Dogecoin’s (DOGE) huge rally to $0.45 propelled it to a market capitalization of over $54 billion to make it the fifth most respected cryptocurrency by market cap.

This lofty market cap comes as a shock to many for the reason that undertaking has no energetic builders and is just a meme coin, thus the present rally brings again recollections of the excesses seen throughout the ICO increase in 2017.

Rallies just like the one seen in Dogecoin point out that a number of merchants have entered the fray and wish to get wealthy in a single day. The one constructive signal is that the mania has not unfold to different cash. If it does, then the crypto markets are more likely to witness a pointy correction so as to shake out the weak arms.

CNBC host Jim Cramer has turn into one of many first well-known individuals to disclose that he closed half of his Bitcoin (BTC) place. Whereas Cramer’s promoting is an remoted occasion, it does warn that not all skilled buyers who’ve just lately turned Bitcoin believers are going to be long-term HODLers.

If the institutional buyers rush to the exit, it may trigger an enormous correction in a number of cryptocurrencies. Merchants must be conscious of irrational exuberance and keep away from being sucked into FOMO-driven trades because it’s higher to stay to a buying and selling plan and assume long-term quite than dream of in a single day riches.

Let’s examine the charts of the top-10 cryptocurrencies to determine the crucial assist ranges and description varied bullish and bearish situations.

