind? There are gonna be so many selections.”

Greatest Cointelegraph Options

A remedy for copyright ills? NFTs promise to empower inventive economies

NFTs will not be an instantaneous resolution to all IP rights points, however ultimately, they can provide creators extra energy than they ever had.

Life past Ethereum: What layer-one blockchains are bringing to DeFi

Ethereum is the dominant drive in DeFi, and layer-two options are a promising various, however the layer-one blockchains will not be carried out simply but.

All that mined just isn’t inexperienced: Bitcoin’s carbon footprint arduous to estimate

The affect of BTC mining on the surroundings has changed into a debate — right here’s what lecturers suppose… and if “inexperienced Bitcoin” is feasible.

Source link