Bitcoin (BTC) might need suffered its largest coordinated assault over the past couple of months, however on this occasion, the investor neighborhood didn’t capitulate. China outright banning mining in most areas after giving BTC miners a two-week discover and this brought about the one largest mining problem adjustment after the community hash fee dropped 50%.

The market sentiment surrounding Bitcoin was already broken after Elon Musk introduced that Tesla would not settle for Bitcoin funds because of the environmental impression of the mining course of. It stays unknown whether or not China’s resolution was influenced or associated to Musk’s remarks, however undoubtedly these occasions held a detrimental impact.

A few weeks later, on June 16, China blocked cryptocurrency exchanges from net search outcomes. In the meantime, derivatives change Huobi began to limit leverage buying and selling and blocked new customers from China.

Lastly, on June 21, the Individuals’s Financial institution of China (PBoC) instructed banks to close down the financial institution accounts of over-the-counter desks and even their social networks accounts had been banned. OTC desk basically act as a fiat gateway within the area so with out them it might be troublesome to change from Bitcoin to stablecoins.

As these occasions unfolded, some analysts had been reluctant to explain the ways as nothing apart from meaningless FUD, however in hindsight, it seems that China launched a really well-planned and executed assault on the Bitcoin community and mining trade.

The short-term impression may very well be thought-about a average success because of the collapse in Bitcoin value and the rising issues {that a} 51% hashrate assault might happen.

Relating to Bitcoin Mining and China, I’d not imagine something you hear. I’d not rule out the likelihood that the Chinese language Communist Get together is making an attempt to orchestrate a 51% assault on the Bitcoin community. Keep vigilant.

— Danny Diekroeger (@dannydiekroeger) June 25, 2021

Regardless of the maneuvers, China’s assault finally failed and listed below are the principle explanation why.

The hashrate recovered to 100 million TH/s

After peaking at 186 million TH/s on Could 12, the Bitcoin community hash fee, an estimate of the whole mining energy, began to plunge. The primary couple of weeks had been as a result of restrictions to coal-powered areas, estimated at 25% of the mining capability.

Nonetheless, because the ban prolonged to different areas, the indicator bottomed at 85 million TH/s, its lowest stage in two years.

As the info above signifies, the Bitcoin community’s processing energy recovered to 100 million TH/s in lower than three weeks. Some miners had efficiently moved their tools to Kazakhstan, whereas others shifted to Canada and the U.S.

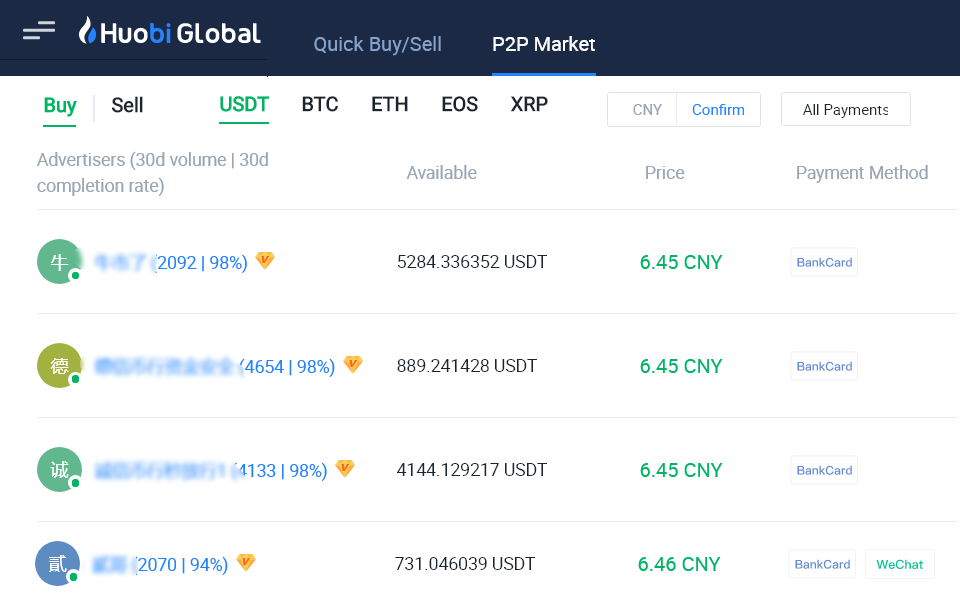

Peer-to-peer (p2p) markets carried on

Despite the fact that the businesses concerned in crypto transactions have been banned from the nation, people continued to behave as intermediaries—a few of these recorded over 10,000 profitable peer-to-peer transactions in response to information from the change’s personal rating system.

