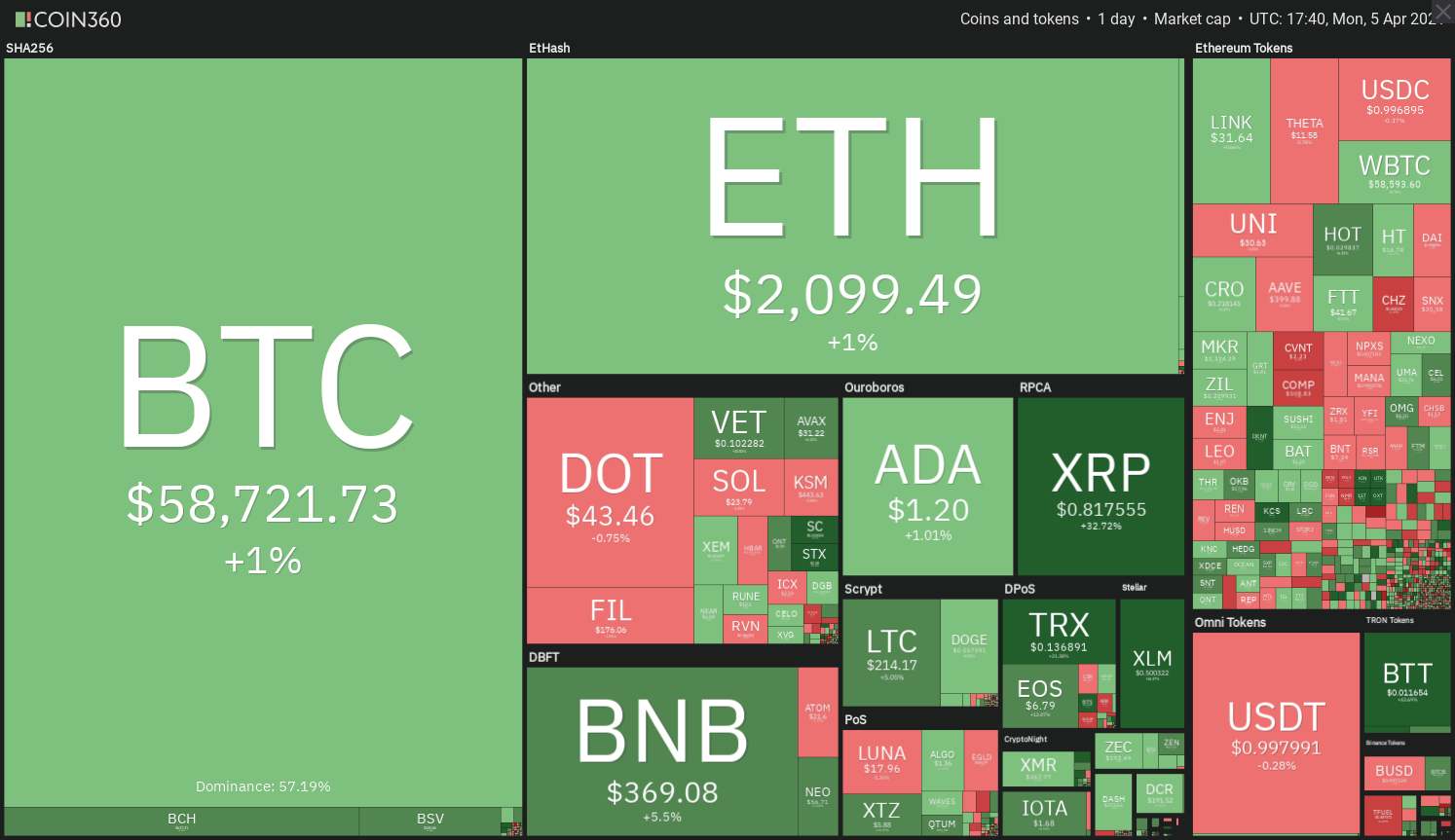

The full crypto market capitalization reached the vital milestone of $2 trillion on April 5. As cryptocurrencies enhance in worth, they’re prone to entice additional investments from institutional traders as a result of they’ll now not afford to neglect it.

Lower than three months in the past, the crypto market had reached the $1 trillion in market cap for the primary time ever. This price of progress exhibits that traders are massively bullish on the potential of the sector and those who delay their funding selections might must enter at a lot greater ranges.

