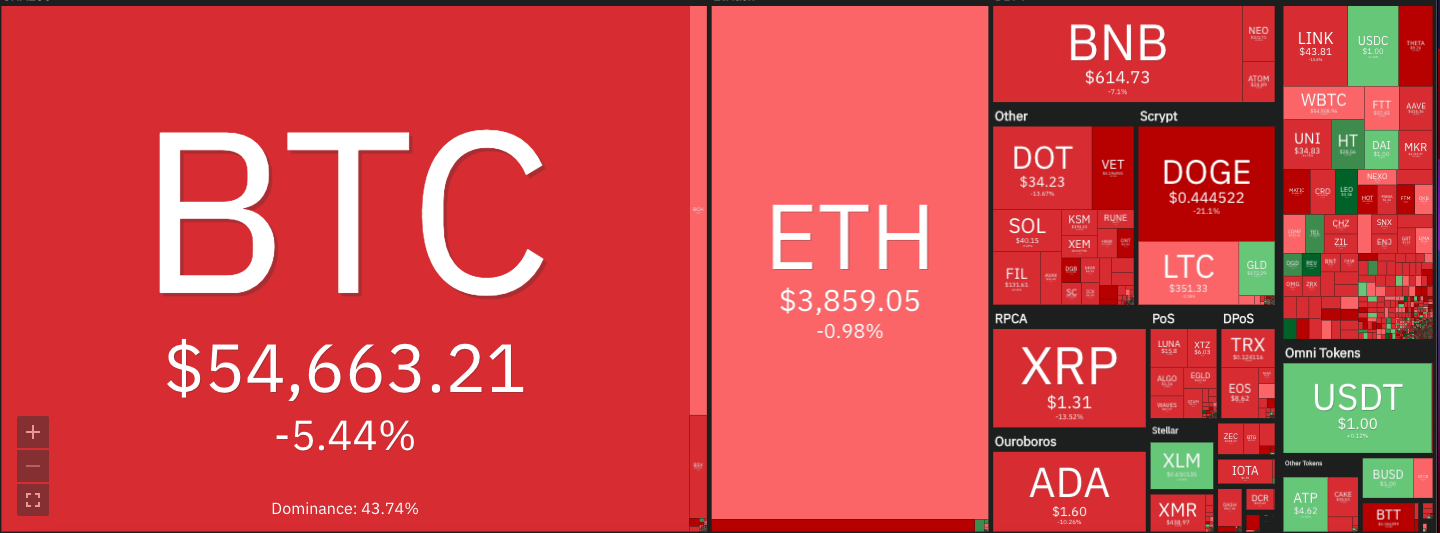

The astronomical rally in Ether (ETH) will not be exhibiting any indicators of slowing down. The bulls simply cleared the overhead hurdle at $4,000 at this time, which additionally pushed the most important altcoin’s market dominance to over 19%.

It’s not solely Ether that’s witnessing sharp shopping for from merchants. Litecoin (LTC) and Cardano (ADA) have additionally risen new all-time highs, suggesting a broad-based altcoin rally.

Nevertheless, Bitcoin (BTC) appears to have misplaced its momentum because it continues to battle close to the $60,000 mark. That has pulled its market dominance to beneath 44% for the primary time since July 2018.

Nevertheless, the latest underperformance of Bitcoin has not shaken the long-term bulls. Morgan Creek Capital Administration founder and CEO Mark Yusko not too long ago mentioned in an interview with CNBC that Bitcoin will rival the “financial worth” of gold.

“If gold’s financial worth is $4 trillion, then digital gold ought to transfer as much as that whole,” Yusko added. Which means Bitcoin must rise to $235,000 sooner or later to satisfy Yusko’s prediction.

Let’s analyze the charts of the top-10 cryptocurrencies to identify the important assist and resistance ranges.

BTC/USDT

Bitcoin has been sandwiched between the transferring averages and the $58,966.53 resistance for the previous two days. This tight vary buying and selling suggests a standing of equilibrium between the bulls and the bears.

If the uncertainty resolves to the draw back, the BTC/USDT pair might drop to $52,323.21. The bulls will attempt to defend this assist and in the event that they succeed, the pair might prolong its consolidation between $52,323.21 and $58,966.53 for a couple of extra days.

The step by step rising 20-day exponential transferring common ($56,611) and the relative energy index (RSI) close to the midpoint recommend a steadiness between provide and demand.

This steadiness might shift in favor of the bulls if the worth sustains above $58,966.53. That would lead to a march to the all-time excessive at 64,849.27. A break above this resistance might sign the resumption of the up-move.

Conversely, a break beneath $52,323.21 might point out the beginning of a deeper correction to $46,985. A break beneath this assist might set off panic promoting.

ETH/USDT

Ether’s rally has continued unabated. After forming a Doji candlestick sample on Might 9, the bulls have asserted their dominance at this time and pushed the worth to a brand new all-time excessive. The sharp rally of the previous few days has pushed the RSI above 83.

A deeply overbought degree on the RSI signifies a shopping for frenzy as merchants worry lacking out on the rally. Usually, such rallies prime out after the final bull has bought. The ETH/USDT pair might rise to $4,528.97 after which to the psychological degree at $5,000.

