Over the past week, we’ve been outlining the absurdity of Treasury Secretary Janet Yellen’s perception that increased inflation and better rates of interest would for the U.S.

By fast manner of overview:

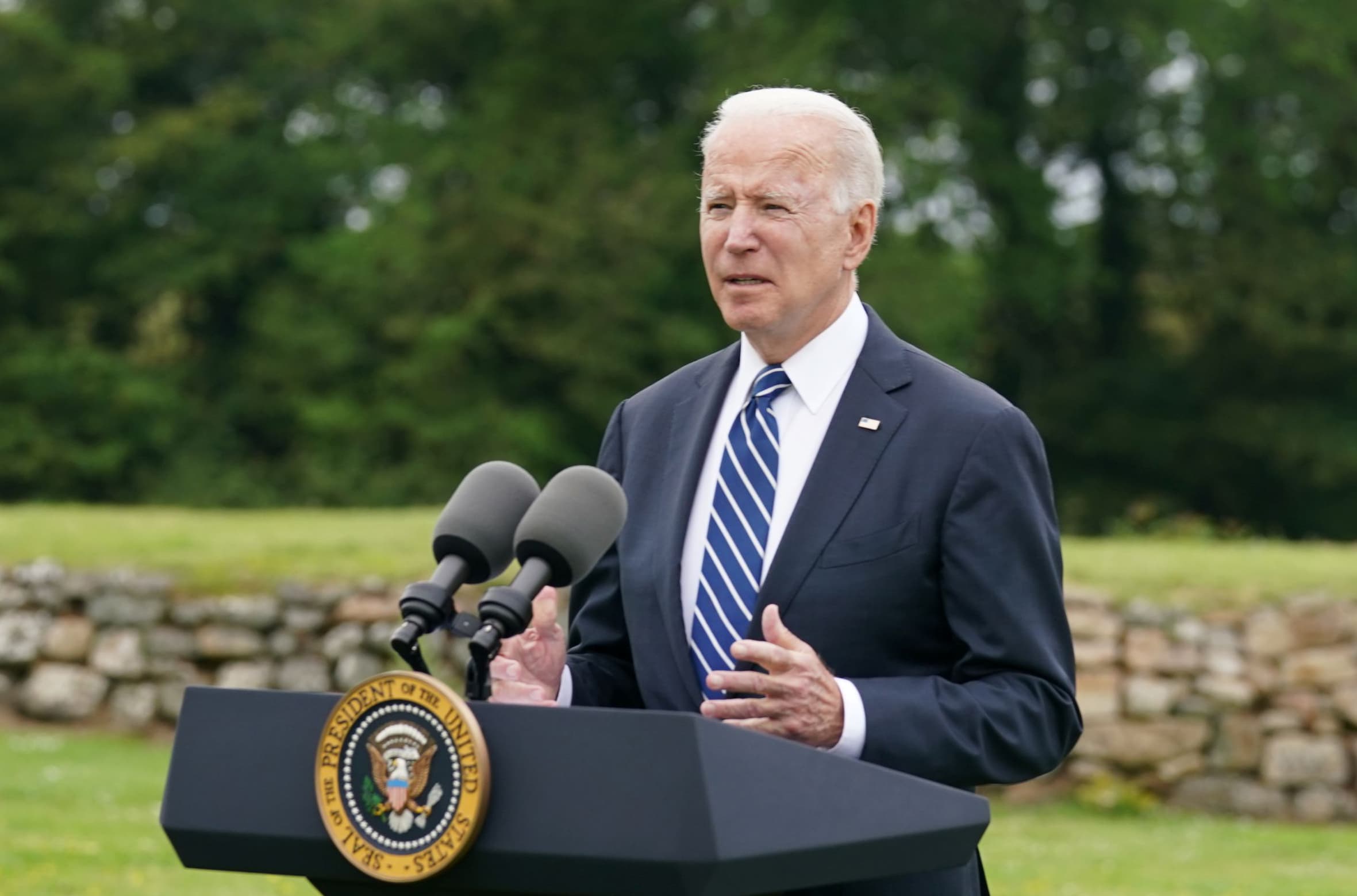

1) Secretary Yellen believes that President Biden’s $4 trillion spending program can be good for the U.S. even when it contributes to increased inflation and ends in increased rates of interest.