Each Huobi and Binance provide an analogous market the place customers can commerce a number of cryptocurrencies together with USD Tether (USDT). After changing their fiat to stablecoin, transacting on an everyday or derivatives change turns into attainable.

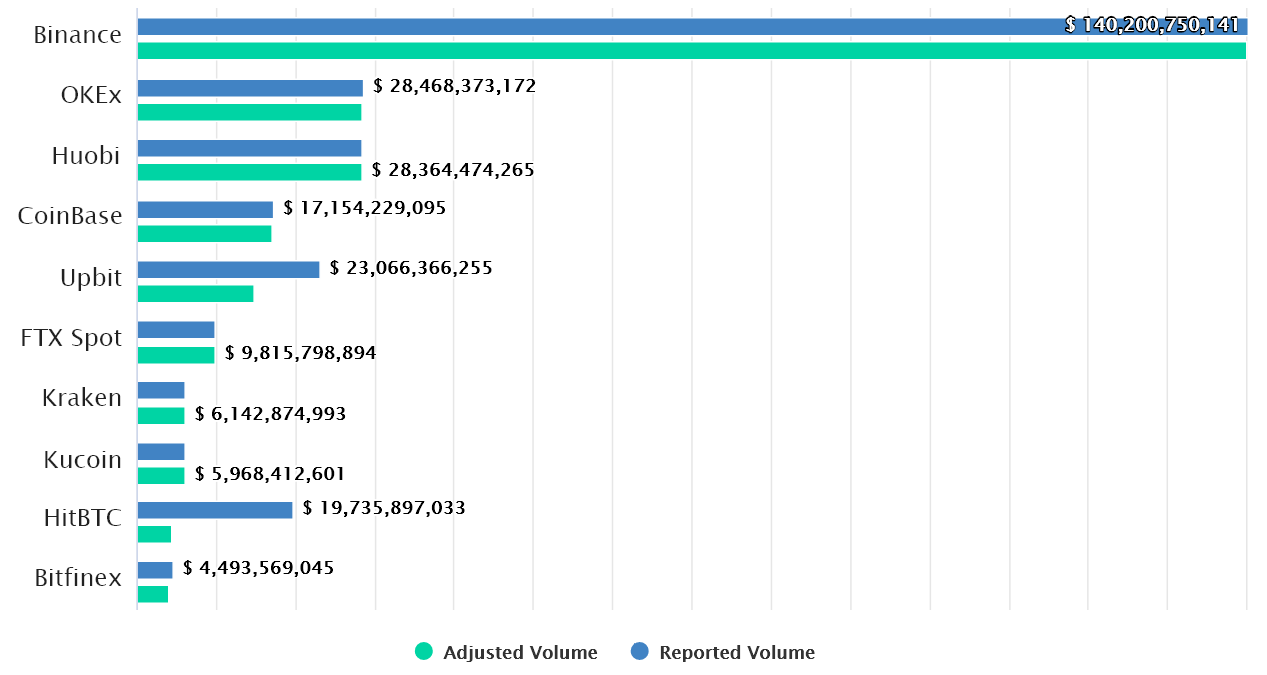

Asia-based exchanges nonetheless dominate spot quantity

An entire crackdown on buying and selling from Chinese language entities would seemingly be mirrored within the exchanges beforehand based mostly on the area, like Binance, OKEx, and Huobi. Nonetheless, trying on the latest quantity information, there hadn’t been a significant impression.

Take discover of how the three ‘Asia-based’ exchanges stay dominant, whereas Coinbase, Kraken, and Bitfinex are nowhere close to their buying and selling actions.

China’s ban on Bitcoin mining and transactions could have led to some momentary hiccups and a detrimental impression on BTC value, however the community and value have recovered in a method that’s higher than many anticipated.

At the moment, there is no such thing as a option to measure the OTC transactions the place bigger blocks are traded however it’s only a matter of time till these intermediaries discover new gateways and fee routes.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes threat. It is best to conduct your personal analysis when making a choice.

Source link