The primary signal of the bullish momentum fading may very well be a correction that lasts for greater than three days. A break beneath the 20-day EMA ($3,173) will sign the beginning of a deeper correction.

BNB/USDT

Binance Coin (BNB) rose to a brand new all-time excessive at $691.77 at this time however the bulls are struggling to maintain the worth above the breakout degree at $680. The lengthy wick on the day’s candlestick suggests an absence of demand at greater ranges.

The upsloping transferring averages point out that consumers are in management, however the unfavorable divergence on the RSI suggests the bullish momentum could also be weakening. A break and shut beneath the 20-day EMA ($599) may very well be the primary signal of a deeper correction.

Alternatively, if the worth rises from the present degree or the 20-day EMA, the bulls will make another try to push and maintain the BNB/USDT pair above $680. In the event that they succeed, the pair might embark on a journey towards $760 after which $808.57.

DOGE/USDT

Dogecoin (DOGE) witnessed a pointy dump on Might 9 however the bulls aggressively defended the 20-day EMA ($0.44) as seen from the lengthy tail on the day’s candlestick. Nevertheless, the consumers couldn’t prolong the restoration at this time and the worth has resumed its journey towards the 20-day EMA.

The 20-day EMA is step by step flattening out and the RSI has declined beneath 58, indicating the bullish momentum is weakening.

If the DOGE/USDT pair once more rebounds off the 20-day EMA, it’s going to recommend robust shopping for at decrease ranges. Such a transfer might maintain the pair range-bound for a couple of extra days.

This view will invalidate if the bears sink the worth beneath the 20-day EMA. if that occurs, the pair might drop to the 61.8% Fibonacci retracement degree at $0.38.

XRP/USDT

XRP has repeatedly damaged above the downtrend line since Might 6 however the bulls haven’t been in a position to maintain the breakout. This means that merchants could also be utilizing the rallies to lighten their lengthy positions.

The consumers must push and maintain the worth above $1.66 to boost the prospects of a retest of the 52-week excessive at $1.96. The step by step upsloping 20-day EMA ($1.45) and the RSI above 56 point out a minor benefit to the bulls.

This constructive view will nullify if the worth turns down and breaks beneath the 20-day EMA. Such a transfer will recommend that provide exceeds demand. The XRP/USDT pair might then drop to the 50-day easy transferring common ($1.16).

ADA/USDT

Cardano made a big exterior day candlestick sample on Might 9, indicating robust shopping for on the breakout degree of $1.48. Nevertheless, the bulls haven’t been in a position to maintain the momentum at this time and the altcoin has fashioned an inside-day candlestick sample.

If the bulls don’t hand over a lot floor from the present degree, it’s going to sign energy and that might improve the prospects of the resumption of the uptrend.

The rising 20-day EMA ($1.45) and the RSI within the overbought territory additionally point out the trail of least resistance is to the upside. A break above $1.83 might open the doorways for a rally to $2 after which $2.25.

Opposite to this assumption, if the ADA/USDT pair turns down and breaks beneath the 20-day EMA ($1.45), it’s going to point out a bull lure. That would pull the worth all the way down to $1.28 after which to $1.

DOT/USDT

Polkadot (DOT) is caught between the transferring averages and the $42.28 overhead resistance. This tight vary buying and selling close to the stiff resistance is a constructive signal because it reveals that merchants are in no hurry to dump their lengthy positions.

If the bulls can thrust and maintain the worth above $42.28, it’s going to recommend that demand exceeds provide. That would lead to a rally to the all-time excessive at $48.36 the place the bears are once more more likely to mount a stiff resistance.

Nevertheless, if the consumers push the worth above $48.36, the DOT/USDT pair might begin its journey to $58.06.

Alternatively, if the worth breaks beneath the transferring averages, the pair might drop to $34.36 after which to $32.56. If that occurs, the pair might prolong its keep contained in the $26.50 to $42.28 vary for a couple of extra days.