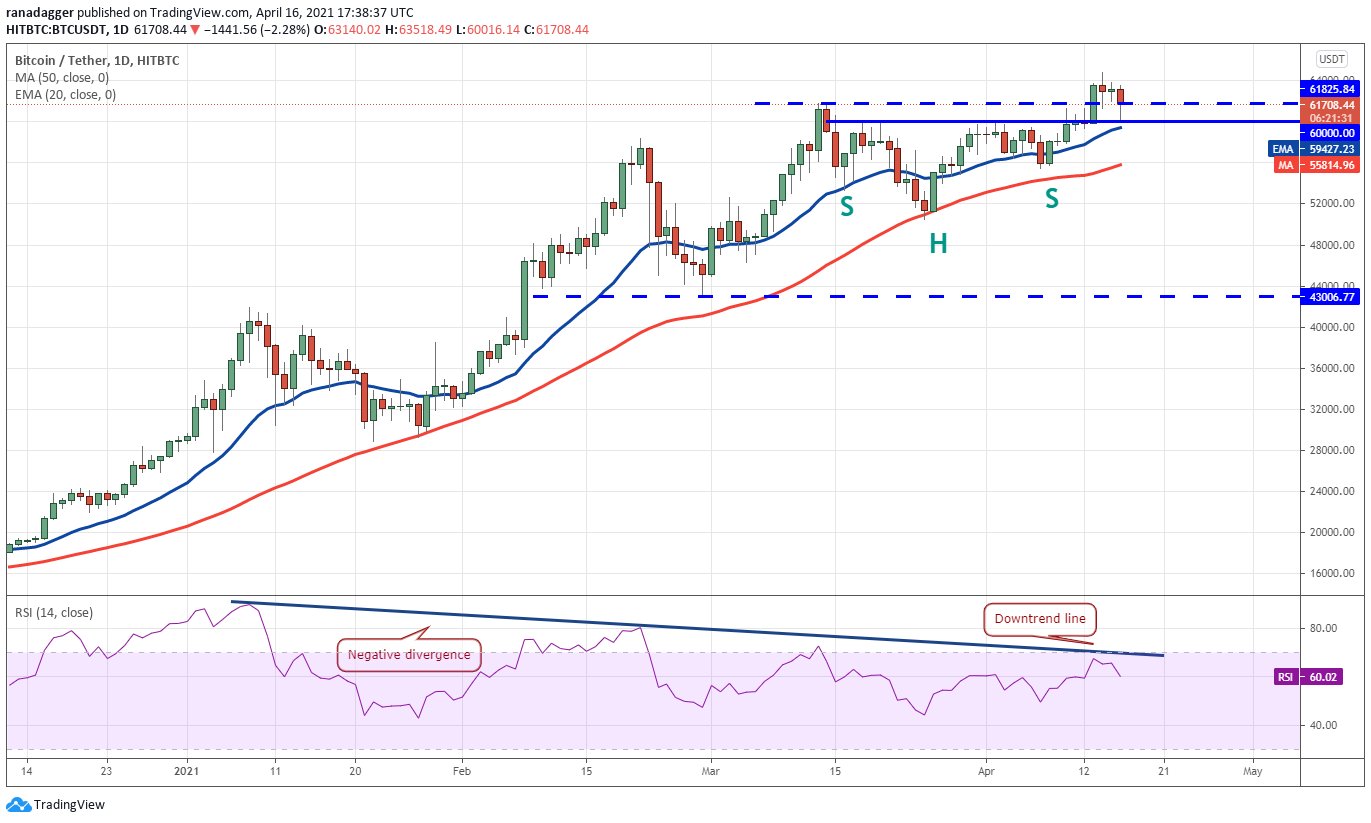

BTC/USDT

The bulls couldn’t capitalize and construct upon the breakout of the overhead resistance zone at $60,000 to $61,825.84 on April 13. Bitcoin worth turned down on April 14 after hitting an all-time excessive at $64,849.27 and the bulls are presently trying to flip the $60,000 stage to assist.

In the event that they handle to do this, the BTC/USDT pair could make yet one more try to resume the uptrend. A breakout of $64,849.27, may begin the following leg of the uptrend that might attain $69,540 after which $79,566.

Nonetheless, the destructive divergence on the relative energy index (RSI) is warning of a attainable correction. Curiously, the worth reversed path when the RSI had reached near the downtrend line.

If the worth dips beneath the 20-day exponential shifting common ($59,427), it is going to be the primary signal that consumers could also be shedding their grip. The break beneath the 50-day easy shifting common ($55,814) will additional cement the view {that a} deeper correction is probably going.

The bulls could try to arrest the decline close to $50,460.02 but when this stage cracks, the pair may drop to the crucial assist at $43,006.77.

ETH/USDT

Ether (ETH) prolonged its uptrend and hit an all-time excessive at $2,545.80 at the moment. Revenue-booking by merchants pulled the worth all the way down to $2,300 however the lengthy tail on the day’s candlestick means that bulls proceed to purchase on dips.

If the worth recovers and the bulls push the worth above $2,545.8, the ETH/USDT pair may begin the following leg of the uptrend. The subsequent goal goal on the upside is $2,745 after which the psychological stage at $3,000.

The upsloping 20-day EMA ($2,131) and the RSI close to the overbought territory counsel the trail of least resistance is to the upside. This bullish view can be invalidated if the worth turns down and breaks beneath the 20-day EMA. Such a transfer may pull the worth all the way down to $1,925.10.

BNB/USDT

Binance Coin (BNB) shaped a Doji candlestick sample on April 14 and that was adopted by an inside day candlestick sample on April 15. Each these setups point out indecision among the many bulls and the bears. This uncertainty resolved to the draw back at the moment.

Nonetheless, a minor constructive is that the bulls are defending the 38.2% Fibonacci retracement stage at $483.95, as seen from the lengthy tail on the day’s candlestick. The bulls will now attempt to push the BNB/USDT pair above the all-time excessive at $638.56 and resume the uptrend.

Conversely, a break beneath $483.95 may pull the worth all the way down to the 20-day EMA ($437). A break beneath this assist will counsel that the merchants are dashing to the exit and that might lead to a drop to the breakout stage at $348.69.

XRP/USDT

XRP is presently correcting the sharp rally. The bulls try to defend the primary assist on the 38.2% Fibonacci retracement stage at $1.48, as seen from the lengthy tail on the day’s candlestick.

The XRP/USDT pair could now consolidate between $1.48 and $1.96 for a couple of days earlier than beginning the following trending transfer.

A break above $1.96 may begin the following leg of the uptrend that might attain $2.54. The rising shifting averages and the RSI within the overbought zone counsel the bulls have the higher hand.

Opposite to this constructive assumption, if the bears sink the worth beneath the $1.48 assist, the pair may drop to the 20-day EMA ($1.18). Such a transfer will counsel the bullish momentum has weakened and that might delay the following leg of the uptrend.

DOGE/USDT

Dogecoin’s momentum has been selecting up for the reason that previous three days and that has resulted within the huge pump at the moment. This exhibits that an increasing number of merchants are getting sucked into the commerce resulting from FOMO.

