It’s well-known that as goes Bitcoin (BTC), so goes the remainder of the cryptocurrency market, as again and again, main worth strikes from Bitcoin create ripples throughout the altcoin market, impacting sentiment and momentum.

This seems to be the identical for blockchain-related shares that commerce within the conventional monetary markets, and a fast look on the charts exhibits they’ve mirrored Bitcoin’s efficiency over the previous a number of months.

The cryptocurrency ecosystem was all abuzz simply over one month in the past when the a lot anticipated Coinbase inventory itemizing lastly arrived on April 14, a date that additionally marks the newest all-time excessive within the worth of BTC at $64,863.

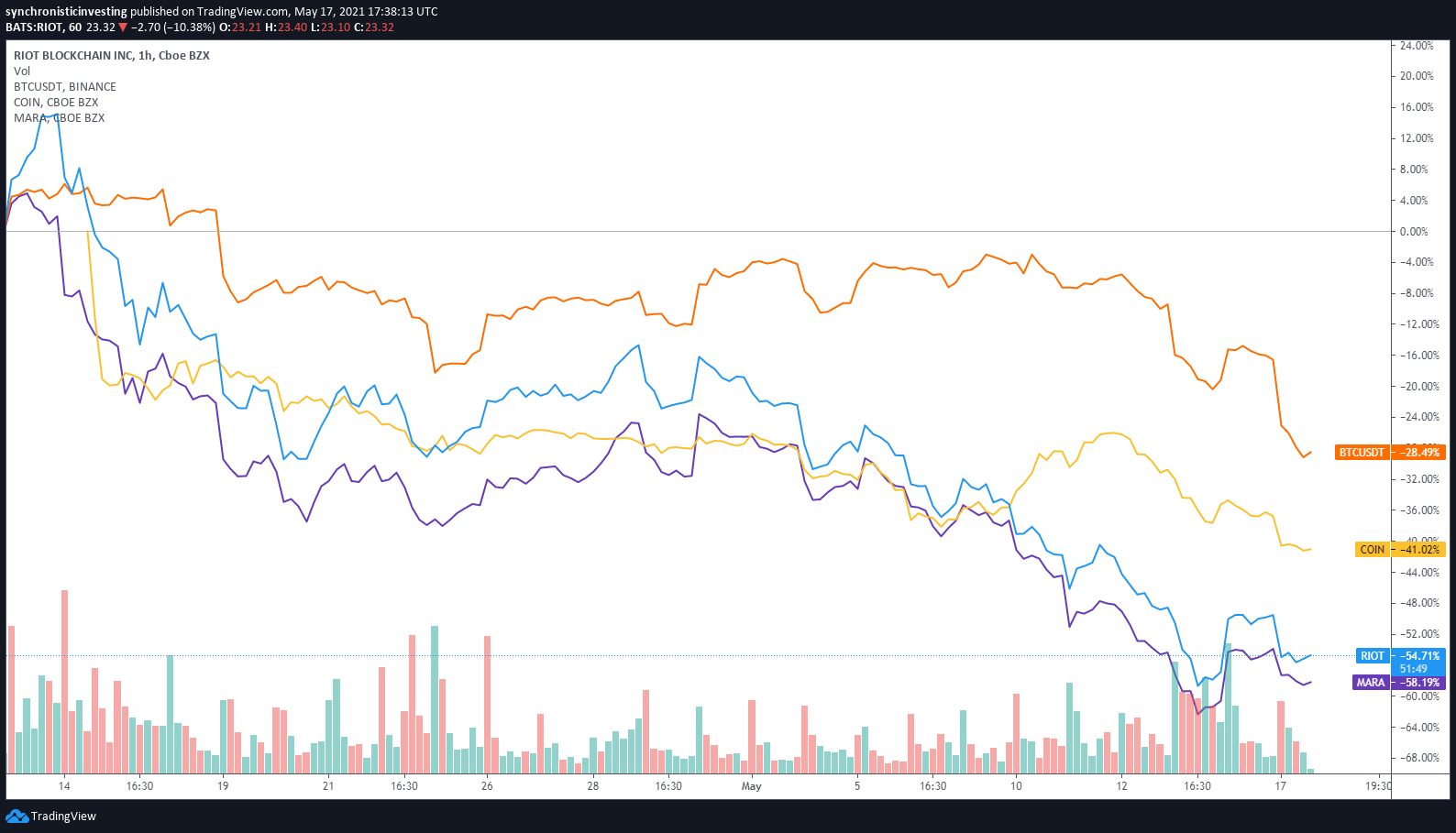

Since its debut, the value of COIN has steadily declined beneath each its direct itemizing worth of $381 and its reference worth of $250 to a present worth of $245, coinciding with a roughly 35% drop within the worth of BTC, which has additionally put pressures on different blockchain-related shares together with Riot Blockchain and Marathon Digital Holdings.

COIN’s struggles since launching, which have resulted in its valuation dropping from a excessive of $100 billion to its present valuation of $49 billion, have centered round issues about whether or not or not the change will have the ability to obtain future revenue expectations within the face of an more and more aggressive panorama, with new centralized and decentralized gamers rising weekly and searching for a chunk of the motion.

Matthew Wheeler, world head of market analysis at Foreign exchange.com, lately highlighted the more and more aggressive panorama Coinbase now faces as cryptocurrency adoption will increase on a world scale.

“Whereas Coinbase has been capable of depend on its first mover benefit and model familiarity to date, margins will proceed to compress from competitors with each ‘CeFi’ brokerages like BlockFi and ‘DeFi’ options like Uniswap.”

These issues have led some analysts, together with New Constructs CEO David Coach, to warn that the value of COIN might fall beneath $100:

“Buyers ought to count on the inventory to proceed to underperform, as shares might fall to $100 or much less because it turns into clear the corporate is unlikely to fulfill the long run revenue expectations baked into the inventory worth.”

Bitcoin sell-off spreads

Whereas the struggles confronted by COIN will be chalked as much as it being a newly listed inventory that’s nonetheless trying to set up its honest market worth, downtrends in Riot Blockchain and Marathon Digital Holdings, which had each outperformed BTC in 2021, additionally exhibit the impact {that a} struggling BTC worth has on crypto-related shares.

A survey of the broader monetary markets signifies that the general tech sector pullback and issues associated to rising inflation have additional hampered worth development in blockchain-related shares, and there are few indicators that these pressures will resolve within the close to time period.

The costs of each RIOT and MARA have adopted Bitcoin worth actions for the reason that 2017–2018 bull market, so it’s doubtless that additional worth development for these and different blockchain-related shares will rely upon how BTC performs going ahead.

It’s curious to notice that the value of RIOT and MARA rallied forward of Bitcoin in 2021 to achieve new all-time highs, indicating the chance that they might be used as a number one indicator for future worth actions for BTC and altcoins whereas providing conventional market traders publicity to the asset class with out having to carry cryptocurrencies immediately.

Nevertheless, relying on how the market performs out transferring ahead, it ought to be famous that Bitcoin stays the dominant market indicator for all issues blockchain- and cryptocurrency-related — that means as goes BTC, so goes the remainder of the market.

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer includes threat, and it is best to conduct your personal analysis when making a choice.

Source link