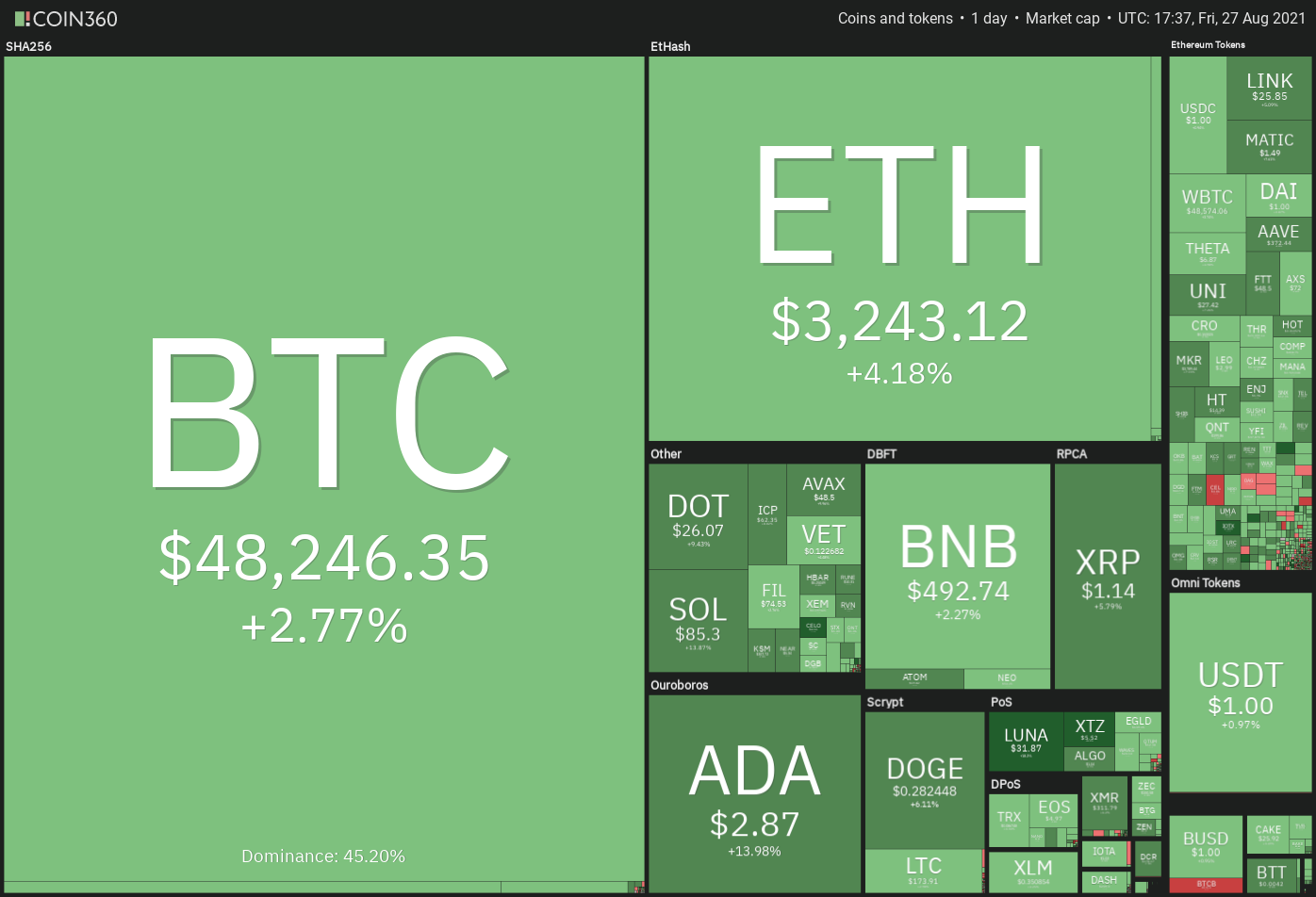

Asset managers and corporations presently maintain over 6% of Bitcoin’s (BTC) circulating provide, based on Purchase Bitcoin Worldwide. A breakdown of the information exhibits Bitcoin fund issuers and asset managers maintain about 4% of Bitcoin’s provide, public corporations account for almost 1% and personal corporations personal roughly 0.83% of the cryptocurrency’s provide.

