Bitcoin (BTC) worth closed the month down 1.98% which in line with knowledge from Bybit, was its first destructive shut in April since 2015.

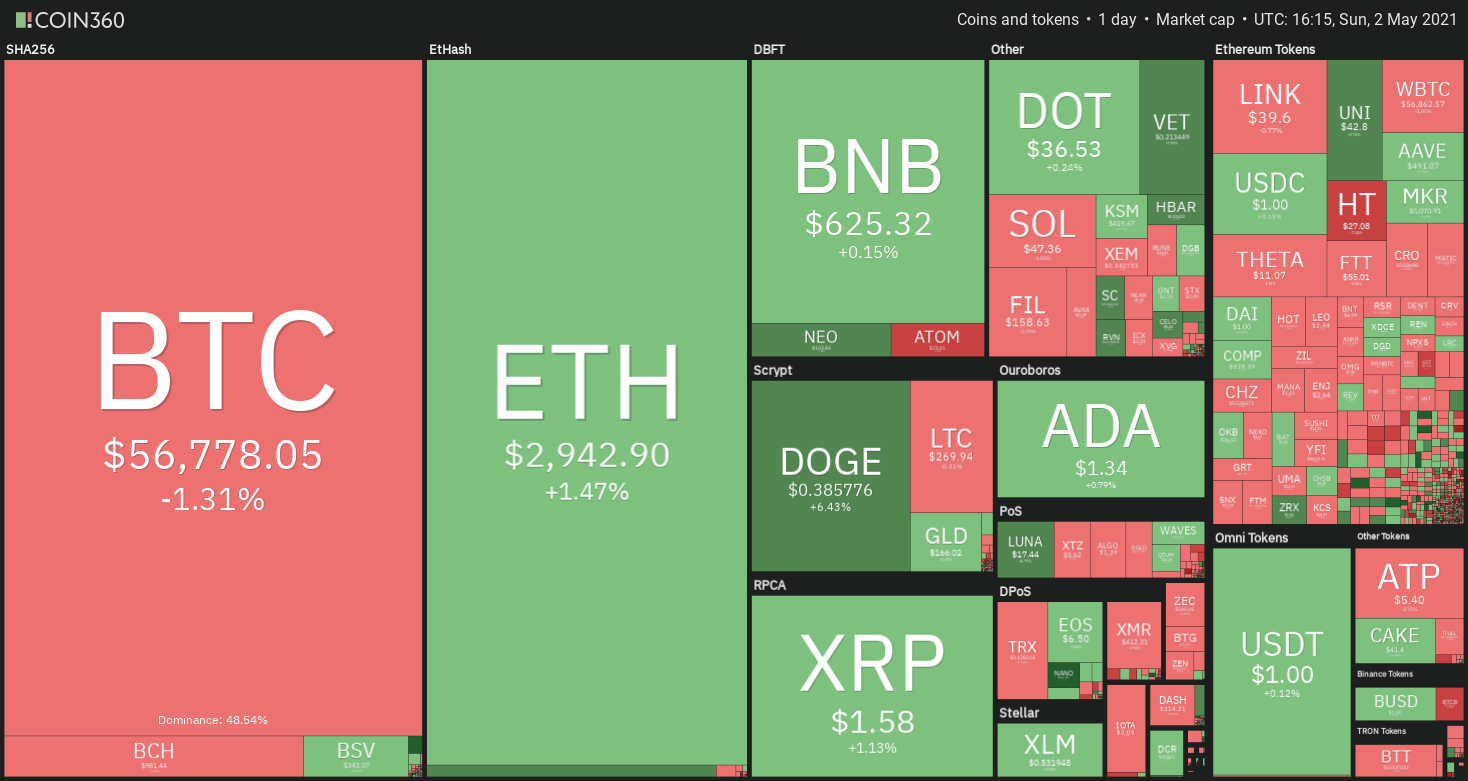

In the identical month Ether (ETH) worth soared over 44% to hit a brand new all-time excessive near $3,000. This broad divergence between the highest two cryptocurrencies exhibits that the markets have matured and Bitcoin’s underperformance will not be affecting altcoins as a lot because it did prior to now.

