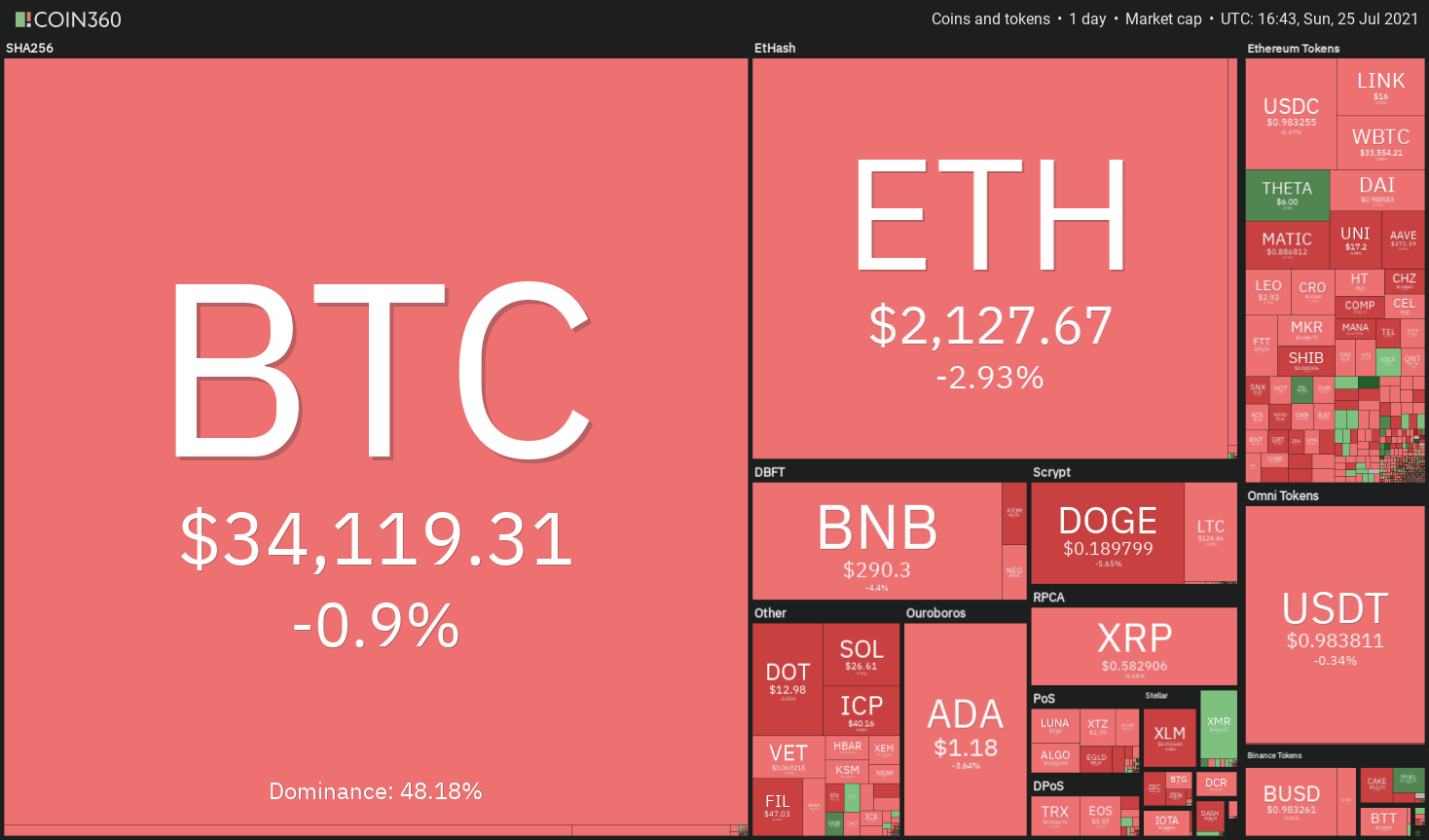

Bitcoin’s (BTC) restoration is dealing with stiff resistance close to the $35,000 mark however Bloomberg Intelligence senior commodity strategist Mike McGlone stays bullish. In his newest evaluation, McGlone stated that the likelihood of Bitcoin hitting $60,000 is bigger than the worth dropping to $20,000.

