If, through the darkest days of 2020, you had turned to the neighbours and predicted a miraculous bounce again within the international financial system this summer time they might have questioned your sanity.

And but the important thing indicators now level to such a phoenix-like restoration that intergovernmental financial heavyweight the OECD has scrapped what was as soon as thought-about an optimistic prediction of simply over 4 per cent progress internationally. As a substitute it believes the restoration will probably be nearer to six per cent this 12 months. The Worldwide Financial Fund says the identical.

Welcome again: forex offers value doing

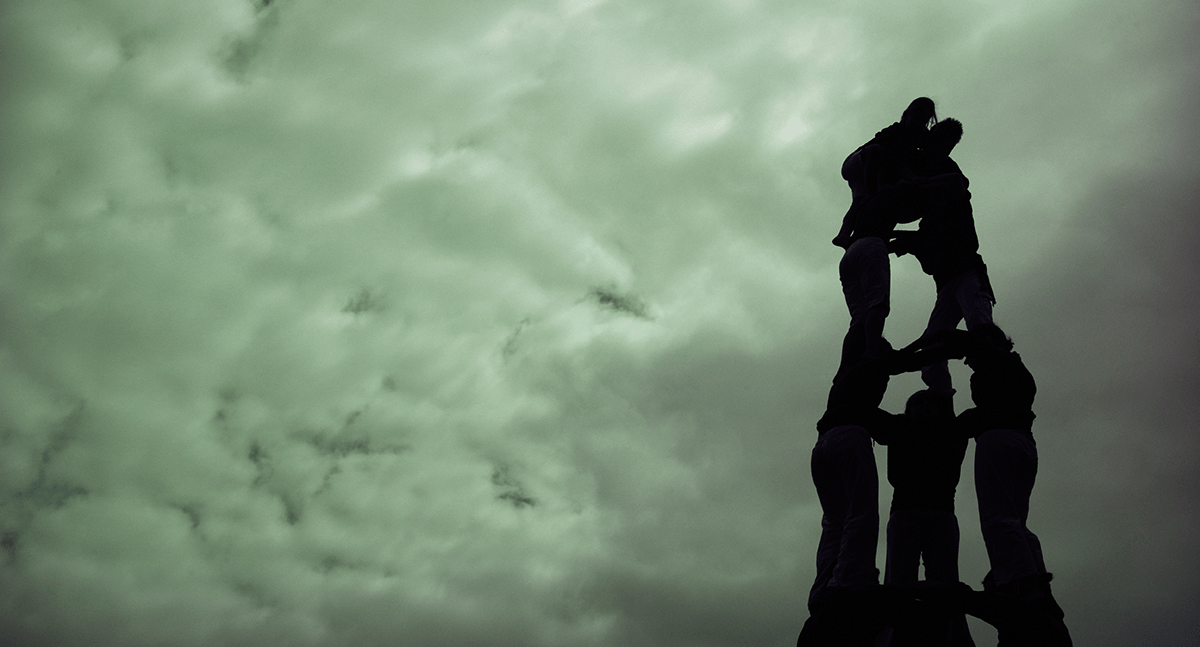

Due to a robust mixture of unwavering fiscal stimulus, awe-inspiring vaccine programmes and different super-human efforts by people, communities, companies and governments all over the world, we’re spending once more, travelling and shifting residence once more, launching new companies and re-invigorating established ones.

We’re dusting off mothballed ambitions and, most significantly, we’re elevating our gaze to the far horizon after staring on the identical 4 partitions for much too lengthy.

However don’t consider for one minute that we’re choosing up the place we left off earlier than Covid-19 scorched its approach by way of all our lives. Removed from it.

The pandemic has turbocharged the digital age, bringing with it unprecedented and everlasting shifts in virtually each facet of life - from how and the place we stay and work to the best way we do enterprise. Issues won’t ever be the identical once more, and nor ought to they be.

It’s now clear that 2021 represents a exceptional turning level and a large alternative to embrace a worldwide view, whether or not which means urgent go on a brand new life abroad, snapping up a second residence, ramping up worldwide enterprise offers or launching new enterprises that profit from a remerging, reunited international financial system.

How the suitable forex deal can assist max your massive plans

The reality about forex charges

All that working, residing and buying and selling throughout borders means forex, and the short, straightforward and safe switch of it, is essential.

However this generally is a complicated and intimidating business, stuffed with mystifying acronyms, drawn out processes, hidden charges, and all the time that niggling concern that we’re being taken for a trip on charges.

And whereas we are inclined to retreat to acquainted names when confronted with uncertainty, the flight to the excessive avenue banks will typically do us a disservice in relation to forex. These generalist monetary establishments usually cost way more in charges, generally double, to switch cash in contrast with specialist brokers.

Charge of change

Then there’s the murky world of change charges.

Typically employed as a hidden additional cost, particularly by conventional operators, sudden fluctuations in charges can and commonly do obliterate important chunks of transferred funds lengthy after budgets have been drawn up and calculations pored over, particularly when exchanging massive sums.

As of late, Covid-19 provides a robust new dimension to this fast-paced and fickle market.

These economies reporting falling an infection or demise charges and optimistic vaccination information have constantly seen a marked uplift within the power of their forex whereas runaway infections imply others stumble.

Whereas the UK has streaked forward with its vaccination programme within the first half of 2021, for instance, the EU has been paralysed by political friction over the AstraZeneca vaccine. The next delay, with its knock-on affect on main Eurozone economies France and Germany, noticed the Euro lose floor in opposition to its friends during the uncertainty.

The world over, as we begin to come out the opposite facet of the pandemic, or not less than essentially the most dramatic part of it, economies would require much less assist from central banks and governments. At that time, the extra conventional gauges of financial well being will rise to the floor as soon as extra.

In different phrases, it has by no means been so necessary to know the place you stand, fixing a beneficial charge when it arises even when that peace of thoughts comes with the prospect of lacking out just a little if issues proceed to go your approach.

A rising variety of forex suppliers now lock in charges to guard each events from the affect of sudden fluctuations.

Discover out extra: Profit from your cash switch

Low-cost, fast, safe: transferring cash between currencies

Q: How do I ensure that I don’t get ripped off?

A: Examine charges and take into account a service that means that you can lock in beneficial charges. Don’t default to your ordinary financial institution with out being positive it’s the only option on your pockets. A great dealer won’t solely take you thru the method step-by-step however may also maintain you knowledgeable on market actions to assist optimise your funds.

Q: Is my cash protected?

At all times use a service that’s authorised by the monetary regulator in your nation of residence or origin. Within the UK, that’s the Monetary Conduct Authority (FCA), which calls for excessive ranges of safety, transparency and accountability from the companies it authorises.

Q: How lengthy does a forex switch take?

With the funds able to go, an honest service is offered on-line 24/7 and might full your switch the identical day, along with your cash accessible to make use of instantly, although extra difficult transfers can nonetheless take a day or two.

Get going: hassle-free transfers and charges you possibly can depend on

Source link