Ether’s bullish pattern has attracted sturdy shopping for from merchants. Information from Bybit means that Ether futures open curiosity climbed to $8.5 billion on April 29, rising 52% over the earlier month. This enhance has been supported by skilled merchants who appear to have taken a extra bullish view on Ether than retail buyers, as highlighted by Cointelegraph contributor Marcel Pechman.

The sturdy efficiency from the crypto sector continues to draw a big selection of buyers. In keeping with the Monetary Occasions, VC agency Andreessen Horowitz plans to faucet into this rising demand by elevating between $800 million to $1 billion for one more fund. The move of cash into varied crypto initiatives exhibits that buyers are bullish for the long run.

T. Rowe Value CEO William Stromberg stated in an interview with the Baltimore Enterprise Journal that the crypto area remains to be in its infancy and it might “take years to essentially unfold.”

With Ether main the altcoin cost, let’s have a look at the top-5 cryptocurrencies which will stay bullish within the quick time period.

BTC/USDT

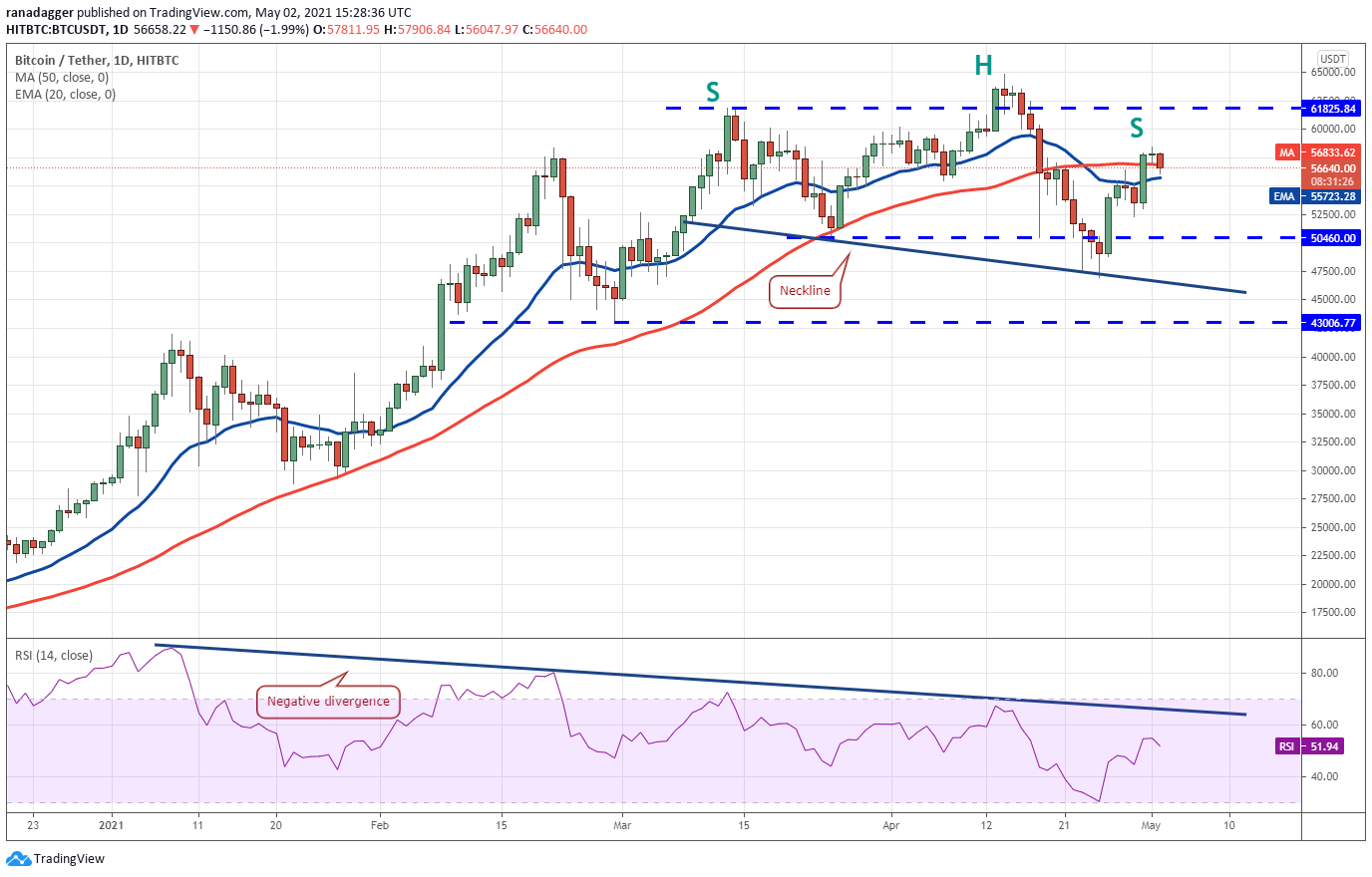

Bitcoin soared above its shifting averages on April 30 however the bulls haven’t been in a position to construct on this energy. The Doji candlestick sample on Might 1 and the drop under the 50-day easy shifting common ($56,833) at this time suggests the bears are promoting at increased ranges and haven’t given up.

If sellers pull the worth again under the 20-day exponential shifting common ($55,723), the BTC/USDT pair might drop to $52,323.21 after which to $50,460. The flat shifting averages and the relative energy index (RSI) close to the midpoint recommend a stability between provide and demand. This might preserve the pair range-bound for a number of extra days.

This view will invalidate if the pair rebounds off the 20-day EMA and rises above $58,469.09. Such a transfer will recommend the bulls are shopping for on each minor dip. The pair might then rally to $61,825.85 the place the bulls are once more prone to face stiff resistance from the bears.

