A four-day profitable streak introduced the Bitcoin (BTC) costs nearer to testing its 50-day exponential shifting common (~$35,115) as resistance.

The wave, which was instrumental in strengthening Bitcoin’s bullish bias throughout 2020 as help, flipped to turn into a resistance through the Could 2021 sell-off. In doing so, it capped the cryptocurrency from extending its upside rebound strikes many occasions.

As an example, Bitcoin’s drop from $56,900 to $30,000 in mid-Could prompted bulls to purchase the dip. In consequence, the cryptocurrency shot again above $40,000 however discovered its bullish momentum exhausting proper close to the 50-day EMA. The state of affairs repeated a number of occasions after Could’s retracement try, as proven within the chart under.

Rekt Capital, a well known cryptocurrency analyst, turned to a 2020 fractal to find out potential outcomes from the continued Bitcoin value motion.

The dealer famous that Bitcoin value examined the 50-day EMA as resistance in October final 12 months when the BTC/USD pair was buying and selling shy of $10,000. However after breaking the wave to the upside, BTC/USD finally established a file excessive close to $65,000.

“This [was] when BTC shaped an nearly similar fractal of Bitcoin’s present value motion,” the profile famous, hinting that the fractal may repeat as Bitcoin exams the identical resistance degree after 9 months.

This week

Bitcoin closed in to reclaim 50-day EMA after portray a rosy week.

The benchmark cryptocurrency was off to finish the seven-day session up by greater than 8%. A majority of its good points got here after The B-Phrase convention that encompasses a trio of Wall Road biggies— Tesla’s CEO Elon Musk, Twitter’s CEO Jack Dorsey, and Ark Make investments’s founder Cathie Wooden. The executives took turns to talk favorably about Bitcoin know-how and shared their ideas in regards to the future.

Musk, whose feedback on cryptocurrencies are infamous for shifting markets, revealed that his non-public rocket firm SpaceX holds Bitcoin. He additionally added that Tesla would resume its Bitcoin fee choice as soon as its miners change to extra renewable power sources to function its blockchain.