2) Inflation is already roaring within the U.S. earlier than President Biden’s $4 trillion spending program. Larger inflation would NOT be good at this level as Individuals are already experiencing rising prices dwelling.

3) Larger rates of interest would even be extraordinarily problematic because the U.S. now has $28 trillion in public debt. This huge debt load requires extraordinarily low rates of interest for the U.S. to keep away from a debt disaster. The final time rates of interest spiked increased in 2018, the company debt market froze, and the inventory market collapsed 20% in a matter of days.

Now, Yellen is among the two most necessary and highly effective figures within the monetary world. As such her views on this are of maximum significance for figuring out what policymakers might be doing going ahead. So far as the Treasury is anxious, inflation might be allowed to rage.

This leaves Fed Chair Jerome Powell as the one potential voice of sanity from a senior policymaker perspective. And sadly for us, Powell is prone to show simply as delusional as Treasury Secretary Yellen in relation to problems with inflation.

The primary signal of this got here in 2018 when Powell used his first Jackson Gap symposium to glorify former Fed Chair Alan Greenspan’s financial insights and “appreciable fortitude” in not elevating rates of interest again within the late ‘90s.

Sure, Powell believed Greenspan was a genius for not elevating charges within the late’ 90s. Should you don’t keep in mind what shares did at the moment, it seemed like this:

Contemplating this, the beneath quote from Powell’s 2018 speech is sort of revealing.

The FOMC thus averted the Nice-Inflation-era mistake of overemphasizing imprecise estimates of the celebs. Underneath Chairman Greenspan’s management, the Committee converged on a risk-management technique that may be distilled right into a easy request: Let’s wait yet another assembly; if there are clearer indicators of inflation, we are going to begin tightening.13 Assembly after assembly, the Committee held off on charge will increase whereas believing that indicators of rising inflation would quickly seem. And assembly after assembly, inflation progressively declined.

Supply: the Federal Reserve data

On this context, it isn’t stunning to see Fed Chair Powell now arguing that inflation is “transitory” and must be ignored. That is virtually the precise coverage he lionized in hits 2018 speech: ignore inflation, don’t elevate charges regardless of how frothy the markets grow to be, and permit a large inventory bubble to type.

From Powell’s Q&A session in early Might:

“We suspect transitory elements could also be at work,” Powell mentioned, including inflation ought to return to the Fed’s goal over time, after which be symmetric round its goal. Powell was commenting at a information briefing, following the Fed’s two-day assembly.

“If we did see inflation operating persistently beneath, that’s one thing the committee can be involved about and one thing we might have in mind when setting coverage,” he mentioned.

Supply: CNBC

So, what does this imply?

That each the Treasury Secretary AND the Fed Chair, the 2 most necessary figures in finance, consider inflation is NOT a problem and even worse, is an effective factor. Neither policymaker believes that they should tighten financial circumstances. If something, Treasury Secretary Yellen believes the federal government ought to print and spend even MORE cash!

So inflation goes to rage and rage, till this bubble bursts wiping out trillions in investor capital.

As I hold warning, inflation goes to ANNIHILATE investor portfolios.

Nonetheless, these traders who’re correctly positioned for it can make literal fortunes.

On that observe, we simply printed a Particular Funding Report regarding FIVE secret investments you should utilize to make inflation pay you because it rips by way of the monetary system within the months forward.

The report is titled Survive the Inflationary Storm. And it explains in very merely phrases make inflation PAY YOU.

We’re making simply 100 copies accessible to the general public.

To choose up yours, swing by:

phoenixcapitalmarketing.com/inflationstorm.html

Greatest Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Analysis

Source link