Though it’s too early to substantiate, the pair appears to be making the precise shoulder of a potential head and shoulders topping formation. This setup will full on a break under the neckline. Till then, merchants will be watchful however mustn’t bounce the gun in anticipation of a breakdown.

The 4-hour chart exhibits the bulls pushed the worth above the $57,500 resistance however couldn’t maintain it. The bears pulled the worth again under the extent and are attempting to interrupt the 20-EMA help. If that occurs, the pair could drop to the 50-SMA.

A powerful rebound off this help might encourage the bulls to make yet another try and clear the hurdle at $57,500. In the event that they succeed, the pair might begin its journey to $61,825.84. Conversely, if the bears sink the worth under the 50-SMA, the potential for a drop to $50,460 will increase.

SOL/USDT

Solana (SOL) broke above the $48.64 resistance on Might 1 and hit a brand new all-time excessive at $49.99 at this time. Nevertheless, the $50 psychological degree is performing as a resistance and the bears have pulled the worth again under $48.64 at this time.

If the bears maintain the worth under $48.64 for 2 days, the SOL/USDT pair might drop to the help at $40.51. A powerful rebound off this help will recommend the bulls are accumulating on dips. The bulls will then make yet another try and clear the $50 resistance.

In the event that they succeed, the pair could begin the subsequent leg of the uptrend that would attain $56.77 after which $68.05. The rising shifting averages and the RSI close to the overbought territory point out the trail of least resistance is to the upside.

This constructive view will invalidate if the worth breaks under the 20-day EMA ($38). If that occurs, the pair might right to the 50-day SMA ($26).

The 4-hour chart exhibits the bulls are attempting to defend the 20-EMA. If they’ll push the worth above the $48.64 to $49.99 overhead resistance zone, the momentum is prone to choose up. The step by step rising 20-EMA and the RSI within the constructive territory recommend the bulls have a minor benefit.