Greenback, shares and the Fed

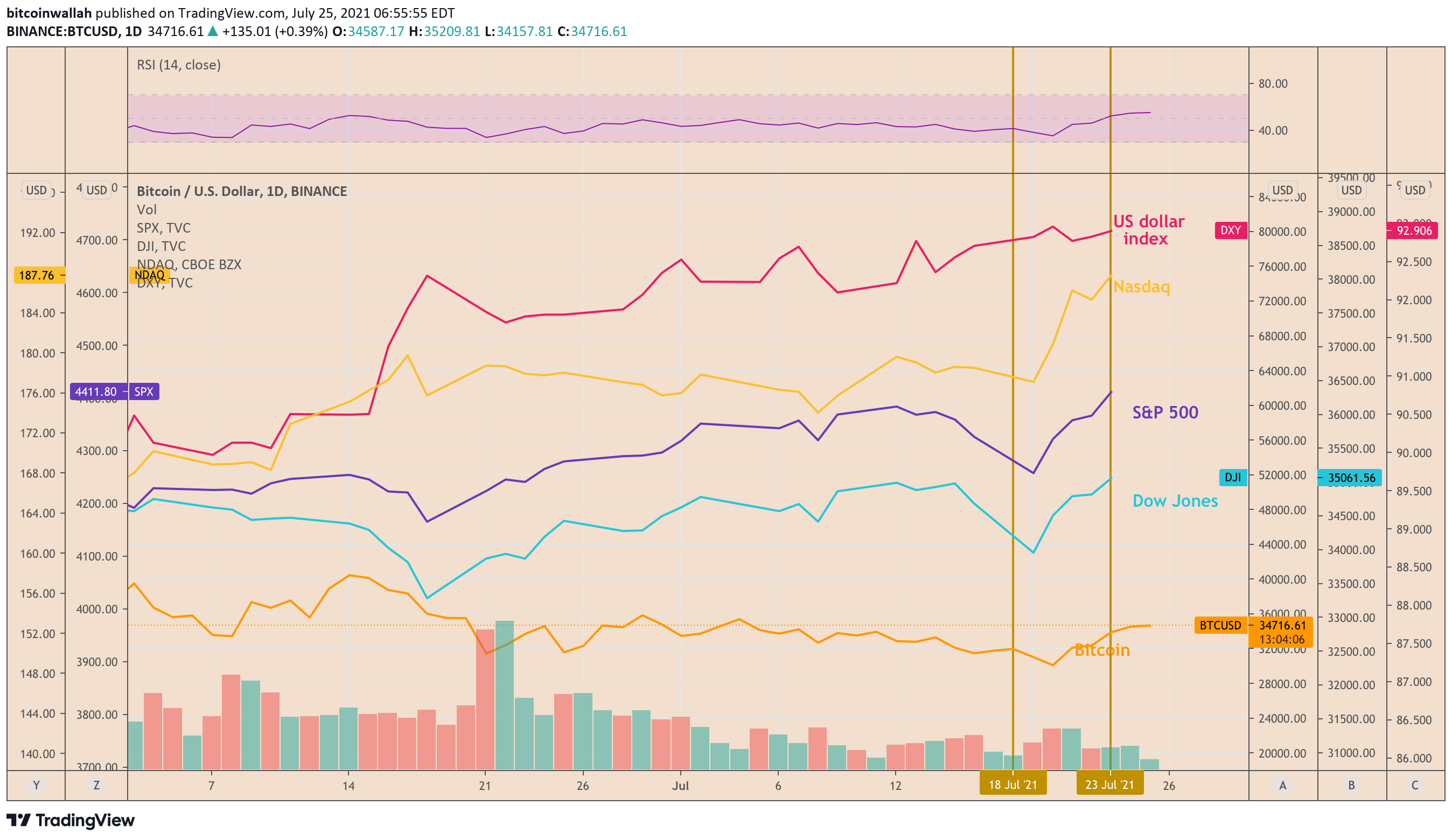

Bitcoin additionally appeared to have capitalized on risk-on flows led by a uneven U.S. greenback index and a rising Wall Road.

Subsequent week seems busy with high-profile knowledge and policy-statement releases.

On Tuesday, the U.S. Convention Board will publish the Shopper Confidence Index for July. As well as, a preliminary Shopper Sentiment Index report from the College of Michigan exhibits a adverse change in client sentiment. The report additionally professes fears of a pointy rise in inflation.

As of late, inflationary pressures have boosted the greenback’s attraction amongst traders. This has sapped Bitcoin’s interim bullish outlook regardless of the cryptocurrency’s standard safe-haven narrative.

On Wednesday, the Federal Open Market Committee (FOMC) will announce its resolution on rates of interest and publish its financial coverage assertion.

Jerome Powell, the chairman of the Federal Reserve, stated in congressional testimony earlier this month that they’re nonetheless away from tapering their $120B a month bond-buying program. He commented {that a} resolution on scaling again the Fed’s asset purchases would come solely upon seeing a considerable enchancment within the labor market.

Nonetheless, the U.S. central financial institution officers count on to debate whether or not they may begin tapering by the top of this 12 months. Intimately, a hawkish shift within the Fed coverage in June was partially answerable for pushing Bitcoin costs decrease and the greenback increased. Due to this fact, Bitcoin bulls would count on to stay cautious in regards to the potential consequence of the FOMC assembly.

Associated: Bitcoin bull outlines 7 steps to extra fiscal stimulus and better BTC costs

Then again, if the Fed decides to sleep on the tapering discuss, given the rising financial uncertainties led by the fast-spreading Delta variant of the Covid-19, it may hamper the greenback’s attraction and, in flip, present a sure diploma of upside increase to Bitcoin.

Fascinated with considering?

As an alternative of desirous about tapering the Fed, working $120B in month-to-month QE, has really expanded its stability sheet by $162B throughout simply the primary 3 weeks in July.

Document excessive stability sheet = file excessive S&P 500.

Each month since November. Like clockwork. pic.twitter.com/UIhzWCnid5— Sven Henrich (@NorthmanTrader) July 24, 2021

On Thursday, the U.S. Bureau of Financial Evaluation will launch its gross home product’s progress estimate for the second quarter. Economists count on it to enhance to 7.9% year-over-year from 6.4%.

Lastly, the US financial system docket will characteristic the Private Consumption Expenditures (PCE), the Fed’s most well-liked metric to measure inflation, on Friday; it’s anticipated to rise 3.7% in July from 3.4% in June.

The views and opinions expressed listed here are solely these of the creator and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, you need to conduct your individual analysis when making a choice.

Source link