Institutional traders appear to be utilizing the weak point in Bitcoin to construct their positions. Cathie Wooden’s Ark Make investments added greater than 450,000 shares of Grayscale Bitcoin Belief in two separate buys prior to now week, rising their holdings to greater than 9 million shares. As well as, Edge Wealth Administration and Rothschild Funding Corp additionally added GBTC shares to their portfolio.

Nevertheless, not everyone seems to be so bullish on Bitcoin. Analysts at Delphi Digital have identified that Bitcoin is testing the help on the 12-month transferring common and a break under it might end in additional draw back. Kevin Kelly, an authorized monetary analyst at Delphi Digital, stated a break under $30,000 might show to be bearish for Bitcoin.

If Bitcoin stays range-bound, merchants are more likely to shift their concentrate on choose altcoins, which can shock to the upside. Let’s research the charts of the top-5 cryptocurrencies that will proceed to draw shopping for curiosity within the quick time period.

BTC/USDT

Bitcoin rallied and closed above the 20-day exponential transferring common ($32,974) on July 23, indicating that the promoting stress is lowering. The bulls are at the moment trying to push the worth above the 50-day easy transferring common ($34,301).

If patrons succeed, the BTC/USDT pair might problem the essential short-term resistance at $36,670. A breakout of this resistance might entice additional shopping for, clearing the trail for a doable rally to the $41,330 to $42,451.67 resistance zone.

The 20-day EMA has began to show up and the relative power index (RSI) has risen above 54, indicating a minor benefit to the bulls.

If the worth turns down from the 50-day SMA however rebounds off the 20-day EMA, it’s going to recommend that the sentiment has turned bullish. The patrons will then make another try and clear the hurdle on the 50-day SMA.

Alternatively, a break under the 20-day EMA will point out that bears proceed to promote at greater ranges. The pair might then retest the help at $31,000.

The 4-hour chart exhibits that bears are aggressively defending the overhead resistance close to $35,000. The pair might now drop to the 20-EMA the place patrons are more likely to step in. If the worth rebounds off the 20-EMA, it’s going to recommend that the short-term sentiment has turned bullish.

The patrons will then once more attempt to clear the hurdle at $35,000. In the event that they succeed, the pair might rally to $36,670 the place bears might once more pose a nonetheless problem. If the bulls don’t hand over a lot floor from this resistance, it’s going to recommend that short-term merchants are usually not reserving earnings at this degree.

This can enhance the chance of a break above $36,670. This bullish view will invalidate if the worth turns down and breaks under the 20-EMA.

ETH/USDT

Ether (ETH) reached the 50-day SMA ($2,165), which is more likely to act as a robust hurdle as a result of the bears had stalled the earlier rally at this resistance on July 7.

If the worth turns down from the present degree however finds help on the 20-day EMA ($2,046), it’s going to recommend that the sentiment has turned bullish. A powerful rebound off the 20-day EMA will improve the prospects of a breakout of the 50-day SMA.

If that occurs, the bulls will attempt to push the worth to the downtrend line. A breakout and shut above this resistance will sign a doable change in pattern. The regularly rising 20-day EMA and the RSI above the midpoint recommend a robust comeback from patrons.

Opposite to this assumption, if bears pull the worth under the 20-day EMA, it’s going to recommend that bears are in no temper to relent. The pair might then plummet to the robust help at $1,728.74.

The bears are aggressively defending the psychological degree at $2,200. The pair might now appropriate to the 20-EMA the place the patrons might step in. If the worth rebounds off the 20-EMA, the bulls will make another try and push the pair above $2,200.

A breakout and shut above this overhead resistance will open the doorways for a doable rally to $2,400. Opposite to this assumption, if bears pull the worth under the 20-EMA, the decline might lengthen to the $2,000 help. A break under the 50-SMA might end in a decline to $1,728.74.