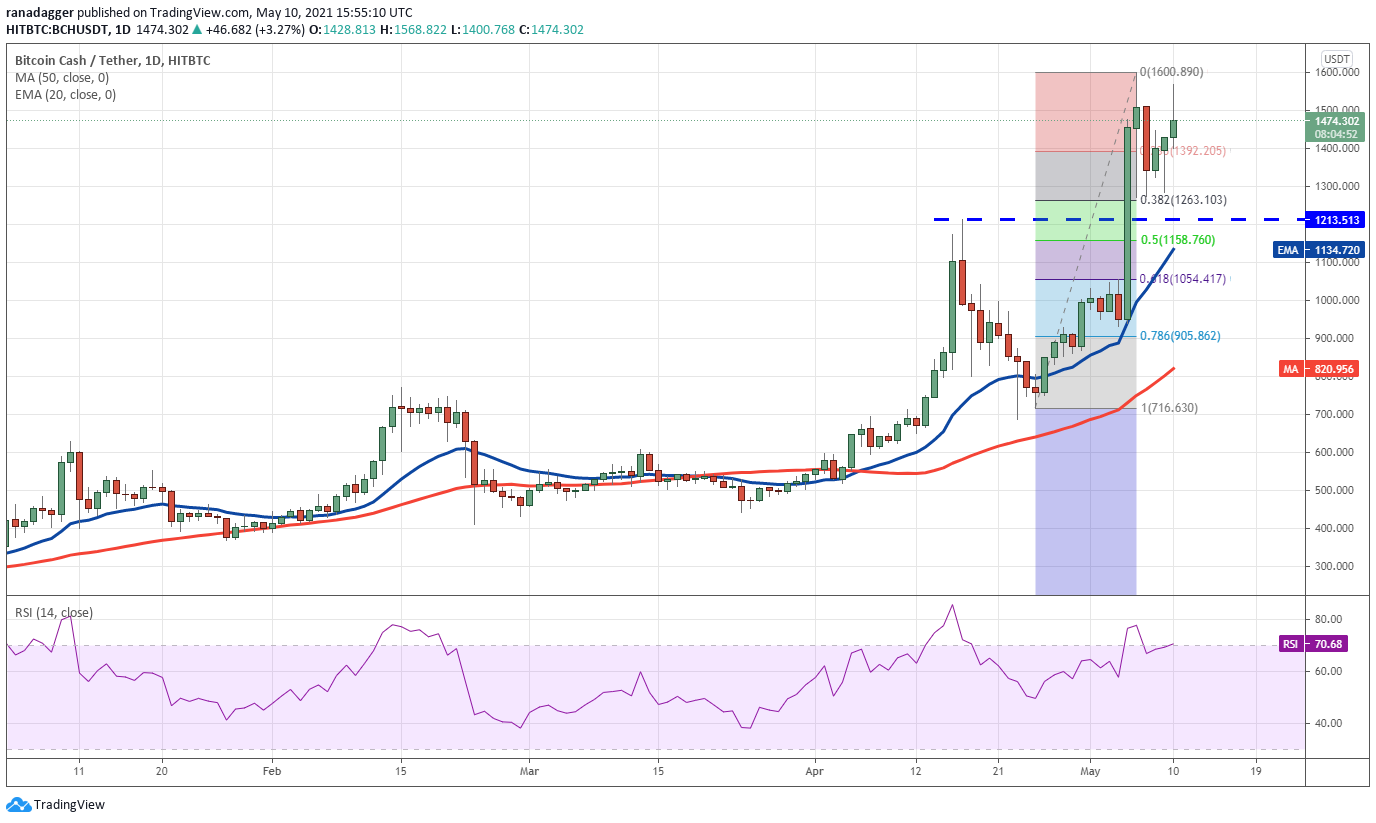

BCH/USDT

Bitcoin Money (BCH) is going through stiff resistance close to the 52-week excessive at $1,600.89 as seen from the lengthy wick on at this time’s candlestick. If the worth slips beneath $1,400, the altcoin might drop to the 38.2% Fibonacci retracement degree at $1,263.10 and stay range-bound for a couple of days.

The primary signal of weak point can be a break beneath $1,263.10 and the benefit will shift in favor of the bears if the BCH/USDT pair slips beneath the 20-day EMA ($1,134).

Nevertheless, the upsloping transferring averages and the RSI within the overbought zone recommend the trail of least resistance is to the upside.

If the worth rises from the present degree or from $1,400 and breaks above $1,600.89, the pair might begin the following leg of the uptrend, which has a goal goal at $2,147.36.

LTC/USDT

Litecoin surged above the resistance line of the ascending broadening wedge sample on Might 9, indicating a pick-up in momentum. The altcoin hit a brand new all-time excessive at $412.76 at this time however the lengthy wick on the candlestick suggests profit-booking at greater ranges.

If the LTC/USDT pair rebounds off the breakout degree, it’s going to recommend that the bulls are shopping for each minor dip. That can enhance the potential of the resumption of the uptrend with the following goal at $463.31 after which $500.

Quite the opposite, if the worth re-enters the wedge, it’s going to recommend that the breakout on Might 9 was a bull lure. That would pull the worth all the way down to the 20-day EMA ($309). A powerful rebound off this degree will recommend the sentiment stays constructive whereas a break beneath the 20-day EMA will clear the trail for a drop to the assist line of the wedge.

LINK/USDT

The bulls pushed Chainlink (LINK) above the resistance line of the ascending channel on Might 5 however couldn’t construct up on the breakout. After hesitating for a couple of days, the bulls made a decisive up-move on Might 9 and pushed the altcoin to $52.42.

Nevertheless, the bulls once more didn’t maintain the rally and the bears are attempting to drag the worth again into the ascending channel. In the event that they succeed, the LINK/USDT pair might drop to the 20-day EMA ($43).

If the worth rebounds off the 20-day EMA, the bulls might make another try to resume the uptrend. Quite the opposite, a break beneath the 20-day EMA will recommend the present breakout was a bull lure. The pair might then drop to the assist line of the channel.

The views and opinions expressed listed below are solely these of the creator and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. You must conduct your personal analysis when making a choice.

Market knowledge is supplied by HitBTC alternate.

Source link