Opposite to this assumption, if the worth turns down from the overhead resistance as soon as once more, it’ll enhance the prospects of a break under the shifting averages. The bears could then pull the worth right down to $40.51. A powerful bounce off this help might preserve the pair range-bound for a number of days.

HT/USDT

Huobi Token (HT) surged above the resistance at $26.89 on Might 1 and hit a brand new all-time excessive at $29.54 at this time. Nevertheless, the bears are attempting to tug the worth again under the breakout degree and lure the aggressive bulls.

If the worth dips and sustains under $26.89 for 3 days, the HT/USDT pair might step by step drop to $22. A powerful rebound off this help might preserve the pair range-bound for a number of days.

Conversely, if the bulls defend the $26.89 help or don’t surrender a lot floor under $25, it’ll recommend sturdy shopping for on each minor dip. A break above $29.54 might resume the uptrend with the subsequent goal goal at $36.54.

The 20-day EMA ($20.54) has turned up and the RSI is within the overbought zone, indicating that the bulls are in management.

The bulls and the bears are battling it out for supremacy close to the $26.89 degree. Though the bears had pulled the worth again to $26.10, they may not maintain the decrease ranges. This means that bulls are shopping for on dips.

The rising shifting averages and the RSI close to the overbought zone recommend the bulls have the higher hand. Nevertheless, the bulls are discovering it tough to push the worth to $29.54. This might end in excessive volatility within the quick time period.

A break under $26 might pull the worth right down to the 20-EMA. If the worth rebounds off this degree strongly, the bulls will make yet another try and resume the uptrend. Alternatively, a break under the 20-EMA might sign the beginning of a deeper correction.

ETC/USDT

The bears are attempting to stall Ethereum Traditional’s (ETC) up-move within the $38 to $41.61 overhead resistance zone. Nevertheless, the lengthy tail on at this time’s candlestick means that merchants are shopping for at decrease ranges.

The upsloping 20-day EMA ($28.74) and the RSI within the overbought zone point out benefit to the bulls. If patrons propel the worth above the overhead zone, the ETC/USDT pair might resume the uptrend and rally to $53.21.

Opposite to this assumption, if the worth turns down from the overhead zone, the bears will attempt to sink the pair to the 20-day EMA. A break under this help will point out the bullish momentum has weakened and the pair might then drop to $22.20.

The 20-EMA is rising and the RSI is within the overbought zone, suggesting the bulls are in management. Nevertheless, the bears is not going to throw the towel simply. They’ll attempt to stall the up-move within the overhead zone.

A break under the 20-EMA would be the first signal that the bullish momentum could also be weakening. That might pull the worth right down to the 50-SMA. Such a transfer might preserve the pair caught contained in the vary for a number of days.

AAVE/USDT

The bulls pushed AAVE above the $489 resistance at this time. Nevertheless, they haven’t been in a position to maintain the shopping for at increased ranges and the bears have pulled the worth again into the $480 to $280 vary at this time. This means the bears try to lure the aggressive bulls who could have bought the breakout from the vary.

If the worth dips under the 20-day EMA ($415), it’ll recommend that bulls are usually not shopping for on dips. That might pull the worth right down to the 50-day SMA ($383) and prolong the keep of the AAVE/USDT pair contained in the vary for a number of extra days.

Quite the opposite, if the pair rebounds off the 20-day EMA, it’ll point out accumulation at decrease ranges. The bulls will then make yet another try and push the worth to $581.67. A breakout of this degree might begin the northward journey to $698.