ICP/USDT

Web Pc (ICP) dipped under the $28.31 help on July 20 however the bears couldn’t capitalize on this weak point. This implies that bulls are accumulating at decrease ranges.

The bounce off $26.92 picked up momentum and the bulls pushed the worth above the 20-day EMA ($38.53) on July 24. That is the primary indication that the bearish sentiment might be ending. The 20-day EMA has flattened out and the RSI has risen to the midpoint, which additionally means that the promoting stress might be easing.

If bulls drive the worth above the 50-day SMA ($47.33), the ICP/USDT pair might rise to the overhead resistance at $59.42. A breakout and shut above this resistance will full a double backside sample, indicating the beginning of a brand new uptrend.

The sample goal on the upside is $90.53. This constructive view will invalidate if the worth turns down from the present degree and breaks under $26.92.

Each transferring averages have turned up on the 4-hour chart and the RSI is within the constructive zone, suggesting that bulls are in management. The patrons are more likely to defend the 20-EMA on the draw back.

If the worth rebounds off the 20-EMA, the pair might rise to the psychological degree at $50. This degree might act as resistance but when bulls don’t hand over a lot floor, the up-move might proceed and the pair might rise to $59.42. Conversely, a break under the 20-EMA might pull the worth all the way down to the 50-SMA.

AAVE/USDT

Aave rebounded off $212.54 on July 20 and rose above the horizontal resistance at $280 on July 23, which suggests robust shopping for at decrease ranges. The worth is at the moment caught inside a symmetrical triangle.

The transferring averages are on the verge of a bullish crossover, indicating that bulls are trying a comeback. If the worth rebounds off the transferring averages, it’s going to recommend a change in sentiment from promote on rallies to purchase on dips.

A breakout and shut above the downtrend line will full the symmetrical triangle sample. The AAVE/USDT pair might then rally to $347.53 and later to $400.

Quite the opposite, if bears pull the worth under the transferring averages, the pair might once more regularly slide to the help line of the triangle. A break under the triangle might flip the tables in favor of bears.

The bulls are dealing with stiff resistance on the psychological degree at $300 but when they don’t enable the worth to maintain under the 20-EMA, it’s going to improve the opportunity of a break above the downtrend line. If that occurs, the pair might transfer as much as $347.53 within the quick time period.

Alternatively, if the worth sustains under the 20-EMA, the pair might drop to $268 after which to the 50-SMA. A powerful bounce off this degree will point out shopping for on dips. The bulls will then once more attempt to push the worth to the downtrend line. A break under the 50-SMA will sign that bears have overpowered the bulls.

Associated: Powered by the individuals: 3 altcoins whose tweet quantity spiked earlier than a robust rally

LUNA/USD

Terra protocol’s LUNA token has bounced again sharply from $5.58 and reached the overhead resistance zone at $7.96 to $8.72. The bears had halted the earlier restoration try by the bulls on this zone on July 11.

If bulls push the worth above $8.72, the momentum might choose up. The regularly rising 20-day EMA ($7.03) and the RSI above 59 recommend the trail of least resistance is to the upside. The LUNA/USDT pair might then rally to the downtrend line.

This degree might once more act as a resistance but when bulls don’t hand over a lot floor, the pair might try to interrupt above the downtrend line.

This constructive view will invalidate if the worth turns down from the present degree and breaks under the 20-day EMA. Such a transfer will point out that purchasing dries up at greater ranges. The pair might then drop to $5.58.

Each transferring averages on the 4-hour chart are sloping up and the RSI is within the constructive territory, indicating that bulls have the higher hand. If bulls can maintain the worth above $7.96, the opportunity of a retest of $8.72 will increase.

If bulls can drive the worth above $8.72, the short-term uptrend might choose up momentum and the pair might rise to $10. This degree might act as resistance but when bulls can flip $8.72 to help, the uptrend might proceed.

Opposite to this assumption, if bears pull the worth under the 20-EMA, it’s going to recommend weak point within the quick time period. The pair might then drop to the 50-SMA.

The views and opinions expressed listed here are solely these of the writer and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer entails danger, you must conduct your individual analysis when making a choice.

Source link