Hong Kong tech firm Meitu revealed on April 8 that it had added $10 million price of Bitcoin (BTC) to its holdings which have been bought at a median fee of $57,000 per coin. After the most recent buy, Meitu’s whole cryptocurrency portfolio consists of $49.5 million price of Bitcoin and $50.5 million price of Ether (ETH). This acquisition exhibits that institutional traders are assured that the rally in Bitcoin continues to be in its early levels.

Tom Jessop, Constancy’s head of the crypto division, believes that Bitcoin has reached a tipping level and that conventional finance corporations will proceed to undertake cryptocurrency aggressively within the subsequent few years. Jessop believes the huge financial stimulus from governments and central banks has accelerated institutional adoption and this can be a pattern that would lengthen for no less than one other 12 months.

It isn’t solely institutional traders who’re speeding into cryptocurrencies. Information exhibits that the variety of retail traders buying and selling cryptocurrency has additionally elevated. Standard buying and selling app Robinhood reported on April 8 that crypto buying and selling on its platform surged to 9.5 million customers in Q1 2021, a six-fold enhance over This fall 2020.

Whereas crypto adoption is on the rise, some legacy finance corporations are nonetheless taking an anti-crypto method. HSBC has reportedly blacklisted MicroStrategy inventory and won’t permit prospects on its HSBC InvestDirect platform to purchase shares from the corporate.