It is clear that institutional buyers have continued so as to add crypto to their portfolios and Adam Proctor, the managing director for billionaire Simon Nixon’s funding agency Search Ventures, stated the corporate plans to extend “allocation to crypto” as they consider it to be an “necessary space for the long run.”

CNBC Mad Cash host, Jim Cramer, just lately stated that he was a “believer in crypto” and really useful that buyers allocate 5% of their funding portfolio to digital currencies.

Will Bitcoin breaking above the psychological barrier at $50,000, end in a shopping for stampede within the sector? Let’s research the charts of the top-10 cryptocurrencies to seek out out.

BTC/USDT

Robust resistance close to the $50,000 mark might have attracted profit-booking from the short-term merchants on Aug. 26. That pulled Bitcoin under the help line of the rising wedge sample however the bears haven’t been in a position to capitalize on this transfer and sink the value under the transferring averages.

The bulls have pushed the value again into the wedge as we speak. If the rebound sustains, the BTC/USDT pair might step by step transfer towards the overhead resistance zone of $50,000 to $50,500. A breakout and shut above this zone will point out the resumption of the uptrend.

The pair might then rise to the resistance line of the wedge the place bears might once more mount a stiff resistance. If the value turns down from this resistance, the pair might proceed to rise contained in the wedge.

A breakout of the wedge will sign a pick-up in momentum. Which will end in a rally to $60,000.

The relative energy index (RSI) has damaged under a symmetrical triangle sample, indicating a marginal benefit to the bears. If the value turns down from the present degree and breaks under the transferring averages, the pair might drop to $42,451.67.

ETH/USDT

Ether (ETH) has been consolidating in a good vary between $3,000 and $3,335 for the previous few days. The 20-day exponential transferring common ($3.097) is flattening out and the RSI is simply above the midpoint, indicating a steadiness between provide and demand.

The worth has rebounded off the 20-day EMA as we speak and the bulls will now try to push the value above $3,335. If that occurs, it can recommend that bulls accrued the ETH/USDT pair contained in the vary. The pair might then rally to $3,670 and later to $4,000.

A break and shut under $3,000 will point out that bears have overpowered the bulls. That would end in additional promoting as a number of stop-losses might get hit. The pair might then drop to the subsequent help on the 200-day easy transferring common ($2,366).

ADA/USDT

Usually, the breakout from a crucial degree is retested as seen in Cardano (ADA). The worth dropped from an all-time excessive at $2.97 on Aug. 23 to the breakout degree at $2.47 on Aug. 26.

The ADA/USDT pair has rebounded off the $2.47 as we speak, indicating that the sentiment stays optimistic and merchants are shopping for on each minor dip. The bulls will make another try to push the value above the overhead resistance at $2.97.

In the event that they succeed, the pair might rally to $3.50. The upsloping 20-day EMA ($2.29) and the RSI within the overbought zone recommend benefit to consumers.

Conversely, if the value turns down from the present degree or the overhead resistance, it can point out that bulls are closing their positions on rallies. A break and shut under the 20-day EMA will sign the beginning of a deeper correction.

BNB/USDT

Binance Coin’s (BNB) intraday excessive on Might 19 was $516.50 and that degree is prone to act as a stiff resistance. The bulls pushed the value above this resistance on Aug. 26 however couldn’t maintain the altcoin above it.

If consumers don’t quit a lot floor from the present ranges, it can recommend energy. The bulls will then make another try to clear the overhead hurdle. If they’ll pull it off, the BNB/USDT pair might rally to $600.

The rising 20-day EMA ($432) and the RSI within the optimistic zone recommend benefit to consumers. This optimistic view will invalidate if the value turns down and breaks under the 20-day EMA. That would end in a decline to the 200-day SMA ($362).

XRP/USDT

XRP has once more dropped to the breakout degree at $1.07. This is a vital degree for the bulls to defend as a result of if it cracks, the altcoin might witness lengthy liquidation and drop to the subsequent help on the 200-day SMA ($0.86).