Normally, such shopping for frenzies finish in a serious high formation. After the final bull has bought, the worth reverses path and the waterfall decline begins. It’s troublesome to foretell a high throughout such a frenzy however the psychological $0.50 stage could act as a hurdle.

The decline after the DOGE/USDT pair tops out is more likely to be vicious. The same old 38.2% Fibonacci retracement stage could not maintain and the pair is more likely to drop to the 61.8% Fibonacci retracement stage at $0.20.

Merchants ought to management the urge to get into such trades even on the danger of lacking out on some income.

ADA/USDT

Cardano (ADA) has been dealing with a troublesome battle between the bull and the bears close to $1.48 for the previous two days. Though the bulls managed to push the worth above $1.48 at the moment, the bears have been fast to drag the worth again beneath the extent.

After the third unsuccessful try to maintain the worth above $1.48, the bulls appear to have dumped their positions at the moment, ensuing within the formation of an out of doors day candlestick sample.

Nonetheless, the lengthy tail on at the moment’s candlestick suggests the bulls purchased the dips to the 20-day EMA ($1.28) aggressively. The bulls could now make yet one more try to drive the worth above the $1.48 to $1.55 resistance zone.

In the event that they handle to do this, the ADA/USDT pair may resume the uptrend and begin the journey towards $2. Conversely, a break beneath the shifting averages may provide the bears a possibility to sink the worth to $1.03.

DOT/USDT

The bulls pushed Polkadot (DOT) above the $42.28 stage on April 13 however couldn’t problem the all-time excessive at $46.80. This exhibits a scarcity of demand at greater ranges. The altcoin has dropped beneath $42.28 at the moment and the bears will now attempt to sink the worth beneath the 20-day EMA ($40).

In the event that they succeed, the promoting may decide up additional because the bulls could rush to cowl their positions. Such a transfer may sink the DOT/USDT pair to $32.50 after which to the crucial assist at $26.50.

Opposite to this assumption, if the worth once more rebounds off the 20-day EMA, it is going to counsel that bulls haven’t given up. They may make yet one more try to thrust the worth above the $46.80 resistance and resume the uptrend.

LTC/USDT

Litecoin (LTC) is in a robust uptrend. The bears had tried to begin a correction at the moment however the bulls bought the dips aggressively as seen from the lengthy tail on the day’s candlestick. The reversal could have caught a number of aggressive bears on the incorrect foot, which could possibly be the explanation for the pick-up in momentum.

The LTC/USDT pair has damaged out of the goal goal at $307.42, clearing the trail for a rally to $374. Nonetheless, the RSI above 76 indicators warning as a result of, up to now, the pair has repeatedly entered a correction when the RSI stage reaches near 80.

The crucial assist to look at on the draw back is the 20-day EMA ($241). A break beneath this assist would be the first signal that the bulls are tiring and a deeper correction is probably going.

UNI/USDT

Uniswap (UNI) broke out to a brand new all-time excessive on April 15 however the bulls are struggling to maintain the upper ranges. When the worth fails to observe up greater after breaking out of a big resistance, it signifies exhaustion.

Nonetheless, the lengthy tail on the day’s candlestick suggests the bulls proceed to purchase on dips. If the consumers can propel the worth above the all-time excessive at $39.60, the UNI/USDT pair may rally to $43.43 after which $50.

However, if the worth once more turns down and breaks beneath the 20-day EMA ($32), a number of aggressive bulls who had bought the breakout of $35.20 could bail out of their positions. The lengthy liquidation may pull the worth all the way down to $27.97.

LINK/USDT

Chainlink (LINK) surged above the $36.93 overhead resistance on April 14, signaling the resumption of the uptrend. The altcoin hit an all-time excessive at $44.33 the place profit-booking set in.

Nonetheless, the lengthy tail on the day’s candlestick means that the bulls aggressively bought the dip to $38.52 at the moment. This means that the sentiment stays constructive and the bulls are shopping for at decrease ranges.

The consumers will now attempt to resume the uptrend by pushing the worth above $44.33. In the event that they succeed, the LINK/USDT pair may rally to $50.

Opposite to this assumption, if the worth once more turns down and breaks beneath the $36.93 assist, the pair may drop to the 20-day EMA ($34). If this assist cracks, the decline may prolong to the 50-day SMA ($30).

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer entails danger. It is best to conduct your individual analysis when making a call.

Market information is supplied by HitBTC change.

Source link