Establishments ought to begin shopping for Bitcoin (BTC) once more, main analyst PlanB has mentioned as one alternate sees a contemporary $250-million withdrawal.

In a tweet on Tuesday, PlanB argued that situations had been now proper for consumers to proceed accumulating BTC with confidence.

PlanB: “Most likely time” for Q2 shopping for

BTC/USD had seen an absence of momentum over the weekend, culminating in a dive to close $56,000. With resistance close to all-time highs of $61,700 now at its lowest for the reason that time that degree was first reached, it might now pay to be bullish.

As well as, a number of on-chain indicators counsel that sellers are exhausted. This capitalizes on an present narrative that favors hodling, not short-notice buying and selling or promoting, because the prime technique for Bitcoin buyers.

“Now that each one Pi-cycle, Wave, Rainbow and NUPL followers have offered their bitcoin, it’s most likely time for establishments to renew shopping for into Q2,” PlanB wrote, highlighting 4 indicators.

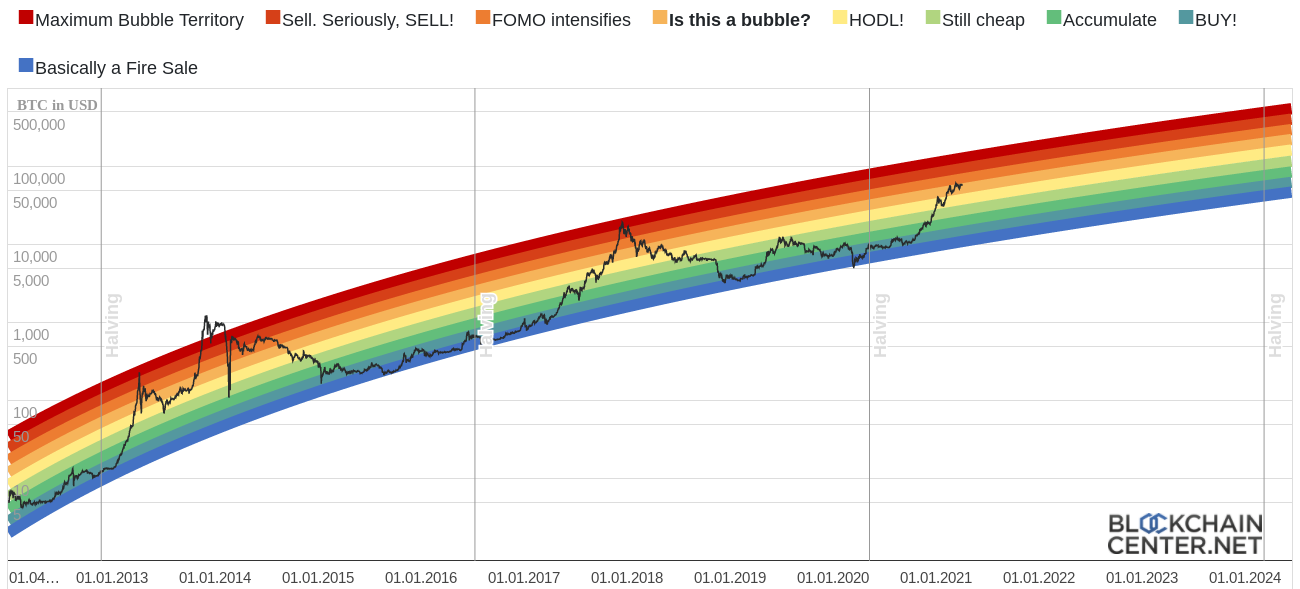

Of those, the so-called “Rainbow” value chart, which categorizes spot value when it comes to investor sentiment, extremely favored hodling this week, in addition to shopping for extra BTC at present costs.

An fascinating comparability is with the highest of the 2 earlier bull markets in late 2013 and late 2017. Then, Rainbow signaled a bubble-like high forming, with the implication that hodlers ought to take revenue. Since present readings are removed from such a peak, the indicator means that the present value beneficial properties nonetheless have an extended technique to go earlier than the bull cycle high is in.

As Cointelegraph reported, PlanB’s stock-to-flow Bitcoin value fashions name for $100,000 and extra this 12 months, with as a lot as $576,000 and better hitting through the present halving cycle ending in 2024.

Huge outflow spikes stay

In the meantime, proof that establishments are nonetheless could already be in.