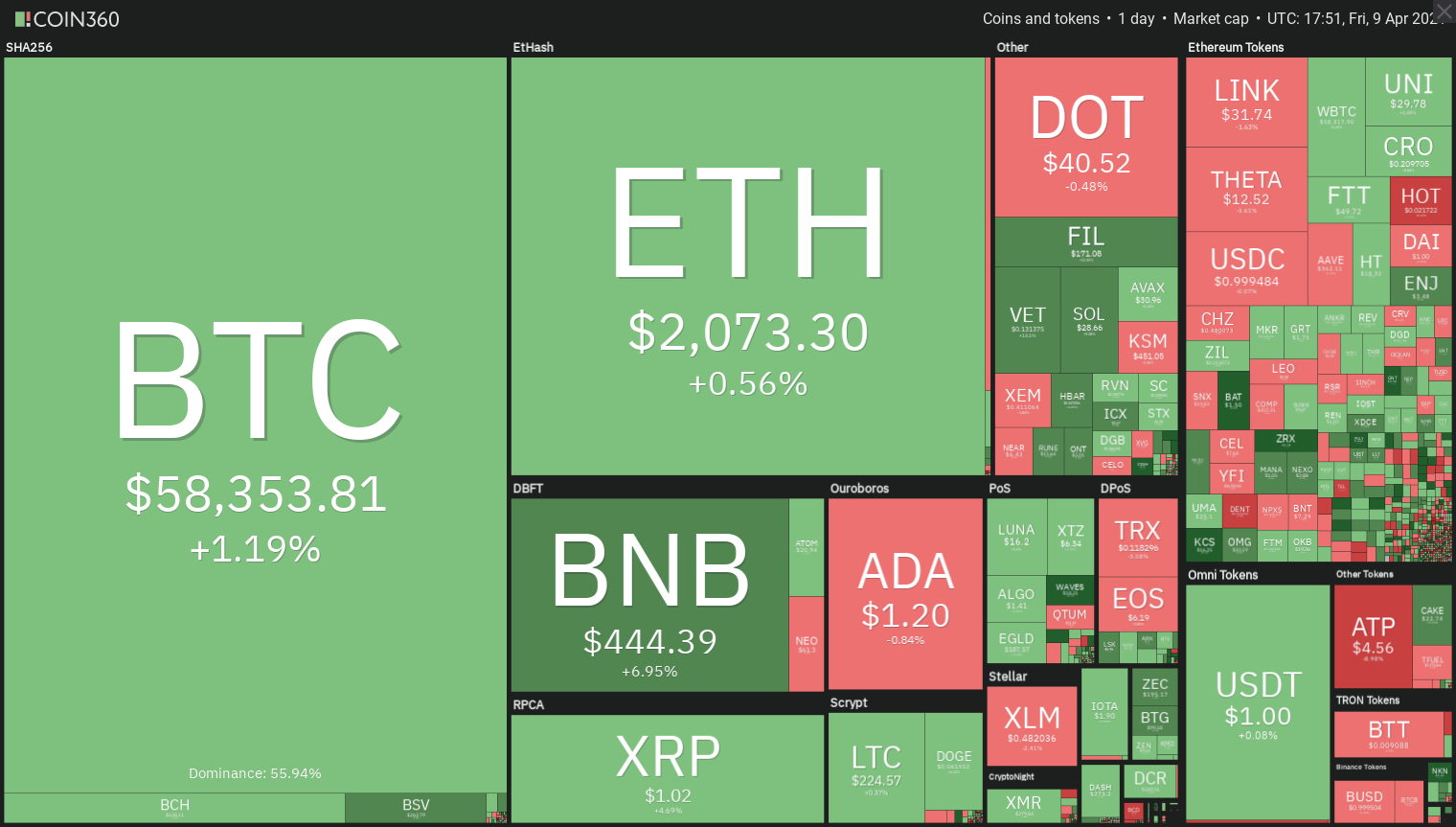

Will Bitcoin and main altcoins lengthen their uptrend and appeal to extra consumers or will they enter a corrective part? Let’s analyze the charts of the top-10 cryptocurrencies to seek out out.

BTC/USDT

The bears couldn’t capitalize on Bitcoin’s break under the 20-day exponential transferring common ($57,043) on April 7. Their failure to interrupt the 50-day easy transferring common ($54,572) assist might have attracted shopping for from the aggressive bulls, ensuing within the rebound on April 8.

Nonetheless, at this time’s Doji candlestick suggests the bulls are struggling to maintain the momentum at increased ranges.

The BTC/USDT pair has shaped an inverse head and shoulders sample that may full on a breakout and shut above $60,000. This bullish setup has a goal goal at $69,540. If the bulls maintain the momentum and clear this hurdle, the uptrend could attain the following goal at $79,566.

Opposite to this assumption, if the value turns down from the present stage, the bears will as soon as once more attempt to break the essential assist on the 50-day SMA. In the event that they succeed, the promoting might intensify as short-term merchants could rush to the exit. That might pull the pair right down to $50,460.02 after which $43,006.77.

ETH/USDT

Ether’s (ETH) drop on April 7 was arrested on the 20-day EMA ($1,933), which exhibits the bulls are accumulating on dips. The worth rebounded sharply on April 8 and rose above the resistance at $2,040.77.

The bulls will now make yet another try to climb above the all-time excessive at $2,150. In the event that they handle to try this, the ETH/USDT pair might resume its uptrend and march towards the following goal goal at $2,618.14.

Nonetheless, the bears are more likely to produce other plans. They may attempt to pull the value under the 20-day EMA. If that occurs, a number of aggressive bulls could get trapped. That might intensify the promoting, leading to a drop to the trendline. A break under this assist will counsel a change in pattern.

BNB/USDT

Binance Coin (BNB) continues to be in a powerful uptrend. The bulls flipped the $348.69 stage to assist on April 7 and adopted that up with a breakout to a brand new all-time excessive on April 8. This exhibits a powerful urge for food from the bulls.

The upsloping transferring averages and the relative energy index (RSI) above 75 point out that the bulls are in command. The following goal goal on the upside is the $500 to $530 zone the place the bears could mount a stiff resistance.

On any correction, the primary assist to be careful for is the 20-day EMA ($334). A robust rebound off this assist will counsel the sentiment stays bullish and merchants are shopping for on dips.

Nonetheless, if the BNB/USDT pair dips under the 20-day EMA, it should counsel that the bullish momentum is weakening.

XRP/USDT

XRP made successive inside day candlestick formations on April 7 and April 8. The present value motion is pointing to a different inside-day candlestick sample at this time. The drop in every day volatility exhibits the altcoin continues to be digesting the latest positive aspects.

This tightening of the intraday vary often ends with a powerful breakout. If the uncertainty resolves to the upside and the bulls drive the value above $1.11, the XRP/USDT pair might begin the following leg of the rally that would take it to $1.34 after which $1.66.

Alternatively, if the indecision resolves to the draw back, it should counsel that offer exceeds demand and merchants have dumped their positions. If that occurs, the pair might drop to the 20-day EMA ($0.72). A break under this stage might pull the value right down to $0.65.

ADA/USDT

Cardano (ADA) dipped under the 20-day EMA ($1.18) on April 7 however the bulls didn’t permit the value to slide under the 50-day SMA ($1.16). This exhibits the bulls are defending the transferring averages aggressively.

The consumers will now attempt to push the value above $1.33. In the event that they handle to try this, the ADA/USDT pair might rise to $1.48. This is a vital stage to be careful for as a result of the pair has returned from it on two earlier events.