Ark Make investments founder and CEO Cathie Wooden is well-known for figuring out disruptive applied sciences and the agency is backing Bitcoin (BTC) to do exactly that. Yassine Elmandjra, a crypto asset analyst at Ark, mentioned Bitcoin was “100 instances higher” than gold, therefore he believes Bitcoin will rise 10-fold from the present market capitalization of $1 trillion to match gold’s $10-trillion market cap.

For Bitcoin to proceed its northward journey, the establishments must proceed pumping cash into it. Goal Bitcoin ETF, Canada’s first licensed Bitcoin exchange-traded fund (ETF) launched two months in the past and at the moment, it holds 16,462 BTC.

If a Bitcoin ETF will get the approval of the regulators in america, it may entice enormous investments, dwarfing the inflows into the Goal Bitcoin ETF.

The crypto story has widened past Bitcoin. Knowledge from enterprise analytics agency CB Insights confirmed crypto and blockchain technology-focused startups obtained $2.6 billion in funding in Q1 2021. That is manner above the entire funding of $2.3 billion obtained in 2020, indicating the rising curiosity within the sector.

So the query on the minds of most traders is whether or not or not the crypto market will have the ability to maintain its present momentum. Let’s analyze the charts of the top-10 cryptocurrencies to seek out out.

BTC/USDT

Bitcoin has bounced off the 20-day exponential transferring common ($56,750) at present, which means that the sentiment stays optimistic and the bulls are shopping for on each minor dip.

The consumers will now attempt to push the value above the $60,000 to $61,825.84 overhead resistance zone. In the event that they succeed, it may open the doorways for a rally to $69,540 after which $79,566.

Nonetheless, the bears are unlikely to surrender simply. They may as soon as once more attempt to stall the rally within the resistance zone. If that occurs, the opportunity of a break under the 20-day EMA will increase.

That might lead to a drop to the vital assist on the 50-day easy transferring common ($53,978). If the bears sink the value under the 50-day SMA, the pair may drop to the following assist at $50,460.02.

ETH/USDT

Ether (ETH) made a brand new all-time excessive at $2,144.59 on April 2. Nonetheless, the bulls couldn’t construct upon this transfer because the bears bought aggressively and pulled the value again under the breakout stage at $2,040.77 on April 3.

Since then, each the bulls and the bears have been battling it out close to $2,040.77. Whereas the bulls try to flip this stage into assist, the bears are attempting to drag the value under it and entice the bulls.

The rising 20-day EMA ($1,872) and the relative energy index (RSI) above 65 counsel the bulls have the higher hand. If the consumers reach pushing the value above $2,144.59, the ETH/USDT pair may begin the following leg of the uptrend which will attain $2,618.14.

Opposite to this assumption, if the bears pull the value under $1,977, the pair may drop to the 20-day EMA. A break under this stage will counsel the bullish momentum has weakened and will lead to a decline to the trendline.

BNB/USDT

Binance Coin (BNB) cleared the $348.69 to $356.98 overhead resistance zone at present and made a brand new all-time excessive. At any time when an asset class hits a brand new all-time excessive, it’s a signal of energy as a result of it exhibits that merchants are shopping for at greater ranges as they anticipate the rally to increase additional.

Each transferring averages are sloping up and the RSI has risen into the overbought territory, indicating the trail of least resistance is to the upside. The BNB/USDT pair may now rally to its goal goal at $400 after which $430.

This optimistic view will invalidate if the value reverses route and breaks under the 20-day EMA ($297). Such a transfer will counsel that merchants are aggressively reserving earnings at greater ranges and provide exceeds demand.

That might pull the value right down to the 50-day SMA ($258) and a crack under this assist might prolong the decline to $220.

DOT/USDT

The bears tried to entice the bulls on April 3, as seen from the lengthy wick on the day’s candlestick. Nonetheless, the bulls weren’t able to give up their benefit and so they once more pushed Polkadot (DOT) above $42.28 on April 4.

There’s a robust tussle between the bulls and the bears close to the $42.28 stage. The consumers are attempting to flip this stage to assist and launch the following leg of the uptrend, which may attain $53.50.

The upsloping 20-day EMA ($37.30) and the RSI close to the overbought territory counsel the trail of least resistance is to the upside.

This bullish view will invalidate if the bears can pull the value again under $40. If that occurs, the ADA/USDT pair may drop to the transferring averages and a break under the 50-day SMA ($35.34) may begin a deeper correction to $26.50.

ADA/USDT

Cardano (ADA) has been buying and selling close to the 20-day EMA ($1.17) for the previous few days. Makes an attempt by the bulls to start out an up-move on April 2 and three didn’t discover consumers at greater ranges as seen from the lengthy wick on the candlesticks.