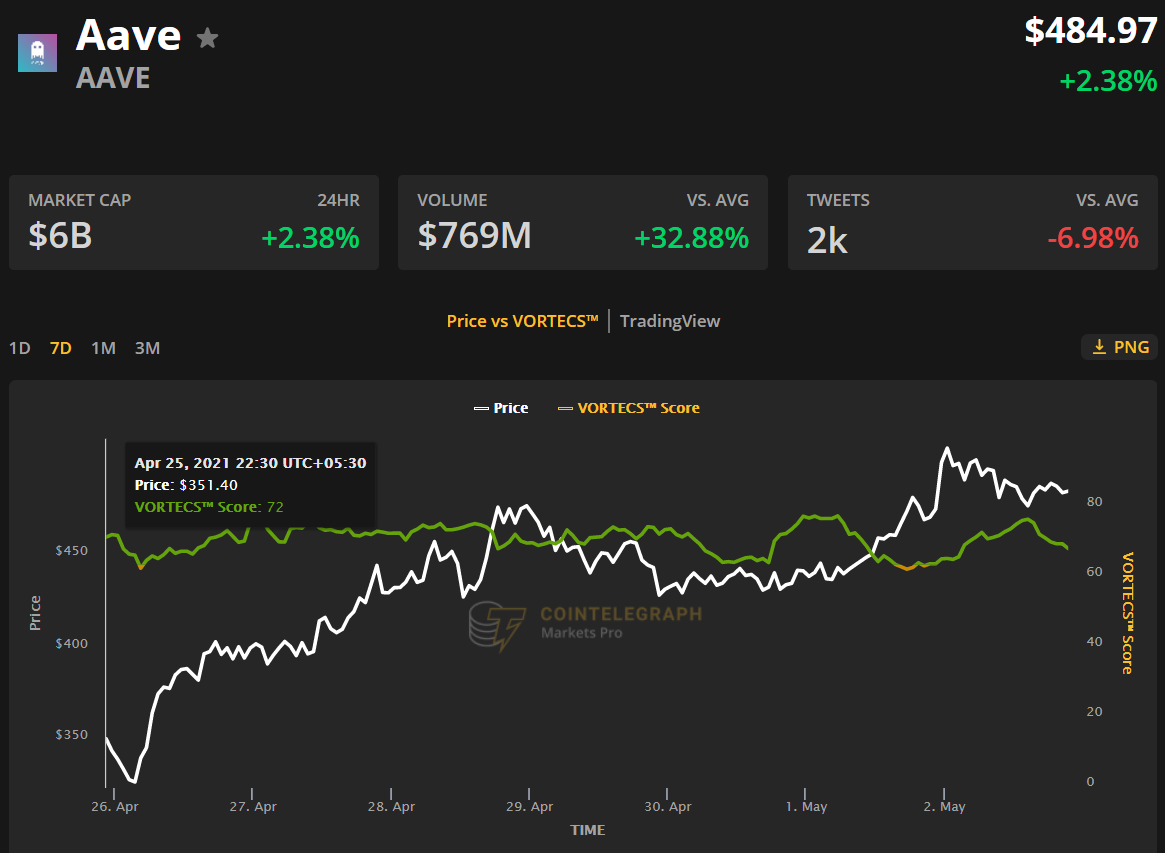

VORTECS™ knowledge from Cointelegraph Markets Professional exhibits the bullish pattern in AAVE has continued from April 25, barring a few momentary dips to 63.

The VORTECS™ Rating, unique to Cointelegraph, is an algorithmic comparability of historic and present market situations derived from a mixture of information factors together with market sentiment, buying and selling quantity, latest worth actions and Twitter exercise.

As seen within the chart above, the VORTECS™ Rating for AAVE has constantly remained within the inexperienced since April 25 when the worth was at $351.40.

The sturdy VORTECS™ Rating might have held again merchants from reserving earnings early and leaving earnings on the desk. AAVE has rallied to $509.83 at this time, recording a acquire of 45% in simply over every week.

The 4-hour chart exhibits the bulls bought the dip to the 20-EMA and are once more making an attempt to drive the worth above the $489 to $512 resistance zone. The rising shifting averages and the RSI above 63 recommend the trail of least resistance is to the upside.

This bullish view will weaken if the bears pull the worth under the 20-EMA. That might recommend that offer exceeds demand. The pair could then drop to the 50-SMA. If this help holds, the pair could consolidate between $420 and $489 for a number of days earlier than beginning the subsequent trending transfer.

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer entails danger, you need to conduct your individual analysis when making a call.

Source link