If the value once more reverses route from $1.48, it should counsel that the range-bound motion could proceed for a number of extra days. Then again, if the bulls can drive the value above $1.48, the pair might resume the uptrend towards the following goal goal at $2.

A break under the transferring averages would be the first signal of weak point and that would end in a drop to the $1.02 assist. If this stage breaks down, the bears might begin a deeper correction to $0.80.

DOT/USDT

Polkadot (DOT) bounced off the 20-day EMA ($38.68) on April 7, indicating shopping for on dips. The bulls will now attempt to push the value above the overhead resistance at $42.28.

In the event that they succeed, the DOT/USDT pair will retest the all-time excessive at $46.80. A breakout and shut above this stage might begin the following leg of the rally that has a goal goal at $53.50 after which $57.

The progressively upsloping 20-day EMA and the RSI within the constructive territory counsel the bulls have the higher hand.

Nonetheless, if the value turns down from the present stage and breaks under the transferring averages, it should point out that merchants are closing their positions on rallies. That might end in a fall to $32.50 after which $26.50.

UNI/USDT

The bulls efficiently held the $27.97 assist on April 7, which is a constructive signal because it exhibits accumulation on dips. Uniswap (UNI) bounced again above the 20-day EMA ($29.65) on April 8 and the consumers will now attempt to push the value above $32.50.

In the event that they succeed, the UNI/USDT pair might rally to the $35.20 to $36.80 overhead resistance zone. The bears are more likely to defend this zone aggressively. If the value turns down from this resistance, the pair could lengthen its keep contained in the vary for a number of extra days.

Opposite to this assumption, if the value turns down from the present stage, the bears will make yet another try to drag the value under the $27.97 to $25.50 assist zone. In the event that they handle to try this, the pair might begin a deeper correction to $20.74.

LTC/USDT

Litecoin (LTC) efficiently accomplished the retest of the breakout stage from the symmetrical triangle on April 7. That was adopted by a rebound on April 8, however the bulls are struggling to select up momentum.

This exhibits hesitation to purchase at increased ranges. If the bulls don’t overcome the hurdle at $246.96 inside the subsequent few days, the potential of a break under the 20-day EMA ($207) will increase. In such a case, the LTC/USDT pair might drop to the assist line.

Opposite to this assumption, if the bulls maintain the momentum and propel the value above $246.96, the pair might begin the following leg of the uptrend that will attain $307.42. The progressively rising 20-day EMA and the RSI above 59 counsel a minor benefit to the bulls.

LINK/USDT

Chainlink’s (LINK) sharp reversal on April 7 couldn’t break under the 20-day EMA ($30.29). This exhibits the sentiment stays constructive and the bulls are shopping for on dips. The rebound on April 8 rose above the $32 resistance however the bulls are struggling to construct on this energy at this time.

If the value turns down and breaks under the transferring averages, it should counsel that offer exceeds demand at increased ranges. That might pull the value right down to the essential assist at $24.

Then again, if the bulls once more defend the 20-day EMA, the LINK/USDT pair might rise to the all-time excessive at $36.93. A breakout and shut above this resistance will counsel the bulls have absorbed the availability and that will point out the beginning of the following leg of the uptrend.

Nonetheless, if the value once more turns down from $36.93, the pair might lengthen its keep contained in the vary for a number of extra days.

THETA/USDT

After the big vary day on April 7, THETA made an inside day candlestick sample on April 8 and has adopted it up with one other one at this time. This exhibits indecision among the many bulls and the bears concerning the subsequent directional transfer. Whereas the bears are defending the overhead resistance, the bulls are shopping for on each minor dip.

The upsloping 20-day EMA ($11.33) and the RSI above 62 counsel a minor benefit to the bulls. The consumers must clear the hurdle at $14 to sign the beginning of the following leg of the uptrend. In the event that they handle to try this, the THETA/USDT pair might rally to $17.65 after which $22.50.

Quite the opposite, if the bears sink the value under the 20-day EMA, will probably be the primary signal of a attainable change in sentiment. It is going to counsel that the bulls are now not shopping for the dips to the 20-day EMA. The following essential assist to look at will probably be $10.35. If this stage is taken out, a deeper correction to the 50-day SMA could begin.

The views and opinions expressed listed below are solely these of the creator and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. It’s best to conduct your personal analysis when making a call.

Market information is supplied by HitBTC change.

Source link