The flattening 20-day EMA ($1.08) and the RSI simply above the midpoint recommend that bulls could also be dropping their grip.

If the value rebounds off the present degree, the XRP/USDT pair might rise to the downtrend line. A breakout and shut above the downtrend line will enhance the potential of a rally to the overhead resistance at $1.66.

Alternatively, if the value as soon as once more turns down from the downtrend line, the pair could also be at a higher threat of beginning a deeper correction.

DOGE/USDT

Dogecoin (DOGE) broke under the 20-day EMA ($0.28) on Aug. 27, indicating that offer exceeds demand. The bulls are presently trying to push the value again above the overhead resistance at $0.29.

If the DOGE/USDT pair breaks out of the downtrend line, the bullish momentum might decide up. The pair might then rise to $0.35 and if this degree is crossed, the subsequent transfer may very well be to the overhead resistance at $0.45.

Quite the opposite, if the value turns down from the present degree, it can recommend that bears are aggressively defending at $0.29. The pair might then drop to $0.21. A robust rebound off this help might maintain the pair range-bound between $0.21 and $0.29 for a number of days.

DOT/USDT

Polkadot (DOT) turned down from the overhead resistance at $28.60 and corrected to the 20-day EMA ($24.03). The sturdy rebound off this degree exhibits that bulls are accumulating on dips.

If the bounce holds up, the bulls will attempt to drive the value above the overhead resistance at $28.60. If the DOT/USDT pair sustains above $28.60, it can full a V-bottom, which has a goal goal at $46.83.

Alternatively, if the bounce fizzles out, the bears will attempt to sink the value under the 20-day EMA. If that occurs, the pair might decline to the subsequent sturdy help at $18. If the value rebounds off this degree, the pair might stay range-bound between $18 and $28.60 for a number of days.

SOL/USDT

The lengthy tail on Solana’s (SOL) Aug. 25 and 26 candlestick exhibits sturdy shopping for at decrease ranges. A shallow correction after a powerful up-move is an indication of energy as a result of it means that merchants should not closing their positions and are shopping for on minor dips.

The bulls have pushed the value above the all-time excessive at $82 as we speak. If consumers maintain the value above $82, the SOL/USDT pair might begin its journey towards the subsequent psychological barrier at $100.

The rising 20-day EMA ($63) and the RSI within the overbought zone recommend that bulls are in management. If the value fails to maintain above $82, the pair might stay caught in a spread for a number of days. The bears should pull the value under $58.38 to interrupt the bullish momentum.

Associated: Bitcoin might hit $30K or $100K this yr as analyst warns ‘subsequent months are key’

UNI/USDT

Uniswap (UNI) broke under the transferring averages on Aug. 24, indicating weak point. The bulls tried to push the value again above the transferring averages on Aug. 25 and 26 however they may not maintain the upper ranges.

The bulls are presently once more making an attempt to push the value above the transferring averages. In the event that they handle to try this, the UNI/USDT pair might rally to $30. A breakout of the $30 to $31.25 overhead resistance zone might sign the beginning of a brand new uptrend.

Conversely, if the value turns down from the transferring averages, the UNI/USDT pair might drop to the crucial help at $23.45. A robust rebound off this degree might maintain the pair range-bound between $23.45 and $30 within the brief time period. The flat transferring averages and the RSI close to the midpoint additionally recommend a consolidation for a number of days.

LUNA/USDT

Terra protocol’s LUNA token has been consolidating between $26 and $32 for the previous few days. Though bulls pushed the value above $32 on Aug. 19 and 24, they may not maintain the upper ranges.

The LUNA/USDT pair has rebounded off the help as we speak and the bulls will once more attempt to resume the uptrend. If the value closes above the $32 to $34.67 resistance zone, the pair might rally to $43.

The rising 20-day EMA ($24.44) and the RSI within the overbought territory recommend that the trail of least resistance is to the upside. This bullish view will likely be negated if the value turns down from the present degree or the overhead resistance and breaks under the breakout degree at $22.40.

The views and opinions expressed listed below are solely these of the creator and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails threat. It is best to conduct your personal analysis when making a call.

Market knowledge is offered by HitBTC change.

Source link