Normally, each low volatility part is adopted by a pointy enhance in volatility however it’s troublesome to foretell the route of the breakout. Subsequently, it’s higher to attend for the breakout to occur earlier than initiating any trades.

If the bulls can push and maintain the value above $1.30, the ADA/USDT pair might problem the stiff resistance at $1.48. This would be the third try to clear the overhead resistance, therefore the opportunity of a break above it’s excessive. The following goal goal is $2.

Alternatively, if the indecision resolves to the draw back, the bears will attempt to sink the value under $1.03 and begin a deeper correction to $0.80 after which $0.70.

XRP/USDT

XRP broke above the stiff overhead resistance at $0.65 at present, which accomplished an inverse head and shoulders sample. The altcoin picked up momentum and cleared the minor resistance at $0.75 and $0.78.

The sharp tempo of the rally means that a number of bears might have been caught off guard, leading to a large brief squeeze. This opens the chance for a rally to the sample goal at $1.11.

The rising 20-day EMA ($0.57) and the RSI above 80 counsel the bulls are again in command.

Nonetheless, the XRP/USDT pair might not rally to the goal goal in a straight sprint as short-term merchants might e book earnings after the sharp rally at present. Which will pull the value right down to the $0.75 to $0.65 assist zone.

The energy of the rebound off this assist zone will give a greater perception into the following leg of the rally.

UNI/USDT

Uniswap (UNI) rose above the 20-day EMA ($29.52) on April 2 however the bears didn’t enable the value to run away. They bought at greater ranges and pulled the value again to the 20-day EMA on April 3.

The optimistic signal is that the bulls have held the 20-day EMA efficiently for the previous three days. If the bulls can drive the value above $32.50, the UNI/USDT pair may rally to the $35.20 to $36.80 resistance zone.

The flattish 20-day EMA and the RSI under 56 suggests an absence of robust momentum in favor of the bulls. This might maintain the pair range-bound for a couple of extra days. The following trending transfer may begin on a break above $36.80 or a break under $25.52.

LTC/USDT

Litecoin (LTC) had damaged out of the resistance line of the symmetrical triangle on April 3 however the bulls couldn’t maintain the upper ranges. The altcoin rapidly reversed route and dropped again into the triangle.

Nonetheless, the optimistic signal is that the consumers didn’t enable the value to interrupt under the transferring averages. This exhibits that the bulls are accumulating on dips. They may once more try to push and maintain the value above the triangle.

In the event that they succeed, the LTC/USDT pair may rally to $230 after which to $246.96. Above this stage, the pair may rise to the sample goal at $307.42.

Conversely, if the value as soon as once more turns down from the resistance line, then the opportunity of a break under the transferring averages will increase. If that occurs, the pair may drop to the assist line of the triangle.

LINK/USDT

Chainlink (LINK) broke above the $32 resistance on April 2 however the bulls couldn’t construct upon this breakout and the bears pulled the value again into the vary on April 3. This means the bears are aggressively defending the overhead resistance at $32.

Nonetheless, the robust rebound off the 20-day EMA ($29) on April 4 exhibits the bulls are shopping for the dips. The bulls will now attempt to thrust the value above the $32 to $33.17 overhead resistance zone.

If they’ll obtain that, the LINK/USDT pair might retest the all-time excessive at $36.93. If this stage can be conquered, the rally might prolong to $40.

Quite the opposite, if the value once more turns down from the overhead resistance zone and plummets under the transferring averages, it’ll counsel that the range-bound motion might proceed for a couple of extra days.

THETA/USDT

THETA has been caught contained in the $10.35 to $14 vary for the previous few days. The bears are attempting to sink the value to the assist of the vary however the bulls haven’t allowed the altcoin to dip under $11.20.

The 20-day EMA ($10.81) is steadily flattening out and the RSI has dropped under 61, pointing to a attainable range-bound motion within the subsequent few days.

Opposite to this assumption, if the bulls can drive the value above $12.58, the THETA/USDT pair may rally to $14. A breakout of this resistance would be the first signal that bulls have the higher hand.

Nonetheless, if the pair turns down from the present stage and slips under $11.20, a drop to $10.35 is feasible. A break under this assist may intensify promoting.

The views and opinions expressed listed below are solely these of the writer and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. You need to conduct your individual analysis when making a choice.

Market information is offered by HitBTC change.

Source link