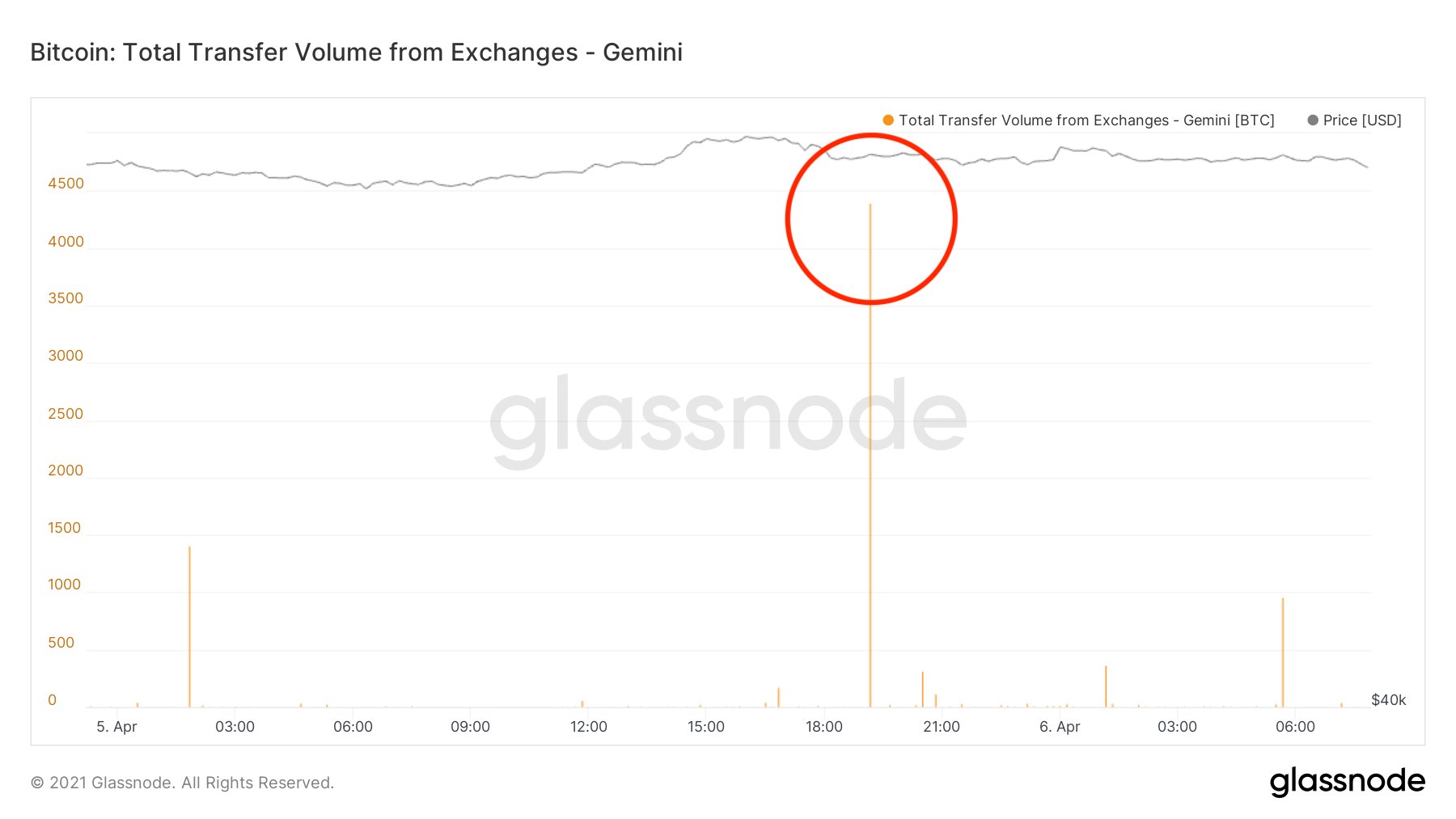

On Monday, skilled client-focused alternate Gemini, noticed $257 million in BTC go away its holdings in a 10-minute interval.

These giant outflows have characterised latest months and, together with the success of devices such because the Goal Bitcoin ETF, trace that demand exhibits no signal of stopping at close to $60,000 per coin.

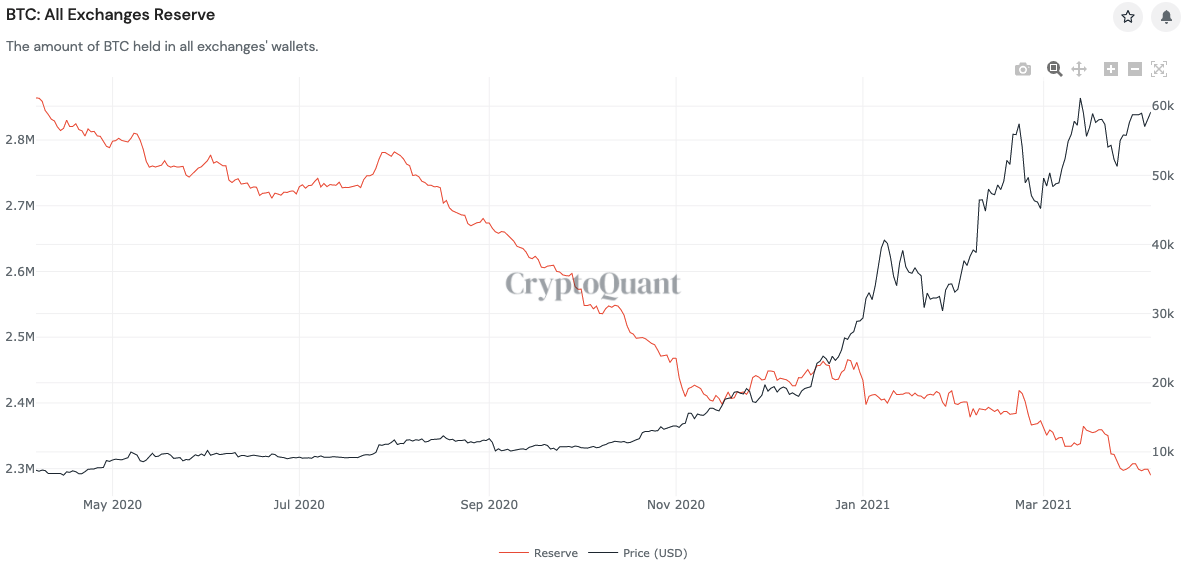

Throughout exchanges, reserves of BTC are nonetheless falling, down beneath 2.3 million as of this week.

In accordance with data from on-chain monitoring useful resource Glassnode corroborated by Whalemap, purchaser assist extra broadly is constant to cement itself at $57,000, decreasing the probability of deeper value dips.

Source link